The rapid proliferation and accessibility of AI continue to transform how hotels and hospitality establishments operate and serve their customers. From enhanced guest experiences to improved operational efficiency, data-driven decision-making, and even data security, every aspect of this industry has evolved significantly in this decade.

However, no other area within the hotel and hospitality sector has undergone as much transformation as bookkeeping and accounting.

Hospitality Accounting: A Multitude of Challenges

Higher volumes of daily transactions, multiple revenue streams, tricky inventory management, and complicated tax compliance – each unique challenge spawns a different set of bookkeeping and accounting problems for the hotel and hospitality industry.

Data errors from manual entry and reconciliations, tax penalties from non-compliance, revenue losses from poor AP and AR, scattered data limiting visibility, and missed opportunities due to reporting delays—almost every hotel and hospitality business faces at least one of these issues, if not several at once.

How AI is Transforming Hospitality Bookkeeping & Accounting

Different types of automation tools can help solve these issues. However, their potential is limited, and they only address specific tasks without solving the bigger picture. AI, on the other hand, is revolutionizing bookkeeping and accounting processes across the hotel and hospitality industry, right from the nuts and bolts of each process.

Here’s a quick look at how AI is reshaping the way the industry manages these critical processes:

1. Error-Free Data Entry Automation, Anomaly Detection & Automatic Reconciliations

AI completely eliminates manual data entry for daily expense and revenue transactions and their associated errors. An AI-powered bookkeeping system automatically extracts data from invoices, receipts, and other documents, reconciles and records transactions, and assigns them to the correct GL codes.

