Franchise Accounting – Hard to Manage & Harder to Optimize

Diverse revenue streams, shared financial obligations, stringent regulations & compliance, multi-location operation & more – the franchise accounting landscape is rife with many complexities that make it harder to navigate for franchisees and franchisors.

In addition, the need for fast, precise, and standardized reporting and accurate financial analysis for optimization makes optimization even harder. For years, these growing accounting needs, complexities, and optimization problems stood as hurdles for franchisees trying to thrive and those looking for growth.

Fortunately, with the emergence of AI-powered accounting tools like Docyt, the complex franchise accounting landscape is set for massive transformation.

Future of Franchise Accounting | AI Bookkeeping & Accounting Solutions

With intelligent automation, decades-old bookkeeping complexities are being simplified, and accounting bottlenecks are being eliminated; CPAs and franchise owners are finally gaining real-time insights that give them financial clarity. And how? Let us find out in this blog.

First, we’ll examine common franchise accounting challenges and then explore how AI bookkeeping software can solve them for your team. Read on:

Most Common Franchise Accounting Challenges

Lack of a Centralized Bookkeeping Solution

Bookkeeping is a resource-intensive and time-consuming process that quickly becomes burdensome and prone to inaccuracy without the right automated solution.

Manual or hybrid bookkeeping solutions can only add administrative burdens for single-location owners. Multi-location operators feel this even more when there’s no centralized system, leading to delayed financial reporting, insights, and compliance issues.

Revenue Tracking and Reconciliation Problems

Franchise owners juggle various revenue streams, which gets exponentially more challenging when managing multiple locations. Reconciling revenue from so many sources is labor-intensive and error-prone, and when done manually, it often results in revenue leaks and inaccurate insights.

Cash Flow & Bill Payment Problems

Franchise cash flow is tricky. It changes depending on the business model, making it challenging to keep up with timely vendor payments, fluctuating operational costs, and unexpected expenses. Balancing timely vendor payments, rapidly fluctuating operational costs, and unexpected expenses while avoiding cash shortages can be hectic.

For example, accounts payable processes for a high invoice volume without automation can quickly become a time drain and lead to payment delays, cash shortages, spoiled vendor relations, and, ultimately, difficult growth.

Corporate Credit Card Expense Management

Accurately tracking credit card expenses is a common yet often underestimated problem for single-location and multi-location franchises.

Single franchise owners may struggle to keep up with transaction records and receipts. Multi-location owners face the additional challenge of accurately tracking card spending across different locations, vendors, and employees. Delayed card expense management skews expense tracking, delays financial reporting, and may even trigger compliance issues for franchises.

