The closing of monthly financials is a critical time for businesses of all sizes. During this process, all transactions for the month are processed and recorded in the accounting system to produce reports necessary to understand the business’s financial state. This process can be time-consuming and grueling, especially for busy small business owners. In fact, many business owners will not have access to the previous month’s critical data until halfway through the following month.

What exactly is the month-end close process?

The month-end close is the process of reconciling and accurately recording all financial transactions within a month ensuring accounts are accurate, balanced, and up-to-date. This process gives businesses a better picture of their current financial standing and future financial projections.

The month-end close includes recording income and expenses, updating accounts payable and receivables, account reconciliation, preparing and reviewing financial statements as well as checking for errors, making adjustments, and preparing analytical reports.

Why is it important to optimize the month-end close process?

In order to get a clear picture of the business’s financial health, closing the books is necessary – completing it on a timely basis is critical. Without a complete understanding of the numbers, furthering growth initiatives and maximizing profit becomes exceptionally difficult.

Although prioritizing the tasks leading to a successful close can be challenging, optimizing the process will:

Reduce Costs: Save on labor costs by reducing the amount of time and required staff to complete the process.

Increase Accuracy: Confidently rely on the accuracy of financial statements to make sound business decisions and avoid possible financial pitfalls.

Improve Efficiency: Get back valuable time, resources, and money to focus on other core activities.

