RevPAR is a fundamental and widely trusted metric in hotel performance. By combining occupancy and average daily rate, it provides a clear picture of how much revenue each room is generating.

It’s straightforward to measure, simple to benchmark, and quickly reveals whether your top line is moving in the right direction.

In regular market conditions, RevPAR does help as a foundational metric. But according to the CBRE Q1 Report, 2025 is anything but stable and normal.

Q1 2025 Findings: What the CBRE Report Tells Us About The 2025 Market

The CBRE Executive Summary for Q1 2025 doesn’t exactly spell out “volatility,” the signs are in between the numbers. Here are the key stats and patterns that reflect the unstable nature of the hospitality market and what it has in store for 2025:

- Arriving earlier than usual, Easter disrupted demand patterns and has shifted travel timelines. As a result, hotels that normally see a spring bump in April saw it come weeks earlier, leading to irregular occupancy trends.

- March saw an 11.6% decline in international inbound travel, which hit the markets that rely on global guests particularly hard. The dip was sudden, and most properties are caught unaware.

- The short-term rentals grew 45% over 2019 levels, and cruise lines saw a 9% boost, which indicates a tangible shift in where travellers are choosing to stay.

And then there’s the spike effect: RevPAR in specific markets got a boost thanks to one-off events like the Super Bowl in New Orleans, hurricane relief in Tampa, and political events in DC, which are isolated moments of inflated performance.

Put all of this together: Quarter 1 of 2025 already saw unpredictable guest flow, a significant shift in how guests prefer to stay, and revenue patterns driven by isolated events. The rest of the year is expected to intensify, if not more.

In short, we’re facing a market that is inconsistent, fragmented, and far from stable. With more unpredictable real-time patterns expected to unfold, 2025 could be a truly tough year for hotel GMs relying on surface-level metrics like RevPAR alone.

But why? Let us dig a bit more into this.

Why RevPAR Falls Short in Volatile Conditions

RevPAR, as discussed in our previous blog here, is a fundamental, quick, and universal metric that works in gauging revenue performance of the hospitality industry under regular conditions. But in a year like 2025, it only gives a surface-level insight, and its limitations become gravely obvious.

Overlooks True Profitability: Take those event-driven spikes, for example. When the Super Bowl rolls into town, RevPAR jumps, but what did it cost you in labor, marketing, or third-party commissions to grab that surge? RevPAR doesn’t say. In isolation, it may sound profitable, but when the surging costs are accounted for, it rarely is as sweet as the observed growth.

Ignores Damage to Margin: Look at the drop in international travel as observed in the CBRE report. The RevPAR might hold steady if domestic guests fill in, but if they’re booking shorter stays at lower rates, the margins might be thinner than they appear – another false positive.

Misguides & Leads to Spending Traps: Even more concerning is how RevPAR can be the wrong sole metric in competitive situations (short-term rentals mentioned above). Say, hotels resorting to discounts or splurging on marketing spends in a bid to increase RevPAR will only find their profits slipping.

The above situations (and they are just a few examples) highlight the critical flaw of RevPAR:

RevPAR measures top-line revenue, but completely overlooks the actual profit retained. When demand rises, competition surges, and costs like wages and utilities fluctuate unpredictably, RevPAR fails to assess and manage that crucial profit gap accurately.

But that’s precisely what GOPPAR is for.

