By now, every hotel CFO, controller, and finance leader knows the 2026 lease accounting standards, IFRS 16, ASC 842, and FRS 102, aren’t exactly additional paperwork.

With the new standards’ focus on leasing, the hotel industry’s already complex accounting requirements have become more complicated, heavier, and more costly to rectify.

So what exactly changed?

- Operating leases can no longer be excluded from the balance sheet; all leases must be shown as a right-of-use asset with a corresponding liability.

- ASC 842 keeps two categories (operating and finance), while IFRS 16 treats all leases as finance leases.

- Under IFRS 16, lease costs are split into depreciation and interest; under ASC 842, some leases may still appear as straight-line expenses.

- Lease payments must now be broken out into interest and principal in cash flow reporting.

Impact on hotel industry: Familiar problems now hurt more & turn into compliance risks

Being a lease-heavy industry, hotels have long struggled with accounting headaches, including scattered contracts across departments, overlooked clauses that skew the math, and spreadsheets that require constant adjustments.

However, these problems have usually been managed with workarounds (and extra hours), accepted as part of the grind of hospitality finance. However, under the new lease standards, these issues are no longer contained or hidden.

The ‘once’ internal mismatches now feed directly into balance sheets, liabilities, and impact ratios, distorting investor perception. Familiar problems become more complex, while entirely new risks emerge and evolve into compliance threats. Irrespective of how prepared or equipped hotel accounting teams tend to be, compliance risks arise, and here’s how:

1. Contracts scattered across departments:

Property leases with operations, equipment contracts with procurement & software subscriptions with IT. Teams spend time chasing them, but seldom are confident that the set is complete.

Under the new standards, missing a single contract can quickly result in a balance sheet gap. And an overlooked embedded lease inside service agreements is no longer an oversight; it becomes a direct compliance failure.

2. Clauses that twist the numbers:

Occupancy-based rent, renewal options signed years in advance, and management contracts hiding lease terms are always complicated. Now they directly change right-of-use assets and liabilities.

A miscalculated variable payment or an overlooked renewal clause no longer remains buried in a spreadsheet; it can quickly distort the EBITDA and leverage ratios, causing problems with lenders.

3. Spreadsheets become too weak for the load:

Finance teams are well aware of how spreadsheets break under pressure. Copying formulas, applying different discount rates, or forgetting adjustments once caused minor mismatches. Under these rules, they cause full reporting errors.

Regulators, auditors, and investors will see the inconsistency. What once felt like “good enough” tracking can now expose the business to risk.

4. The new numbers can shake investor confidence:

When every lease is moved onto the balance sheet, liabilities rise, and ratios and EBITDA change too. As a result, they affect covenant tests, lending terms, and even the ability to secure financing.

All thanks to new leasing compliance standards, a reporting error that once stayed internal now triggers questions from banks or investors. The pressure is not just technical; it is also financial, and a major one at that.

Preparing for the New Standards: Complexity Meets Cost & Consequence

Hotels do not simply adopt new accounting rules; they wrestle with them. In the end, a few manage to adapt, while many stumble, because accounting is not just about expertise. It requires the right resources, the right tools, and a tolerance for the heavy costs that this transition demands.

Each standard falls onto a mountain of contracts scattered across time zones and departments, creating a clean-up task that few finance teams can absorb.

- Even mid-size firms incur transition costs of 0.125%–0.13% of revenue, an expense that drains margins before results improve.

- For global hospitality groups, the challenge multiplies, as they must reconcile ASC 842 in the United States with IFRS 16 in overseas markets, often across decentralized subsidiaries and fragmented data.

Even those who are supposedly prepared are not spared. New systems bring new demands:

- Additional staff to operate them.

- More training for teams already stretched thin.

- Reconciliations at quarter-end that collapse under mounting pressure.

