Navigating the complex landscape of US accounting & tax laws isn’t a walk in the park—it’s like a puzzle with many tricky pieces. Accounting firms face many challenges, from dealing with tons of paperwork to navigating regulatory hoops. This blog sheds light on the top hurdles the US accounting firms face and explains how AI-powered accounting automation platforms like Docyt empower accounting firms of all sizes to cut through the regulatory and operational complexities.

Here are the top challenges impacting US Accounting Firms

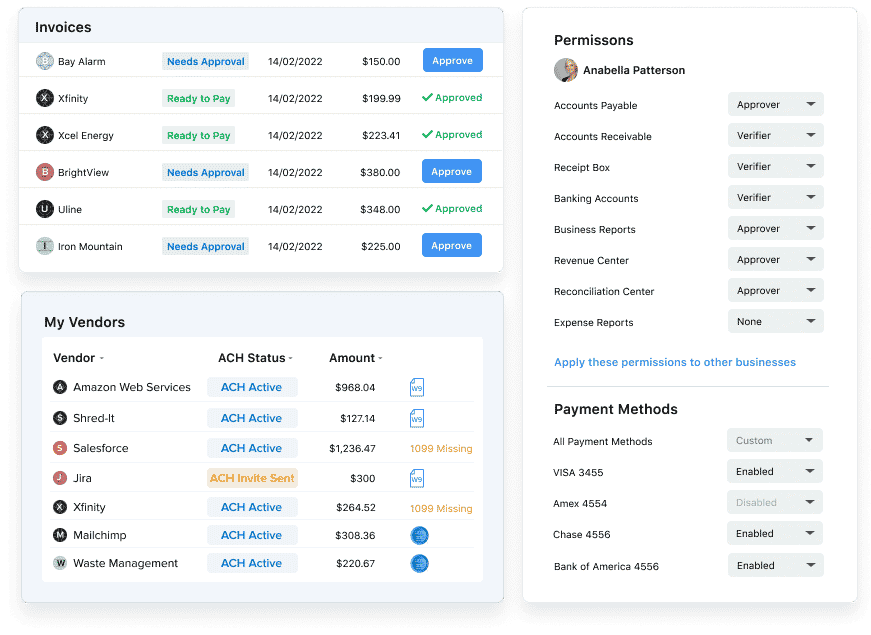

1. Managing Expenses

Running an accounting firm is a costly affair. It requires spending significantly on day-to-day operational expenses like overhead, salaries, software, supplies, and marketing. Manual data entry, poor tracking and categorization, approval and limit setting issues, managing vendor compliance, exercising control over spending limits, preventing waste and fraud, and handling extensive documentation are common challenges accounting firms face when managing expenses. These expense management inefficiencies can adversely impact financial accuracy and decision-making.

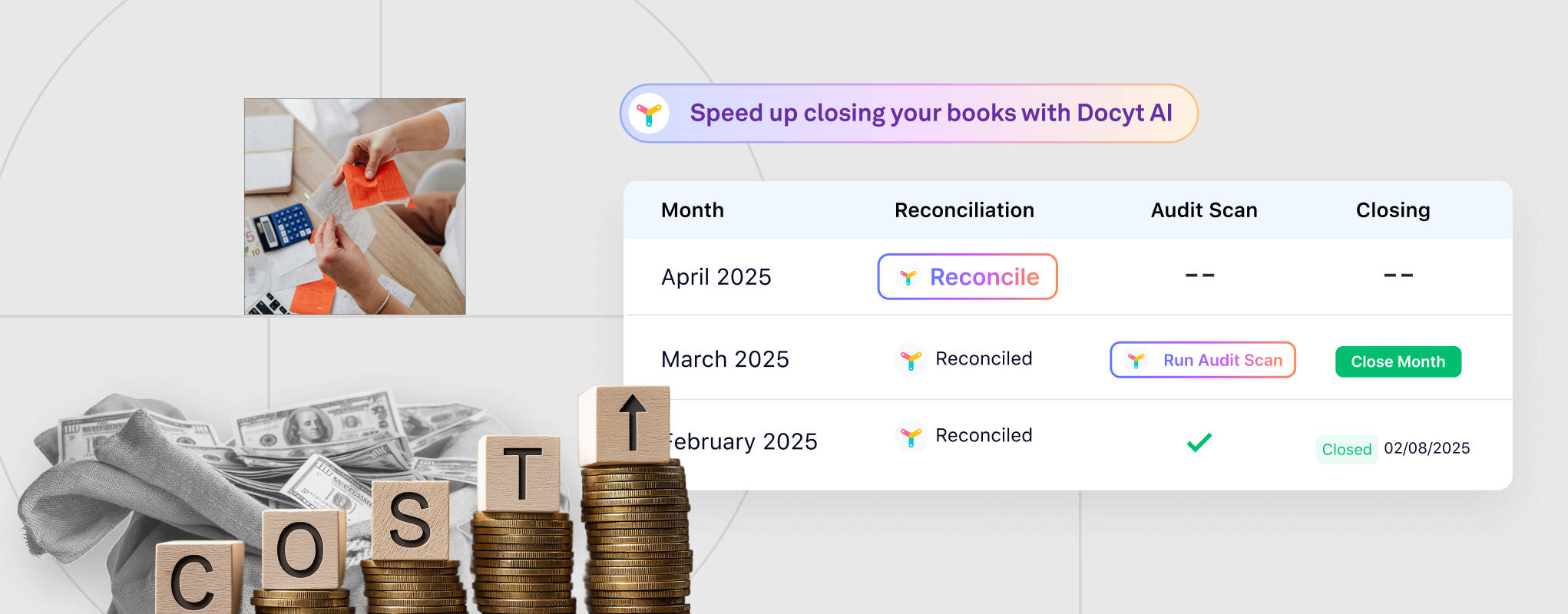

2. Book Closing Delays

Typically, companies close their books on a monthly or quarterly basis to save time. However, this practice can lead to delays in decision-making, disruptions in financial reporting and regulatory compliance, and missed growth opportunities.

