The accounting profession is facing a structural talent shortage, with a large part of the workforce nearing retirement and burnout already widespread.

At the same time, client expectations continue to rise every year. Faster turnarounds, real-time visibility, and higher advisory value have already become the baseline.

Caught in the crossfire of growing demands and shrinking teams, protecting margins has turned into one of the hardest fights CPA firms must win.

Fortunately, AI-powered accounting automation arrived just in time.

In today’s competitive environment, defined by talent shortages, rising client demands, and shrinking margin room AI isn’t a nice-to-have anymore; it’s the line between firms that keep up and firms that slowly fall behind.

The real challenge now isn’t whether to automate, but where to start so you actually free capacity, protect margins, and avoid adding yet another disconnected tool to the mix.

This guide is written for firms in precisely that position.

Below, we break down five accounting workflows every CPA firm should automate first to boost margins – without additional hiring or capital:

Automated Reconciliation, Categorization & Matching: Simplest Way to Improve Margin Gains

Reconciliation is the first workflow worth automating because it removes the heaviest workload with the highest payoff: more clients handled per staff member, cleaner books, and a noticeable rise in margins.

By automating the earliest layers of accounting, AI handles the bulk of recurring vendors and deposit patterns before staff see them.

The firms that adopt automated reconciliation gain immediate breathing room.

- The entries stay current, so reviewers work on clean data to boost accuracy while cutting down hours lost to second rounds of review.

- Senior staff stop spending mornings verifying small items. Month-end stops expanding, and teams move faster because the ledger is already stable when they open it.

Check out the Automated Reconciliation guide to understand the process & benefits in-depth.

Automated Document Intake & Client Communication: Cuts the CPA Firm’s Most Annoying Costs

Everyone in a CPA firm knows the how draining the document intake can be. Missing PDFs, scattered uploads, incomplete receipts, and the “can you resend that” cycle all take time no one bills for.

Automating document intake and client communication takes out the constant interruptions that make accounting unpredictable. When documents arrive cleanly and consistently, everything that follows becomes easier and cheaper.

AI-powered document intake simplifies the workflow without adding steps.

- Captures documents the moment clients send them, reads them accurately, and attaches them to the right place so nothing waits for manual clean-up.

- Nudges clients automatically when something is missing, which removes a surprising amount of noise from the week.

This translates to faster reviews, fewer delays caused by missing documents, and a stable month-end close while handling more volume with the same team.