Why GOPPAR is Better for a Market Like 2025

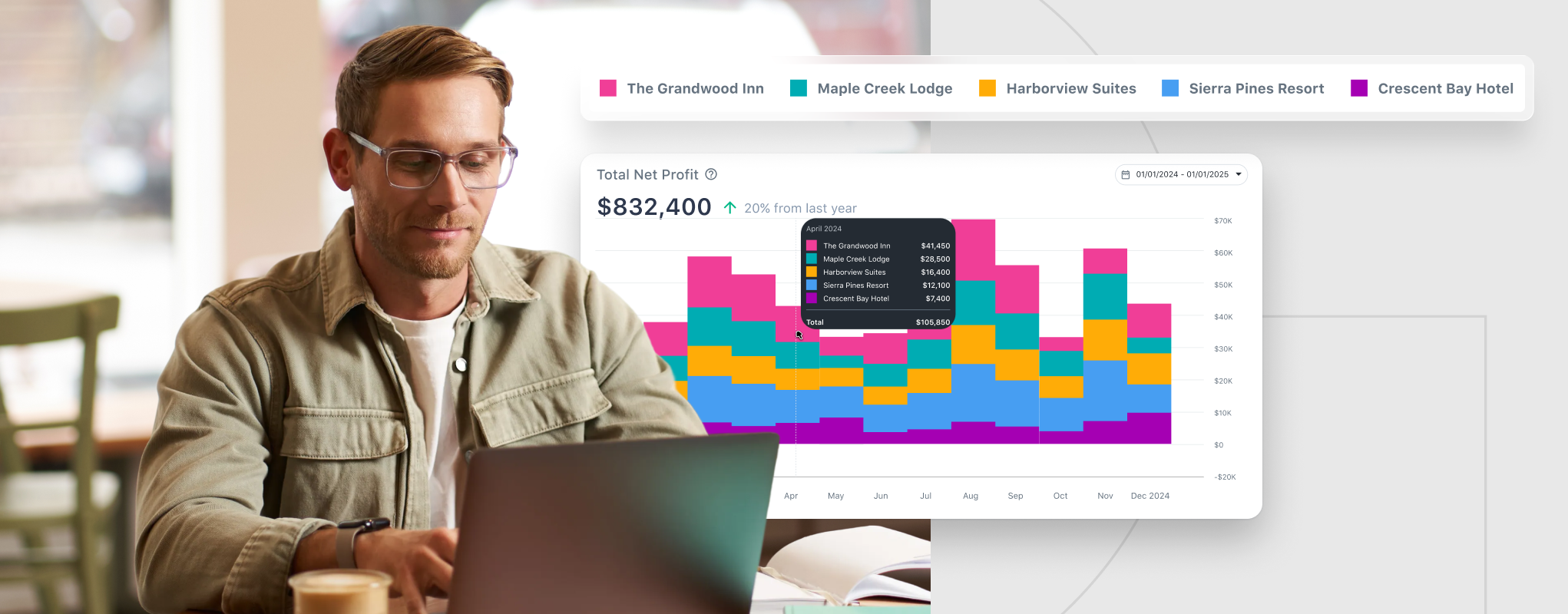

Gross Operating Profit per Available Room, termed as GOPPAR, picks up where RevPAR falls short. It measures the actual profit generated by each available room after accounting for all direct operating expenses. This comprehensive metric includes all hotel revenue streams (rooms, F&B, events) and subtracts the direct operating costs tied to them.

Like RevPAR, it doesn’t just measure revenue; it accurately indicates operational efficiency and real-world profit performance to enable better decision-making in volatile markets.

In 2025, that difference is critical, here’s how they both differ concerning the CBRE Report:

- If labor costs are up 4% but RevPAR is only up 2.2%, GOPPAR shows the margin squeeze.

- If you offer discounts to stay competitive with short-term rentals, GOPPAR reveals whether the strategy is sustainable.

- If you host more events or increase F&B offerings to drive non-room revenue, GOPPAR captures the full value of those efforts.

It’s not just a better metric but a more complete one. And in volatile conditions, it’s the most relevant metric that GMs can rely on to steer off risk.

But Why Tracking GOPPAR Is Difficult for Most Hotels

Though most GMs benefit from comprehensive metrics like GOPPAR, most properties seldom have access to them due to a lack of the right processes and accounting tech stack. Here’s why:

Revenue Tracking Headaches: With countless daily transactions from various sources, reconciling different revenue streams is error-prone and time-consuming. And this makes getting an actual “Gross Operating Revenue” figure for GOPPAR a constant struggle.