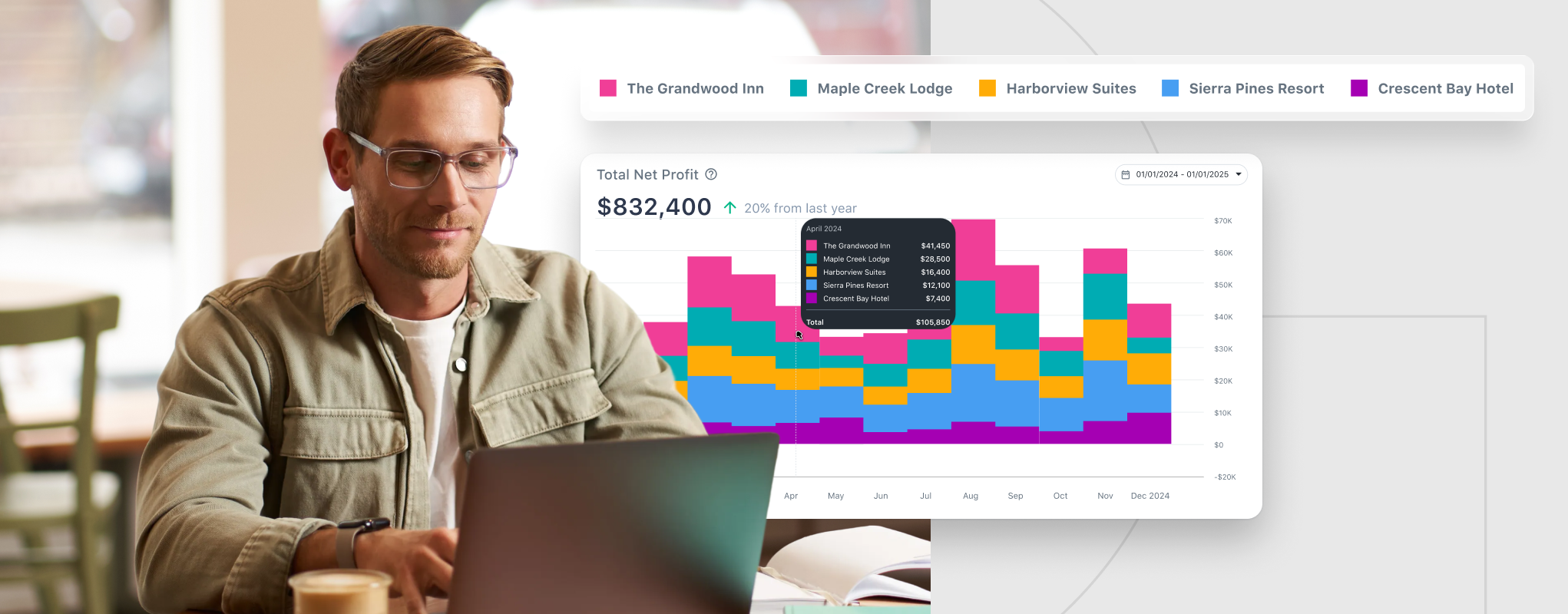

3. Limited Visibility into Financial Performance

As they say, ‘out of sight, out of mind’. Maintaining real-time visibility into their clients’ financial processes and performance is crucial for accounting firms. Limited visibility can hinder the ability of accounting firms to effectively guide clients in improving their financial performance, ensuring timely reporting, and making informed decisions to keep pace with industry trends and manage uncertainties.

4. Maintaining Regulatory Compliance

The accounting industry in the US is heavily regulated, requiring strict adherence to numerous regulations, especially concerning tax requirements such as:

- Generally Accepted Accounting Principles (GAAP)

- International Financial Reporting Standards (IFRS)

- Sarbanes-Oxley Act (SOX)

- Securities and Exchange Commission (SEC)

- Internal Revenue Service (IRS)

Non-compliance with these regulations can invite IRS scrutiny and potential lawsuits or legal cases. Manual bookkeeping and accounting practices leave room for non-compliance. Leveraging AI-powered automation tools, like Docyt, significantly reduces your risk of non-compliance.

5. Revenue Reconciliation Challenges

Accounting firms encounter challenges reconciling client revenue due to complex transactions, varied revenue sources, and regulatory compliance. Common errors in revenue reconciliation stem from manual processes, multiple revenue tracking systems, data entry mistakes, high transaction volumes, and inadequate reporting. These errors can lead to discrepancies in revenue reconciliation, resulting in financial misstatements, compliance problems, and diminished stakeholder trust.

Why Docyt AI?

Docyt AI offers a comprehensive suite of solutions to empower US accounting firms to overcome these challenges and serve their clients effectively. The Docyt360 platform saves countless hours monthly by automating repetitive bookkeeping tasks. Docyt AI seamlessly manages data entry, handles laborious expense tracking, and streamlines time-intensive account reconciliation behind the scenes so you can focus on growing your business and providing a better experience for your clients.