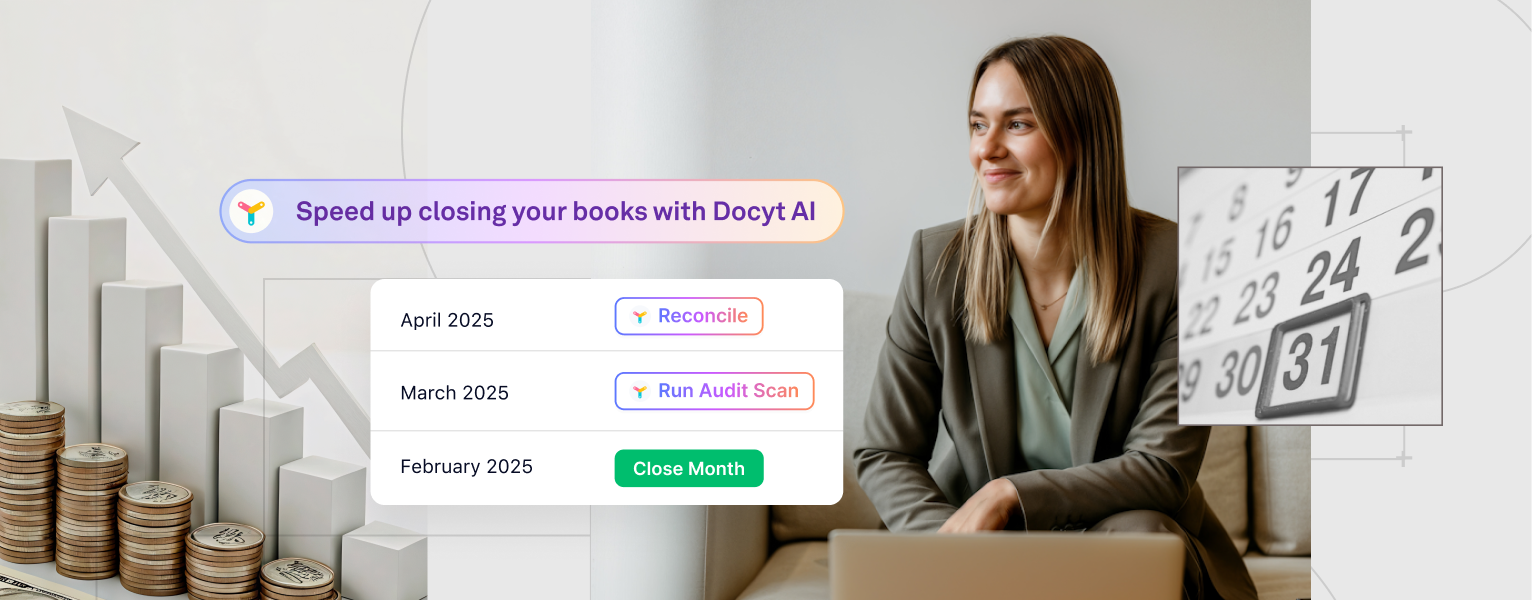

Managing every detail of your business is no small feat. As a small business owner, ensuring you have effective accounting practices in place is crucial, but finding the time is the challenge. The great news is that there are solutions readily available to maximize time and optimize your accounting processes. Docyt, an end-to-end accounting software platform boosted by Generative AI, is a powerful automation tool that will transform your operations. In this article, we will explore five practical Generative AI use cases tailored specifically to meet your small business accounting need and uncover how this innovative technology can streamline your financial operations.

What exactly is generative AI?

Generative AI is a type of artificial intelligence that can create content without human intervention. This technology revolutionizes Small Business Accounting by automating manual processes like KPI tracking, revenue tracking, invoice generation, and financial report creation.

Automated Financial Reporting

Are you tired of spending countless hours generating financial reports only to find errors? Let generative AI do the heavy lifting for you. Generative AI tools generate reports faster, saving time and effort in data collection. Automating the financial reporting process ensures that reports are continuously up-to-date with real-time insights. The AI algorithms can analyze complex financial data and produce detailed reports for you, ensuring accuracy and practical strategy-building insight. Doesn’t this sound like a better use of your time?

Generative AI can understand, analyze, and provide insights from complex financial data while offering higher accuracy. For example, with automation, Generative AI takes the balance sheet data and runs through a series of scenarios, performing sensitivity analysis to assess and provide you with the potential effects of different financial decisions and market conditions, ultimately providing you with insight and recommendations.

So, if you are ready to select a new line of services or products, let Generative AI be your guide!

Expense Tracking, Categorization, and Management

Accurate tracking and categorization of expenses play a crucial role in budgeting and ensuring tax compliance. You can simplify this process by leveraging generative AI, which automates the scanning and extraction of information from receipts and invoices utilizing receipt capture technology. With human-like understanding, Generative AI ensures that all expenses are correctly categorized with accuracy and efficiency.

