Managing expenses and cash flow is the lifeline to financial health, sustainability, and future growth. Understanding the relationship between these two concepts and AI technology like Docyt can dramatically improve this process. Learn how AI facilitates a deeper understanding of cash flow and improves expense management strategies.

Let’s explore.

The Relationship Between Cash Flow and Expense Management

The cash flow statement is a necessary financial document that shows how money moves in and out of the business. These documents inform expense management by highlighting when and where to spend and/or cut back as necessary. Simply put, you cannot manage your expenses effectively without a clear understanding of your cash flow.

AI Improves Cash Flow Analysis

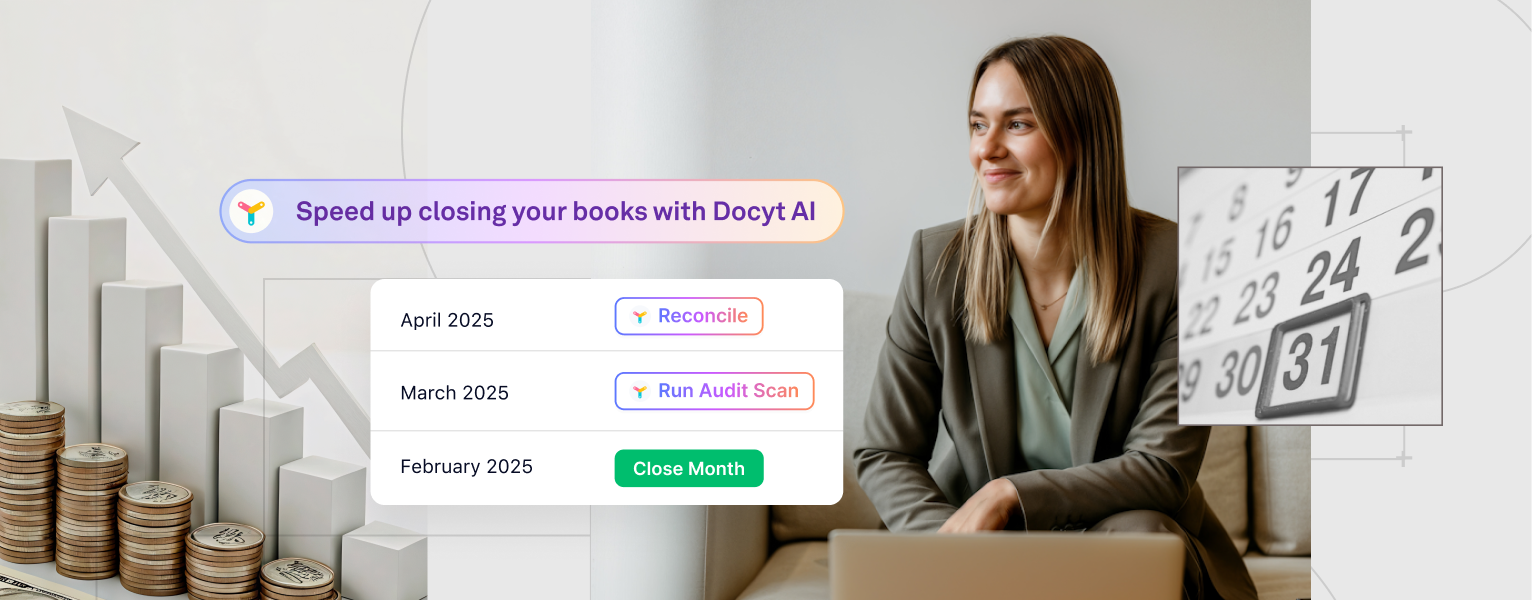

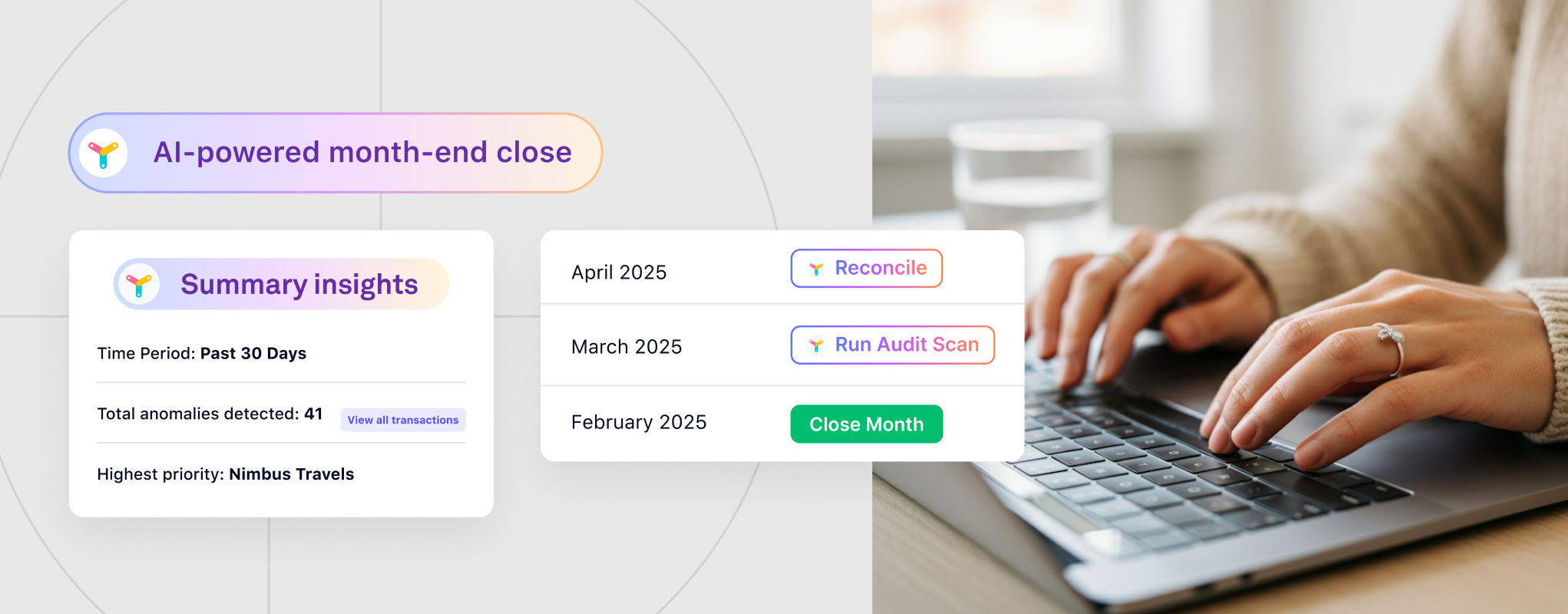

Technologies like Docyt AI transform cash flow analysis by automating data collection and processing, ensuring accurate and up-to-date information. This level of precision is crucial for understanding cash flow statements in real-time, which in turn influences effective expense management. By using artificial intelligence, we can crunch patterns in income and expenditure, predict future trends, and make possible actionable insights to optimize cash flow.

Tailoring Expense Management Through AI Insights

When using advanced bookkeeping automation software boosted by AI, businesses can gain a granular understanding of where their money is being spent and identify areas of opportunity where expenses can be better controlled. Here’s an example: Docyt uses AI to categorize and analyze expenses continuously because the software is able to scour large