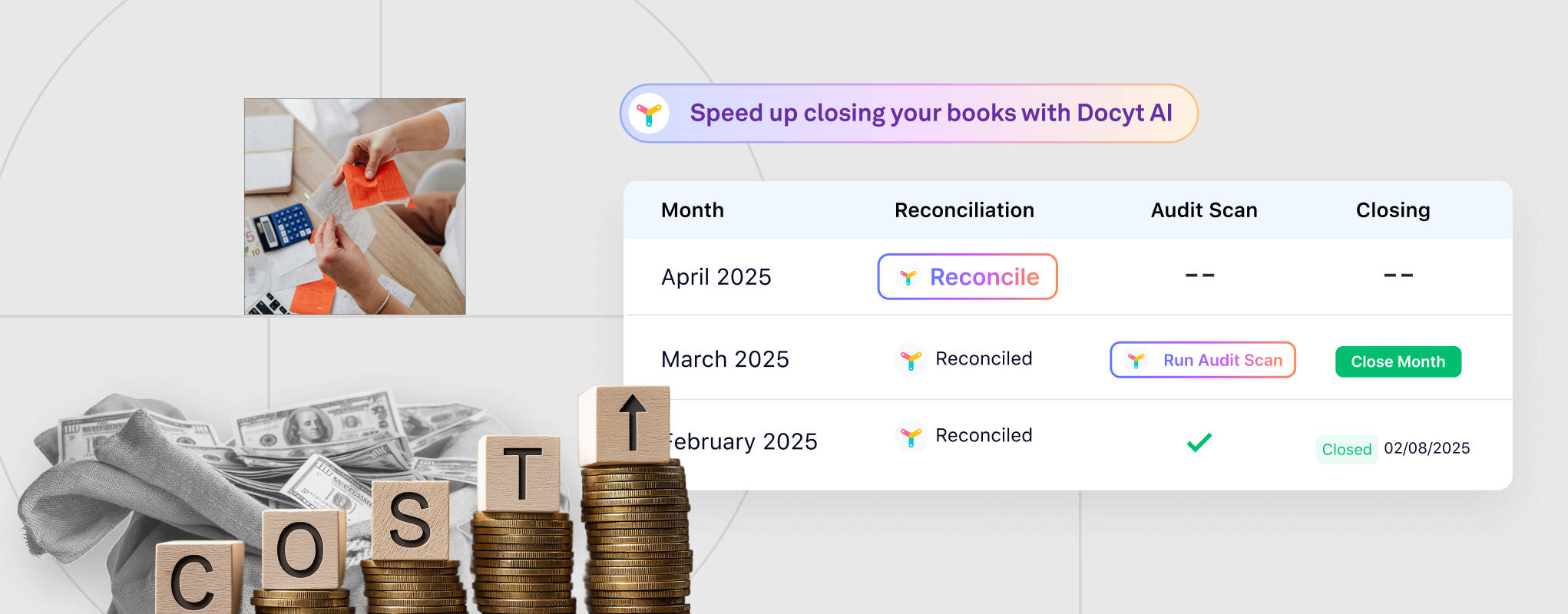

This is the moment where Docyt matters. It does not merely keep pace with the rules; it reshapes the process so hotels can move forward without bleeding time, money, and credibility.

Why Docyt is the right fit:

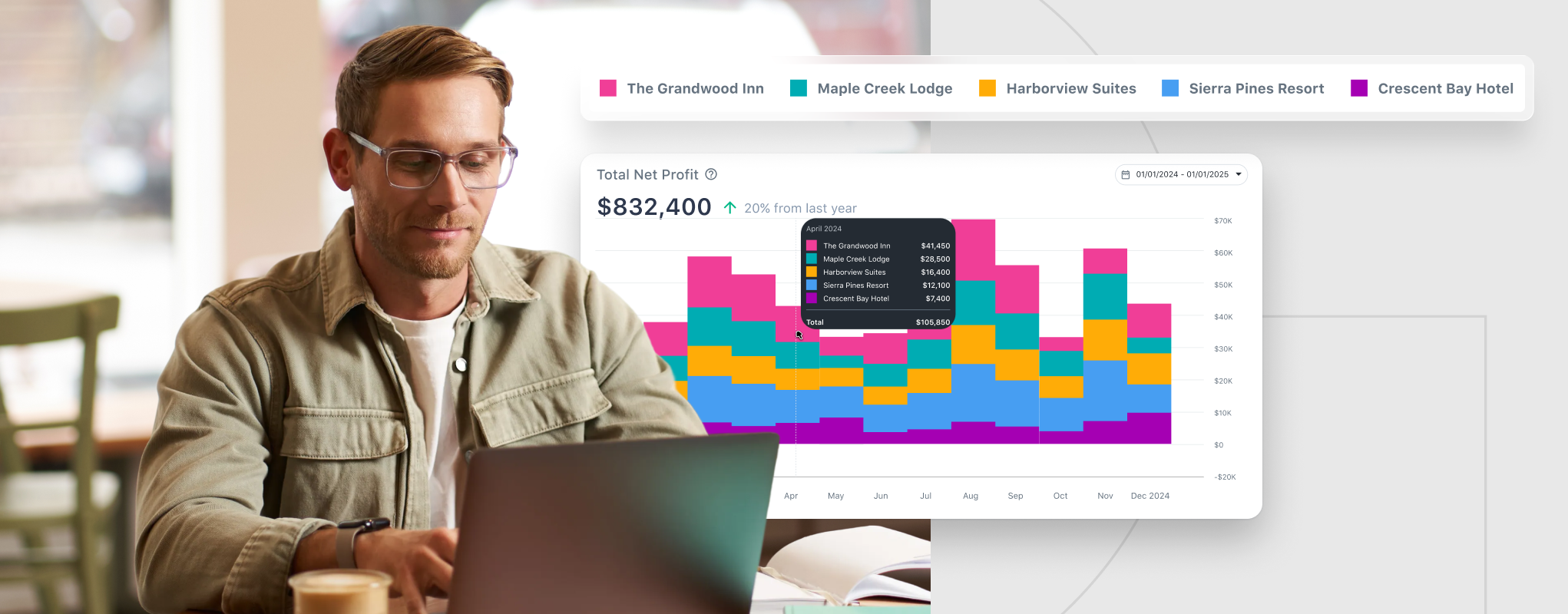

Imagine every contract pulled into one system, every clause captured, and every discount rate applied the same way.

Calculations run without broken formulas, and covenant impacts appear before a deal is signed. Instead of chasing errors, finance directs strategy. Audits that once took months to complete are now reduced to quick checks.

That is the radical shift hotels need in the face of new leasing standards – not more staff, not bigger spreadsheets, but a platform that makes the most challenging aspects of lease accounting run smoothly, profitably, and efficiently.

Docyt is built for the reality hotels face:

- It gathers every lease, property, vehicle, equipment, and IT into one system & reads contracts line by line, catching hidden clauses before they slip through.

- Calculates right-of-use assets, liabilities, and journal entries consistently, so numbers never contradict.

- Models the effect of new leases on debt to equity, EBITDA, and cash flow before you sign, and gives you leverage in negotiations.

In short, with Docyt, audits become a non-burdensome process. Reports are generated on time, errors disappear, and finance teams stop fixing mistakes and start planning for growth.

New lease accounting standards in 2026 & your next move forward:

The 2026 lease rules don’t create new problems. They make old ones heavier, sharper, and more expensive.

Scattered contracts now mean missed leases & complex clauses distort ratios. Fragile spreadsheets no longer handle the data and trigger errors. The new accounting standards can distort ratios and key financial metrics, influencing lending terms in real-time. This is the weight every hotel CFO faces.

Docyt carries this weight off your team’s shoulders. It handles the complexity introduced by the upcoming accounting standards and turns compliance into an advantage. Powered by Docyt, this transition is not only manageable, but it also becomes the reason your hotel group grows easily, smoothly, and profitably.

An AI accounting platform that specializes in accurate end-to-end hot accounting automation , Docyt also handles compliance at any level of complexity, for any number of hotels. If you are evaluating new accounting platforms while also seeking to stay ahead of compliance requirements under current and future lease standards, Docyt is an ideal choice.

Schedule a Docyt demo and find out more today.