As we near the midpoint of the year, it is imperative that you critically review your financials to stay in line with your business goals. A mid-year accounting checklist will help you continue to streamline operations and ensure you are setting yourself up to make the most of the second half of the year. AI accounting software like Docyt greatly increases the speed and accuracy of your overall financial management and keeps you on track to provide the data necessary to complete the review. Below, we take a look at a typical mid-year checklist for accounting and identify the areas where AI software can help simplify the process.

Review of Financial Statements

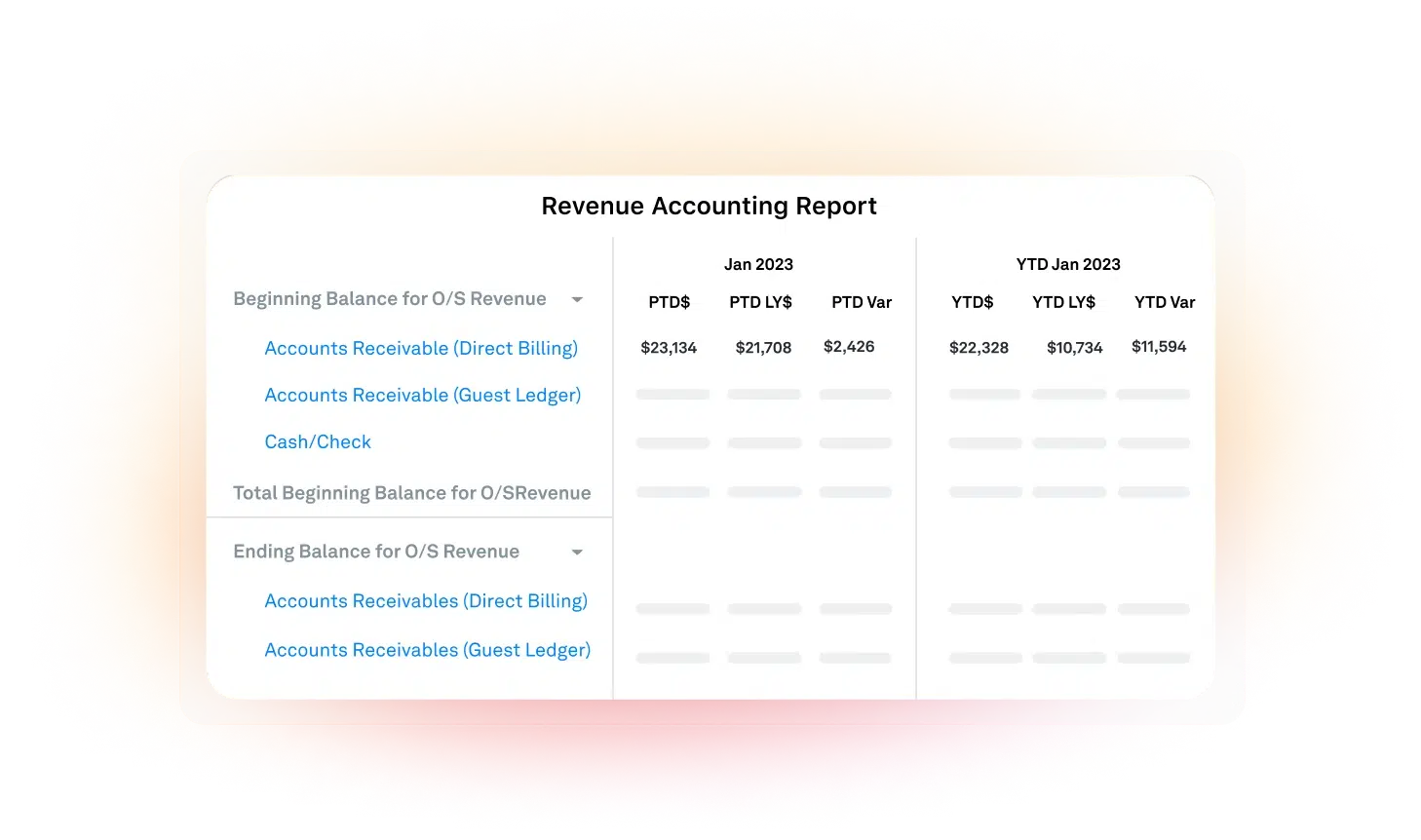

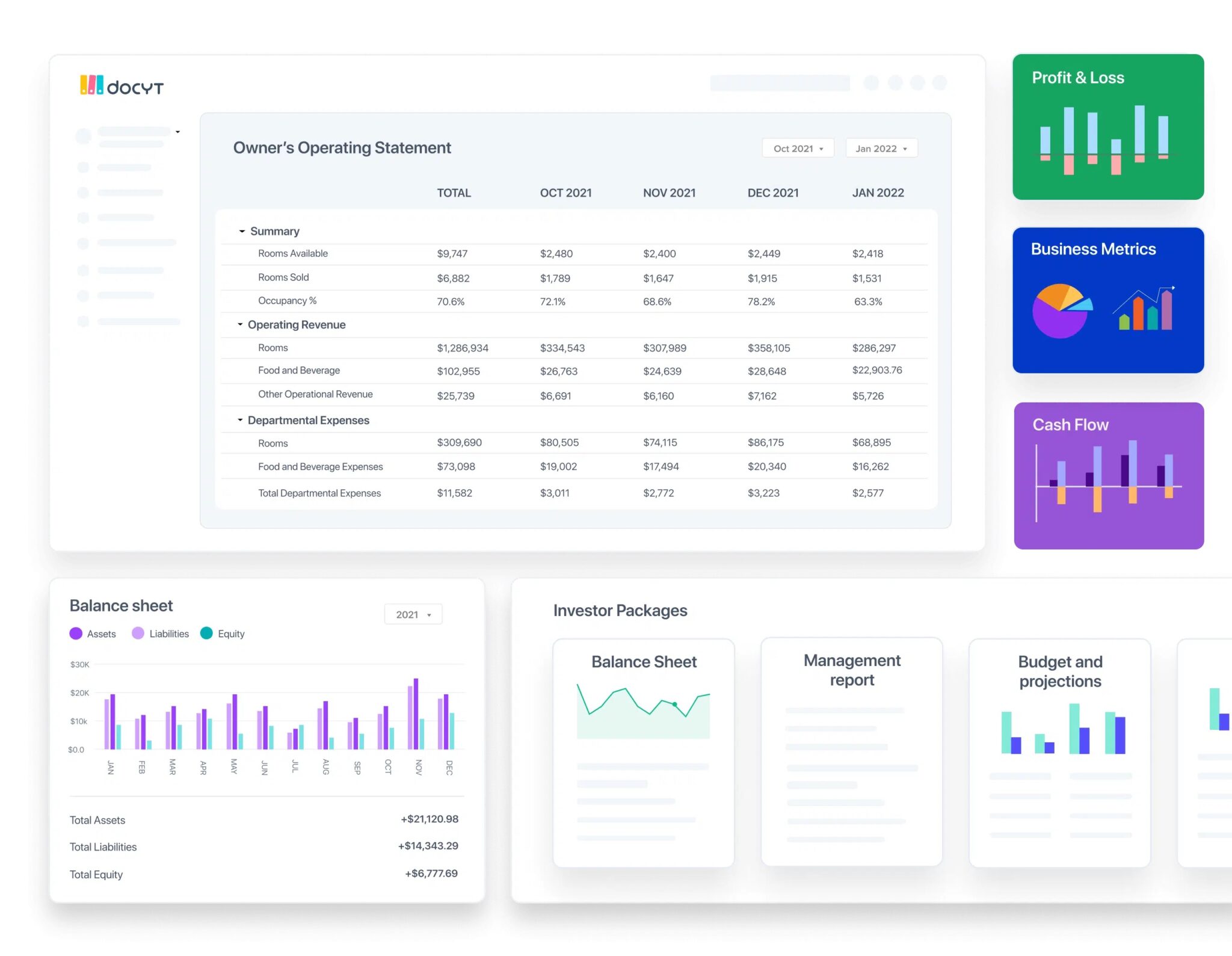

Begin by assessing your financial statements, such as your profit and loss, balance sheet, and cash flow statement. Look for discrepancies and check that all entries are correct. Comparing your mid-year financial report with your budget will help you identify variances and areas for improvement.

