Perceived by many to be mundane and time-consuming, bank reconciliation remains a necessary part of monthly accounting. Through advancements in artificial intelligence and end-to-end accounting software (and to the pleasure of bookkeepers everywhere), automated bank reconciliation is quickly becoming the norm. But can machine learning fully automate reconciliation? In this article, the experts at Docyt explain the concept of bank reconciliation, its challenges, and how AI-powered solutions are revolutionizing the way businesses approach this crucial financial task.

What is Bank Reconciliation?

Before diving into the possibility of automation, let’s briefly look at what bank reconciliation is. Bank reconciliation is the process of comparing a company’s financial records, namely its general ledger and bank statement, to make them match. Both sets of financial records should ultimately match one another, and if they don’t, you’ll need to do some detective work to figure out why.

This practice helps identify fraud or discrepancies like incorrect payments and missing or duplicate transactions. This provides a roadmap to make necessary corrections. Once the reconciliation process is complete, you can get an accurate picture of a company’s financial health.

The Challenges of Manual Bank Reconciliation

Traditionally, bank reconciliations have been performed manually, involving a painstaking review of numerous transactions. The sheer volume of data alone can overwhelm even the most meticulous accountants. Not to mention, it can be a significant drain on valuable resources and time that could be better spent on more strategic tasks.

