Collaboration Tools

Month-End Close Automation with Powerful AI Tools

Why wait until the end of the month to close the books? Embrace continuous reconciliation.

Advantages of Docyt AI Tools

Daily closing of books

Never wait until month end to close the books. Docyt AI automates bookkeeping workflows and tasks, so your financials are always live.

Real-time, continuous reconciliation

Increase financial accuracy with Docyt AI handling the reconciliation process. Even with high transaction volumes or complex transaction scenarios, Docyt AI adapts quickly.

Financial accuracy

Each transaction and closing task is tracked through detailed logs. Docyt AI reviews, updates, and flags transactions so you avoid delays and financial inaccuracies.

Tailored to your industry

Every business has unique metrics, workflows, and chart of accounts. Docyt AI quickly adapts, learns, and applies this understanding to handling transactions and tasks.

How Docyt's AI-Powered Month-End Close Works

1

Connect your bank feed to Docyt AI

2

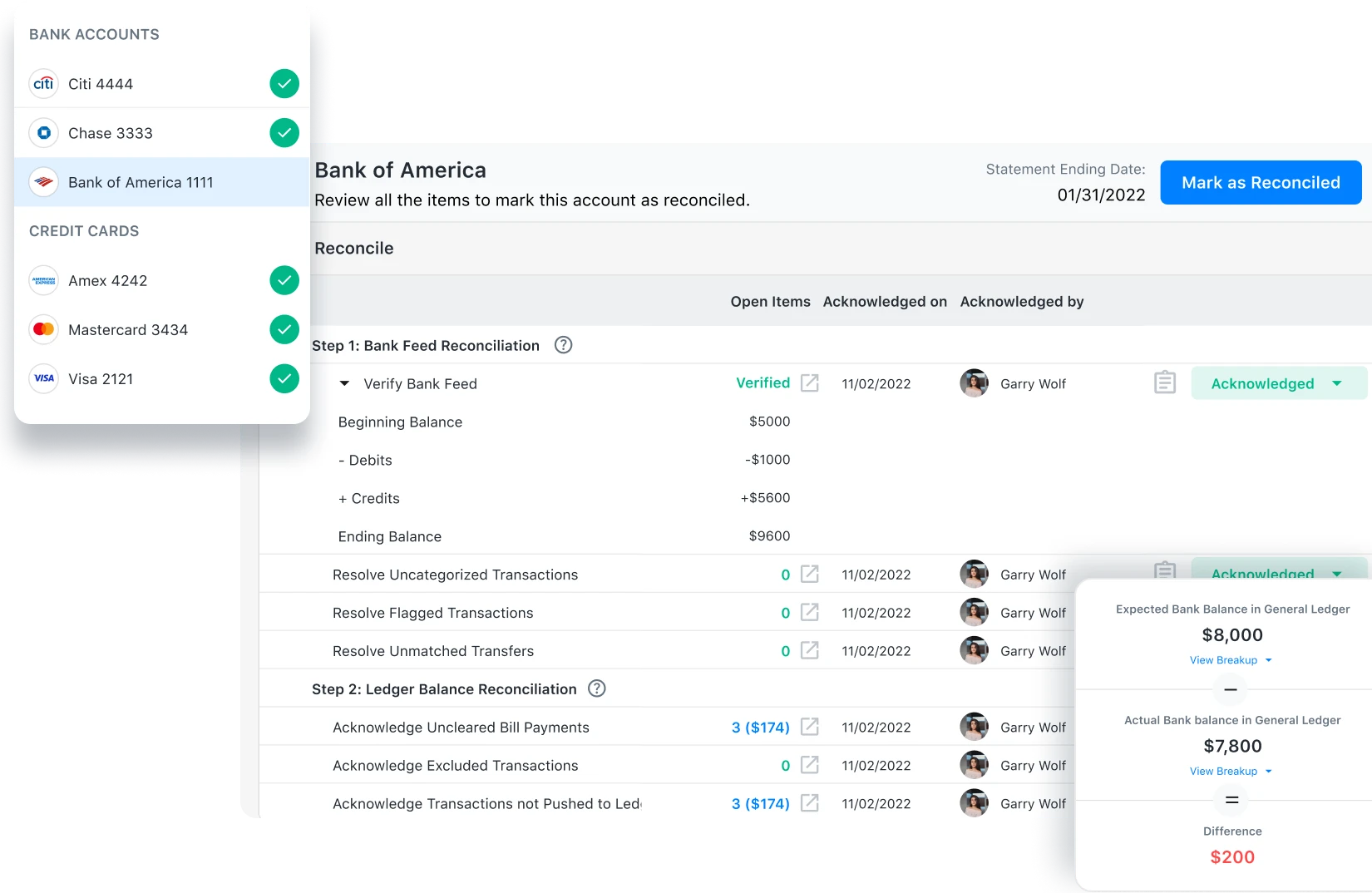

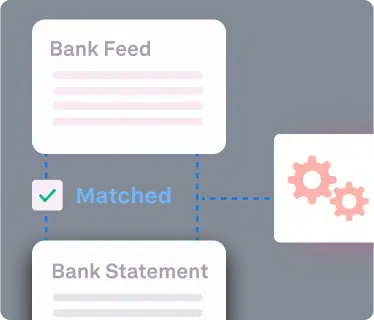

Automatic bank statement verification

3

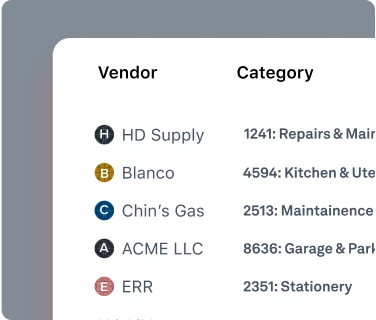

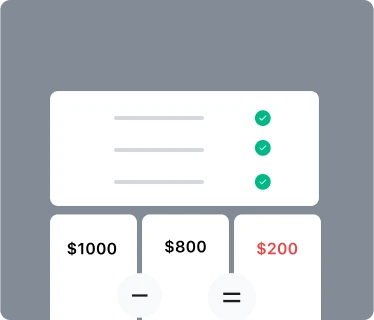

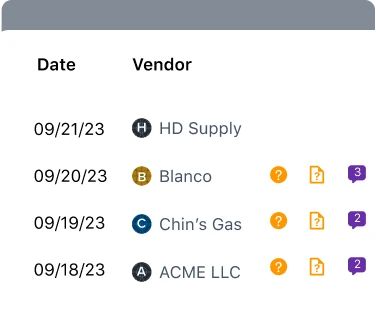

Automatic transaction categorization

Automatic alerts on flagged transactions

4

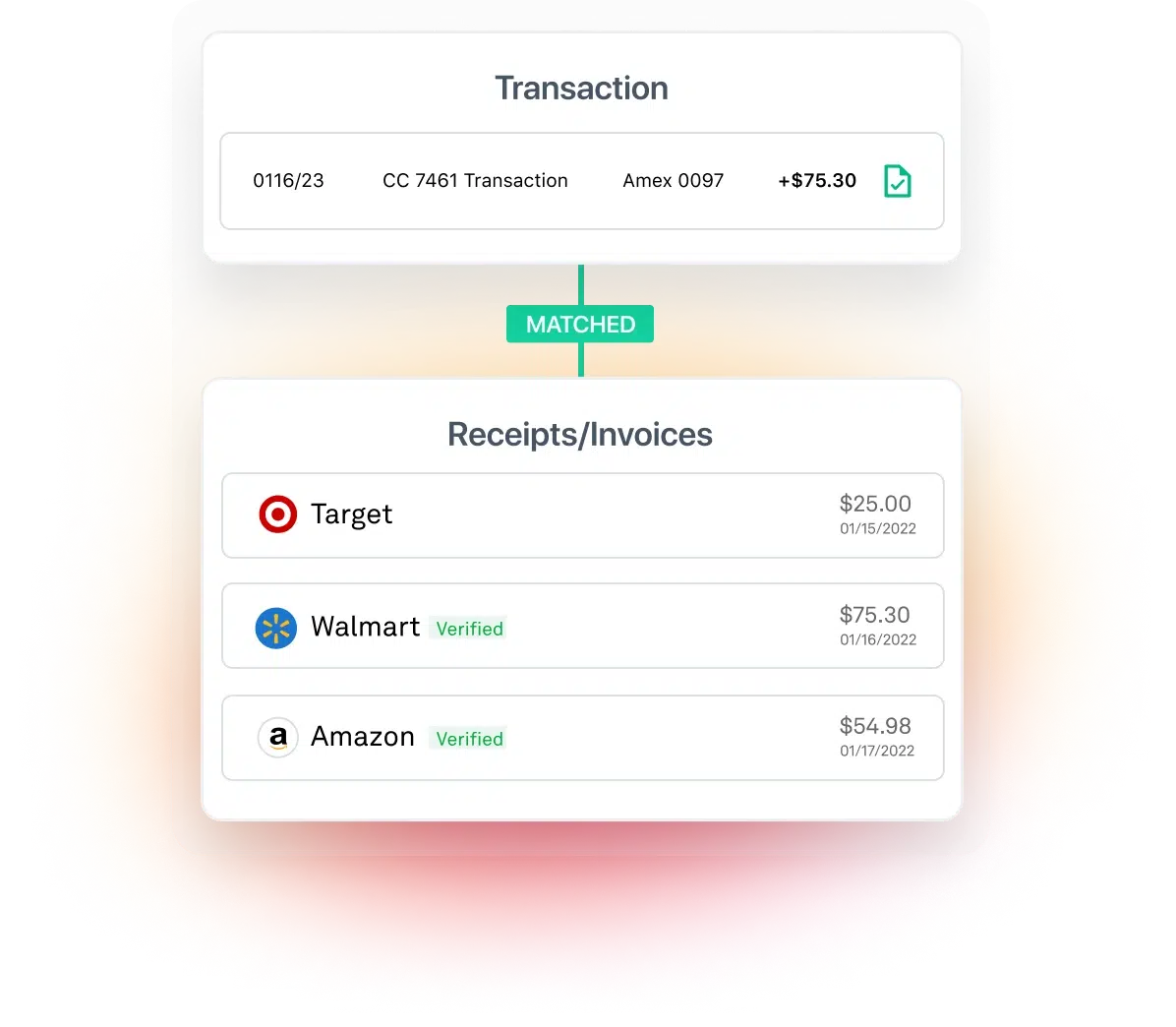

Automatic document matching

Automatic alerts on flagged transactions

5

Month-end checklist for review

Automatic alerts on flagged transactions

6

Automatic sign-off report

Automatic alerts on flagged transactions

Automatic alerts on flagged transactions

Hands-free bank reconciliation

Docyt AI connects to more than 12,000+ financial institutions via direct bank feeds. Easily connect your bank feed and Docyt AI verifies bank transaction data against your bank statements, ensuring all transactions are verified accurately.

Experience the power of 360-degree transaction categorization

Say goodbye to manual accounting

Let Docyt AI take on the repetitive tedious work so you can focus on growing your business.

Capterra 4.6/5

Apple App Store 4.6/5

G2 4.9/5

Speed up document-to-transaction matching

Make the month-end close nothing more than a formality

Save substantial time each and every month with Docyt AI’s standardized book-closing checklist. This simple systematic approach guides you through each line item on your balance sheet, making the month-end close efficient and transparent.

