Month-end never sneaks up on finance teams, yet it rarely feels under control. Each property adds its own statements, invoices, and payroll files, and the combined workload increases in proportion to the scale of the properties.

A single payroll adjustment in one property bends the consolidated report for the entire group. Duplicate vendor payments appear, statements arrive incomplete & finance staff have to stitch fragments together.

And then to top it off, the underlying systems continue to speak in different languages. Hotel PMS revenue, restaurant POS sales, bank feeds, and emailed invoices all require translation before they can be trusted.

Nearly every multi-property operator recognizes this cycle, in one way or another. Some do turn to automation tools, hoping to fix them to break this cycle. But most automated solutions only address a single part of the process – reconciling here, reporting there – without creating an actual end-to-end flow.

So, while each step becomes a bit faster, the larger cycle remains broken, and the same inefficiencies move downstream. Read on to know how the work breaks down, even in automation setups.

When Automation Isn’t Enough: The Common Problems Multi-Hotel Teams Still Face

- Consolidation does happen in the traditional process, but more often than not they never truly align. PMS exports one way, POS another, and bank feeds add their own variations. Because integration has always been a problem, finance teams now spend hours bringing them all together.

- Transaction coding starts clean, but they begin to underwhelm. As hundreds of entries accumulate, inconsistencies emerge and spread across entities.

- Reconciliation happens – but not soon enough. Balances also eventually match, yet the lag turns minor gaps into larger distortions that create problems.

- Recurring entries absorb attention that never pays back. Rent, insurance, allocations, and subscriptions repeat predictably but still demand manual handling.

- Reporting completes the cycle, although it is never on time. Executives review results that trail operations, and as a result, the decision-making falters.

Every hospitality property experiences the above problems to some extent and hopes for better tools that can plug the gaps and solve these issues.

And that brings us to our next question: why do the traditional automation tools fail?

Why Traditional Automation Tools Fail:

Automation should create order, yet most systems only divide it. Each tool operates within its own boundaries, handling a fraction of the accounting process while ignoring the rest. This may look efficient on paper, but it becomes a maze in practice when the number of tools and processes increases.

The finance team moves between screens, exporting here, reconciling there, and hoping the pieces will align by the end of the month. They rarely do, here’s why:

Lack of continuity & flow:

Information travels from PMS to POS to bank feed, changing its form each time. A number loses its context, a date shifts to a different format, and a vendor name mutates slightly. The thread that connects one stage to another begins to fray. Accountants spend hours relinking what software should have carried forward intact.

Reduced accuracy:

When data accumulates across multiple entities, even the slightest inconsistency can spread. For example, two invoices overlap, a transfer is made to the incorrect ledger, and a payroll adjustment is repeated. Though each mistake is tiny on its own, but together they distort the numbers, and as a result, reports, even though they appear complete, are not as relevant as we want them to be.

Slowed-down process:

Increased volume, lack of tight integration, and continuity eventually impact the speed of the cycle. As transactions multiply, the tools lose their pace. Files can take longer to load, reconciliations go on and eat extra days, and reporting, naturally lags. And automation which was meant to accelerate the accounting cycle, starts to weigh it down.

Fragmented automation creates motion without progress. It rearranges numbers but never allows them to align. To handle accounting at scale, the system itself must stay whole, linking data as it flows, preserving accuracy as it expands, and sustaining speed as it grows.

That level of control is only achieved by AI-powered accounting automation tools, such as Docyt.

Docyt AI – Where Every Best Practice Finally Holds Together

Every finance leader already knows the drill: consolidate, code, reconcile, and report. The processes are familiar; what changes everything is how they connect.

In most systems, they don’t. Manual work slows the flow, creates small blind spots, and turns accuracy into a moving target. Docyt rewrites this process.