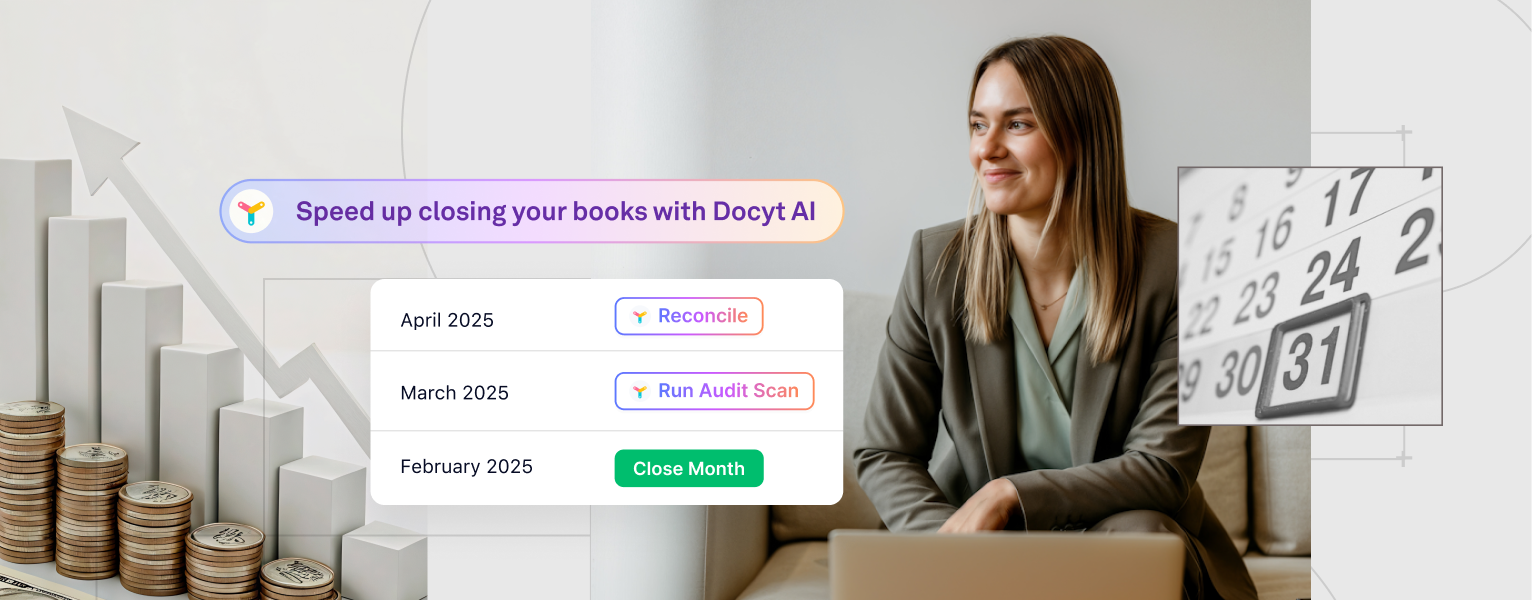

Automated Month-End Close: Turns the Hardest Week of the Month into Predictable Margin

Month-end close absorbs more staff attention than any other recurring process. AI-powered month-end close helps by handling tasks continuously as they arrive:

- Transactions stay up to date, and unresolved items surface immediately.

- Adjustment suggestions appear as soon as the system has enough context.

This continuous flow keeps the ledger much closer to ready, so the team spends the final days verifying rather than rebuilding

Automated month-end close translates to:

- Shorter close cycles

- Fewer last-minute corrections

- Lighter senior review

- Higher reporting quality

- More capacity during the busiest part of the month

Month-end close is often the first workflow automated when a CPA firm wants predictable delivery and more room for advisory work.

Have a closer look at how incredibly time-saving month-end close automation can be here: From Weeks to Hours: How AI Reduces Time & Complexity in Month-End Closures

AP Processing & Approvals: Immediate Margin Win Once Automation Takes Over

AP is rarely difficult, but it is endlessly distracting. The work gets held up by people, timing, and missing information. The better approach is to let AI run the early stages so the team does not have to chase anything.

Here is a different way to look at the gain: AP automation protects momentum. Invoices enter cleanly, approvals move without reminders, and duplicates never make it into the queue. The team spends more time reviewing and less time managing the process.

Practical improvements include: Fewer interruptions, cleaner vendor records, faster approval cycles, predictable payment runs & lower risk of downstream adjustments.

Firms that automate AP feel the relief quickly. Capacity rises not because the workflow disappears, but because it stops interfering with everything else.