Ever-present Multi-Location Accounting Complexities

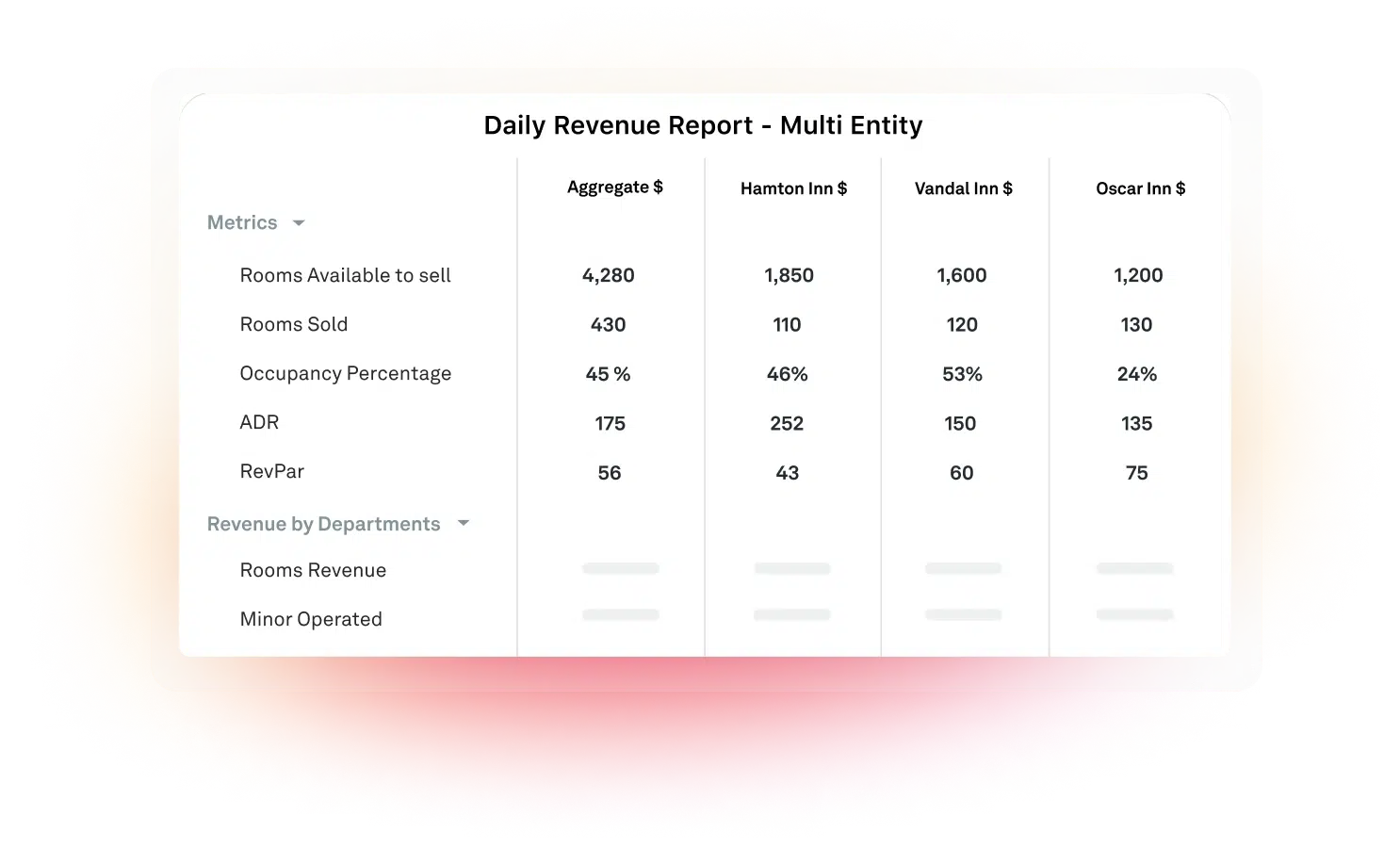

Inter-company accounting, Inventory management, financial reporting, stakeholder management & comparative financial analysis; for multi-location franchise owners, accounting is a complex array of problems that are extremely difficult to solve.

Without specialist franchise accounting software that specializes in multi-location accounting, every aspect of accounting becomes a complex state of problems that takes time, slows down decision-making, and, worse, may even result in inaccurate analysis and wrong decisions.

AI-powered Bookkeeping and Accounting solutions like Docyt are designed to tackle all the accounting challenges that can stop franchise owners from growing their businesses.

Docyt AI - Future of Franchise Accounting Is Not a Set of Tools

Plenty of independent accounting tools can assist franchises with specific needs. But solving franchise accounting complexities isn’t about cobbling together a set of tools. It’s about a unified, centralized platform that covers every aspect of your bookkeeping and accounting processes in one place, like Docyt.

Docyt goes far beyond simply providing automated bookkeeping for franchises. It powers franchises to maximize the benefits of AI bookkeeping and automation with the right integrations, specialized expertise, and support.

At Docyt, we support franchises with payroll integration, payment processing, and even timekeeping integrations to make the entire process standardized and smooth. And that is not all. Our in-house bookkeeping and accounting experts can also help you set up your books right, providing ad-hoc bookkeeping, accounting, and tax assistance when you need it.

The future of franchise accounting isn’t piecing together tools—it’s having an all-in-one solution that offers end-to-end automated bookkeeping and accounting, seamless integration, and dedicated support every step of the way.

The future of franchise accounting is Docyt, and it’s here.