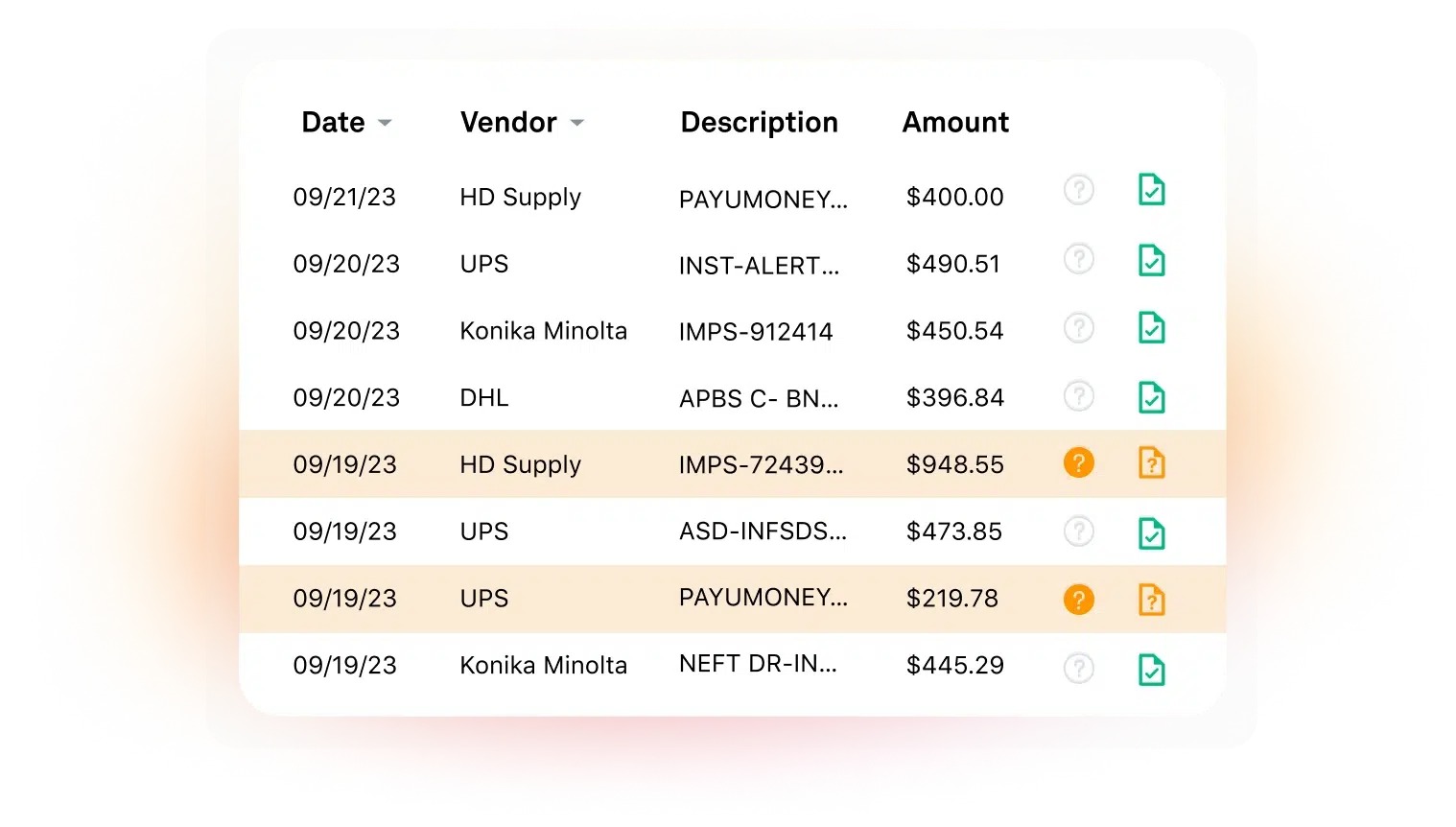

Automatic flagging on transactions that need attention

Why users love Docyt AI

Sumit Dalwadi

President, Dalwadi Hospitality Management

With Docyt, it’s nice to get back to a place where our financials are all caught up and in real-time again.

FAQs

ClosingFlow is a cutting-edge solution that combines real-time accounting with precise month-end close automation powered by Docyt AI. It streamlines and enhances the process of continuous reconciliation and closing your financial books, ensuring accuracy and efficiency.

Pristine Monthly Bank feeds, provided by Docyt AI represent a new era in digital banking. This feature collects and refines your bank statements, assuring that every transaction you make is accurate and reliable. It makes tracking your finances easier and provides clear and real-time insights.

Docyt AI uses advanced AI algorithms to segment projects based on multiple parameters and industry-specific nuances. This ensures real-time and informed decision-making regarding the suitability of each transaction to the General Ledger.

Docyt AI delivers end-to-end, automated transaction categorization using Precision AI to auto-categorize 80% of all transactions. The remaining 20% of uncategorized transactions typically requiring human review are now handled by Generative AI to provide additional context around the transaction in question. Learn more about Docyt AI.

Docyt uses compound AI (Precision, Predictive and Gen AI) to automatically identify, analyze, categorize transactions, reconcile accounts, and generate real-time financial reports by learning from your firm’s historical data and ongoing inputs. It also integrates seamlessly with your existing systems to eliminate manual data entry and ensure financial accuracy.

Docyt AI is designed to enhance your bookkeeper’s efficiency and accuracy, not replace them. Automating repetitive tasks frees up your team to focus on higher-value work, such as strategic financial planning and advising clients.

Get started with Docyt AI Bookkeeping Software

Ready to automate month-end, gain real-time insights, and grow your business faster? Let us show you how easy it is.

Capterra 4.6/5

Apple App Store 4.6/5

G2 4.9/5