With dozens of processes, a high volume of transactions, and teams working around the clock to keep the books aligned, hospitality accounting is a complex system where a new challenge or process can emerge at any time.

The first instinct is to add a tool as an add-on. On the surface, this seems obvious. But in practice, it is not as straightforward as it looks.

Capabilities rarely add up, but problems multiply.

Because hospitality accounting is already a fragmented set of processes, a new tool may introduce a new gap.

Data flow problems, handoff issues, and blind spots often arise at any stage of the process. Each situation that occurs at any stage triggers the next bottleneck down the line.

- PMS & POS don’t sync => revenue gets rekeyed => errors creep in & delays reconciliation

- Delayed reconciliations => month-end close drags out => reporting falls behind.

- Late close => reports reach GMs too late => no chance to act on variances or control damage

- Slow AP approvals => expenses stay hidden => P&Ls skew => forecasts go off track.

Over time, instead of building a unified control system, hotels end up with an array of fragmented systems. For a hotel group, all the above problems only amplify with time.

And the cost isn’t just operational headaches; its real money lost in the form of delayed decisions, missed opportunities, uncontrolled costs, and even bleeding profit margins.

The only way to stop the ripple effect is to unify all processes into a single system that keeps operations and finances aligned.

But a unified hospital accounting platform isn’t enough to maximize profit.

A unified hospitality accounting platform helps streamline workflows, plug gaps, and reduce inefficiencies that offset Profits. In short, it is similar to not losing the revenue one has already gained.

However, if the goal is to maximize Profit and gain an edge in the hyper-competitive hotel industry, protecting margins with automation alone isn’t enough.

In addition, hotels require unified intelligence platforms that not only automate processes but also provide actionable, real-time insights to help operators protect margins and act proactively.

At the heart of a hotel accounting system that consistently maximizes Profit sits a unified financial intelligence platform, like Docyt AI.

Docyt AI: A Unified Financial Intelligence Platform Built to Maximize Profit:

With Profit, every transaction moves seamlessly through the system: recorded instantly, reconciled automatically, and reflected everywhere it needs to be.

From the point-of-sale terminal to the general ledger, from payroll approvals to portfolio roll-ups, each process is tightly connected, ensuring there are no gaps, no rekeying, and no delays. Here’s how:

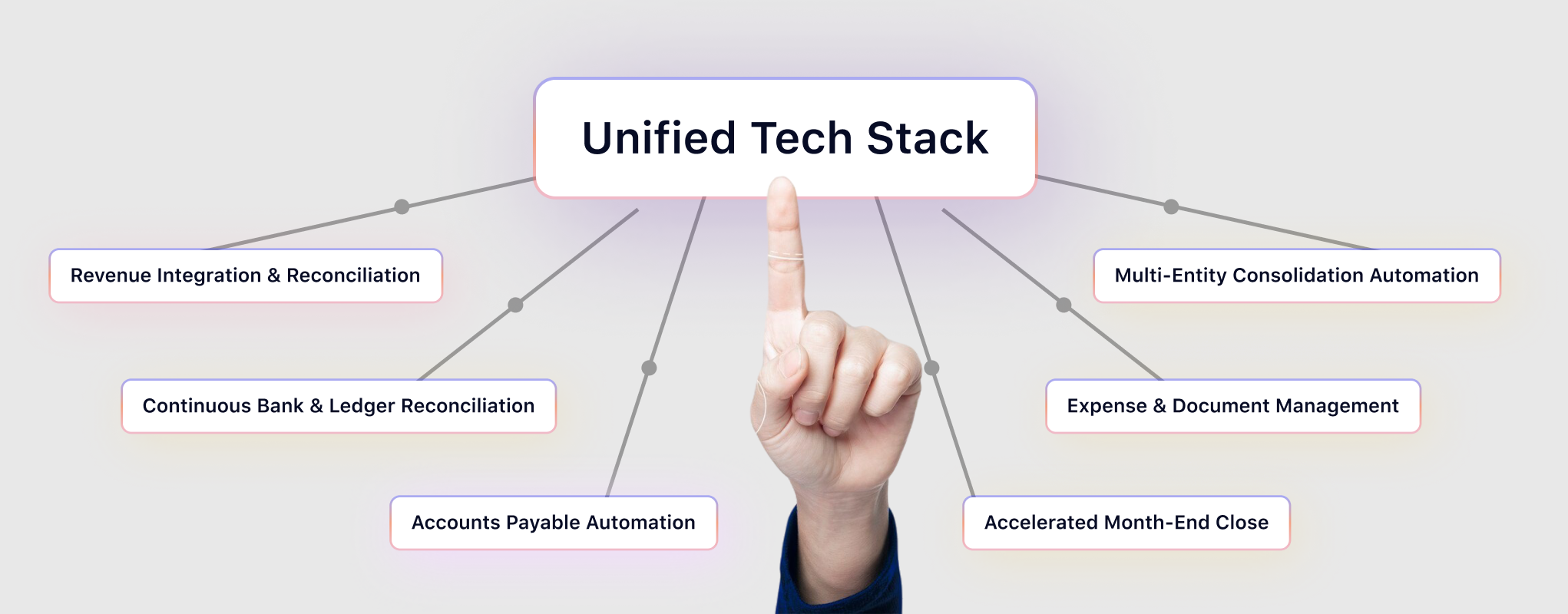

- Revenue Integration & Reconciliation: From PMS and POS to merchant processors and banks, every revenue transaction flows into Profit automatically.

- Continuous Bank & Ledger Reconciliation: Docyt reconciles transactions every day. So, books are always live, aligned, and ready for review.