Enter the World of Machine Learning: A Game-Changer

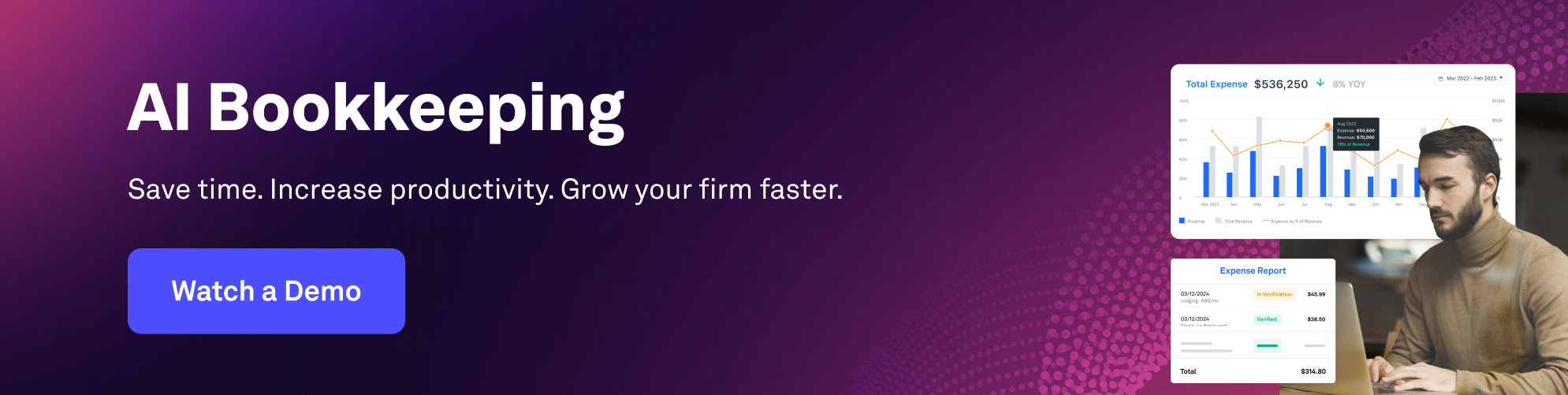

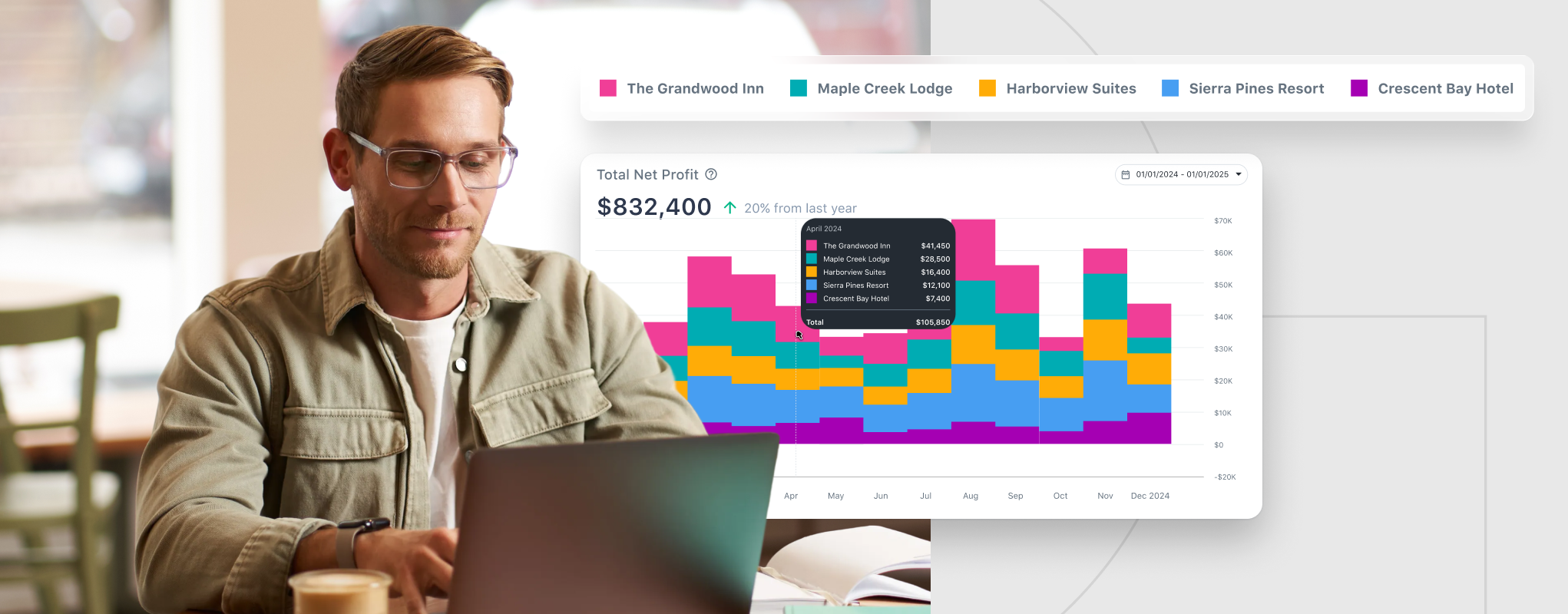

With the advent of AI-powered accounting software, businesses worldwide have been given the gift of automated bank reconciliation. Through intelligent algorithms and machine learning capabilities, software solutions like Docyt ingest and analyze vast amounts of financial data, compare it to bank statements, and identify inconsistencies at breakneck speeds. By relegating the process to AI automation, the risk of manual data entry errors is essentially eliminated. Docyt customers reap the benefit of getting real-time financial insights from this automated process, which becomes a regular part of routine business.

How to Automate Bank Reconciliation

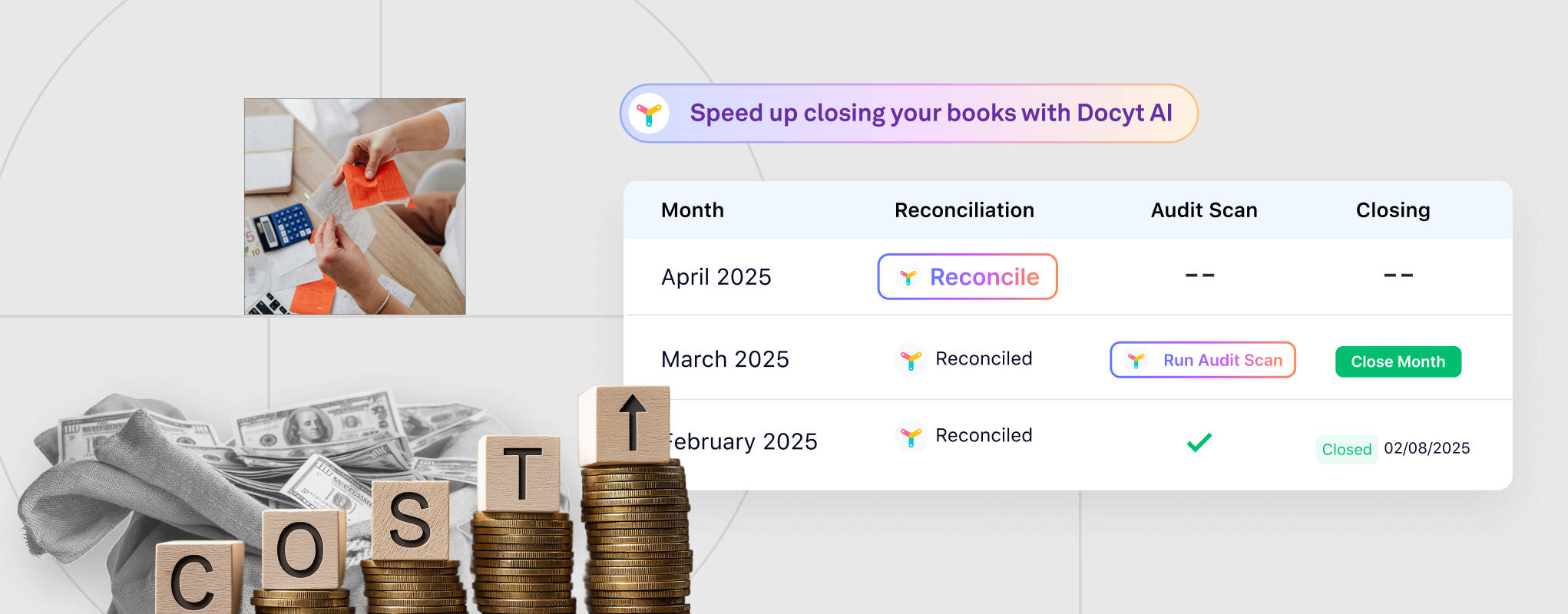

Bank reconciliation automation starts with adopting AI-powered accounting software like Docyt. With Docyt, your business bank accounts are connected to the software through a secure bank feed. Docyt’s AI-powered algorithms analyze the financial data from submitted expenses and automatically match transactions to bank statements. The AI automatically flags discrepancies or irregularities for human review. With time, the system learns by absorbing human interaction to improve accuracy. Which speeds up the bank reconciliation process over time.

By embracing machine learning bank reconciliation, businesses will significantly decrease the time it takes to complete the process, reduce errors, and better understand their financial status.

Conclusion

Fully automating bank reconciliations was once dismissed as unattainable, but advanced AI technology quickly makes it the industry standard. By incorporating machine-learning solutions like Docyt, business owners can confidently streamline their back-office tasks, minimize human error, and get time back to focus on other strategic initiatives for the business.

Disclaimer: Docyt does not provide accounting, tax, business or legal advice. The content of this article is purely for informational purposes and should not be considered as professional advice. We strongly recommend consulting with your trusted professional advisors for any matters directly related to your business or before implementing any actions based on the information presented here.