Company credit cards are now arguably the most popular way to pay for business expenses. Whether it’s a casual lunch or a business trip – most companies use credit cards as the preferred method of payment. As such, credit card reconciliation is becoming increasingly important for businesses across all industries.

Credit card reconciliation compares transactions in a credit card statement to the receipts which document the spending. Banks and financial institutions can make mistakes, therefore companies shouldn’t rely solely on statements for accuracy, and must perform credit card reconciliation.

Reconciliation helps identify errors and detect fraud. Furthermore, accountants need to be able to verify each transaction actually occurred and is the correct amount. Reconciling credit card statements with company financial records will help ensure your books are accurate.

The Drawbacks of Company Credit Cards

The ease and flexibility of credit cards have made them a popular form of payment for businesses. However, there are certain issues that come along with credit card accounting. In a perfect world, general ledgers and credit card statements would always match with zero errors. The reality is this isn’t always the case.

Tracking and reconciling credit card usage can be time consuming for companies. Let’s say you have an employee who frequently travels on business. Every week they go to a new destination – this means airline flights, hotel bookings, meals, and other incidental expenses along the way. A single employee may have dozens if not hundreds of monthly credit card transactions. Taking the time to manually review and reconcile each transaction is time consuming. This work grows exponentially as more employees are issued credit cards.

Accounting teams can spend countless hours chasing down paper receipts and matching them to credit card statements. What if you could automate this process? That’s where Docyt can help.

Docyt Automates Credit Card Reconciliations

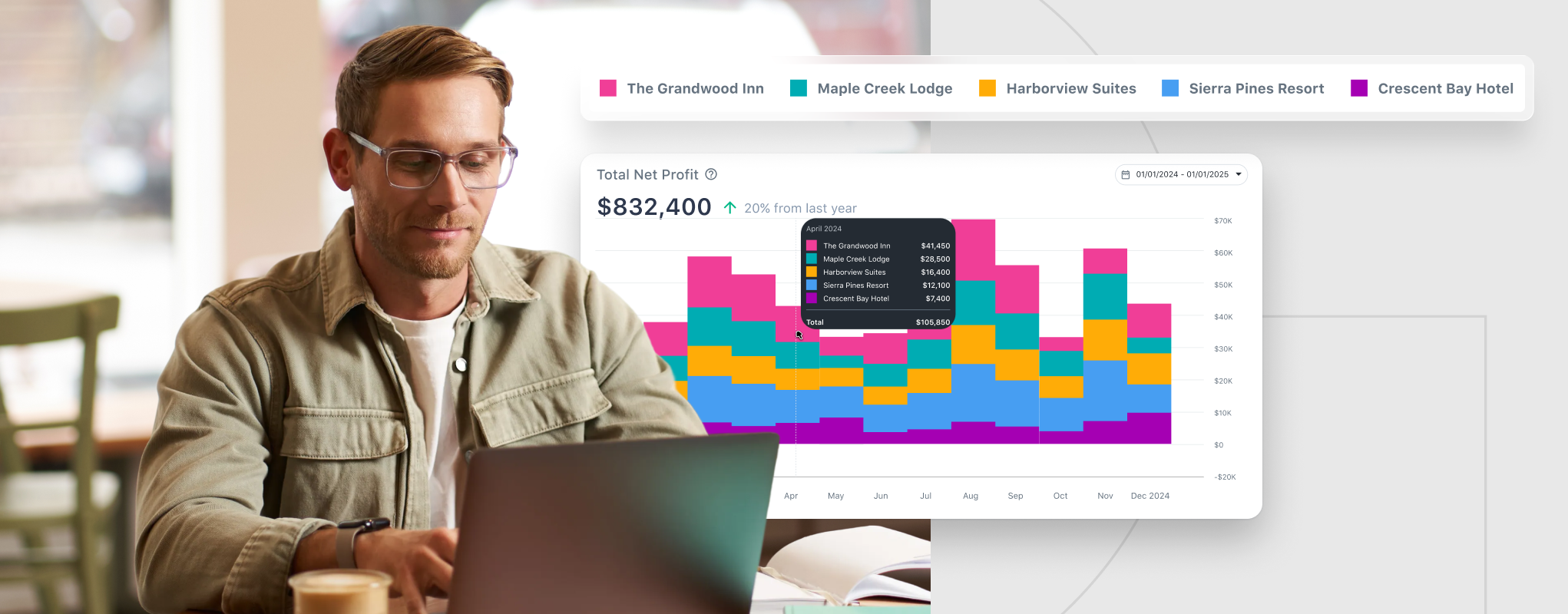

Docyt’s accounting automation software helps business owners take control of their expenses. Instead of wasting time chasing down employees for paper receipts, Docyt allows employees to submit the receipt within the Docyt app. Docyt then automatically matches receipts to the respective credit card transaction.

