Hospitality finance teams rarely work inside a single platform. Property management, payroll, point of sale, bank portals, and large ERPs all hold fragments of the financial picture, yet none communicate fluently with one another.

When systems fail to align (which is inevitable), minor timing mismatches often escalate into full reconciliation problems. Intercompany balances can drift, books lose accuracy, and audits become harder to defend.

Research shows that mismatched intercompany entries are among the top drivers of delayed closes and restatements. And naturally, leaders end up spending time fixing errors instead of producing insight for owners and investors.

Hotel Accounting Stack: Fragmentation Can Break Your Back Office

Fragmentation doesn’t just slow the teams down; it also weakens trust in the numbers. Because each platform maintains its own ledger and none shares a foundation, balances that appear correct in one system fall apart once consolidated. Spreadsheets fill the gaps, formulas are adjusted in real-time, and approvals move through long email chains.

On top of this, shared services like payroll or vendor invoices often slip through without being divided correctly across properties. Some entries arrive late, others land in the wrong books, and by the time the close arrives, general managers are left with distorted profit and loss statements (P&Ls).

Vendors often see unclear balances, and finance teams are forced to explain payments that never matched the record in the first place. Fragmentation, when left unchecked, often turns into reputational as well as financial risk.

The Docyt Solution: AI-First Intercompany Visibility

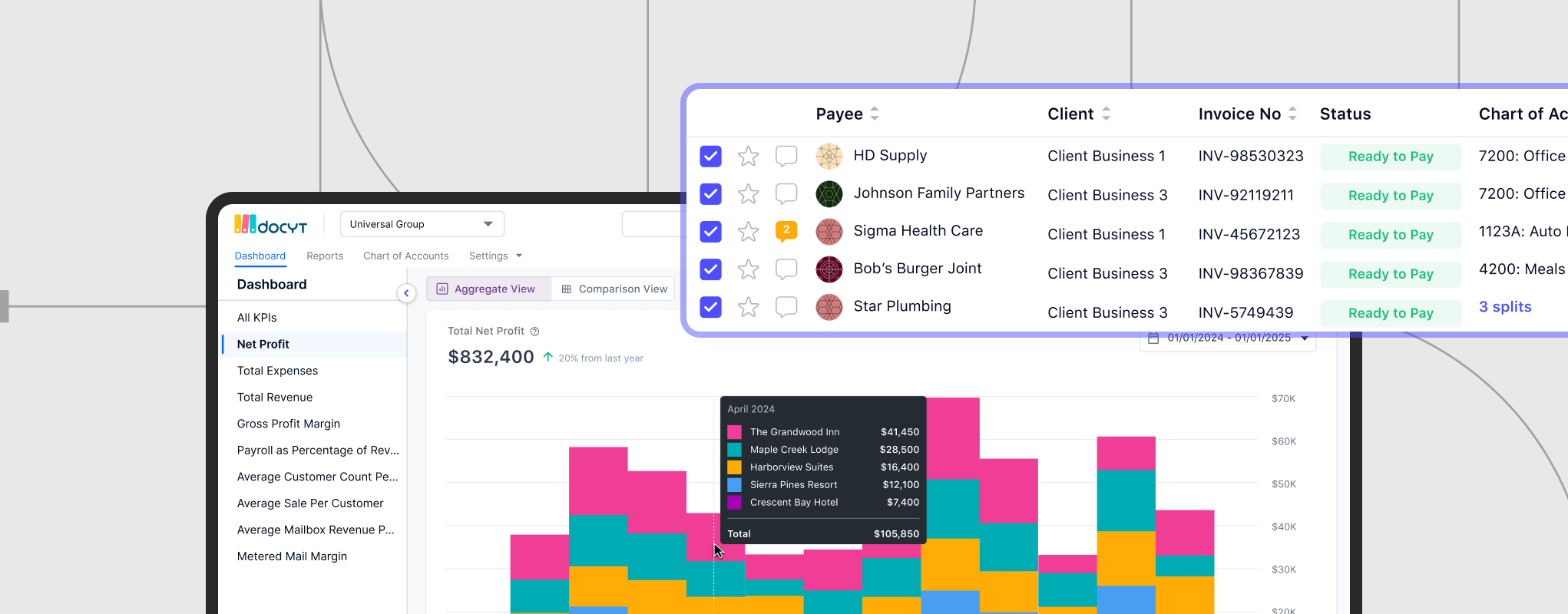

Docyt approaches this problem at the source. Docyt directly connects with PMS, POS, payroll systems, and bank feeds, bringing every transaction into a single environment.

