Revenue leakage in hotel accounting isn’t rare. It’s systemic, and in most hotels, it’s inevitable.

A significant portion of this leakage can be attributed to night audits. And what makes this type of revenue leakage dangerous is that it’s difficult to detect until it inflicts ruinous damage.

Hotel Night Audits & How Revenue Leaks Evade Detection

They masquerade as regular activity: a comped room, a walk-in rate mismatch, or a no-show not reconciled with the OTA – these slipups don’t look like errors; they appear to be part of busy hotel operations.

However, each of these errors leaves behind a small, unchecked delta in your revenue map that accumulates over time, invisibly.

The hotel accounting tools processes are fragmented: With your PMS in one place, POS in another, spreadsheets handling reconciliation, and deposits tracked elsewhere, most night audit workflows are buried under data silos, untraceable gaps, and manual guesswork.

Without a unified system that connects tools and creates an auditable trail, revenue leakage becomes a built-in consequence.

And the result: Hidden revenue leakages that are difficult to detect and even harder to rectify.

If this sounds familiar, then this blog is for you. Today, we discuss the most common fault lines in the night audit that lead to leakages (so you catch them all). And then delve into the processes and tools that innovative and profitable hotel properties use to plug them.

Let’s jump right in.

Where Leakage Begins: Five Quiet Fault Lines

1. Uncaptured No-Show Revenue: If a guest doesn’t arrive but their reservation isn’t updated across all systems (PMS and OTAs), or if deposits aren’t matched daily, revenue from no-shows can easily go unclaimed.

Because most manual checklists rely on a staff member to spot and follow up, the no-show revenue is the first one to slip through, particularly when nights are busy or the handover isn’t thorough.

2. Tax Coding Errors: If the night audit is manual, tax calculations aren’t always systematically checked against current rates and rules. These errors do cause revenue leakage when tax is either over- or under-collected, which means both lost revenue and also potential regulatory penalties (another leakage)

3. Comp Rooms and Unlogged Adjustments: Comped rooms or unapproved folio adjustments are rarely documented, especially if they occur late at night or outside the standard review sequence. These untracked comps and edits slowly leak your revenue without a trace.

4. Posting and Payment Mismatches across Systems: Payments posted as one tender type (e.g., card vs. cash) but settled as another can result in discrepancies that manual audits rarely catch. Without daily automated reconciliation between PMS, POS, and OTA folios, mismatches become errors that appear as open items, unresolved variances, or even undetected theft.

5. Ignored Minor Discrepancies that Add Up: When variance alerts aren’t tailored as per the revenue, lots of minor discrepancies remain undetected. Traditional audits rarely have the time or capacity to investigate all exceptions. The tiny differences accumulate night after night, eventually causing a material dent in monthly revenue.

How Smart Hotel Properties Plug Revenue Leaks: 3 Fixes That Work

Unlogged adjustments, uncaptured revenue, payment mismatches, discrepancies, and even tax errors represent faults at every point in the revenue pipeline. While these errors are minor, over time they collectively make a dent that’s difficult to track or fix.

But here’s how smart hotel properties are quietly plugging the leaks and tightening the flow without overhauling their systems:

1. Nightly Reconciliation – Because Month-End Close is Key Revenue Leakage Enabler

Mismatched folios, misposted payments, or unclosed balances are the starting points of most revenue leakages. Although acknowledged, these slipups are challenging to track by the time the monthly close rolls around.