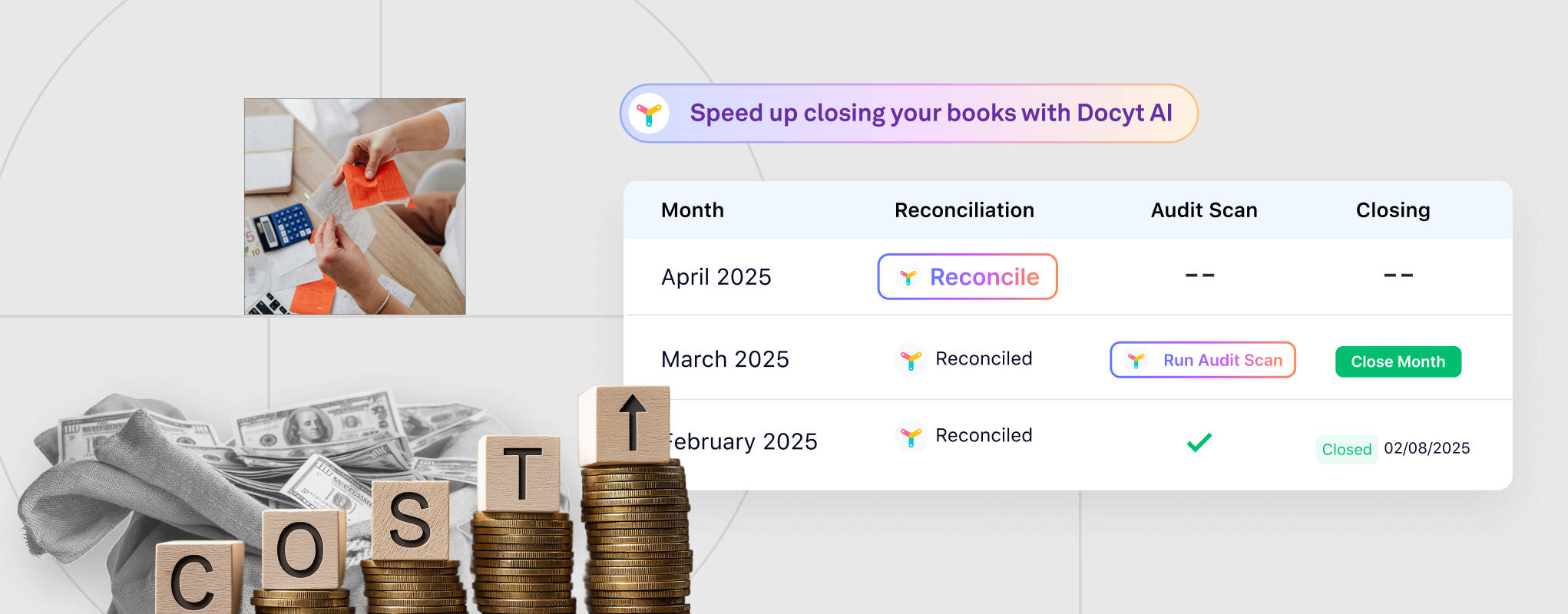

Powered by Machine Learning, AI tools also analyze large volumes of financial data in the General Ledger to detect errors flag potential fraud or unusual activities. Together with automated data entry, precision categorization, anomaly detection, and hands-free reconciliation, AI tools make month-end close accurate, efficient, and ridiculously fast. For example, Docyt’s AI enables automated month-end close in as little as 15 days.