Its matching engine identifies shared costs and splits them across properties automatically. Balanced “Due To / Due From” entries are created as transactions occur, not after someone manually reviews them. Each split or allocation carries its own trail, so payroll adjustments, vendor bills, and intercompany transfers remain transparent and audit-ready.

Instead of scattered fragments, finance teams work with a coherent record that both managers and auditors can trust.

Turning Chaos to Control: What Unified Visibility Looks Like with Docyt’s Profit AI

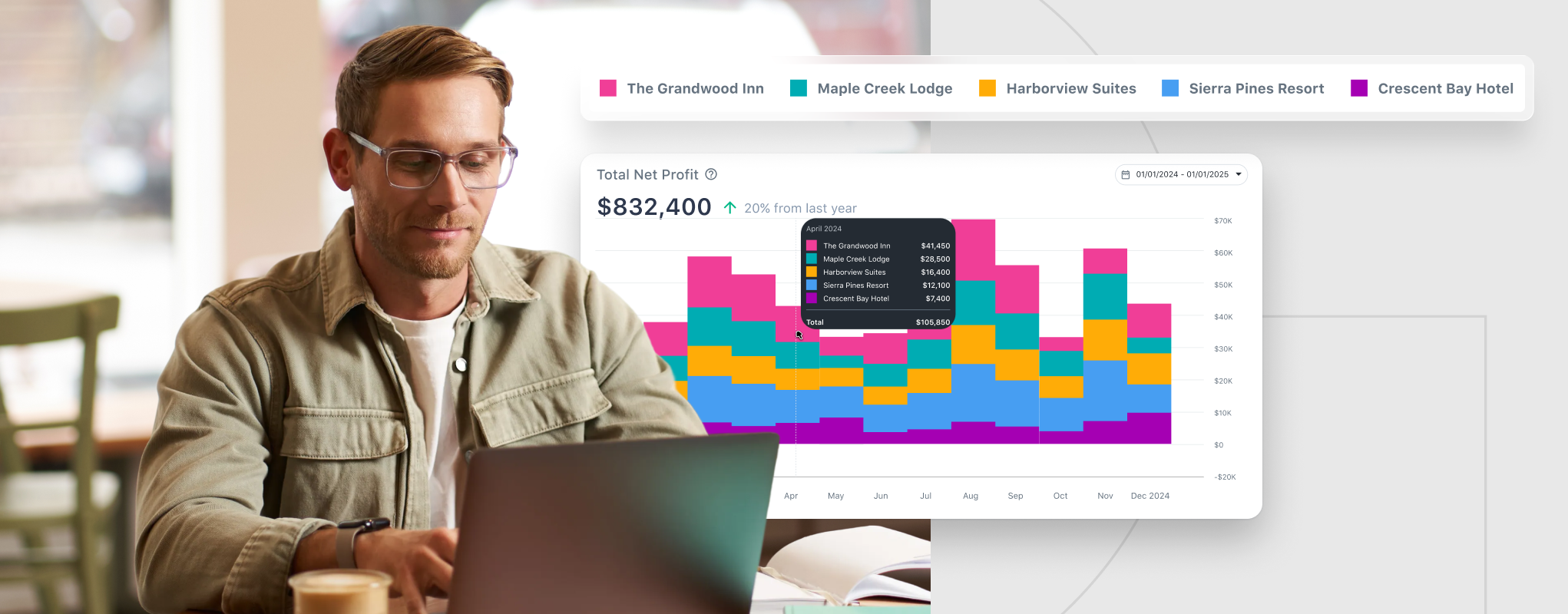

Once the records are aligned, the view changes completely. Dashboards display performance by property and across the entire portfolio, providing owners and managers with real-time profitability information without waiting for the month to end.