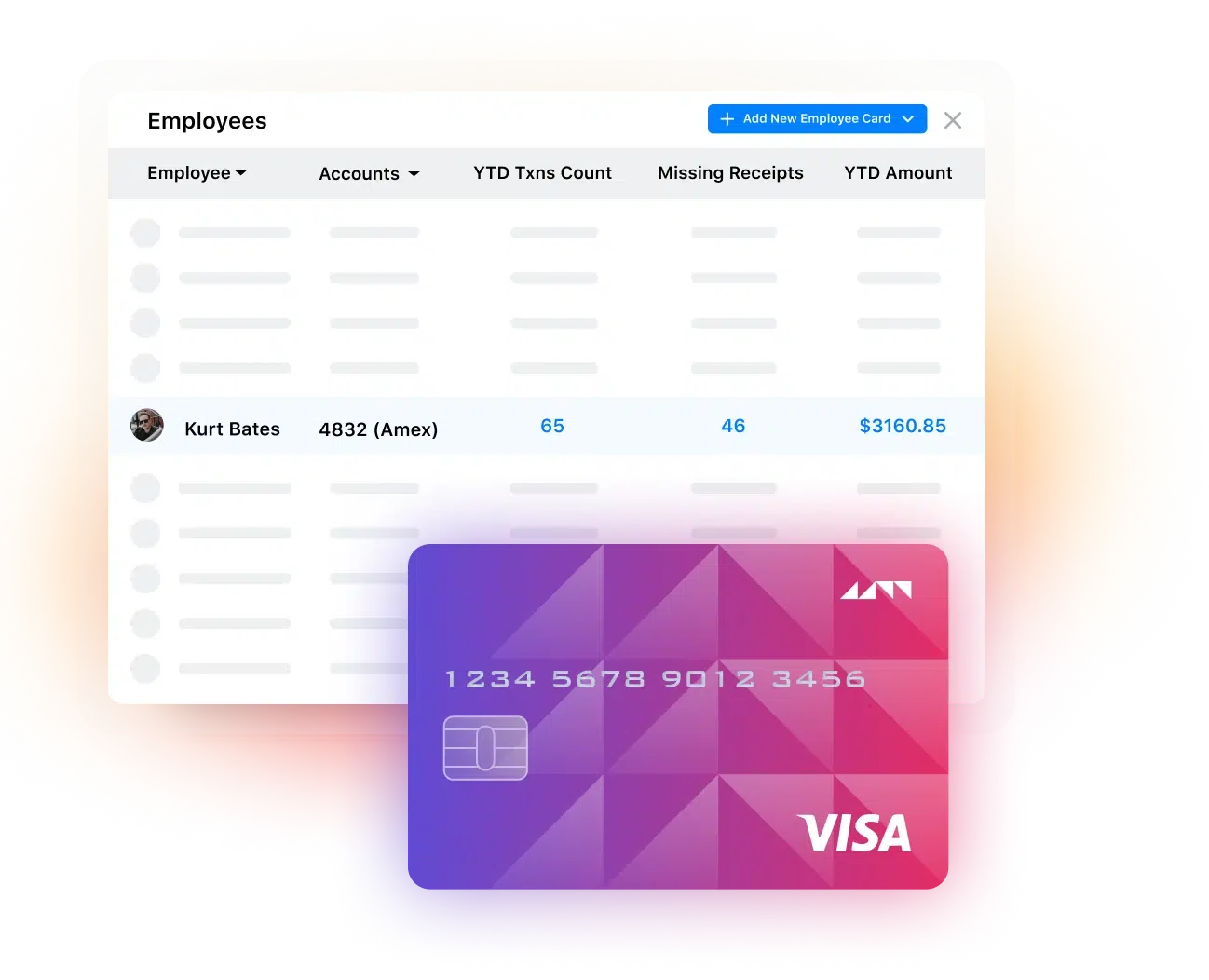

Ensure full reconciliation for all bank accounts and credit card statements. This exercise will help identify unreconciled transactions and errors that might have occurred in the process.

Automating bank reconciliation with Docyt can prevent human error and save you time.