Docyt’s 360° Automated Transaction Categorization

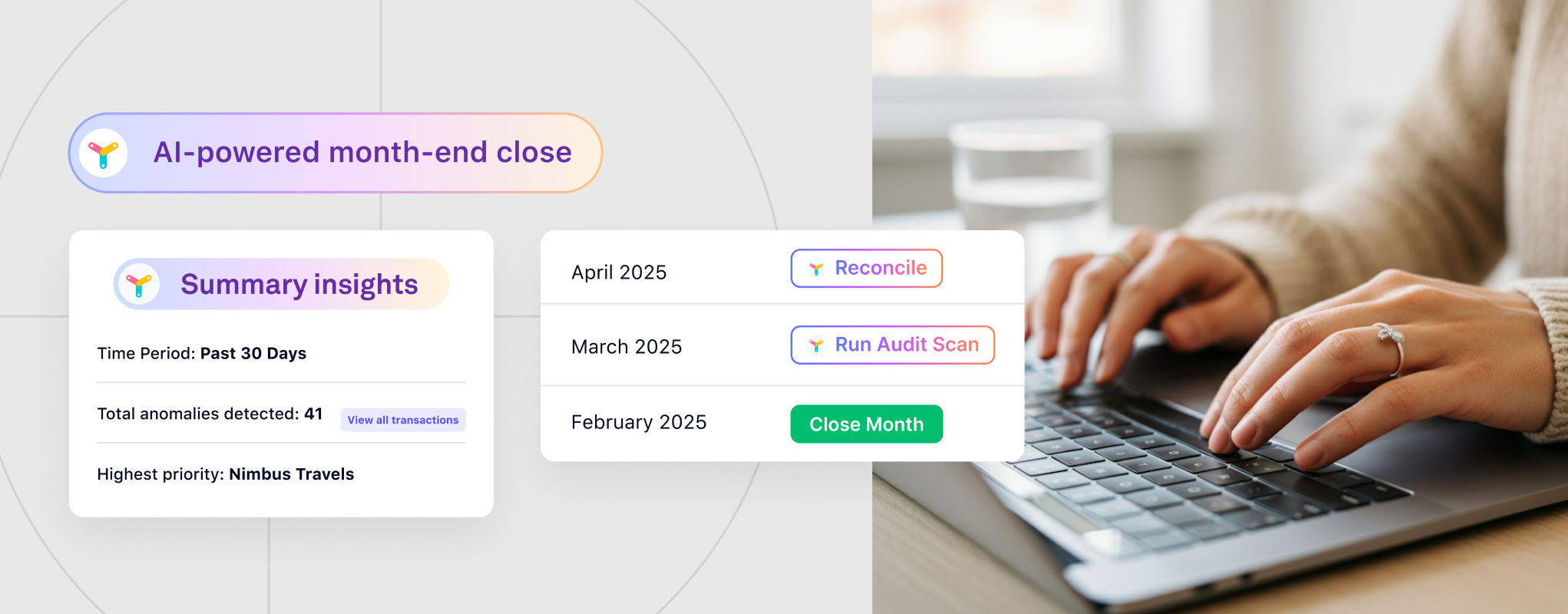

Using generative AI, Docyt brings transaction categorization full circle. What does this mean? Precision AI, Docyt’s flagship categorization technology, competently categorizes 80% of the transactions it sees. In the past, remaining transactions required human guidance. By adding generative AI to the mix, Docyt is now capable of accurately categorizing the remaining 20% of transactions without human interaction by providing additional context around unfamiliar transactions.

Platform Onboarding

Generative AI guides you through onboarding with accounting firms or intelligent accounting software.

Whether you are beginning a new relationship with an accountant or recently purchased intelligent AI-based accounting software for your small business, generative AI-powered solutions can interactively guide users through the process of onboarding. Generative AI chatbots lead business owners through an easy-to-follow process, requesting missing documents and answering questions as necessary.

Generative AI also provides small business owners with 24/7 access to invaluable insights through chatbots and fast, direct interaction with accountants or software support as necessary.

Real-Time Accounting Insights

Managing your business intelligently and taking immediate action using generative AI for real-time revenue analysis is critical to sustainable business. Time is precious, and as a small business owner, you understand that better than anyone. Deploying AI-powered automation software into your accounting and bookkeeping practices gains you access to real-time, accurate financial reports.

For example, a small business owner utilizes gеnеrativе AI to analyze his real-time revenue data and learns he is paying too much for a specific vendor’s services. Armed with this information, the business owner can research the competitive marketplace and negotiate vendor contracts more effectively, thereby reducing expenses and maximizing profitability. Generative AI can predict and report anomalies based on your financial data, giving you complete visibility into your bottom and top lines. By accessing both internal and external ChatGPT sources, you can use that information to find optimal solutions.

Business Expansion

You have no time for lunch, let alone crunching numbers… As a small business owner, you can benefit most from lightning-fast report generation engaged with Generative AI to leverage real-time data and provide a personalized summary of your financials.

Why not take advantage of advanced demand and revenue forecasting? Generative AI will leverage historical sales data, external factors, and cutting-edge predictive analytics to generate accurate forecasts, empowering you with insights to make informed decisions.

For example, A small family-owned bakery uses Generative AI to improve its inventory management and pricing strategies. This helps the bakery to optimize inventory levels, set competitive prices, and plan strategic marketing campaigns. Overall, Generative AI helps the bakery to increase profitability and customer satisfaction.

Conclusion

AI-powered accounting software provides practical solutions for small business owners’ accounting needs. You can automate financial reporting, streamline expense tracking and invoice generation, obtain accurate financial forecasts, simplify tax compliance, and even automate bill payments.

Have these Generative AI examples piqued your interest? Are you considering embarking on the Generative AI journey? If so, it can provide several benefits for your business. By embracing this technology, you’ll be able to save time and reduce errors while gaining better control over your finances. These tools are specifically designed to enhance the efficiency of your accounting tasks, allowing you to focus on growing your business efficiently.

Reach out to us to learn more: https://docyt.com/schedule-consultation/