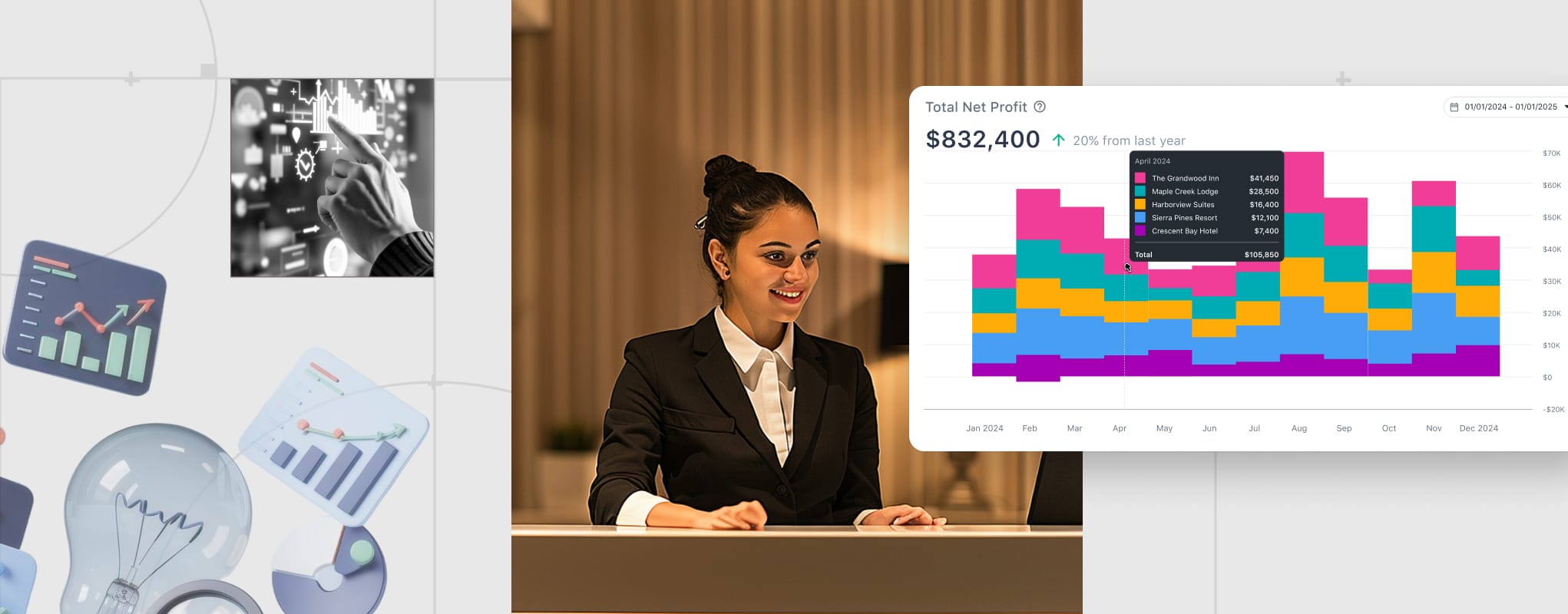

Automated Multi-Entity, Intercompany & Consolidation: Protects the Firm’s Most Valuable Hours

Multi-entity accounting relies on accuracy at every step, and minor inconsistencies widen quickly across entities. CPA firms already know how quickly this area can take over a week. A smarter goal is not to explain the pain but to reduce the hours seniors spend resolving it.

AI helps by keeping related entries aligned as they happen. Transfers record cleanly. Shared expenses apply consistently. Consolidations draw from data that already agrees. Seniors stop spending mornings tracing entries and start reviewing work that is already in good shape.

The advantages that matter most:

- Cleaner intercompany balances

- Faster consolidation cycles

- Stronger reporting for multi-unit clients

- Frees high-level staff for high ROI work

Automation should be implemented here once the firm stabilizes its base workflows, because this area offers one of the strongest margin lifts.

Whether you’re a solo CPA or scaling a growing practice, these workflows directly address the three biggest pressures firms face today – talent shortages, rising client expectations, and margin compression, while giving you a competitive edge.

AI Agents or AI Accounting Platforms – What to choose?

If you are an accounting firm looking to automate a specific workflow to experiment and learn, you can start with AI agents built for individual use cases like month-end close, reconciliation, or transaction coding. (Learn more about them here: What Are AI Agents?)

These AI agents can improve one workflow in isolation. But in practice, they often introduce fragmentation, integration effort, and partial visibility, which means the benefits stall before they spread across the firm. The gain shows up in one corner, while pressure quietly builds elsewhere.

If, on the other hand, you are aiming for system-wide automation across workflows, the faster, more durable path is an end-to-end AI accounting platform. A platform like Docyt AI connects documents, transactions, reviews, and close inside a single continuous system, so improvements in one workflow compound across the entire operation rather than breaking at the seams.

If your goal is not to run pilot experiments but to create real, lasting operating leverage across your firm, this is where a connected end-to-end AI platform matters more than individual AI agents.

Schedule a Free Docyt demo to see how it helps automate your workflows end-to-end and turns workflow efficiency into sustained margin growth.