2. Seamless AP Workflow Automation

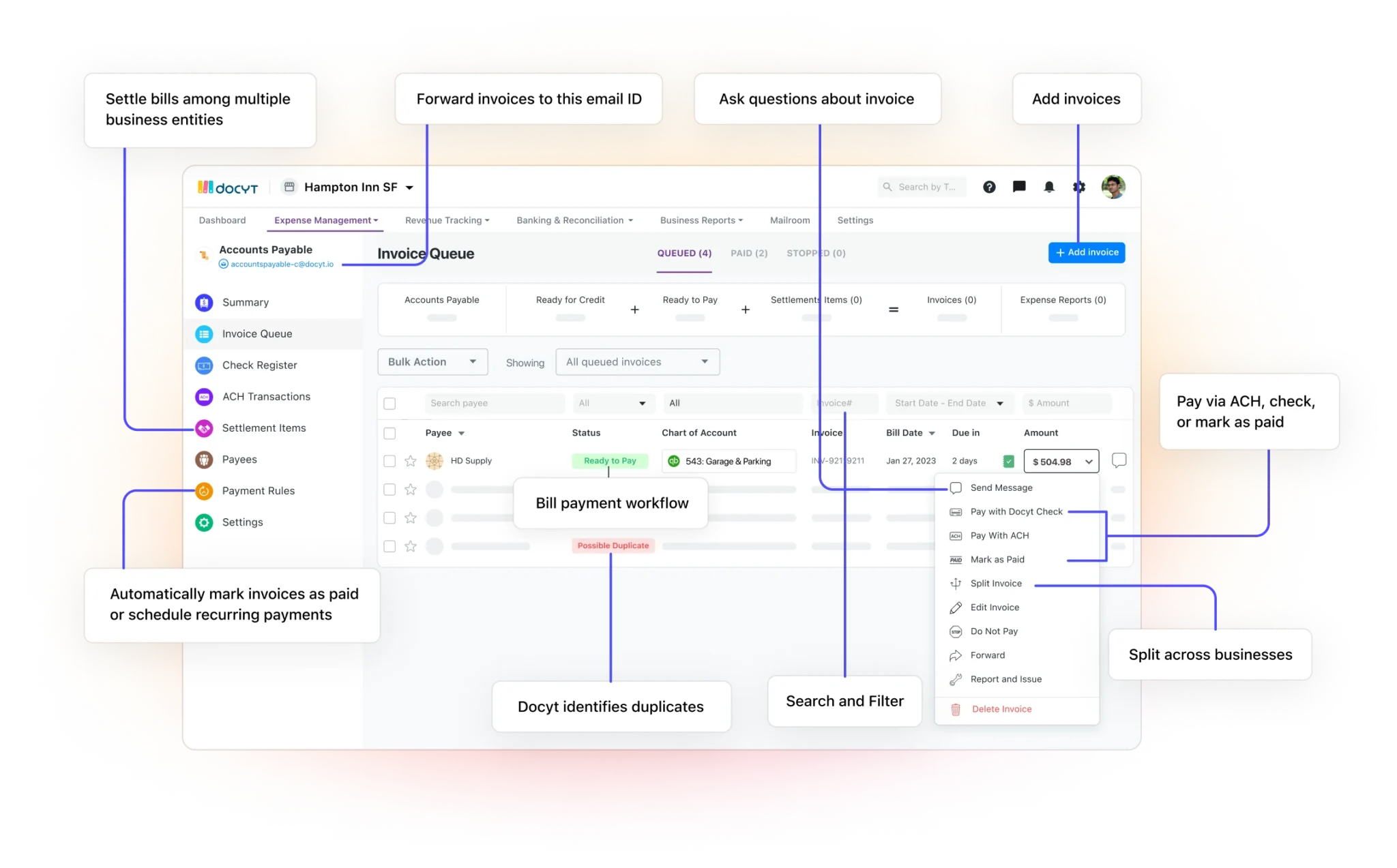

Using AI-driven OCR systems, invoices are scanned, categorized, and coded directly to the general ledger (GL) with impressive accuracy. Machine learning takes it a step further by learning from past corrections, so it gets smarter over time.

AI also streamlines centralized payments, effortlessly managing inter-entity transactions and settlements. Automating everything from invoice processing to reconciliation and payment workflows saves teams countless hours and reduces errors, freeing up time for more strategic work.

3. Time-Clocking Integration with Bookkeeping & Accounting

Modern AI-powered booking and accounting tools also offer time-clocking integrations that automate payroll processing.

These systems provide real-time metrics, offering insights into workforce efficiencies, labor costs, and scheduling options. Enabling streamlined payroll workflows that offer better visibility and control, these integrations ensure accurate labor allocation and improve decision-making.

4. Daily PMS & OTA Reconciliation for Hotel and Hospitality Establishments

Traditionally, PMS reconciliation has been a time-consuming process prone to delays and inaccuracies—especially for hotels and hospitality businesses handling high transaction volumes.

Today, AI-powered bookkeeping software has revolutionized daily PMS reconciliation. These tools automatically match transactions, identify discrepancies, and flag out-of-balance cases with instant alerts. AI streamlines reconciliation across diverse revenue streams, making it effortless for businesses to manage their operations efficiently.

Similarly, for establishments working with Online Travel Agencies (OTAs), AI tools also automate and simplify OTA reconciliation. From booking matching, commission tracking, revenue validation, and claim filing, these solutions save time, minimize errors, and ensure accurate financial reporting.

5. Real-Time Industry Reporting & Analytics for 360-Degree Visibility & Insight

Waiting until month-end for reporting in the hotel and hospitality industry defeats the purpose of bookkeeping and accounting, which is to provide timely insights for proactive, strategic decisions.

