Artificial intelligence has changed how accountants interact with their systems. Ask any firm that has tested the new wave of AI-driven tools. They promise journal entries at a keystroke, expense categorization from PDFs, even reconciliations on command. You upload a file, type an instruction, and the output appears.

It feels futuristic until the pattern sets in. Every file still needs your supervision. Every month still waits on you. Somewhere between the first prompt and the fiftieth, the glow of novelty fades into a question few want to say out loud: is this automation, or just typing with better lighting?

That question defines the gap between prompt-based systems and true autonomous accounting.

The Comfort and the Trap of Prompt-Based AI

Prompt-based AI began with an elegant thought. What if accountants could describe their task in words instead of clicks? For a while, that simplicity felt liberating. Upload the payroll, tell the AI what month it is, get a neat entry back. It mimics conversation, not coding.

For firms experimenting with AI, it is an easy first step. But the honeymoon ends where scale begins. Each client wants its own tone, its own chart of accounts, its own exceptions remembered. Soon you are maintaining not automation but a library of delicate spells, prompts that work today and misfire tomorrow.

Every instruction still needs your eyes. Every correction still needs your judgment. The operator never leaves the loop; only the interface changes.

The Quiet Costs of Prompt Management

Prompting feels like control until it isn’t. The illusion breaks when staff spend hours rewriting the same command for different entities, hoping the AI will not misinterpret a clearing account or a reclass.

Let’s call it what it is: manual work wearing a new label. The effort shifts from entering data to managing language. Instead of typing figures, accountants test sentences. The energy once spent on reconciliation now goes into coaching a model that does not know the client, the policy, or last month’s adjustment.

That is only the surface. Beneath it sit deeper problems that shape how firms experience these tools: dependence, context loss, scalability strain, and inconsistency that creeps in unnoticed.

Where Prompts Fall Apart

- Dependence Masquerading as Autonomy

Prompt systems never really learn. They rely on you to restate the firm’s logic every time. Each staff change or client variation resets the process. The workload stays human even when the interface looks modern.

- Context Lost in Translation

Accounting lives on relationships between ledgers, entities, and time. Prompts cannot hold that web of context. They treat every request as a blank slate, unaware of prepaid rent, deferred revenue, or cross-entity adjustments unless explicitly told. The output may look right but lacks the reasoning that keeps the books coherent month after month.

- Scale That Buckles

A prompt that works for one client collapses under fifty. Each entity adds its own vocabulary, exceptions, and quirks. What began as simple automation becomes an archive of templates that require maintenance. When month-end pressure hits, people quietly return to spreadsheets.

- Consistency on Shaky Ground

Ask three staff members to describe the same task, and you will get three slightly different prompts and three slightly different outputs. These variations accumulate over time. Classifications drift, reconciliations diverge, and audit trails blur. Consistency erodes not through neglect but through linguistic variance itself.

Prompt-based AI looks intelligent, but clever is not the same as capable. It remembers nothing, understands little, and scales poorly.

