Do you feel stuck in a seemingly endless stream of numbers, receipts, and bills? You are not alone. Most of us in the accounting profession have been there, more often than we’d like to admit. We’ve had dreams (or maybe nightmares) about the balance sheet, the income statement, and those pesky receivables that just won’t fix themselves.

Enter revenue cycle accounting…

A system where revenue is easy, thanks to the latest advances in AI.

The accounting revenue cycle is like the life story of a dollar bill as it waltzes gracefully through your company’s hands into its final destination, aka your bank account. From the moment a customer shows interest in your product or service to the lucky moment when money flows into your account, managing your revenue means the revenue cycle is continuously being tracked. And here’s the catch: while this dance may seem uncomplicated, it’s full of potential hiccups and missteps. This is why you need a professional dance instructor—or in our case, a flawless revenue cycle strategy.

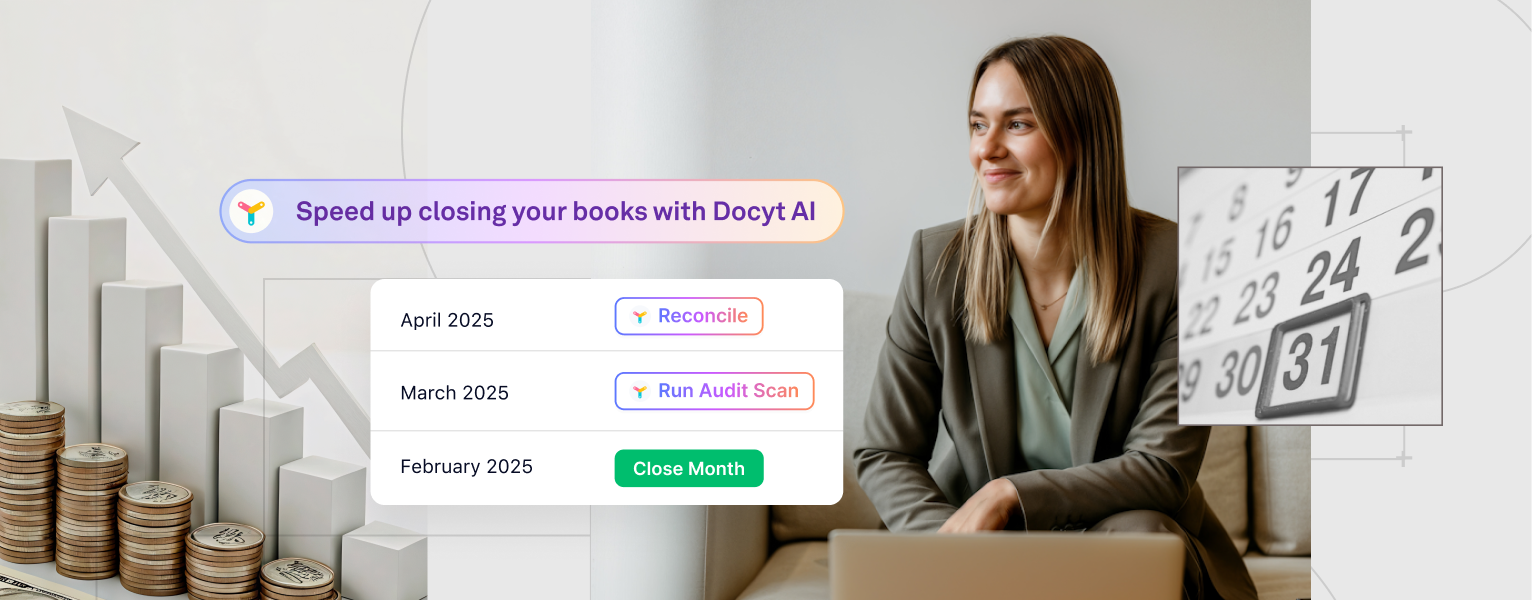

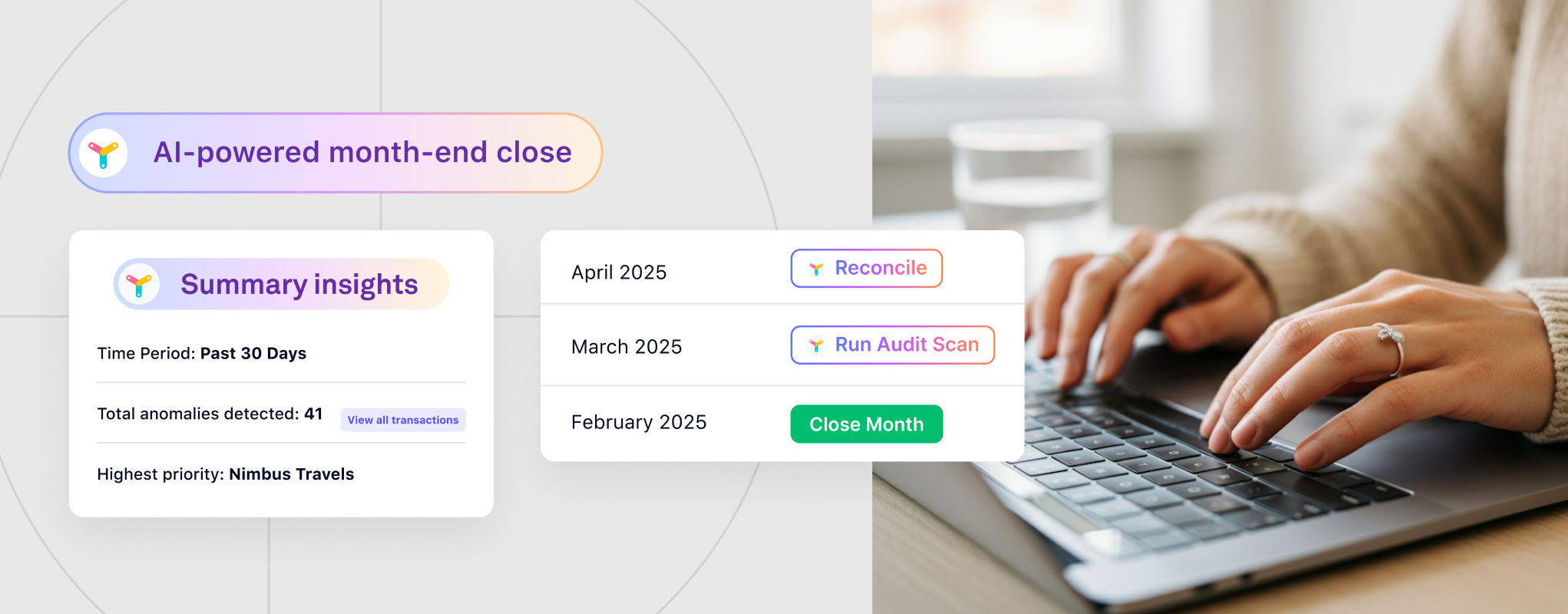

Introducing Docyt – It’s not just another face in the crowded AI space. Docyt’s AI-powered accounting software is like that top-tier choreographer who makes sure every step, every spin, and every jump in your revenue dance is executed perfectly.

Now, you might wonder, why automate the revenue cycle accounting system?

Because Docyt makes it easy.