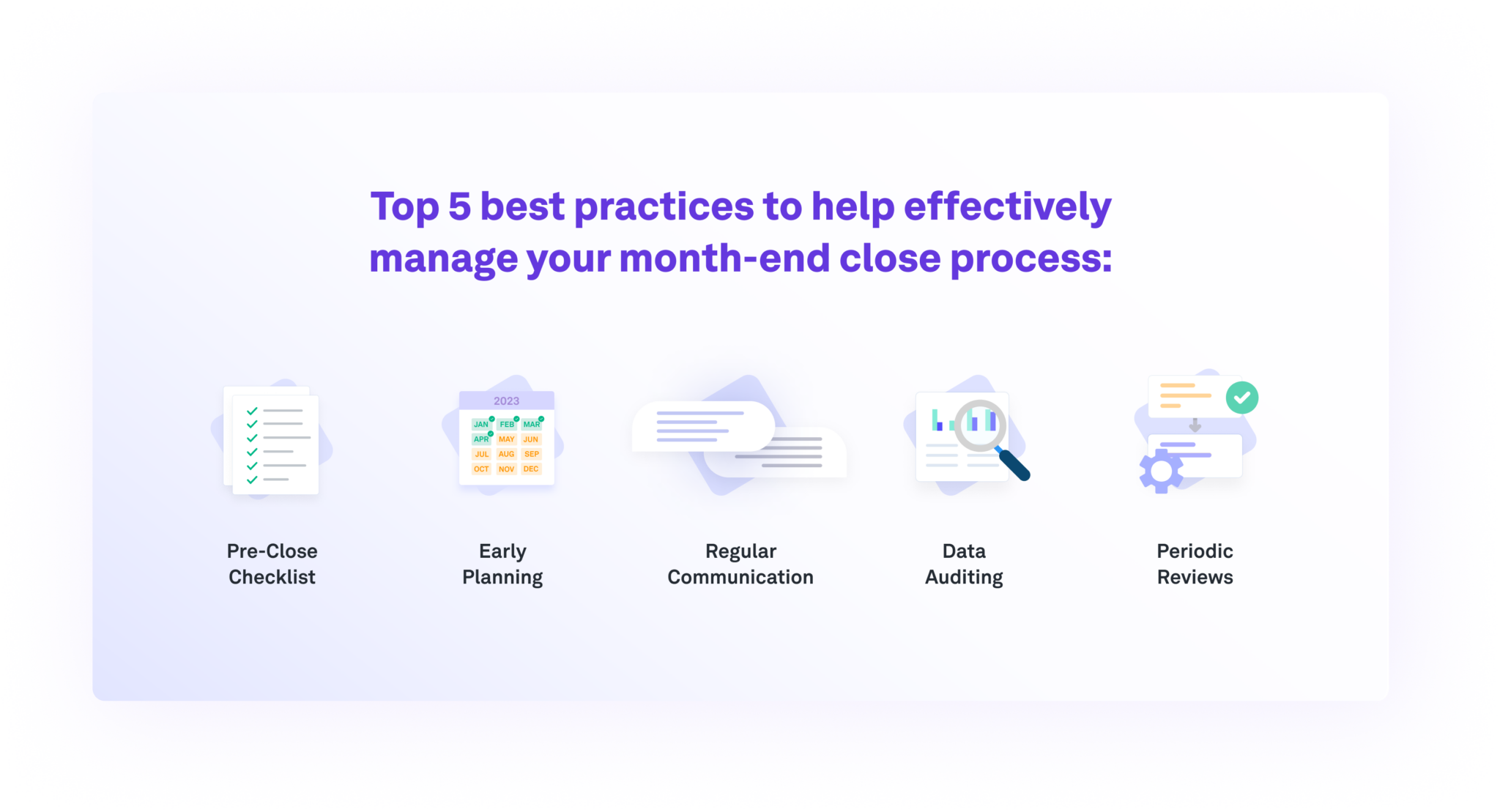

Pre-Close Checklist:

A checklist ensures the completion of tasks, reduces the risk of errors, and increases accountability and efficiency.

Early Planning:

Presetting deadlines and expectations of tasks help the process run smoothly and timely.

Regular Communication:

Keeping employees informed and aware of the progress can help keep staff who are involved with the month-end close process on target with their tasks and can help mitigate potential problems ahead of deadlines.

Data Auditing:

Audit data regularly to identify errors and discrepancies, reduce risks, and increase the accuracy of reports. Side note: Manually auditing your books is always an option, although it is both tedious and time-consuming, whereas, with AI-powered accounting software, data analysis is a breeze because of automation!

Periodic Reviews:

Review the process and make improvements if needed. If not, then rinse and repeat.

What are the best ways to optimize the month-end close process?

Automate:

Daily transaction automation minimizes the time needed to complete repetitive bookkeeping tasks that tend to get pushed aside until the end of the month.

Document:

By documenting the month-end process and creating a standard process to follow, information is readily available if called into question and future closes will run more smoothly.

Analyze:

Regularly conduct a post-close analysis to find areas that need improvement.

Train:

Consistent training for employees responsible for closing the monthly financials can increase accuracy and efficiency.

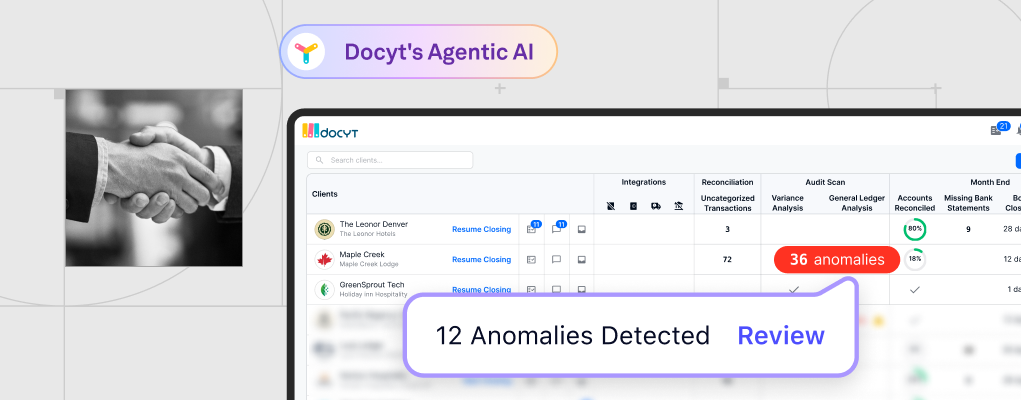

If you’d like to take it a step further with modernizing your month-end close process, consider using accounting technology, which many businesses have taken advantage of to streamline a lot of their manual processes. Accounting technology automates your basic bookkeeping tasks from recording expenses to corporate credit card management to automating bank reconciliation and financial reporting and more! Instead of waiting until the end of the month, accounting software like Docyt is continuously updating your books throughout the month.

If you’d like to learn more about how to leverage accounting technology for your business, schedule a free consultation with Docyt today!