Moving Beyond Prompts: Accounting That Knows the Ledger

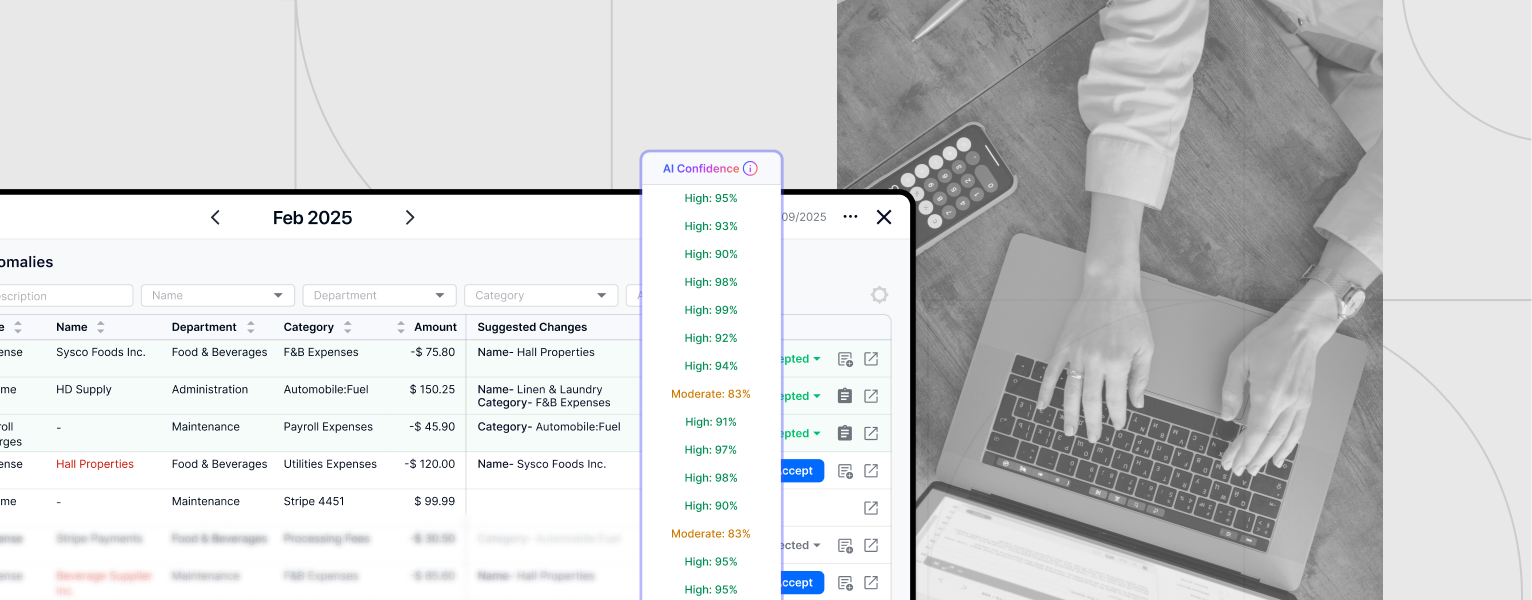

To move past these limits, automation must stop waiting for instructions and start acting from understanding. That is the principle behind Docyt’s HpAI Agents. They are not built to chat but to comprehend.

These agents are trained on tens of thousands of actual month-end closes across industries and entity structures. They do not guess how accounting behaves; they have already seen how it works in practice.

How Intelligent Agents Change the Work

Subledger-Level Awareness

Rather than producing isolated journal entries, HpAI agents operate inside a structured subledger. They see how transactions originate and how they flow. Payroll becomes accruals, liabilities, and clearings. You do not ask them to create the entry. They already know what belongs where.

No templates. No repeat prompts. Only autonomous motion guided by accounting logic.

Learning That Compounds

HpAI learns continuously from real books. Each client adds nuance, and the system refines itself with every engagement. The result is intelligence that compounds. Where prompt AI starts over every month, HpAI grows sharper.

Accountants Stay in Control

Instead of crafting prompts or editing raw output, accountants simply review. Approve or adjust. That is the entire loop. The AI handles creation and validation; the accountant ensures reasoning holds. Control remains human, but friction disappears.

