Docyt AI

Automate accounting tasks. See your expenses and profitability in real-time.

Why traditional accounting methods no longer make the cut

Manual processes

Traditional bookkeeping is manual, labor intensive, time-consuming, and requires a lot of data entry in various systems.

Data inaccuracies

Human errors, broken data feeds, manual inputs, and inconsistent categorization result in erroneous books.

Manual gatekeeping

Human gatekeeping of the transaction categorization process is manual and delays closing of books on time.

Delayed month-end closing

Manual month-end close processes don’t have good controls and often don’t follow industry vertical best practices.

Say goodbye to manual accounting

What sets Docyt AI apart?

Docyt Accounting Intelligence Platform pairs powerful automation with AI to deliver real-time accounting and personalized insights, empowering businesses and accountants to make better decisions to drive profitability.

Automated bookkeeping

Automate G/L data entry, accounts payable processing, transaction categorization, bill payment, and reconciliation using Docyt's Precision AI, eliminating the need for manual effort.

Financial accuracy

Avoid detective work on transactions. Docyt AI delivers high levels of accuracy in transaction categorization, account reconciliation, and identification of errors.

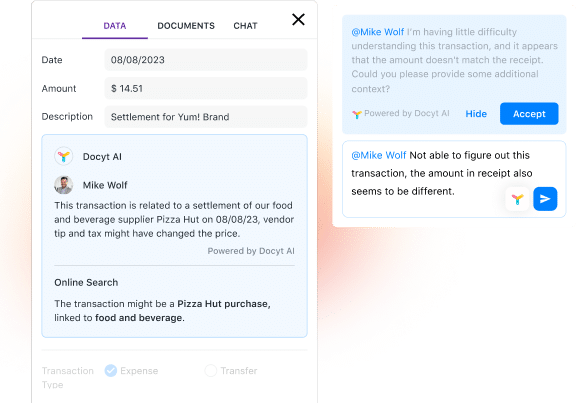

Enhanced collaboration

Reduce frequent back-and-forth on book collaboration. Through Generative AI, Docyt can contextualize and summarize human-to-human conversations into accounting coding & actions.

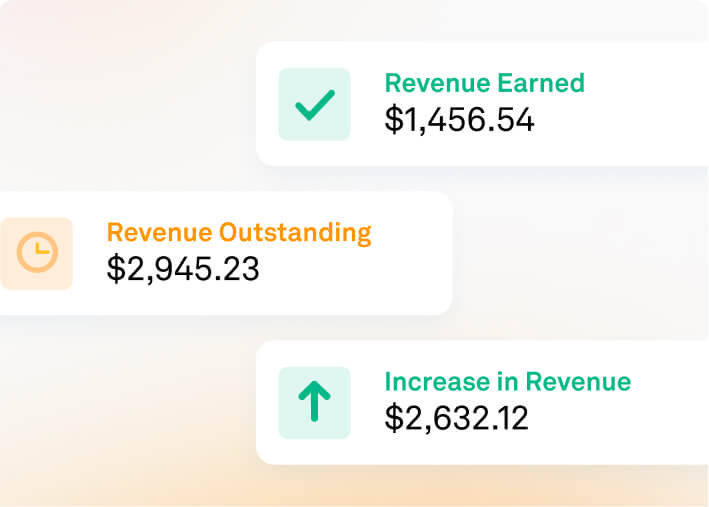

Real-time financial insights

Get personalized analysis of your monthly financial performance. Receive immediate answers to queries such as profitability metrics, revenue, expenses, and more.

Innovative solutions, not problems.