Expense Visibility Challenges: While tracking revenue is hard, tracking expenses is even harder. Labor costs fluctuate daily, and operating expenses arrive from hundreds of sources. Manually tracking, categorizing, and verifying all these costs in real-time is such a big challenge that most systems do not even support the functionality.

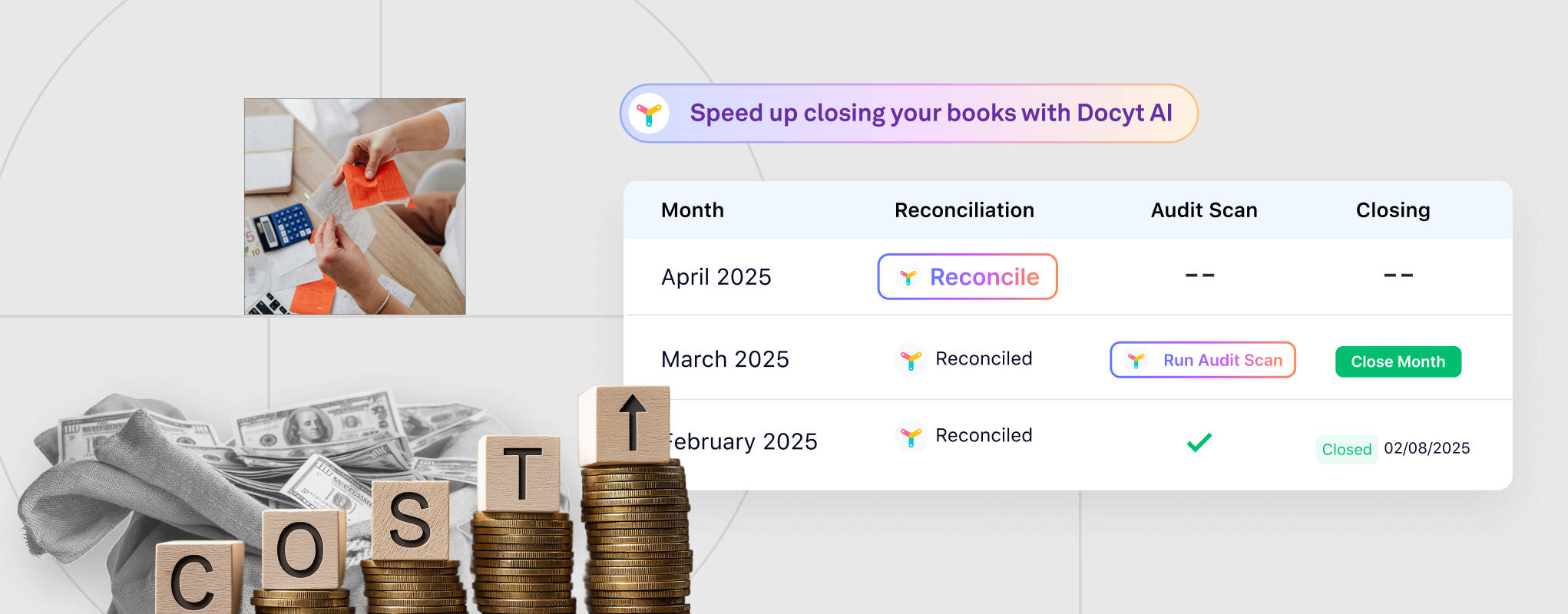

Reporting Delays & Disparate Systems: Even if data is eventually collected, integrating it into a cohesive P&L that follows hospitality standards like USALI, and then calculating GOPPAR, typically involves manual spreadsheet work.

Because different departments often use various systems that don’t talk to each other, resulting in delays, usually weeks or even months. So by the time GMs finally see a GOPPAR number, the market conditions that influenced it have already shifted, making the insight worthless.

Only when GMs are equipped with AI accounting solutions like Docyt AI that track GOPPAR in real-time can they turn insights into immediate action and navigate the volatile market.