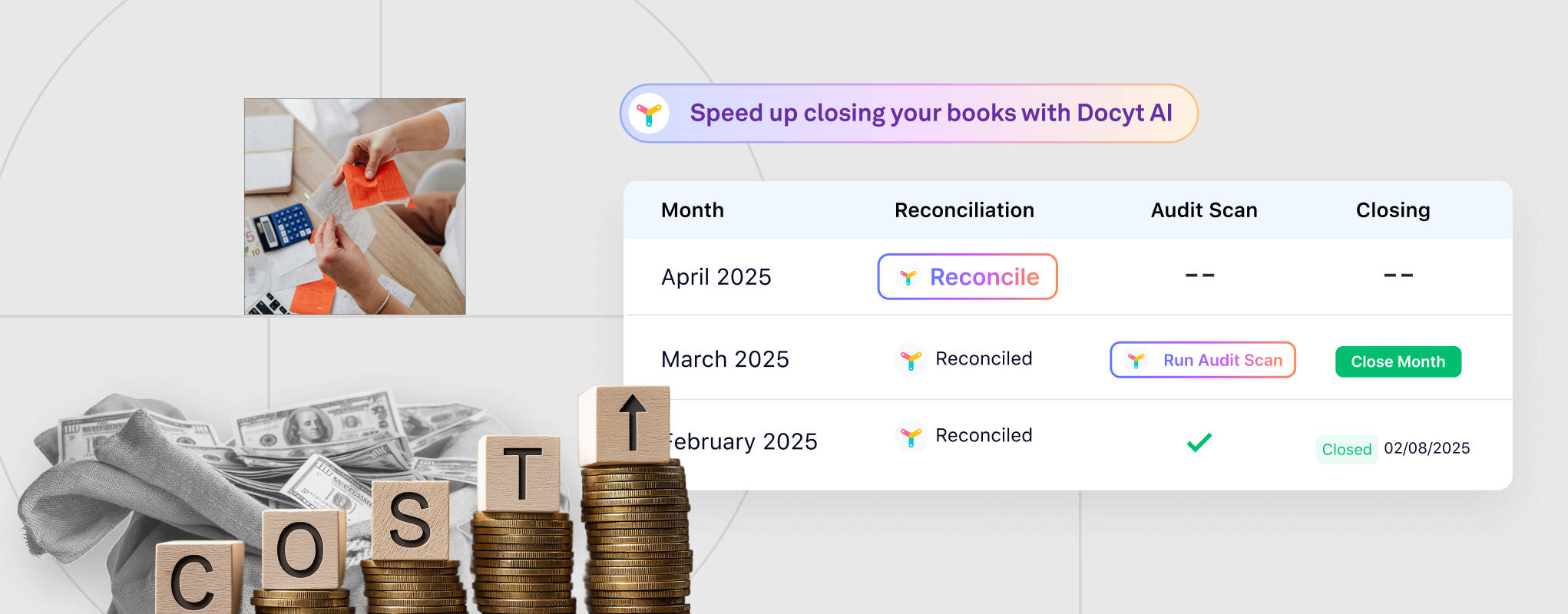

More innovative accounting teams today automate reconciliation to eliminate these problems. Instead of reconciling once a month (or even once a week), they automate the reconciliation every night.

Equipped with automated reconciliation systems, they cross-reference every guest folio with payment logs, OTA payouts, and the actual bank feeds before logging off every day.

The result is a clear, up-to-date financial picture, where discrepancies are identified early and revenue leakage due to the above factors is eliminated (before it can compound).

2. Real-Time Comp Tracking – Free Shouldn’t Mean Invisible

A comped room or discount might seem small in the moment. But when these adjustments aren’t tracked clearly, they quietly reduce revenue and become difficult to track.

On top of this, many teams still rely on scattered notes or verbal approvals, meaning no one knows exactly why a comp was given or who approved it.

Real-time comp tracking helps avoid these recurrent problems by enabling accounting teams to track comps in real-time. By logging every compensation with reason, time, and approval, these systems make the process transparent and help managers prevent misuse, ensuring that only valid complaints are processed.

3. Intelligent Thresholds – To Escalate Only When It Truly Matters

AI-powered accounting tools help catch even the tiniest discrepancies. However, when every minor mismatch triggers an alert, teams begin to ignore notifications. On the other hand, with too few alerts, critical issues can get missed.

Setting a convenient threshold for uncertain errors is a fix that helps ensure long-term success, and today’s hotel accounting tools offer features that let accounting teams tailor these thresholds.

For example, if an OTA booking is marked as a no-show in your PMS but the payout still appears in your account, the $712 discrepancy is flagged immediately. But a $9 difference (customizable threshold) from a restaurant tip is logged and noted, so it doesn’t clutter the dashboard.

The above fixes aren’t about a massive change. They’re more intelligent defaults that’re small, deliberate shifts, which build a stronger night audit foundation and plug the most common revenue leaks.

In any other era, even these basic upgrades would’ve required a complete overhaul of your hotel’s accounting setup.

But not in 2025.

Today hotel owners will no longer need to overhaul their accounting systems to automate night audit and arrest the revenue leakage. They need more smart tools that work quietly in the background, connecting what’s already there.

To be precise, they just need on tool for night audit automation – Docyt.

Docyt AI – Achieve Seamless Hotel Night Audit Automation with Simple Integration

AI accounting solutions like Docyt don’t ask for an overhaul or replacement of your PMS, POS, or bank feeds.