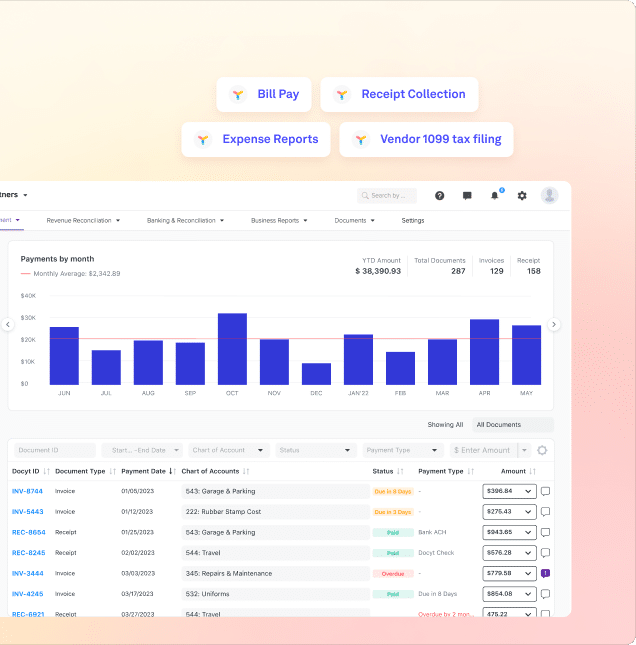

ExpenseFlow

Cut wasted hours and costs managing business expenses. Docyt's all-in-one AI bookkeeping solution handles bill pay, credit card reconciliation, expense reports, receipts, reimbursements, and vendor payments.

Connect with us

RevFlow

Automate your revenue tracking across all your revenue channels. Docyt RevFlo connects to 30+ PoS and revenue systems and continuously reconciles against deposits.

Connect with us

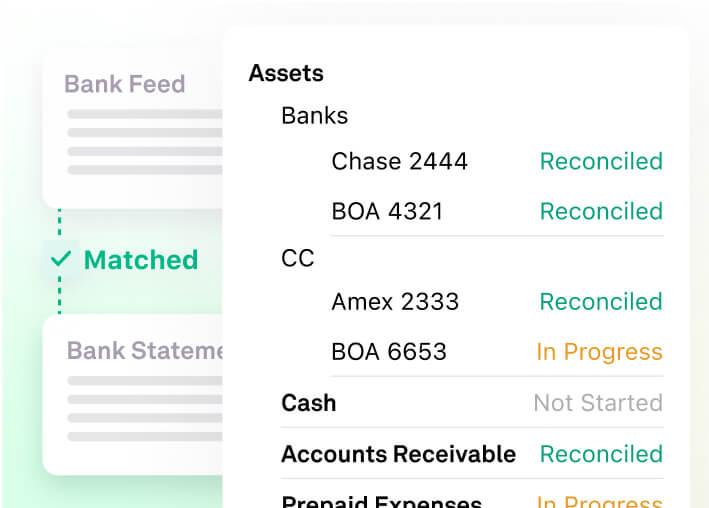

CloseFlow

Reconcile bank and other balance sheet accounts continuously to execute daily soft closing of your books. This reduces month-end to just a quick sanity check.

Connect with us

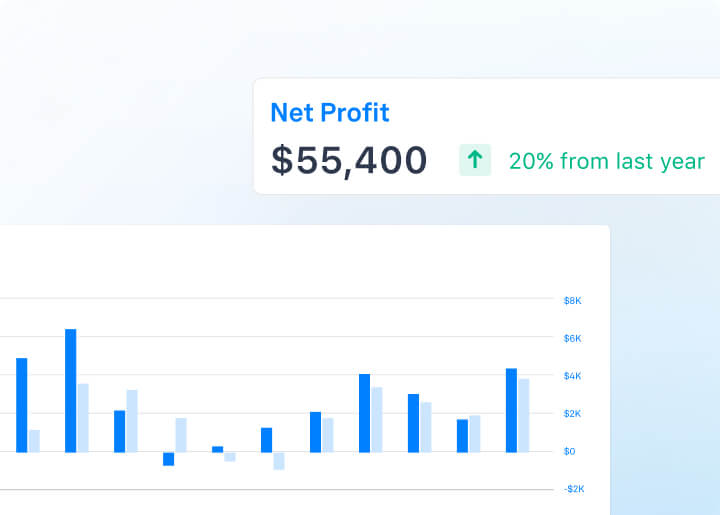

InsightFlow

Our AI accounting platform enables fast, informed decisions with real-time performance insights. Easily monitor business trends, KPIs, and financial/non-financial metrics with customizable, advanced reporting and dashboards.