Business owners get complete visibility into individual and overall employee spend, and employees feel empowered as they’re provided with full visibility into their spending habits.

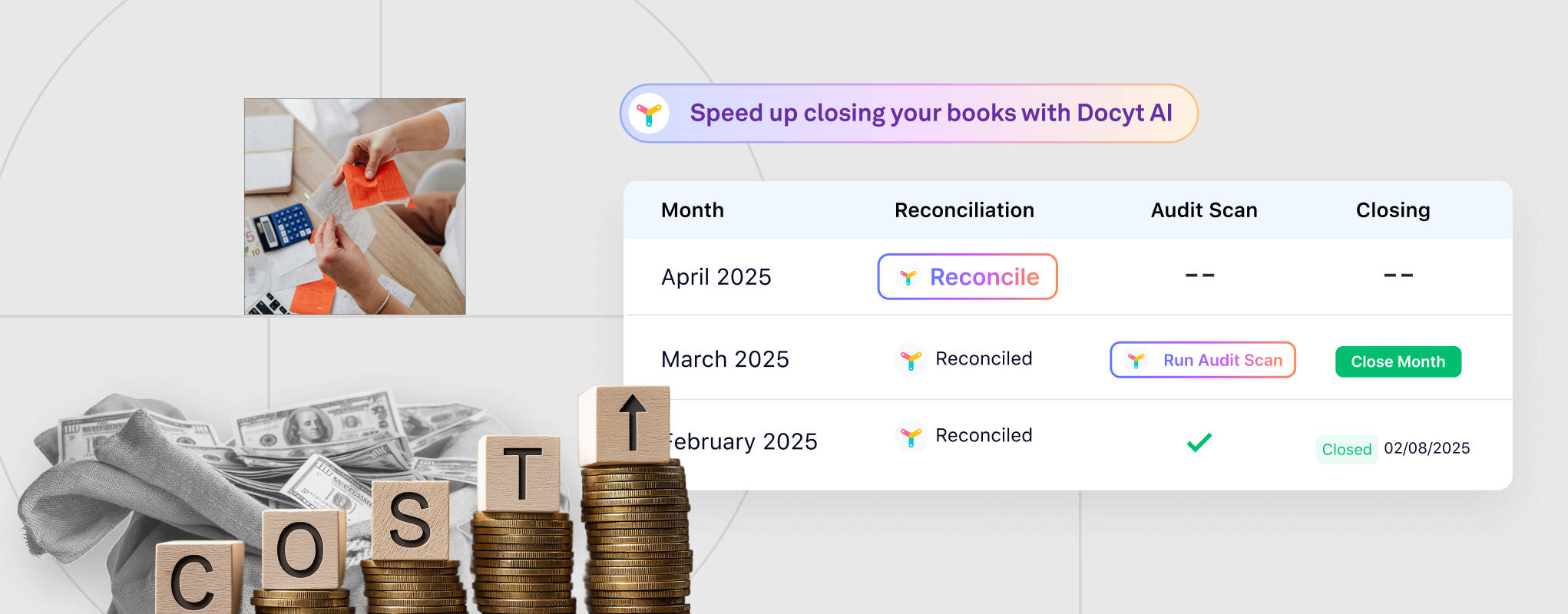

Lastly, with Docyt’s continuous reconciliation, your company will be able to uncover and resolve discrepancies throughout the month, rather than waiting for month end. This saves you time.

Automate the Credit Card Reconciliation Process

Docyt’s accounting automation software digitizes paper receipts, automatically matches receipts to credit card transactions, and expedites the month-end closing process – helping to make life easier for business owners and accountants.

If you’re looking to simplify credit card reconciliations, Docyt has you covered. Book a demo to learn more today.