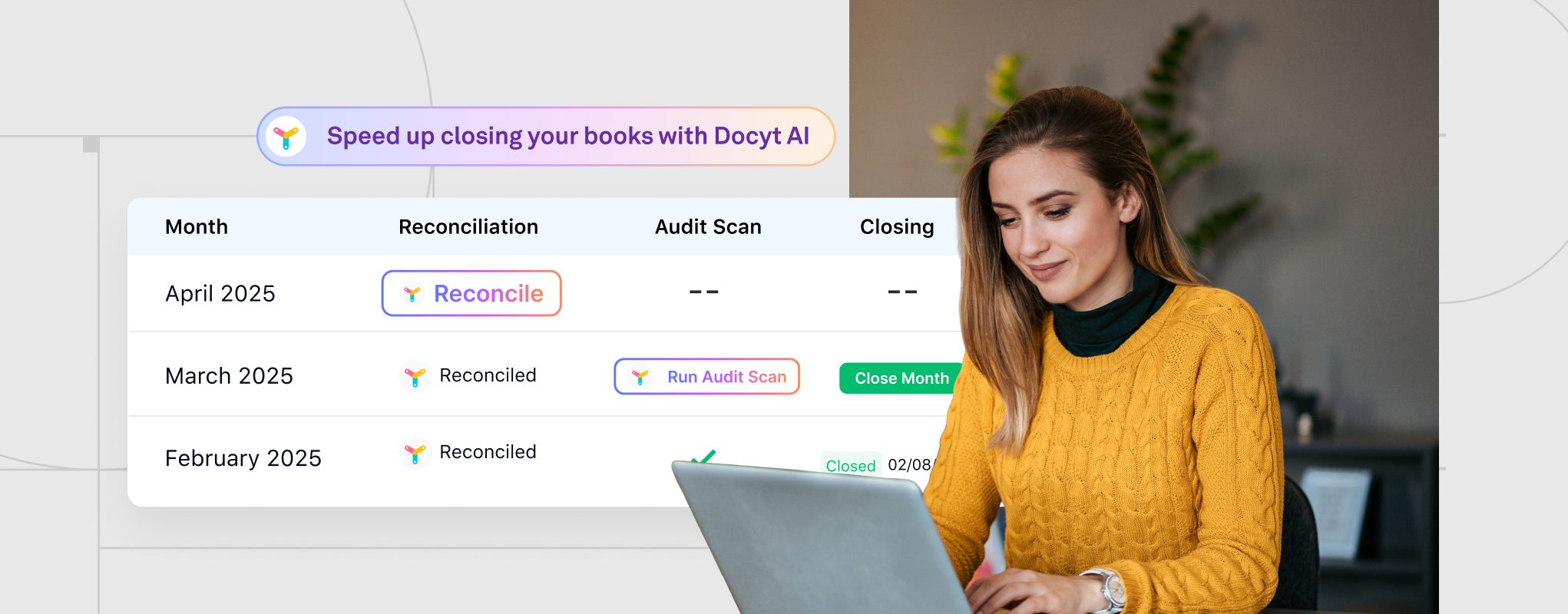

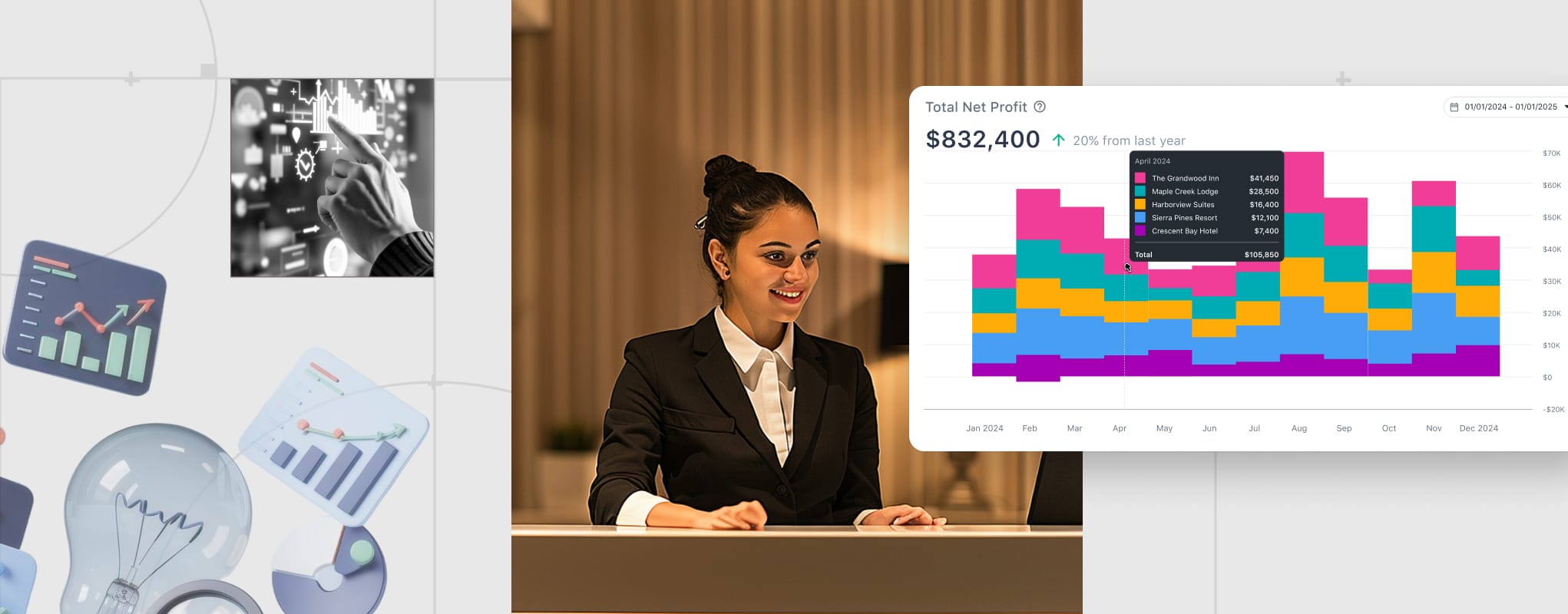

An AI-powered accounting automation platform, Docyt brings together scattered financial tasks into a single, connected workflow. Invoices, PMS exports, POS reports, and bank feeds all move through a single, uninterrupted process. Nothing drifts, nothing waits.

Each stage learns as it runs. It captures data at the source, classifies it with precision, automatically reconciles transactions, and updates reports as the numbers change. Even as property values grow and transaction volumes rise, accuracy remains firm. Powered by Docyt’s AI-powered automation, everything operates in one steady, intelligent, and complete process from start to finish.

In short, Docyt isn’t another tool in the stack; it’s the system that turns best practices into living habits, keeping the entire process accurate under pressure, moving faster at scale, and giving exceptional control.

For Multi-Property Operators: Still Doing the Work After Automating It?

If you are a multi-property operator who has already leveraged traditional automation tools and still ended up facing conventional accounting problems, the problem isn’t your team’s discipline – it’s the system’s design.

With Docyt, you don’t need another dashboard or plugin. You need a platform that holds the entire accounting process together from first entry to final report, with accuracy that doesn’t crumble when the volume grows.

See it yourself. Schedule a Docyt AI demo and find out why Docyt might be the last accounting platform your business ever needs.