In this fast-paced digital age full of evolving advanced technology, forward-thinking accounting firms are in search of ways to improve services and streamline operations. Among the most promising new technologies to affect the industry is ChatGPT, a form of generative AI. The AI-powered tool stands to revolutionize how accounting firms and CPAs handle a whole host of accounting tasks while exceeding client expectations, increasing productivity, and improving accounting accuracy. The question most commonly asked by accountants not currently using ChatGPT is: “How do I use the platform?”.

With that in mind, we have put together the top 5 ChatGPT use cases to help accounting firms stay ahead of the curve.

Use Cases for ChatGPT for Accounting Firms

Facilitating Tax-Time Preparation

Tax preparation is chock-full of tasks requiring high attention to detail, continuous calculations, and client interactions while simultaneously confirming updates to current tax laws. The good news is that ChatGPT can help. It has access to information that will either answer simple tax questions or provide the proper online resources to find the answer. So, how can a chatbot help tax accountants prepare client returns? By ensuring all applicable deductions and credits have been properly applied and answering clients’ general tax-related questions or guiding them to the proper resources.

What you should NOT use ChatGPT for:

Completing a Tax Return: Although somewhat intuitive and a source of a wide range of information, ChatGPT cannot reliably provide an accurate and complete tax return that considers client-specific details. Not to mention the ethical considerations of sharing confidential client information with the greater ChatGPT world.

Compliance Research: Tax rules and regulations change from year to year. ChatGPT learns from user interaction without regard to the source. As a result, it is not (yet) 100% reliable and any information gleaned from it should be double-checked for accuracy.

Key reasons to incorporate ChatGPT into your tax process:

Improved client relations and communication with instant support

Increased productivity internally

Massive time and money savings

Client Communications and Support

Probably the single most time-consuming task an accountant manages is communicating with their clients. ChatGPT can handle routine queries made by the client and provide an answer within seconds. This frees up the accountant’s time to focus on more complex tasks, increasing client support. Whether it’s preparing emails to communicate necessary steps throughout the tax preparation process or simply setting up appointments, when using ChatGPT, your clients are certain to receive fast service.

Key Benefits: Improves client satisfaction, enhances the firm’s efficiency, and increases productivity across the board.

Automate Data Entry and Processing

Data entry is a monotonous task highly likely to result in human error. ChatGPT, integrated with standard bookkeeping software, can automate processes like data entry and data processing. ChatGPT’s advanced algorithms can read and interpret your clients’ financial documents, place the data into the correct fields, and reconcile any discrepancies it finds. Note: To avoid confidentiality issues, consider feeding raw data to ChatGPT without reference to your client’s personal information.

Key Benefits: Reduces labor costs, increases accuracy, improves productivity, and saves accountants time that can now be spent on more strategic activities.

Preparing Financial Reports

Preparing and generating financial reports for clients is a critical task for accounting firms during tax time. To expedite and streamline this process you can turn to ChatGPT for assistance. The data that you have already fed ChatGPT to automate the data entry process, can now be used by this AI genius tool to automatically produce well-detailed and accurate financial statements like balance sheets, income statements, and cash flow statements in a matter of seconds.