Intercompany balances are updated live, eliminating the familiar question of why a number does not reconcile. Supporting bills and receipts are attached directly to the entries they belong to, so anyone reviewing the books can find documents without having to search through emails. Days once lost to cleanup are now reduced to minutes of verification. Transparency becomes the baseline rather than the exception.

Video – Docyt for Hotel Businesses | Bill Pay

Video – Dashboards for Multi-Entity Visibility

Profit Impact: Better Decisions, Faster Close

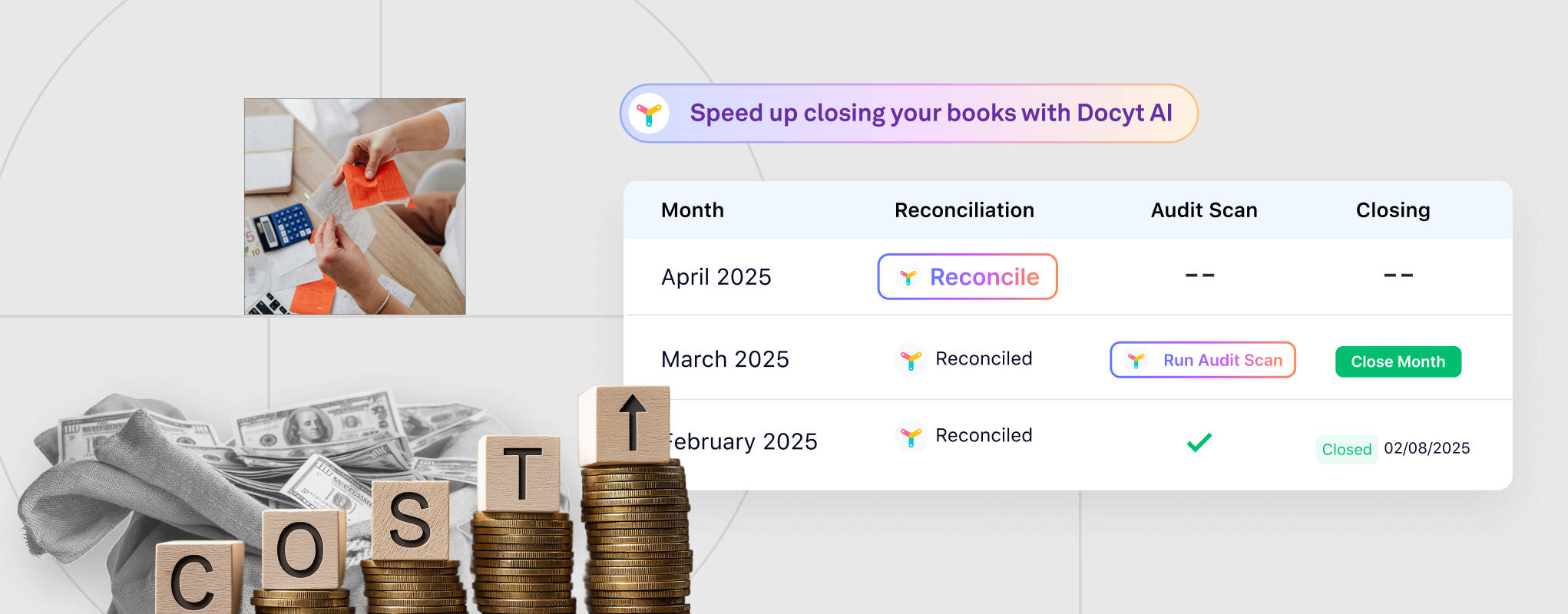

By integrating data streams and applying AI-driven matching, Docyt’s Accounting and Business Intellgence platformI provides a single source of truth that keeps records balanced, transparent, and ready for audit.

With this unified visibility, the benefits extend beyond efficiency.

Month-end closes shorten and misstatements fall away reducing rework and audit exposure. P&Ls present clean ownership, so each general manager sees exactly what drives their results without disputes over allocations.

Finance leaders spend less time correcting and more time advising. Investors and lenders focus on reliable numbers, while operators redirect their energy toward strategy. And everything culminates to clean books that translate directly into stronger and more informed decisions.

Book your personalized demo now to see how Docyt’s platform delivers clean, multi-entity accounting at scale.