sets of data instantaneously, analyze the data, identify and assess cash flow trends against a seasonal lull in the business, and make predictions based on historical insight, the trusted AI partner can suggest spend reductions during a specific period to help you a avoid cashflow bottleneck before it occurs. AI is always proactive in managing expenses and has an enhanced understanding of cash flow and how the two are tied together.

Real-Time Decision Making with AI

Docyt’s AI-powered automation software captures data in real-time and, therefore, continuously reconciles accounts through automation and produces highly accurate and current financial and non-financial reports. Integrating AI into a platform with real-time data allows for real-time monitoring and decision-making. This also means that you will always have immediate insight into your cash flow position and expenses making it possible to quickly adjust your strategy to the dynamic demands of the marketplace on a dime. Ultimately, Docyt AI can ensure you are financially agile and resilient.

Conclusion: Smarter Financial Management with AI

Knowing your cash position and managing expenses is crucial to success, but understanding the relationship is even more important for long-term success. Although the Devil is always in the details of cash flow, with artificial intelligence proving itself to be an invaluable partner in effectively managing expenses, the journey gets a tad bit easier. AI bookkeeping tools provide you with improved financial operations and the intelligence to provide it with the best tactical decisions. Docyt AI guarantees you secure, thorough, and efficient financial practices with promises of a prosperous future.