In the hospitality industry, triumph hinges on a strategic approach, especially when managing multiple properties. Vital to this strategy are Key Performance Indicators (KPIs), which offer invaluable insights into business performance and allow hospitality leaders to fine-tune a hotel’s operational performance and guest satisfaction.

In this blog, we’ll explore 5 essential KPIs that can significantly impact the performance of multi-entity hospitality businesses.

1. Revenue per Available Room (RevPAR)

RevPAR is a fundamental Key Performance Indicator (KPI) that assesses a hotel’s financial performance by analyzing the revenue generated per available room. To calculate RevPAR, there are two commonly used formulas:

Formula 1**

The first one is the total amount of room rent revenue divided by the total rooms available to have been rented. It is important to note that the total rooms available include rooms that were available but were not occupied for this calculation.

RevPAR = Total Revenue / Number of Rooms Available

Formula 2**

Hotels can calculate RevPAR by multiplying the average daily rate by the occupancy rate, providing a more accurate measure for fully occupied hotels with limited available rooms.

RevPAR = Average Daily Rate × Occupancy Rate

**Both formulas yield a dollar amount theoretically lower than the actual daily rate, as hotels shouldn’t be occupied beyond 100%.

💡 Tip

For multi-entity hospitality businesses, examining RevPAR across diverse locations offers valuable insights into pricing effectiveness, demand fluctuations, and measuring overall market competitiveness. This KPI serves as a compass to identify high-performing entities and highlight areas that may require attention to optimize revenue streams.

2. Average Daily Rate (ADR)

Average Daily Rate, commonly known as ADR is a critical financial KPI often used to determine the operating performance of a multi-entity hospitality business. It’s a calculation of the average revenue generated per room on a given day.

Formula 1

Average Daily Rate = Rooms Revenue Earned / Number of Rooms Sold

Formula 2

Revenue per Available Room = ADR X Occupancy Rate

ADR can be analyzed against historical data to identify trends and evaluate promotional effectiveness. Timely monitoring of ADR across different entities enables hotels to devise effective pricing strategies to attract guests, increase occupancy rate, and maximize revenue. Hoteliers can increase ADR through upselling, cross-sale promotions, and complimentary offers.

💡 Tip

Comparing ADR with similar hotels assists in setting accurate room rental prices based on factors like size, clientele, and location.

3. Occupancy Percentage

Monitoring occupancy percentage is crucial for analyzing the utilization of available resources. Tracking the percentage of occupied rooms allows multi-entity hospitality businesses to:

- Predict upcoming trends and peak seasons

- Analyze areas for potential improvement

- Make strategic decisions related to pricing adjustments, staffing, and marketing spending required to attract guests and drive profitability.

Formula

The occupancy percentage is calculated by –

Occupancy % = (Number of Occupied Rooms / Total Number of Rooms in the Hotel) X 100

For example – If a hotel has 250 rooms, of which only 100 are booked in a given month, then the occupancy rate of the hotel will be (100 / 250) X 100 = 40%

💡 Tip

Finding a balance between ADR and occupancy rates empowers businesses to fine-tune room rates for profitability without compromising guest satisfaction.

4. Cost per Occupied Room

Cost per Occupied Room (CPOR) measures the cost to run a hotel per room and is calculated by dividing total expenses by occupied rooms. CPOR is essential for evaluating hotel profitability and operational efficiency. Effective CPOR management involves optimizing occupancy rates, adjusting pricing, and controlling operational costs to ensure profitability and competitive pricing.

Formula

Cost per Occupied Room = Total Expenses / Number of Occupied Rooms

💡 Tip

High CPOR indicates a need for operational adjustments to balance expenses and revenue.

5. Gross Profit and Net Profit Margin

Gross Profit Margin reveals how effectively a hotel uses its resources to deliver services and generate profit, excluding overhead and other expenses. In simple terms, it represents revenue after accounting for business costs.

Formula

Gross Profit Margin = ((Revenue – COGS) / Revenue) x 100

Net profit margin is a critical financial metric that provides insights into the hotel’s overall profitability. It measures the percentage of revenue that remains as profit after deducting all expenses, including operating costs, taxes, and interest.

Formula

Net Profit Margin = Net Profit ⁄ Total Revenue x 100

Net profit margin is a vital indicator of a company’s cost management efficiency. High margins suggest effective control and substantial returns, while low margins may indicate issues with cost control or revenue generation. It serves as a critical measure of competitive advantage. Companies with lower margins may need to make improvements to remain competitive.