Docyt AI – A Complete AI Accounting Solution for Every Hospitality Property

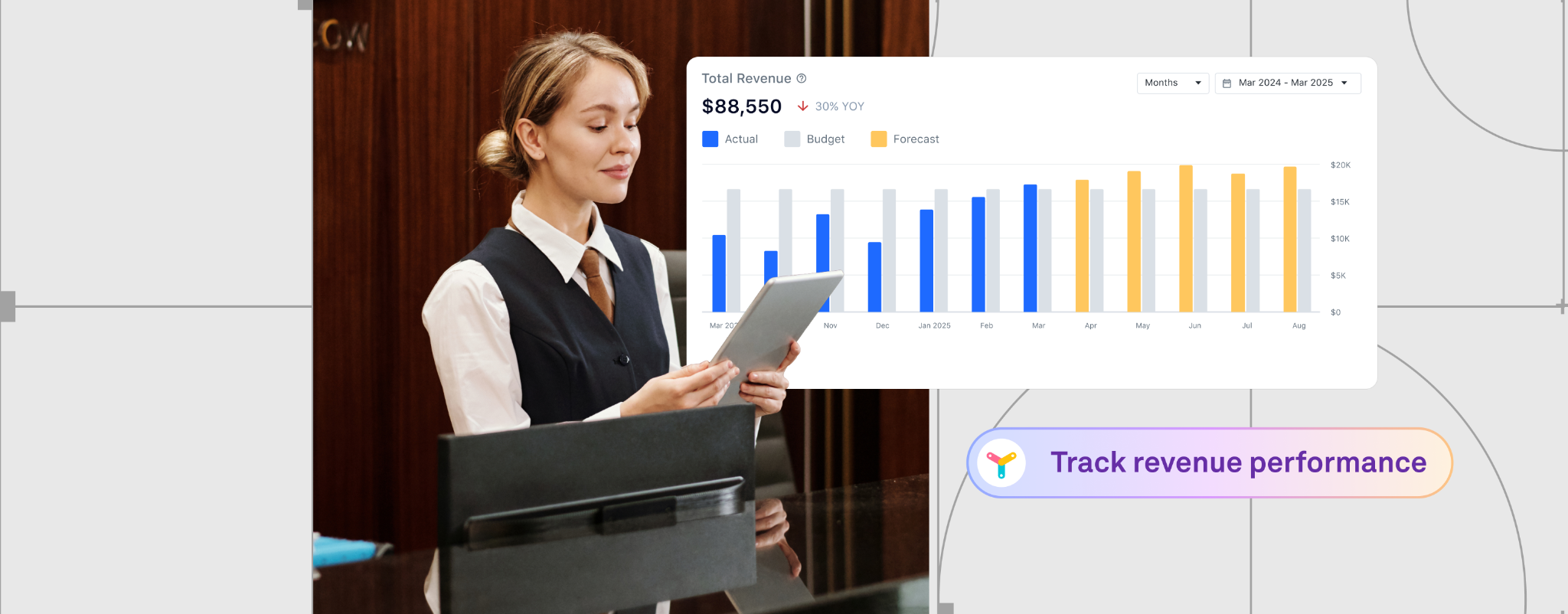

From revenue reconciliation to expense tracking to reporting, Docyt automates every layer of hotel accounting to provide real-time GOPPAR.

Here’s how Docyt AI makes that possible:

- Automated revenue reconciliation across PMS, POS, bank feeds, and merchant deposits- so revenue data is always clean and current.

- Automated expense tracking that captures every cost across departments, vendors, and labor.

- Real-time reporting workflows that replace month-end delays with daily financial visibility.

This is what allows GOPPAR to update daily, not weeks later, because every input is accurate, synced, and systematized every minute.

And that’s only the foundation. What makes Docyt AI truly indispensable for hospitality accounting is that it gives GMs direct access to every metric that influences GOPPAR by clearly showing not just what changed, but why it changed, and what needs to be done next.

So with Docyt, GMs don’t just instantly see a dip in GOPPAR; they can immediately pinpoint if it’s due to rising labor costs, underperforming F&B, poor marketing ROI, or pricing misalignment, and also helps them take swift action before numbers worsen.