When you own a business, one of the most important decisions you’ll make is which accounting method to use. Generally, you have two choices; cash basis accounting or accrual basis accounting. Cash basis accounting is considered the easier of the two methods as transactions are recorded when money changes hands; accrual basis accounting, although more complex, provides richer detail and reporting accuracy as it recognizes both revenue and expenses when incurred, rather than when paid.

Cash or Accrual Basis for Businesses

There are some advantages to cash basis accounting. It’s simple enough that even non-accountants will understand it, and it only requires a single bookkeeping entry. When you look at cash basis vs. accrual basis accounting, it may be tempting to go the easier route, especially if you’re a small business owner with limited resources. But there are a lot of benefits of accrual basis accounting for small businesses you may not be aware of. The following are just a few:

- More accurate – Unlike cash basis accounting, which only shows transactions when money changes hands, accrual basis accounting provides a more detailed picture of both income and expenses in real time. When applying for a business loan, financial institutions tend to view businesses more favorably if they use accrual basis accounting.

- GAAP compliant – While you may not be worrying about following Generally Accepted Accounting Principles (GAAP) right now, keep in mind that if your goal is to grow your business, you’ll need to have a clearer picture of your finances, which only accrual accounting can provide. This is particularly important if your plans include outside investors.

- Better financial planning – Accrual basis accounting provides you with more accurate revenue and expense reports since it includes bills that haven’t been paid or money not yet received. This results in more accurate planning and budgeting.

- Tax benefits – There are plenty of accrual basis tax benefits to be had, including the ability to deduct expenses such as wages, commissions, utilities, insurance, and interest payments that you’ve accrued at year-end but have not yet paid. You can also review your receivables and write off any uncollectable accounts, reducing your taxable income.

Is Accounting Automation the Answer?