Connect with us

Fastest-growing AI accounting automation platform

$1B+

Worth invoices processed

20k+

Financial accounts automated

$1B+

Balance sheet assets reconciled

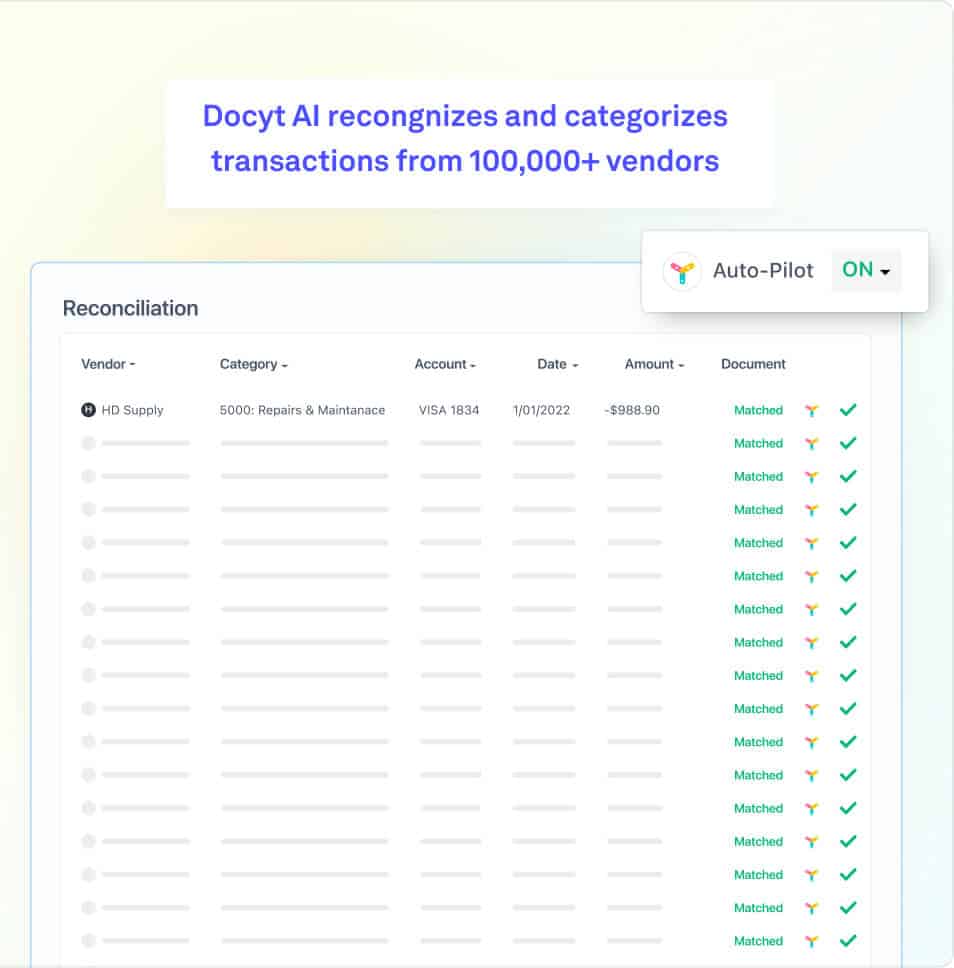

100k+

Vendors processed