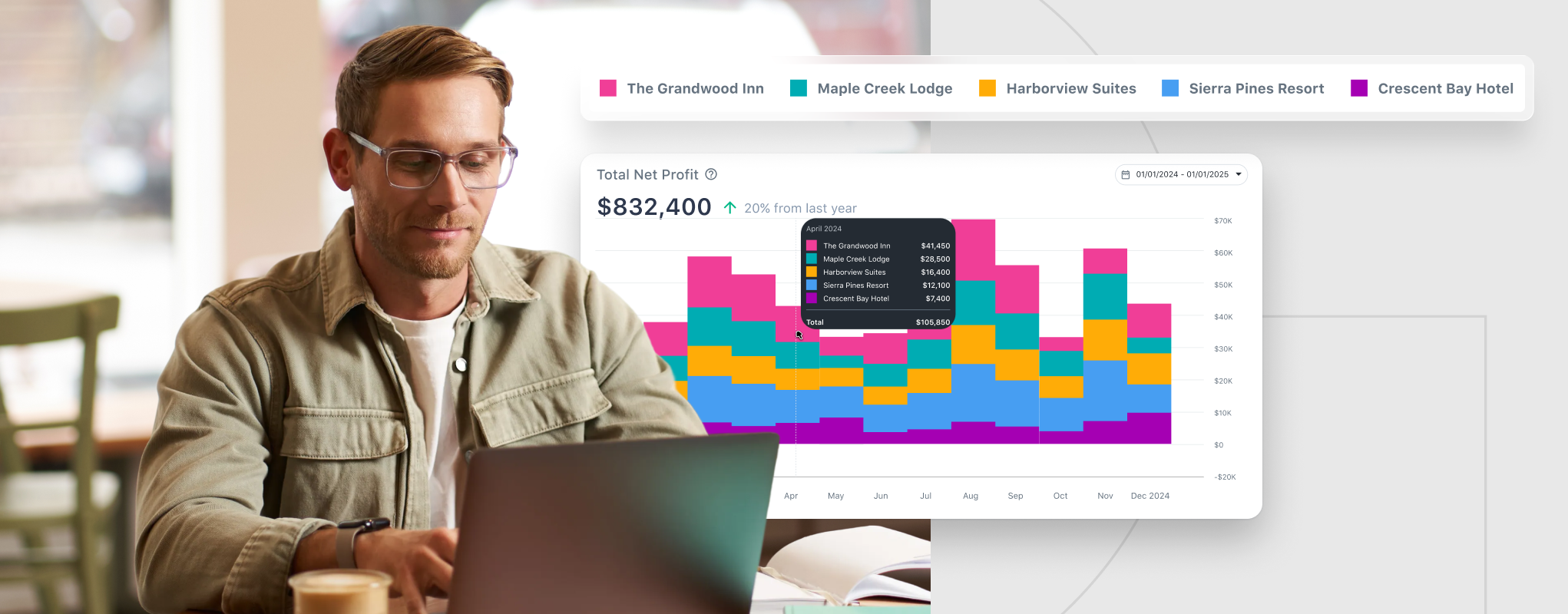

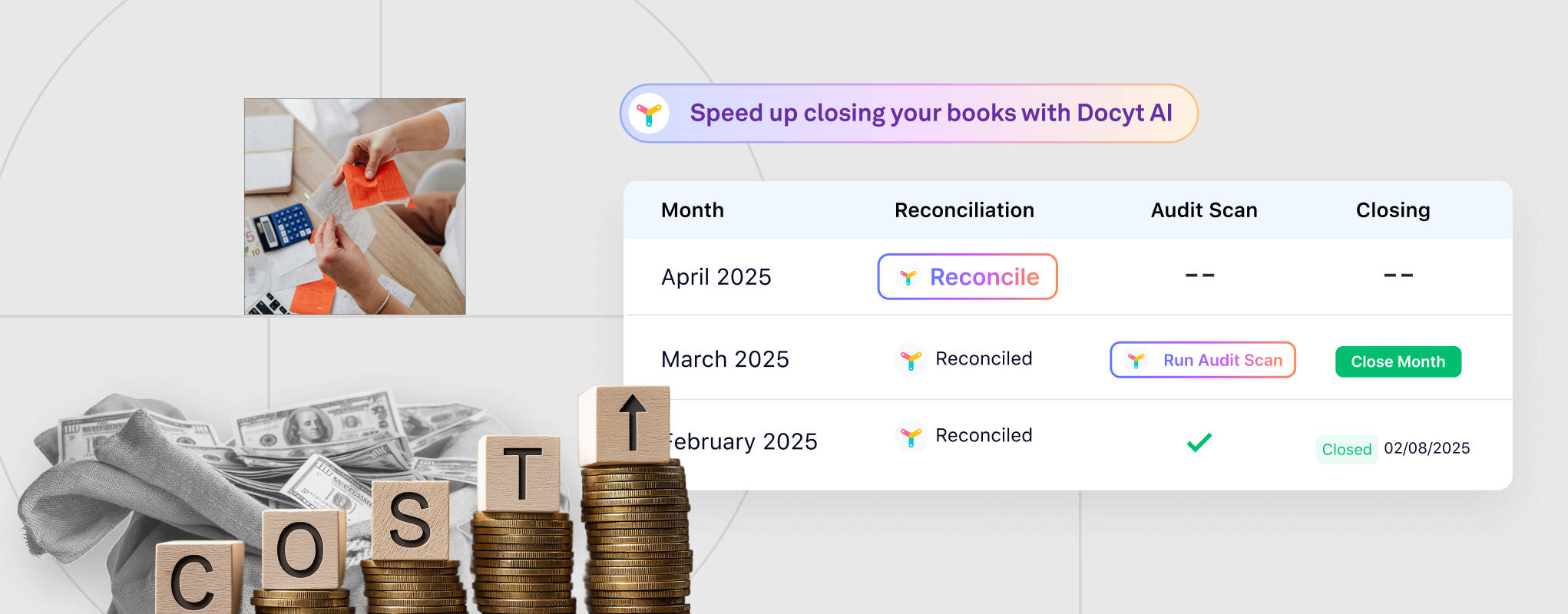

Why Docyt AI?

Docyt AI gives hoteliers a real-time view of crucial metrics like RevPAR, ADR, Occupancy Percentage, Cost per Occupied Room, Gross Profit Margin, and Net Profit, and more. Our Portfolio Dashboard goes beyond the basics, calculating these important metrics to give you a complete financial picture.