Taking the time to assess the mid-year financial status of any hospitality operation critically makes good sense. This review gives you a clear picture of your current situation against your forecasts, allows you to adjust your plan if necessary, and prepares you to remain on track for the rest of the year. However, the old adage, ‘garbage in, garbage out’ applies here. The financial reports you will need to start the process are only as good as your numbers. Your daily bookkeeping must be up-to-date, complete, and accurate to get an actionable mid-year financial report.

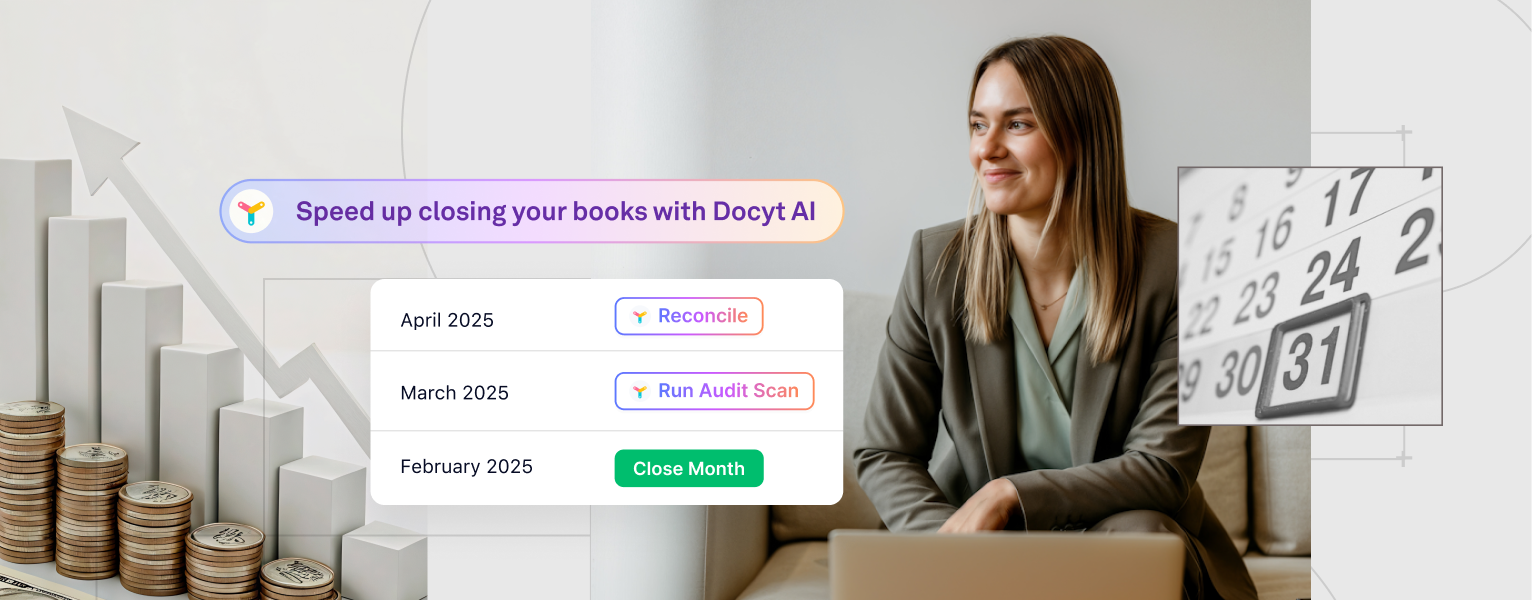

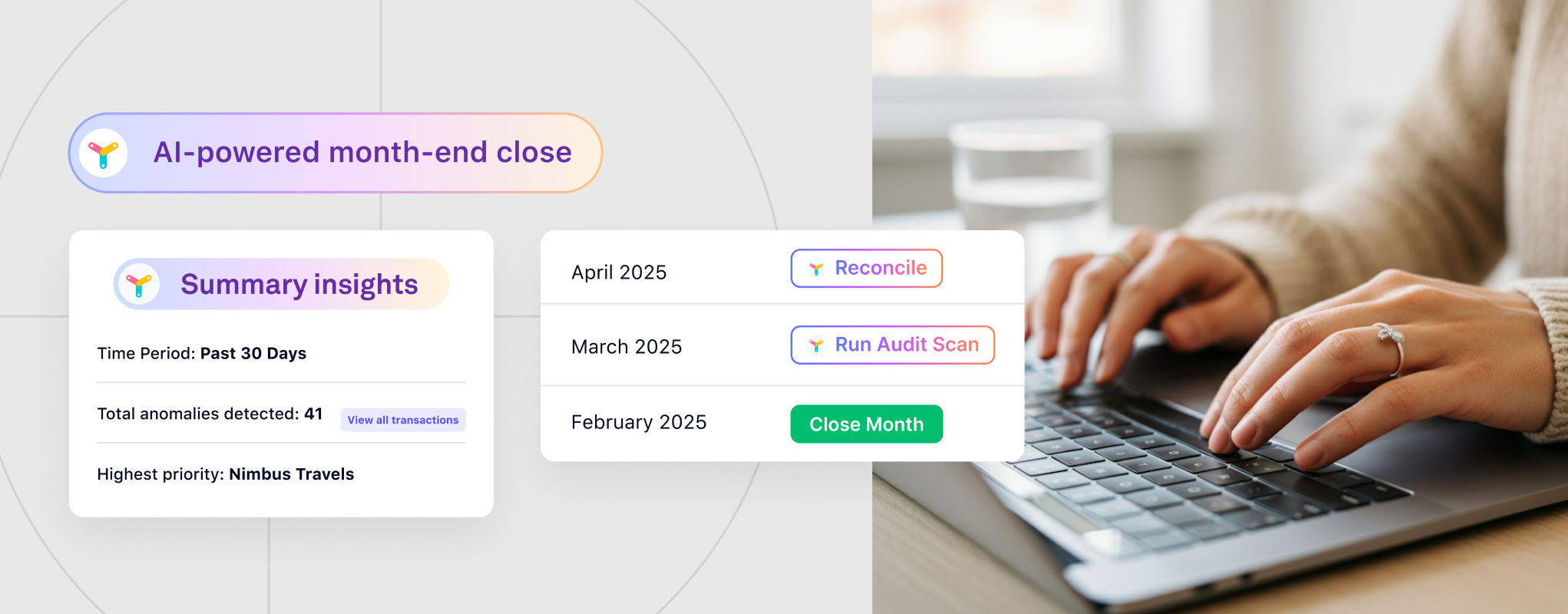

These objectives can be largely facilitated by integrating advanced AI-powered bookkeeping automation software into your daily bookkeeping routine. This article takes a step-by-step look at how hospitality accounting professionals can leverage AI to achieve an actionable mid-year financial report.

Here’s how AI-powered bookkeeping automation software like Docyt turns this process from painstaking to pleasant.