Docyt’s AI-powered accounting software offers an exceptional solution for automating your business’s revenue cycle. With the utilization of advanced technology and intelligent algorithms, the Docyt platform simplifies and streamlines the process of tracking and managing revenue. Additionally, leveraging its continuous revenue reconciliation feature, Docyt ensures that you are always well-informed with daily earnings reports.

Searching for a way to easily track your revenue data? Docyt is designed to slice and dice your data in multiple ways, allowing you to monitor earnings by payment processor, spend category, or day. Not only that, but Docyt also keeps track of each merchant processor account separately. Regardless of payment types you accept – cash, American Express, Chase, Square, or any other form of payment – Docyt has you covered! This feature ensures more accurate reconciliation and minimizes revenue loss caused by missed transactions. If your business has multiple revenue streams across different divisions like food and beverage, retail, hospitality, and more; rest assured! Docyt generates individual reports for each department or division so you can stay organized and stay on top of your financial game.

So, the next time you’re knee-deep in spreadsheets, invoices, and calculators while managing your business, remember that there’s a smarter way to do things. With the ever-evolving realm of AI, revenue cycle management is not just a luxury but a necessity. After all, in this fast-paced world, who has time for manual errors? Before I sign off, here’s some cheeky advice: We’re not always with the times. In today’s accounting world, this means embracing tools like Docyt to ensure your accounting cash cycle doesn’t miss a beat.