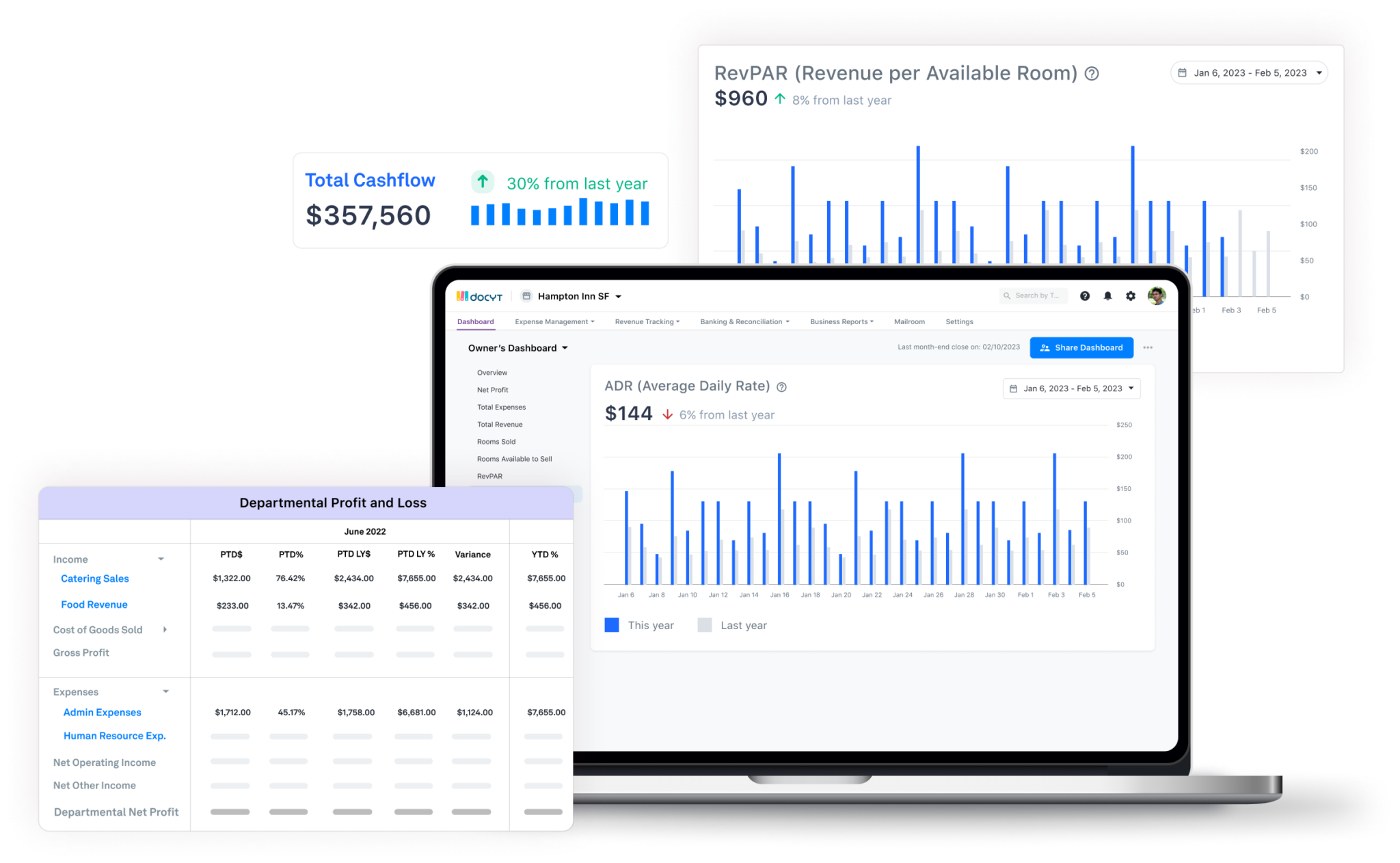

Fortunately, today’s AI bookkeeping solutions transform how financial reports and insights are accessed. From owner’s reports and balance sheets to real-time P&L statements, businesses can instantly generate up-to-date USALI reports for unmatched financial visibility.