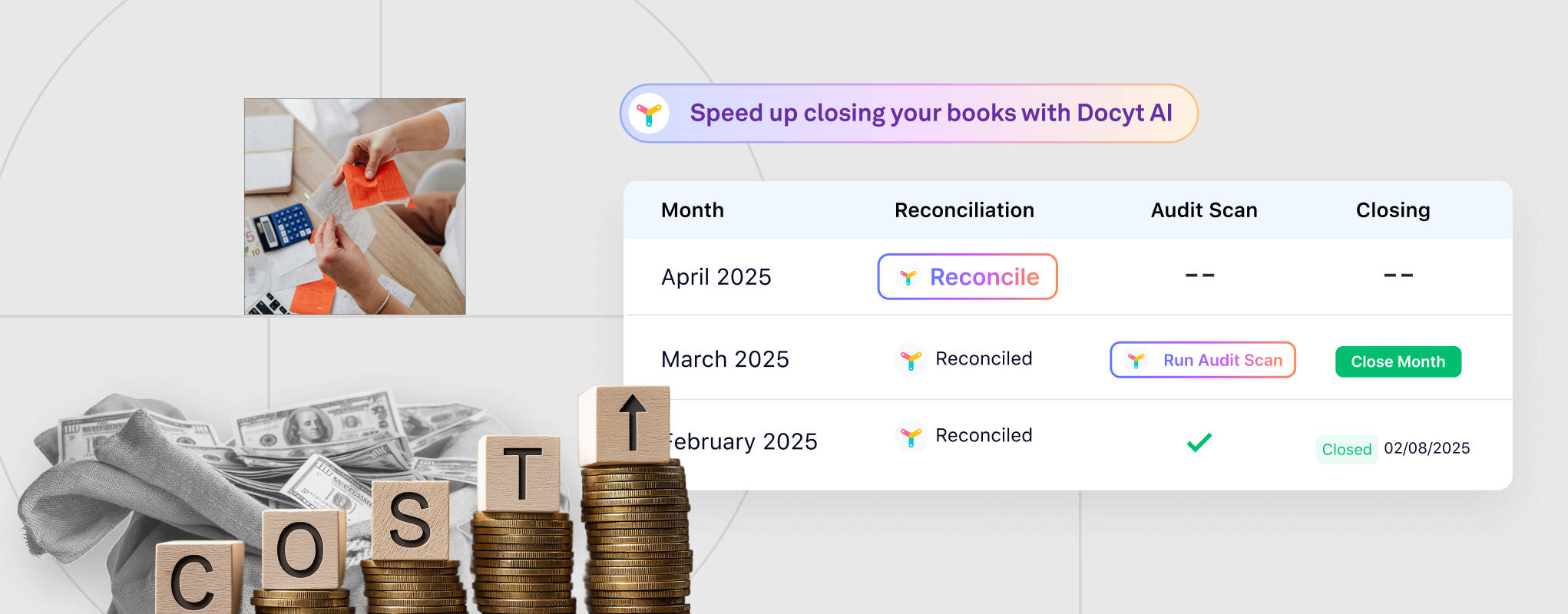

From Entries to Systems

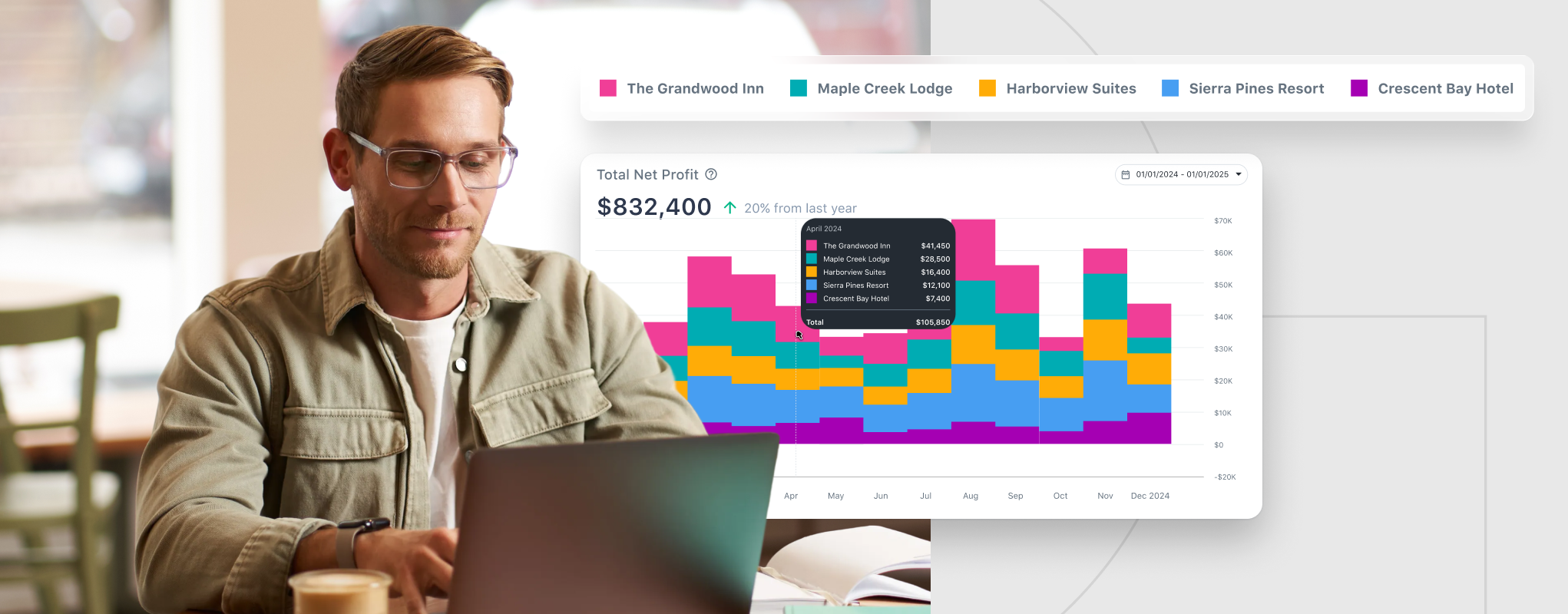

Prompt tools create lines. HpAI creates structure. Subledgers give order, traceability, and audit readiness. They allow downstream tasks—variance reports, reconciliations, and close reviews—to inherit precision from the source.

Why This Shift Matters

For firms under pressure to deliver more with the same team, this difference is operational, not theoretical.

Prompt AI trims seconds; HpAI frees capacity. Prompt AI depends on upkeep; HpAI builds endurance. One accelerates typing; the other redesigns how work scales.

When every client file needs manual care, people remain the bottleneck no matter how many tools you add. HpAI removes that constraint. It handles preparation, validation, and reconciliation in parallel. Firms can close books for dozens of clients without expanding staff or maintaining prompt libraries.

Because HpAI’s subledger architecture integrates directly with general ledgers and ERPs, it grows with the firm instead of aging out of it. As standards change or clients migrate systems, the framework holds. That is stability prompt-based tools cannot match.

The Larger Leap: From Talking to Thinking

Prompt-based AI taught firms that automation could be conversational. That was a necessary first step. But accounting is not a chat; it is a discipline that rewards continuity, context, and control.

True automation does not wait for you to explain. It already knows the terrain it works within. It interprets the data like an experienced controller, not through commands but through comprehension.

That is the leap HpAI takes. It is not listening for direction. It is reading, reasoning, and building intelligence inside the books themselves.

In Closing:

Accounting will never scale through better instructions. It scales through systems that can think. Prompts can make a quick assistant, but they cannot create a foundation that understands.

HpAI can. It learns, contextualizes, and executes with the precision of an accountant who never forgets last month’s logic. The next era of automation is not about telling AI what to do. It is about working with AI that already knows.