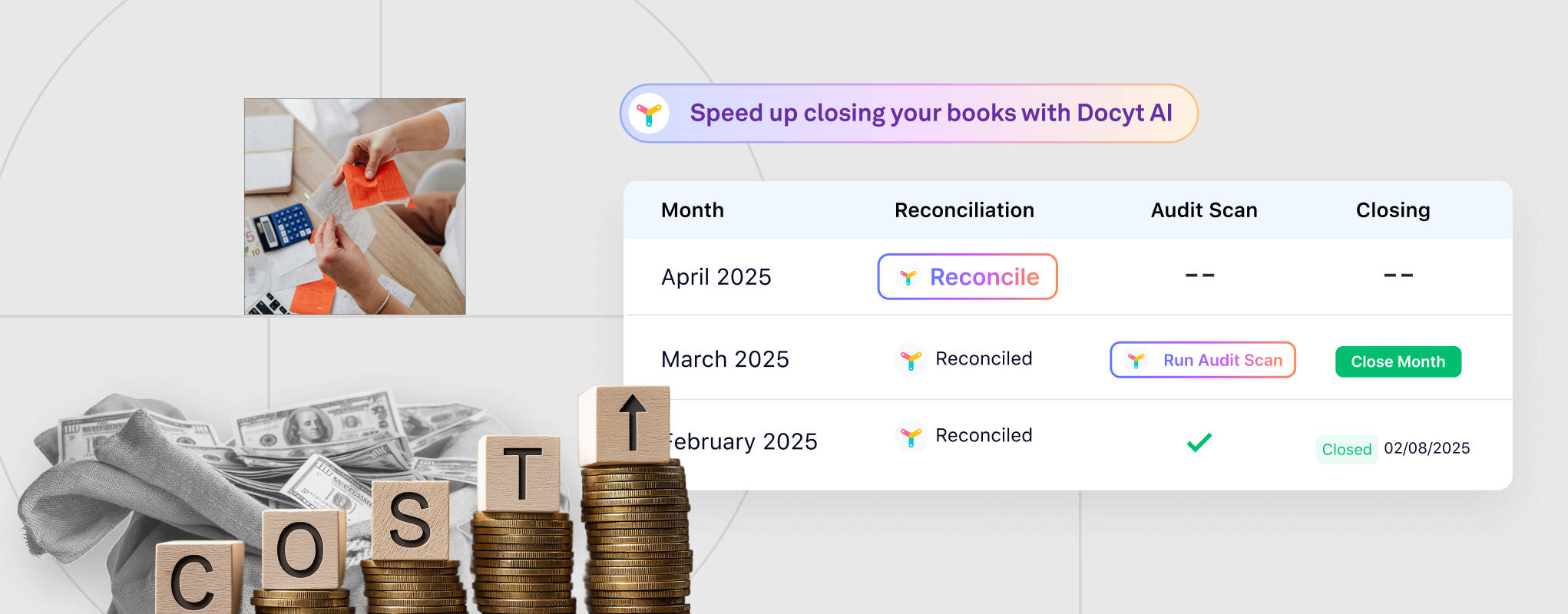

- Accelerated Month-End Close: With automated transaction categorization, standardized checklists, and built-in flux analysis, closing the books becomes just a quick confirmation.

- Accounts Payable Automation: Invoices, approvals, and vendor payments move seamlessly through Docyt. As a result, expenses no longer sit hidden in approval queues, so P&Ls stay accurate and forecasts stay on track.

- Expense & Document Management: Receipts, expense reports, and credit card reconciliations are automatically captured, matched, and logged—no more paperwork, like, ever.

- Multi-Entity Consolidation Automation: For hotel groups, Profit AI instantly rolls up financials across properties. So, leaders can see the entire portfolio at a glance or drill down into individual properties without manual consolidation work.

In theory, these are separate pillars. In practice, they work together as interlocking fundamentals that form a single, unified automation platform that eliminates all traditional inefficiencies before they deplete revenue or profit margins.

Beyond Automation: Profit AI’s Five Layes of Intelligence for Maximized Profitability

Beyond Automation: How Profit AI Delivers Maximum Profitability But, as said above, automation is only the foundation. Profit AI’s true strength lies in its ability to deliver real-time, precise intelligence that powers operators to act at the right moment, pull the right levers, and consistently maximize profit margins.

Here’s a closer look at how Profit AI’s five layers of intelligence work together to maximize margins and growth in hospitality operations:

- Accuracy & Self-Correction Intelligence: Profit begins with precision. So, Profit AI protects margins by further refining data integrity by preventing minor errors from snowballing into costly losses.

- Flags missing deposits, duplicates, and suspicious activity.

- Suggests corrections before errors escalate.

- Adaptive learning that improves categorization and reconciliations over time to ensure accurate decision making.

- Real-Time Financial Visibility Intelligence: Keeps Profit within reach by giving operators live numbers they can act on immediately.

- Live P&L, balance sheet, and cash flow keep profitability always in view.

- Continuous reconciliation and variance alerts for instant corrections.

- Daily flash revenue reports to adjust strategy on the go.

- Operational Performance Intelligence: Identifies key levers in everyday operations to improve margin control and cost efficiency for better profits.

- Real-time labor efficiency insights (payroll/overtime tracking, portfolio benchmarks) enable cost discipline and prevent overruns from eating into profits.

- Departmental P&L for improved accountability, resource optimization & efficiency.

- Vendor and expense analysis gives an edge in negotiation & cost optimization.