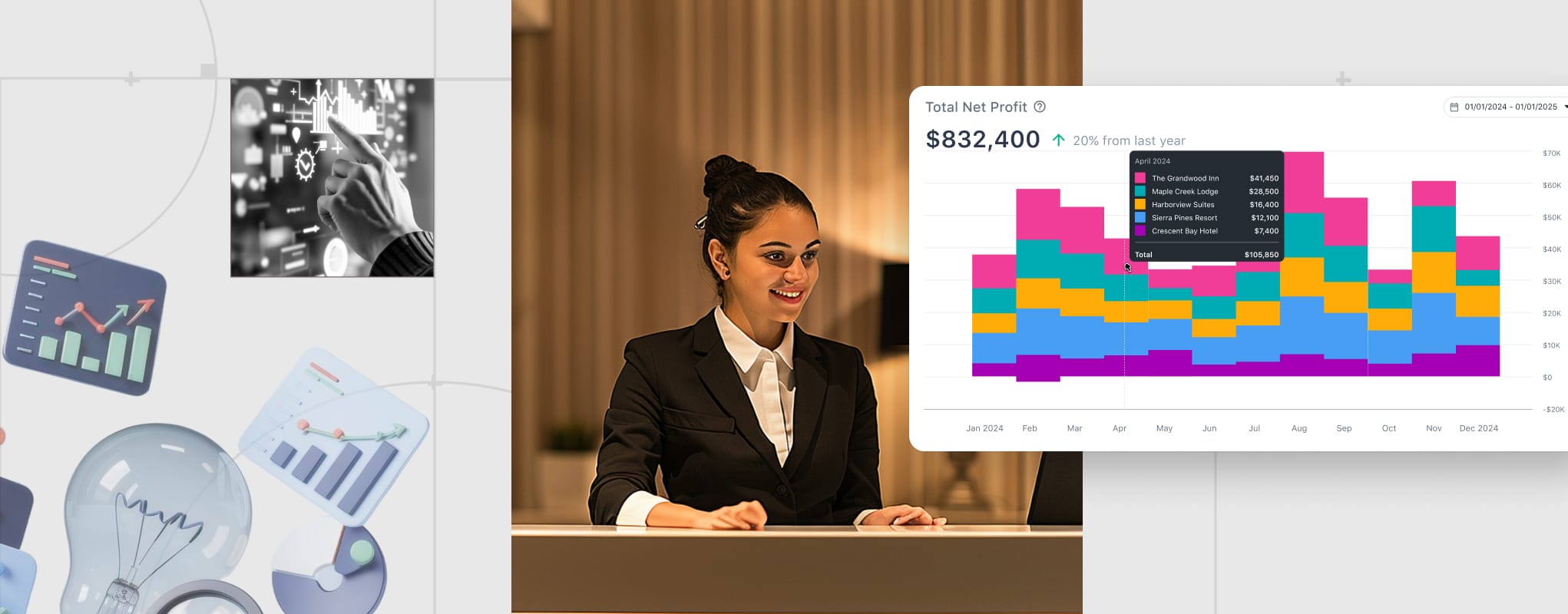

Something to consider is adopting AI-powered bookkeeping software like Docyt that automates your clients’ entire financial workflow and provides real-time financial data. Couple an AI-powered end-to-end bookkeeping solution with ChatGPT’s ability to generate unique reports like strategic growth mapping to help scale your clients. Now that’s accelerating your client services!

Key Benefits: Increase productivity, improve accuracy, improve client relations, and save time.

Enhancing Financial Analysis and Forecasting

For accounting firms, financial analysis and forecasting are crucial and part of the expected routine. With that in mind, this is highly recommended for all accounting firms that want to add significant value to their clients’ services. ChatGPT uses advanced algorithms to analyze large volumes of data very quickly, interpret and scrutinize the information to identify trends, and ultimately generate valuable insight that can be used to make well-informed decisions. Additionally, this advanced AI technology can craft financial forecasts that will guide your client’s strategy. Introducing a feature like this that delivers deeper insights beyond traditional accounting practices positions your firm to become a trusted strategic partner to your clients.

Key Benefits: Saves time, improves accuracy, increases productivity, improves client relations, enables informed decision-making, and positions the firm (and client) as strong competitors.

Conclusion

Implementing ChatGPT in accounting can shift the entire client services game for firms and make them more efficient, accurate, and client-focused. Utilizing the top five uses detailed above—client communication, data entry automation, generation of financial reports, tax preparation support, and improved financial analysis—an innovative accounting firm can stay competitive and provide a significantly greater value to its clients.

So whether you are using standard accounting software and integrating ChatGPT to automate data entry and financial report generation or have deployed an AI-powered bookkeeping platform and are introducing ChatGPT as a well-educated resource to help answer complex client inquiries, advanced AI tools like ChatGPT can elevate your firm’s client service and give you a competitive edge.