Access Real-Time USALI-based Financial Statements

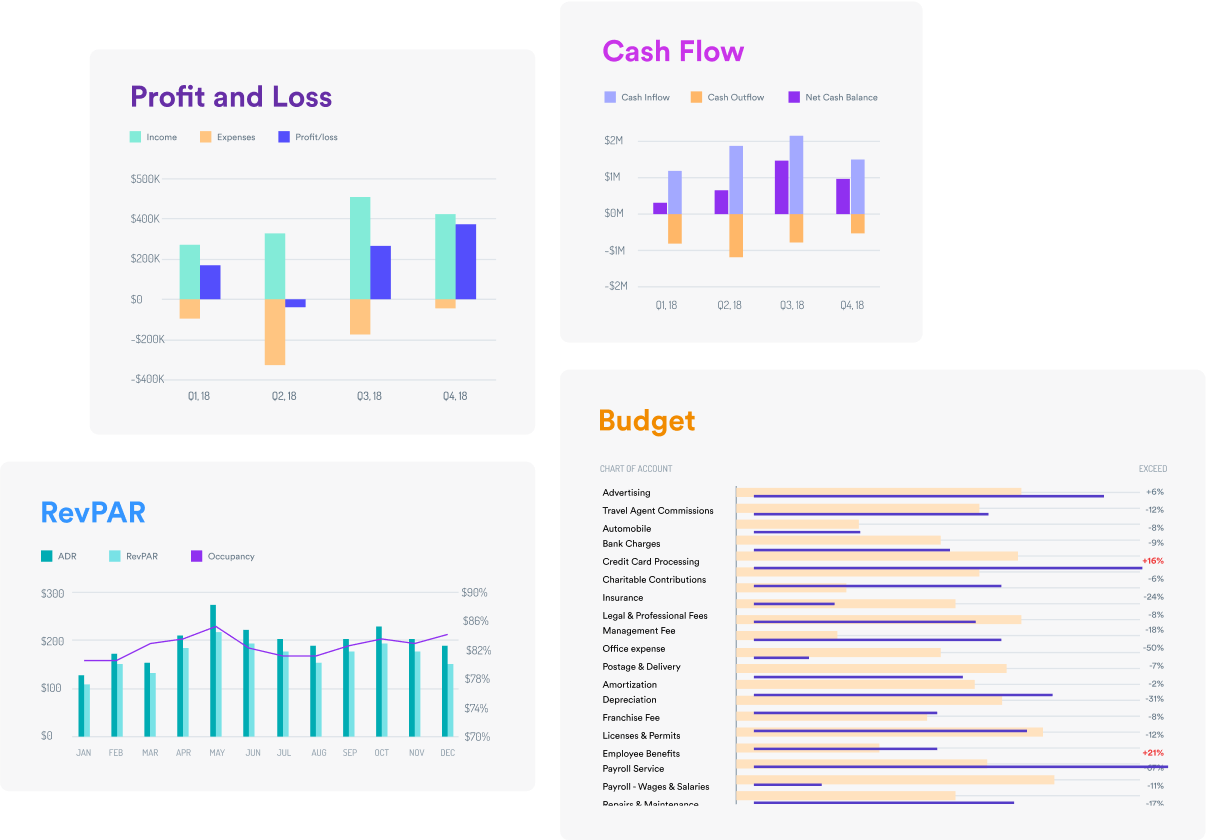

Whether you’re operating a single property or multiple properties, the mid-year financial check-up begins with evaluating the most current P&L, balance sheet, and cash flow statements guided by the Uniform System of Accounts for the Lodging Industry. Docyt’s powerful AI automation gives you access to the most updated version of these reports in real-time to provide an accurate view of your business’s financial health. You can view your business holistically on a single dashboard or drill down to view specific details. Access to real-time USALI-based financial statements lets you quickly identify discrepancies, keeping you informed of any changes in your finances across multiple locations or multi-entities.