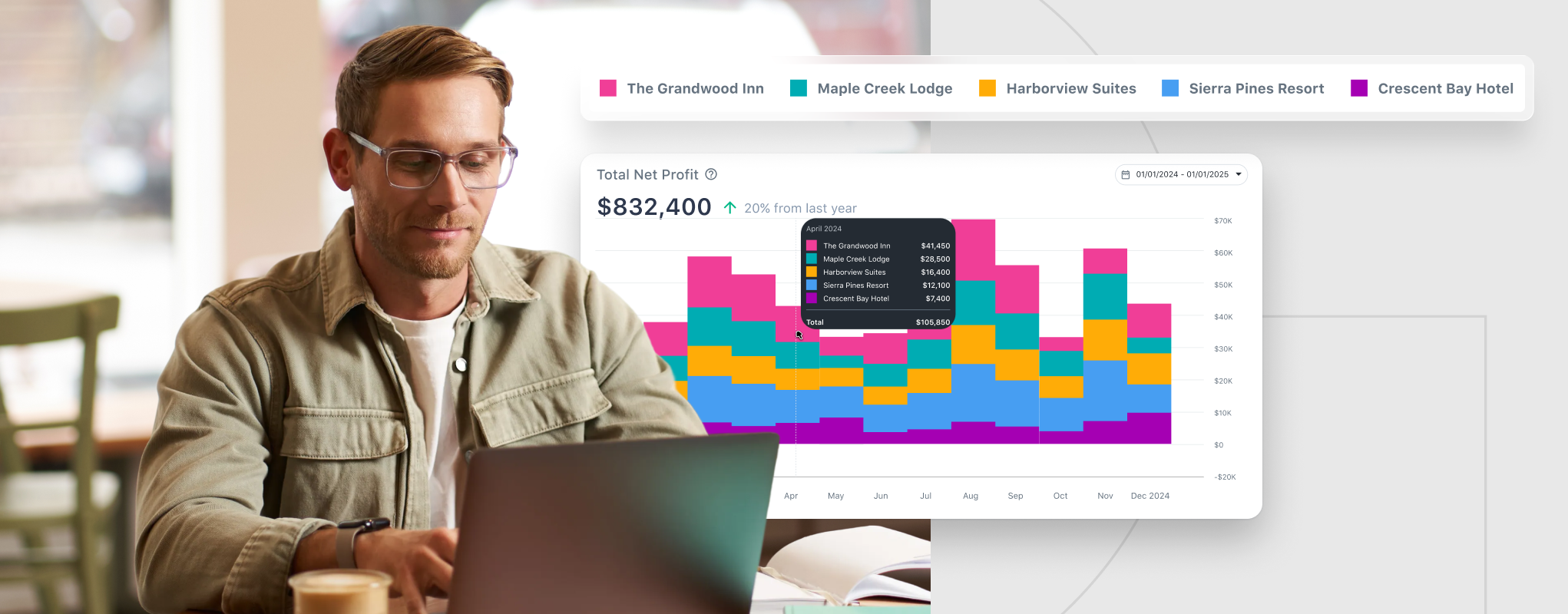

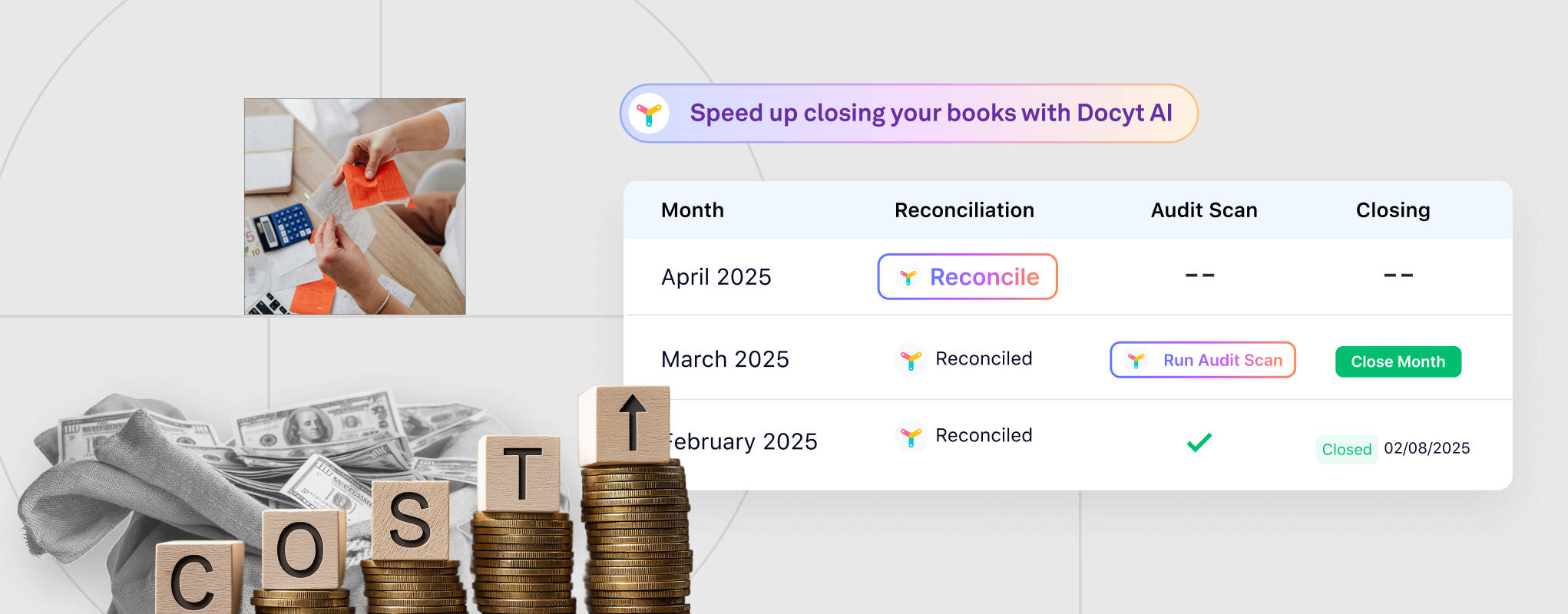

If you know that accrual basis accounting is the better option for your business, but the thought of undertaking standard accounting tasks such as managing accounts payable and accounts receivable is overwhelming, consider using automated accounting software such as Docyt. Powered by artificial intelligence (AI) technology, Docyt automates bill payment, receipt capture, expense reimbursement, and tracks and reconciles revenue.

For more information on how Docyt can automate the accounting process for your business, schedule a consultation with one of our knowledgeable sales representatives today.