They simply plug into the existing ones, sync, reconcile & verify the transactions to provide complete night audit automation, plugging all potential night audit revenue leakages. Here’s how:

With simple integration, Docyt enables complete night audit automation, plugging all the potential revenue leakage issues for hotels:

- AI automatically reconciles PMS/POS revenue with bank deposits, flagging missed revenue so nothing slips through the cracks.

- POS sales are automatically matched with folios.

- Reconciliation happens in real-time, catching night audit errors before they slip through.

- Flags even minor variances through custom alert thresholds.

And because Docyt continuously monitors the flow, they don’t just track what’s been closed; they make sure it’s closed correctly. You spot gaps early, not days later.

- So a missing deposit? Flagged.

- A payment posted wrong? Caught.

- A comp or no-show? Backed by receipts, not just notes.

- A tender mismatch? Detected and corrected automatically.

To make it truly airtight, every reservation, payment, compensation, and edit is tied back to the source, making the audit cleaner, the books tighter, and the revenue accounted for line by line, night by night.

Docyt AI, Complete End-to-End Accounting Automation for Hotels

That said, the advanced AI-powered night audit automation offered by Docyt is one of its many features that naturally result from automating every layer of hotel accounting.

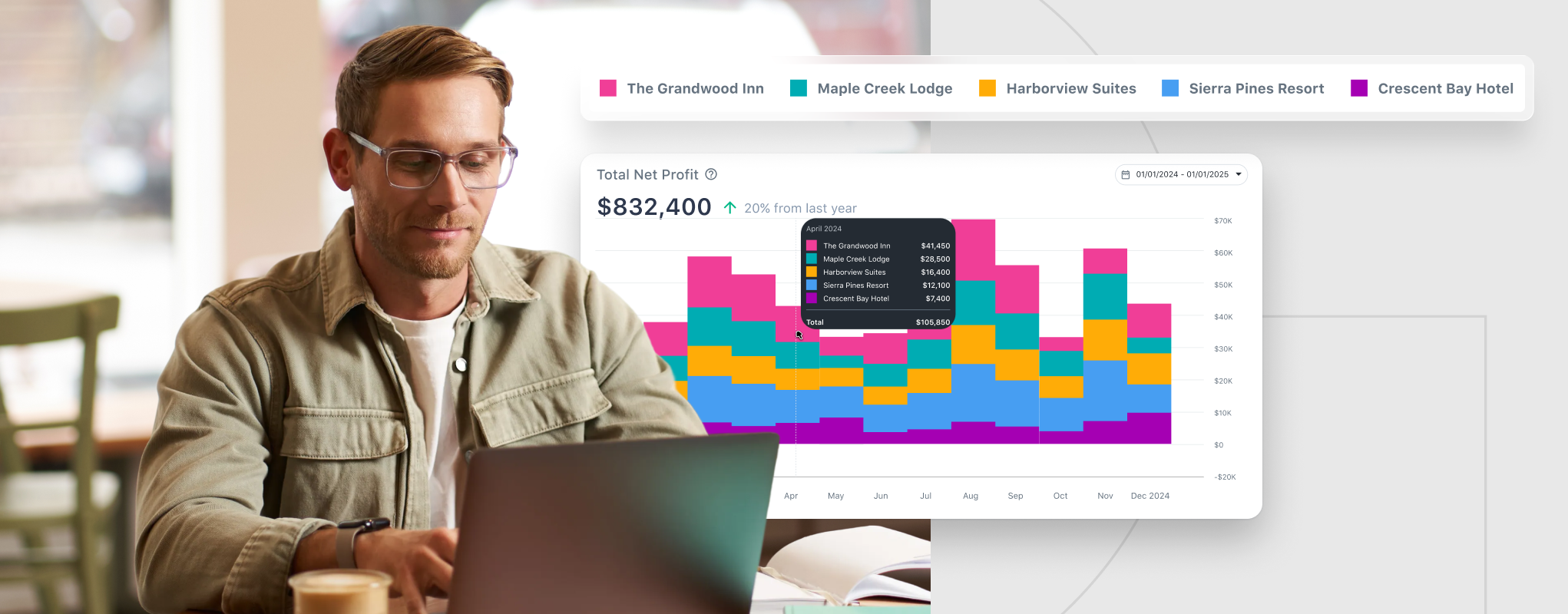

An end-to-end AI accounting platform for hospitality properties, Docyt AI handles everything from bookkeeping and reconciliation to revenue and expense management, labor analysis, and advanced BI reporting – all in one platform with simple integration.

To learn more, check out Docyt’s advanced AI accounting automation for hospitality properties.