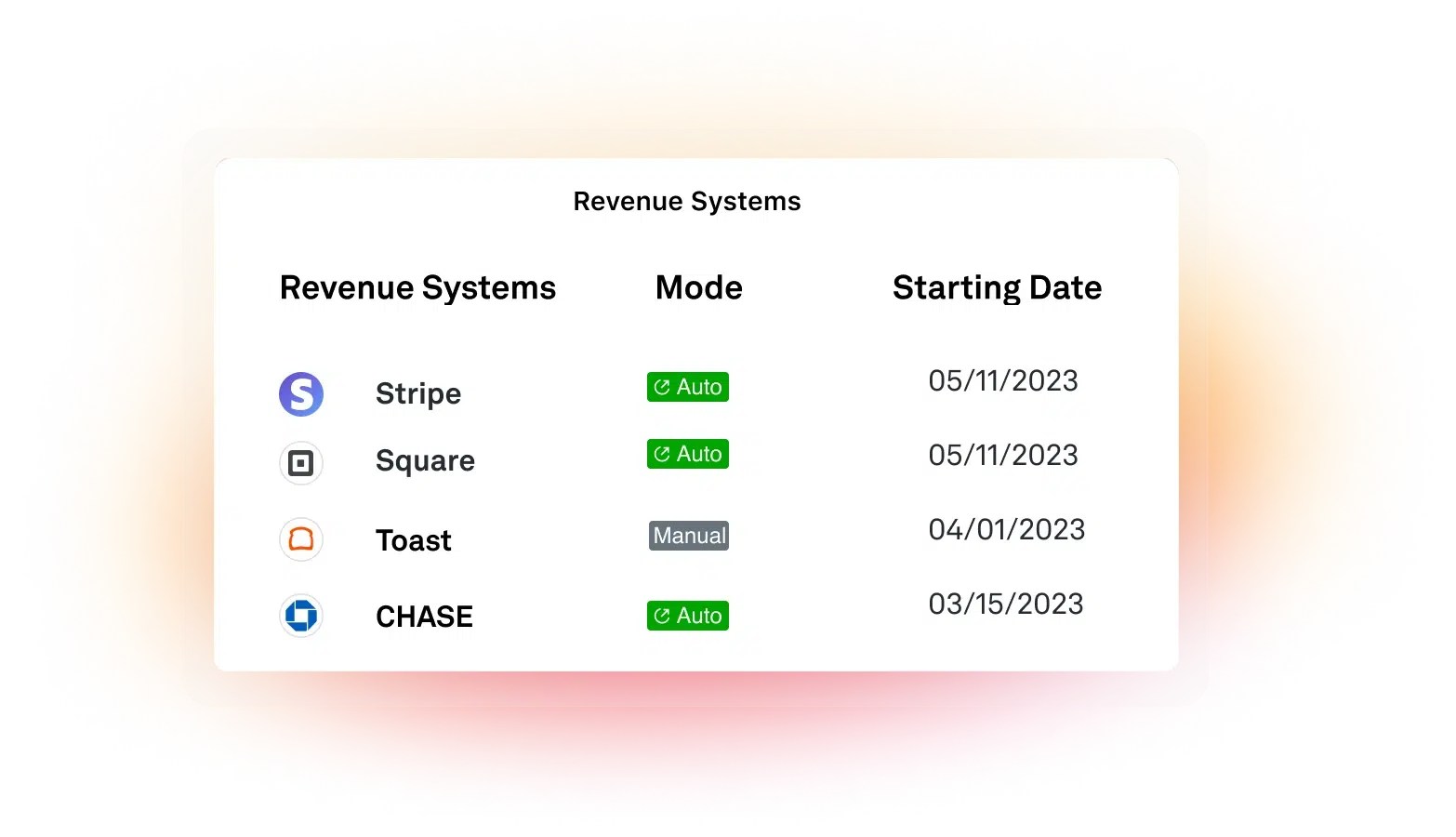

Automate Revenue Reconciliation

No matter how many revenue streams you use in your business, AI-powered bookkeeping eliminates mundane data entry and the human error associated with it. With Docyt AI, every dollar that comes into your business is correctly recorded and reconciled. How? The RevFlow module automatically matches your daily revenue data from each merchant processor to the bank’s deposits essentially ‘closing the books’ each and every day. Finalizing the numbers each day leads to actionable daily revenue reports and the data you need to recover missing revenue or pivot your decision-making process if necessary.

Streamline Expense Management

AI-powered expense management includes everything from bill payments, payment approval, and credit card reconciliation to expense reimbursement in the most effective way possible. By digitizing receipts and invoices with Docyt’s ExpenseFlow, all expenses will be accounted for and reconciled accordingly. Spending patterns can be clearly identified, controlled and, in turn, streamlined for the remaining part of the year.

Conduct an Inventory Check

Confirming that your records agree with the stock on hand is an important step in the mid-year review process. Inaccurate inventory can lead to significant headaches, including overstated or understated assets or incorrect cost-of-goods sold calculations. All reorder levels should be up-to-date to ensure there is no overstocking or stock-out situation. In the hospitality industry, accurate inventory records ensure good service and that costs are upheld. Docyt will help you seamlessly track and manage these adjustments in real time.

Budget and Forecast Update

Use your financial mid-year checkup to update your budget and financial forecasts for the year’s balance. Use InsightFlow by Docyt to access real-time financial reporting on personalized dashboards and help guide the adjustment of your financial plans based on current trends and performance.

Data Security

Docyt is a SOC 2 certified organization, which makes securing your financial data with Docyt a breeze, which has digital encryptions for data storage and ensures the safe handling of your important documents, of prime importance. In an era of growing cyber threats, most importantly, financial data can be saved by Docyt, which provides acclamations of encryptions of data stored and handled. The security will ensure that your financial data remains confidential and free from unauthorized access.

The midyear financial checkup could assure you that your hospitality business stands on solid ground and is well-equipped for the advantages and disadvantages that the second half of the year brings. Advanced tools, such as Docyt, help increase effectiveness, accuracy, and efficiency to deliver invaluable insights that can help drive informed decision-making and growth.