Review Accounts Receivable and Payable

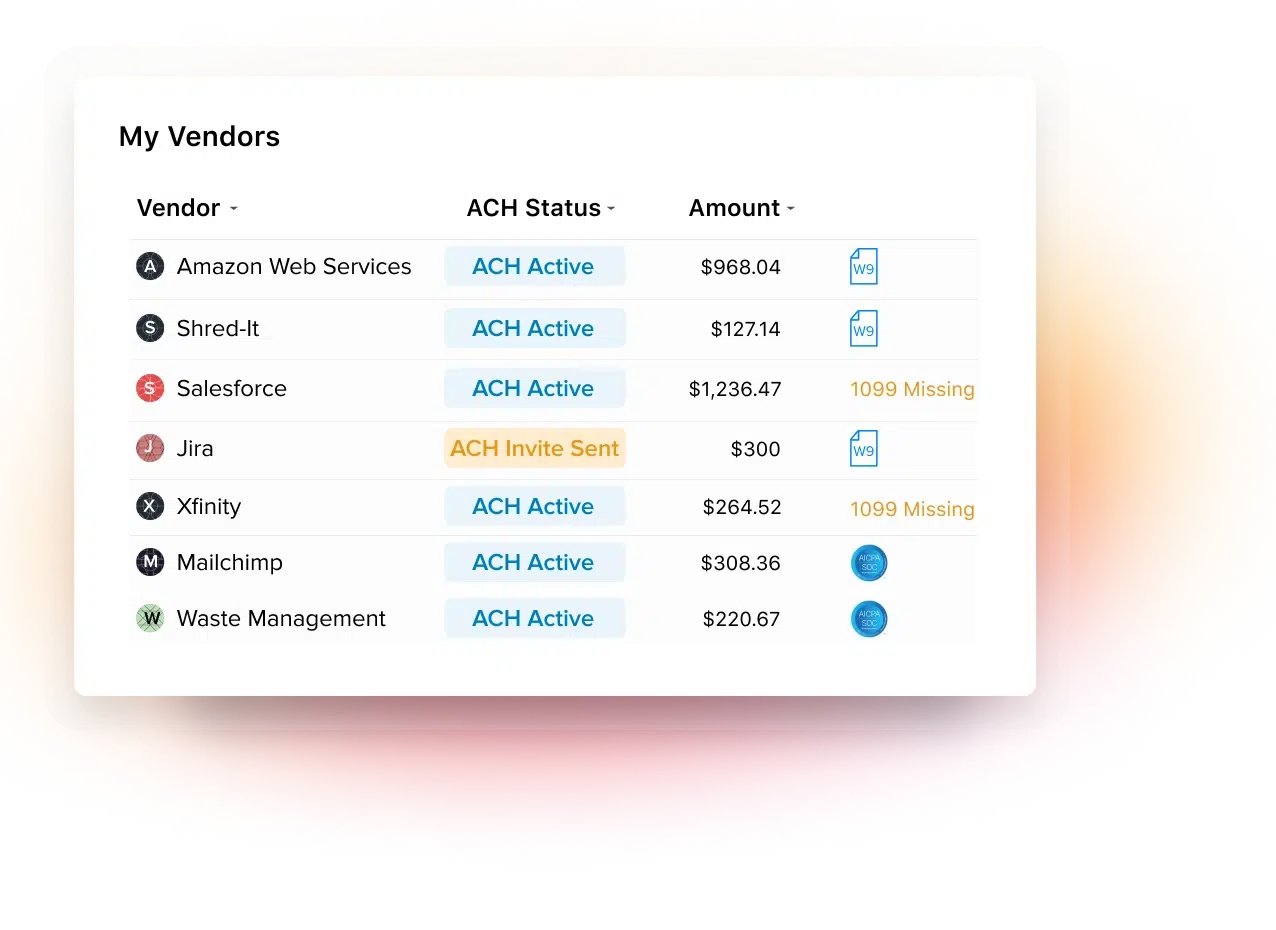

Thoroughly review your accounts receivable to ensure you have invoices for every item and received all payments. Sending timely reminders about overdue invoice payments throughout the year can speed up the process. Check your accounts payable for any unpaid bills.

Automate these processes with Docyt’s RevFlow and ExpenseFlow for efficient results.