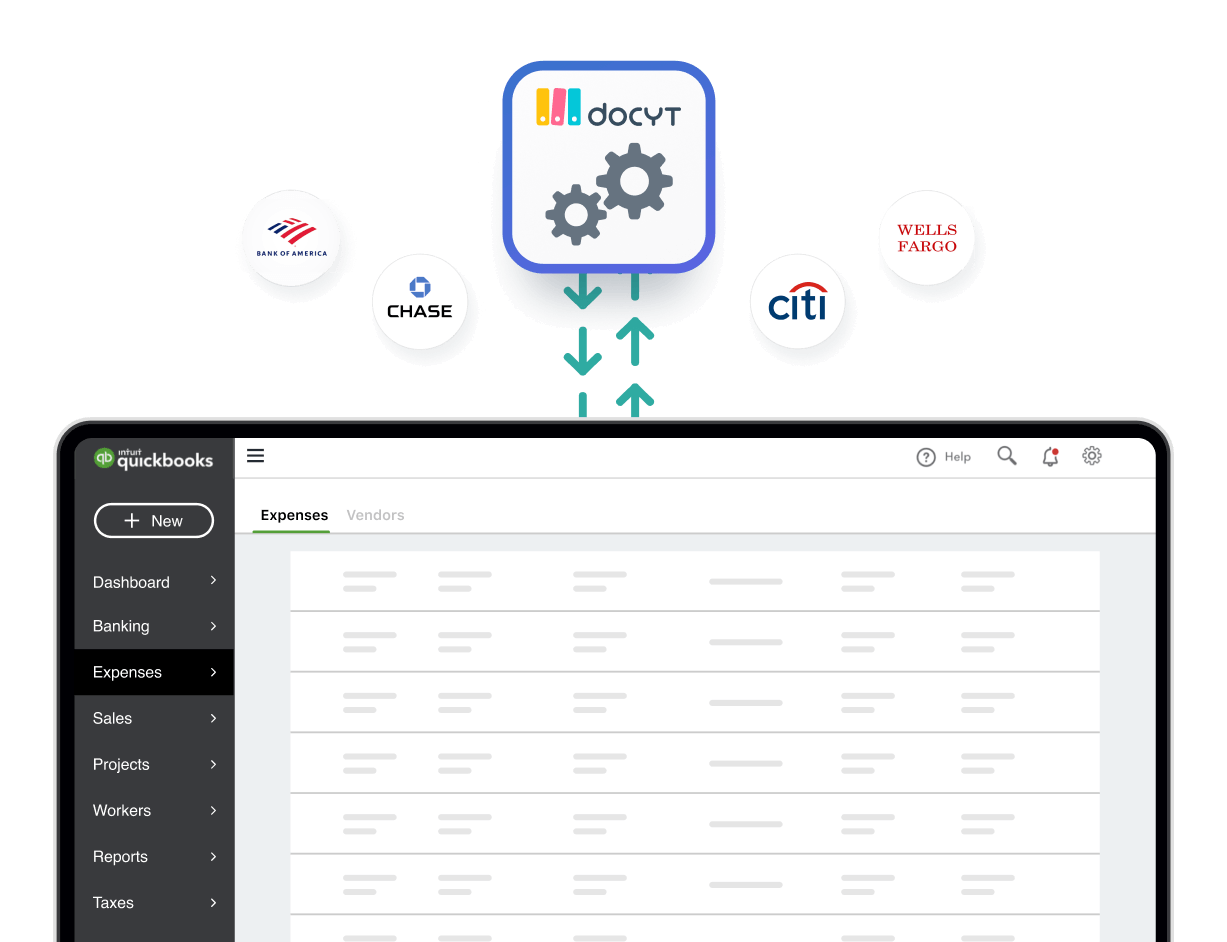

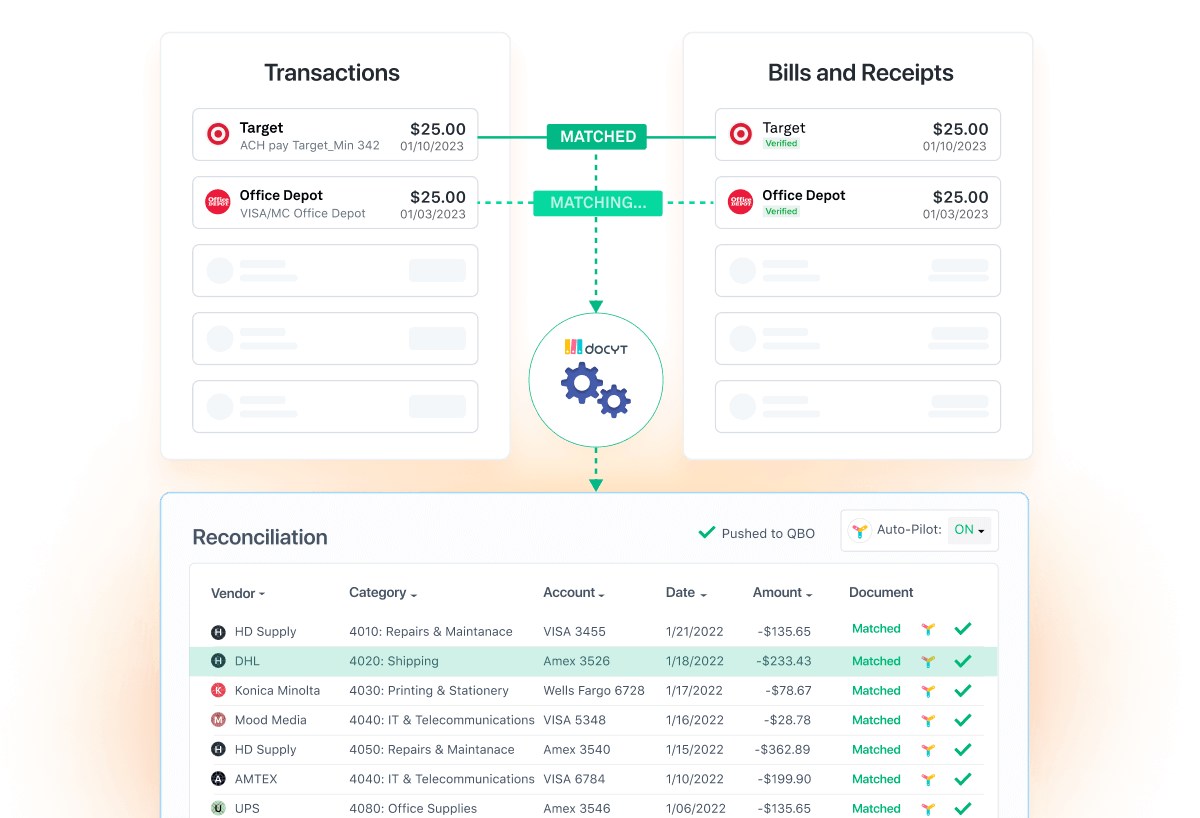

How Docyt AI works

Docyt AI bundles a set of AI models into two independent systems: Precision AI and Generative AI. The Docyt AI system is fine-tuned to simplify your daily and monthly financial operations and customizes itself to your unique accounting and financial data needs. Human oversight is incorporated only where necessary, eliminating it where it is redundant so you can concentrate on your business.