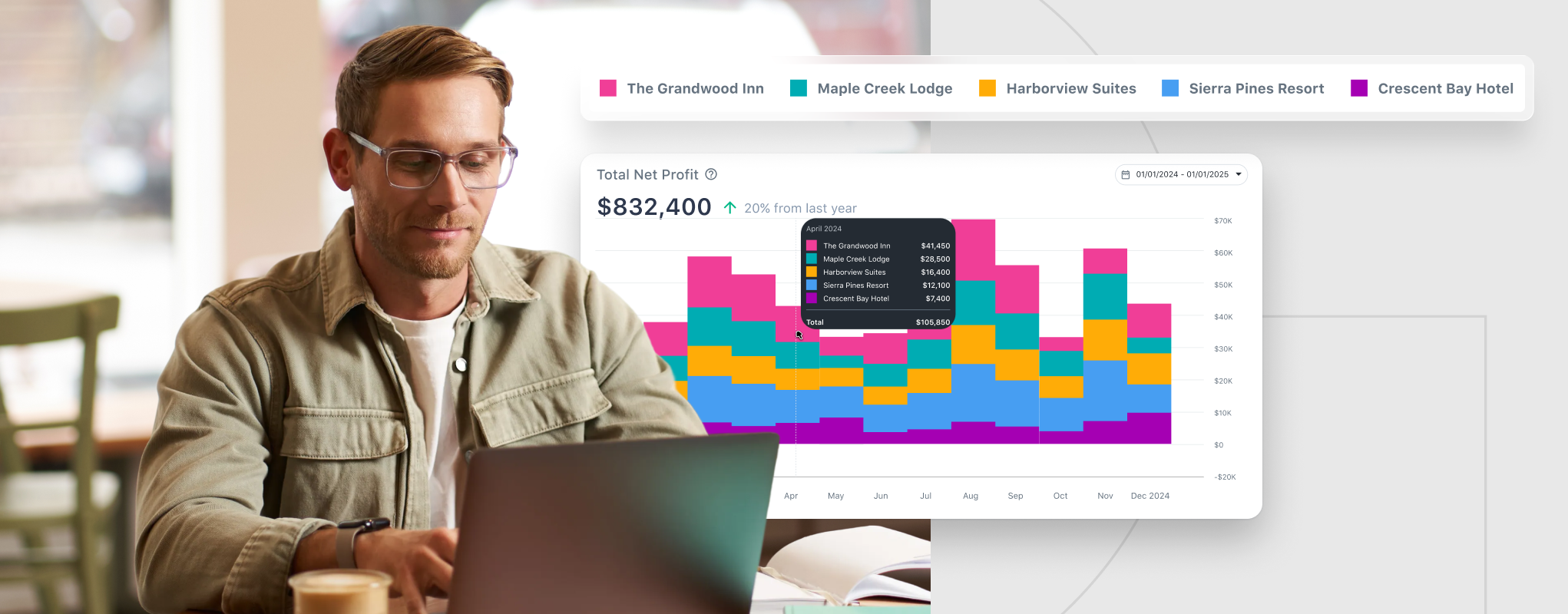

AI tools like Docyt AI take this further with live, real-time dashboards that track key metrics and KPIs. These live dashboards are customizable to suit specific business needs and allow users to drill down into granular details of the metrics with just a few clicks. They also provide a consolidated view across multiple business units, aggregate views, and side-by-side comparisons of business units to provide exceptional visibility and insights into all aspects of your business. Learn more about InsightFlow of Docyt’s AI bookkeeping and accounting solution to know what makes our real-time financial reporting superior.

AI Bookkeeping & Accounting for Rapid Shift from Compliance to Value

For decades, hotel bookkeeping and accounting have consumed valuable time and resources while often being relegated to a compliance-driven, back-office function.

With automated data entry and reconciliations, time-clocking integrations, automated AP & AR, and real-time reporting, AI is reinventing how it can be harnessed into value-focused activities. It now enables greater visibility and insights for strategic decision-making while also saving time, money, and resources.

Leading hotel and hospitality management groups are quickly adopting AI-powered bookkeeping and accounting solutions to leverage real-time insights, enable greater efficiency, and improve decision-making, all while saving time and money to thrive in this highly competitive industry.

Check out how Dalwadi Group cleared 3 months of backlog across seven properties and recovered $10,000 lost in discrepancies— all in just a matter of days with Docyt’s AI Bookkeeping & Accounting.