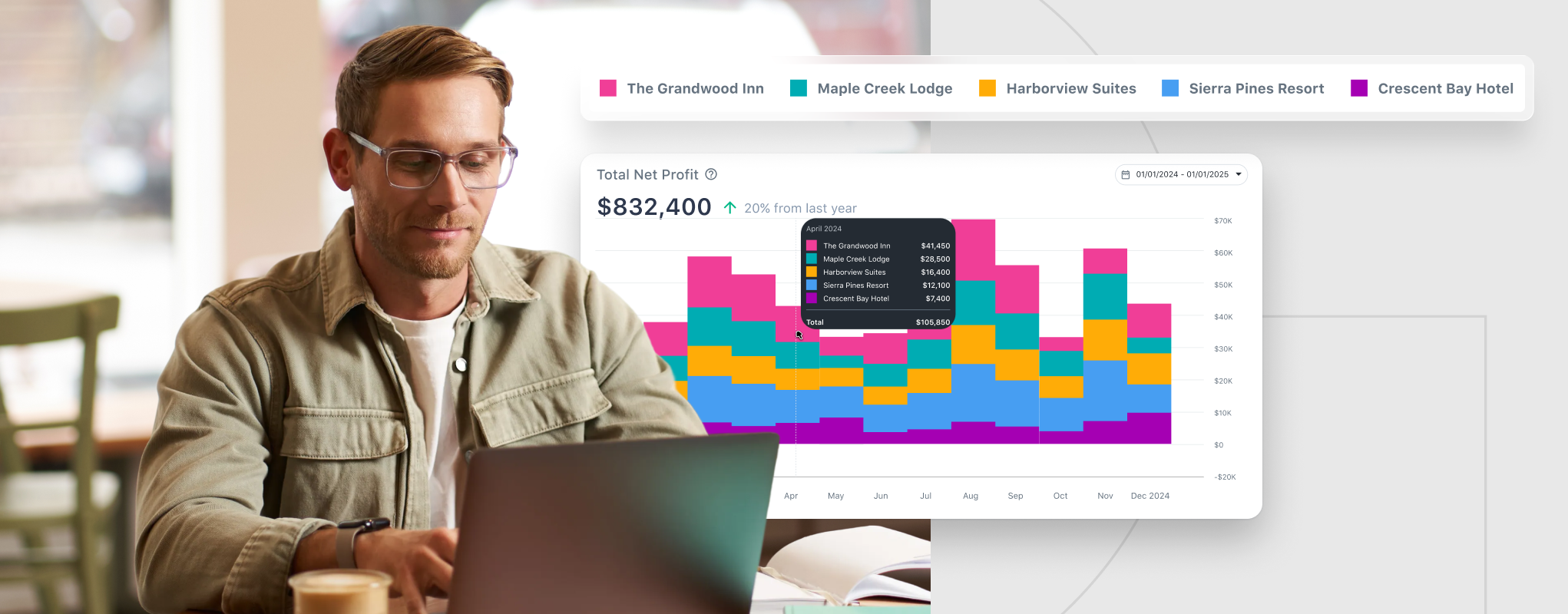

- Market & Portfolio Intelligence: Reveals revenue patterns across markets and properties so growth opportunities don’t go unnoticed.

- Revenue segmentation reveals the most profitable channels and guest types. Channel, guest type, or market

- Multi-entity consolidation with side-by-side views identifies underperforming hotels & helps lift group-wide margins.

- Drill-down from portfolio to transaction detail makes sure no profit driver is overlooked.

- Predictive & Alignment Intelligence: Strengthens long-term profitability by helping leaders anticipate risks and keep teams aligned.

- Dynamic forecasting and profit target tracking for more thoughtful planning and resource allocation.

- Cash flow trend detection and liquidity risk alerts protect profit margins.

- Configurable dashboards with role-based KPI sharing (owners, GMs, department heads) ensure everybody is on the same page.

- Automated email alerts for proactive decision-making – so no costly surprises.

Profit AI – Subtracts Inefficiencies & Adds Intelligence to Maximize Profits

By unifying five key layers of intelligence, Profit AI makes every lever of profit intelligence accessible to hotel operators.

It safeguards margins with precise, self-correcting financials, gives operators the clarity of real-time visibility, and transforms daily operations into controllable levers for efficiency.

It equips hotel operators with forecasting and alignment tools that anticipate risks and identify growth opportunities across markets and portfolios.

Unlike costly overhauls, Profit AI is a seamless add-on that works with any existing infrastructure to create a profit-maximizing intelligence system, instantly elevating hotel performance and margins.

Check out our live demo to see how Profit AI can transform your operations.