Evaluate Budget Performance

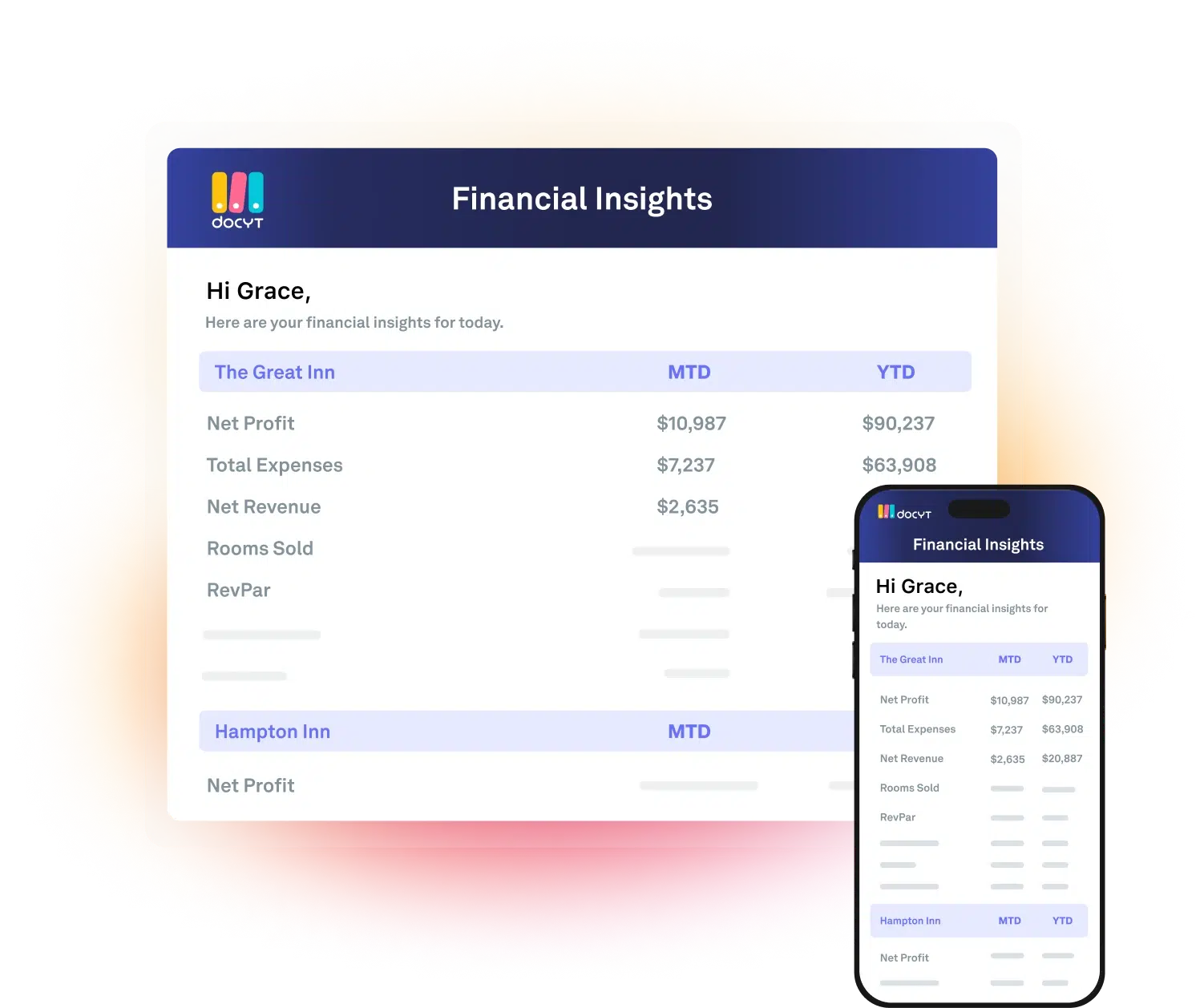

Measure the actual expenses and revenues against the budget. Look for any significant deviations in these comparisons and identify the reasons for these discrepancies. This review will help you adjust your financial plans for the remainder of the year.

The availability of real-time financial reporting from Docyt allows you to understand how well you manage your budget.

Update Inventory Records

Physically check the items in your inventory to confirm that the information matches the stock in your stores. Make the necessary adjustments to the inventory records to state the book balances accurately. This keeps the data on inventory levels updated, ensuring cost management and meeting customer needs.

Review of Payroll and Employment Records

Check to confirm that all payroll records are updated through the end of the current period and that taxes and benefits, if applicable, are calculated accurately. Ensure that all employee information is updated in accordance with labor laws.

For example, integrated platforms like Docyt can handle your payroll bookkeeping, securely store your payroll data in one place, and ensure that your business is compliance-ready.

Tax Obligations

This is the best time to review the tax liabilities that have already arisen for the first half of the year. It’s important that you make all the estimated tax payments on a timely basis. Being well prepared in advance for your tax obligations will help you avoid last-minute stress and potential penalties.

Financial Goals and Forecasting

Update your financial goals and forecasts for the remaining part of the year. From the mid-year review, you can set realistic targets and adjust strategies to keep the business on track.

Data Security

With the rise in cyber threats, businesses’ vulnerability is at an all-time high. Docyt, in this regard, comes complete with potent security features like encrypted storage and secure data vaults to protect sensitive information. Docyt displays its commitment to security with its SOC 2 certification.

Following this mid-year checklist for accounting, you can be sure your business is in good financial health and is well-prepared for the second half of the year. By doing this, Docyt’s advanced tools improve accuracy and efficiency, provide valuable insights for better decisions, and result in growth.

For more information on how Docyt can help automate the accounting process, schedule your demo today!