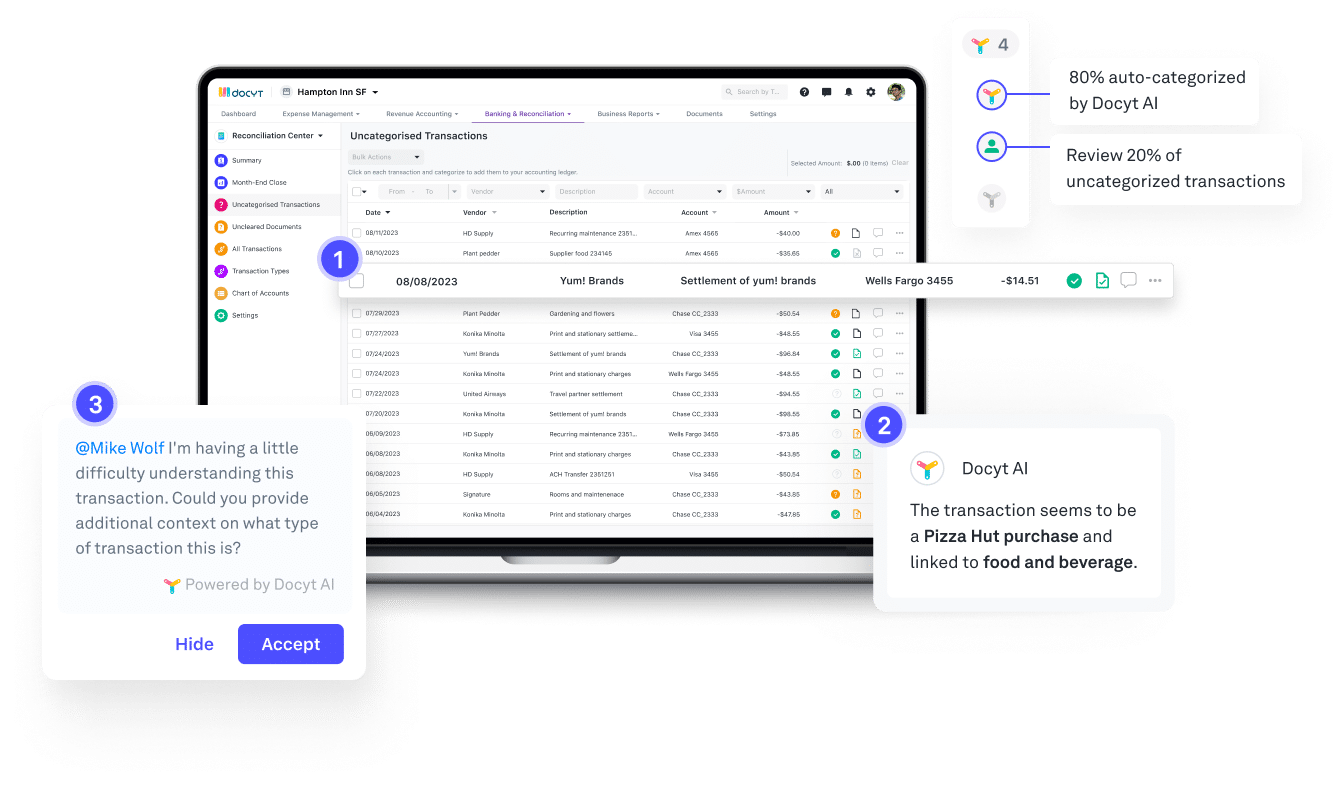

Precision AI models

Responsible for automating accounting processes with extreme accuracy, hence named Precision AI. These AI models process over 80% of back-office data and finance workflows. Multiple models work together to deliver precise outcomes.

Generative AI models

Generative AI models analyze extensive data sets to produce concise, high-quality text summaries and more. In accounting, it offers powerful capabilities for transforming conversations into actionable accounting data, generating reports and insights, and quickly answering financial questions.

The 3 C’s of Docyt AI

Categorize | Contextualize | Condense

Streamline workflows for bill pay, corporate credit card management, receipt collection, expense reports, and vendor 1099 tax filing.

Our AI bookkeeping solution reads and understands your expenses like a human. It extracts the correct information from your receipts and invoices and confidently categorizes and reconciles them

Docyt AI delivers end-to-end, automated transaction categorization using Precision AI to auto-categorize 80% of all transactions. The remaining 20% of uncategorized transactions typically requiring human review are now handled by Generative AI to provide additional context around the transaction in question.

Docyt AI takes a two-pronged approach to revenue reconciliation:

Automated Transaction Matching: Reviews transactions and matches them to connected bank feed to reconcile.

Automated Transaction Categorization: Automatically categorizes and codes transactions based on historical transactions and patterns before acceptance into the General Ledger. It will not categorize unless it’s 100% confident.

Docyt AI generates personalized and informative financial reports based on the financial data available. This reduces the manual work and time for users to pull reports that are unique to the user’s needs.

Docyt AI Powered Accounting