If you manage a mid-scale portfolio, you already know the uneasy pause that forms when three systems present different answers. Your PMS reports one number, the bank suggests another, and the accounting software refuses to settle on either. You stare long enough and wonder why ordinary revenue data demands this level of interpretation.

Ask any controller about their day, and they will mention small puzzles that have become ritual. A deposit appears without a matching folio entry, stalling reconciliation, and the team has to dig through the reports to find it.

A correction post inside the PMS, but refuses to land inside the ledger, which can skew accuracy and adds another task (of many) to the month-end close. A batch settles neatly yet arrives in accounting as scattered fragments, and the controller has to manually reassemble the pieces.

None of these moments causes panic, but they slowly reshape the workload as the portfolio grows.

Fragmentation grows quietly & gaps widen without notice.

Fragmentation doesn’t show up all at once. It slowly builds from different decisions made at different times.

For example, when one property switches to a new PMS, another keeps the old one for a while, and the data from each place behaves a little differently. A simple bank change shifts how settlements come in.

A small POS update can throw off part of the data feed, but no one notices until the end of the month.

Nothing actually “breaks” or “stalls”. But the systems just drift apart bit by bit, and the accounting team ends up dealing with the mess that forms in the gap.

Some of the common signs of fragmentation that appear across the portfolios include:

- A batch that settles in the bank but reaches the ledger in pieces

- A PMS adjustment that posts correctly but fails to appear downstream

- An invoice that appears in accounting before the document lands where it belongs

Though each moment seems harmless on its own, together they create a constant undertone of supervision because numbers that should align naturally require frequent inspection.

Suggested Reading: When the GL Becomes a Bottleneck: Why Property Accounting Breaks Under Scale

Why the trouble persists and slows growth

Once these mismatches are incorporated into accounting, they create a slow drag on the entire process.

Reviews take longer because the team now has to double-check items that used to reconcile on their own. Even simple reports demand extra context, since numbers pulled from different systems no longer align.

The team does adapt at first. A controller keeps a mental list of properties that need closer attention. And the staff accountant adds a few extra steps to their month-end checklist “just to be safe.”

All these individual fixes work for a while, but consequently, they also hide how much time is being spent correcting what the systems should align automatically.

Over time, these small gaps turn into a predictable burden, and the accounting team is not just closing books – they’re compensating for disconnected systems every single day.

As the portfolio grows, the manual effort amplifies to the point of failure.

This is the point at which operators begin to feel a new constraint: the business is ready to scale, but the accounting backbone is not.

If the systems disagree now, what happens when the portfolio doubles? The natural response is predictable: operators look to fix this by replacing the old tool with a new one.

But Replacing One Tool with Another Rarely Clears the Tangle

Most operators respond to fragmentation by replacing a single tool. A PMS feels outdated, so a new one steps in. A bank creates repeated confusion, so the account migrates elsewhere. An accounting platform feels restrictive, so it gets swapped for another. Each decision feels justified because the frustration seems to originate from that tool.

Yet the relief proves temporary.

The upgraded PMS behaves well for a short period, though deposits still require manual pairing.

The new bank improves visibility, though merchant settlements continue to reach the ledger out of step with folio totals.

Even the latest accounting software cannot interpret mismatched inputs created upstream. Here are so many ways these choices unfold:

- A hotel adopts a modern PMS, only for the month-end to reveal familiar reconciliation puzzles.

- A property changes banks, then discovers the new settlement pattern complicates matching tasks.

- A portfolio upgrades accounting software, yet the team still spends afternoons verifying upstream data.

This loop continues because fragmentation forms between tools, not inside one of them. Data changes subtly from system to system, and accuracy depends on people watching every handoff.

Replacing one piece cannot settle the differences created by the others. It only shifts the location of the tension.

In summary, a portfolio cannot overcome fragmentation through isolated upgrades. It requires an environment that interprets financial information consistently across every property, every bank, and every operational workflow. Today’s AI-powered accounting tools, like Docyt, create that environment.

Docyt AI – A Unified System for Property Management Accounting

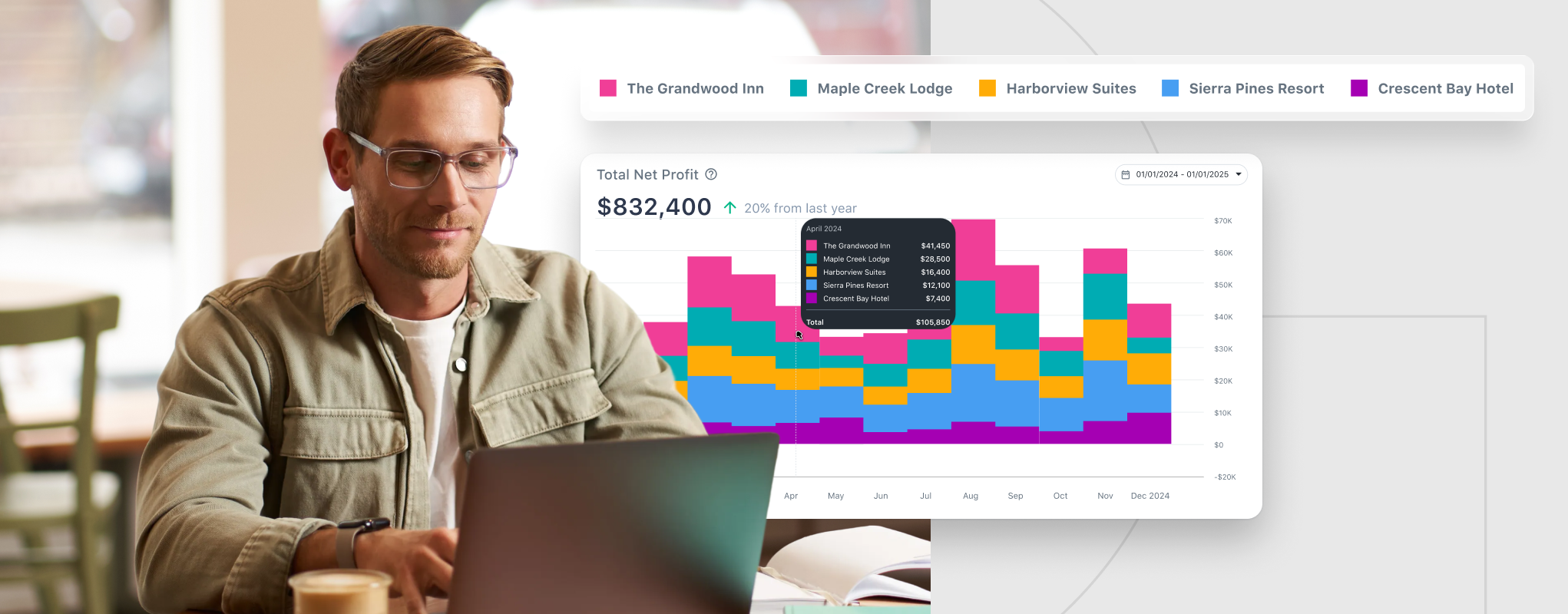

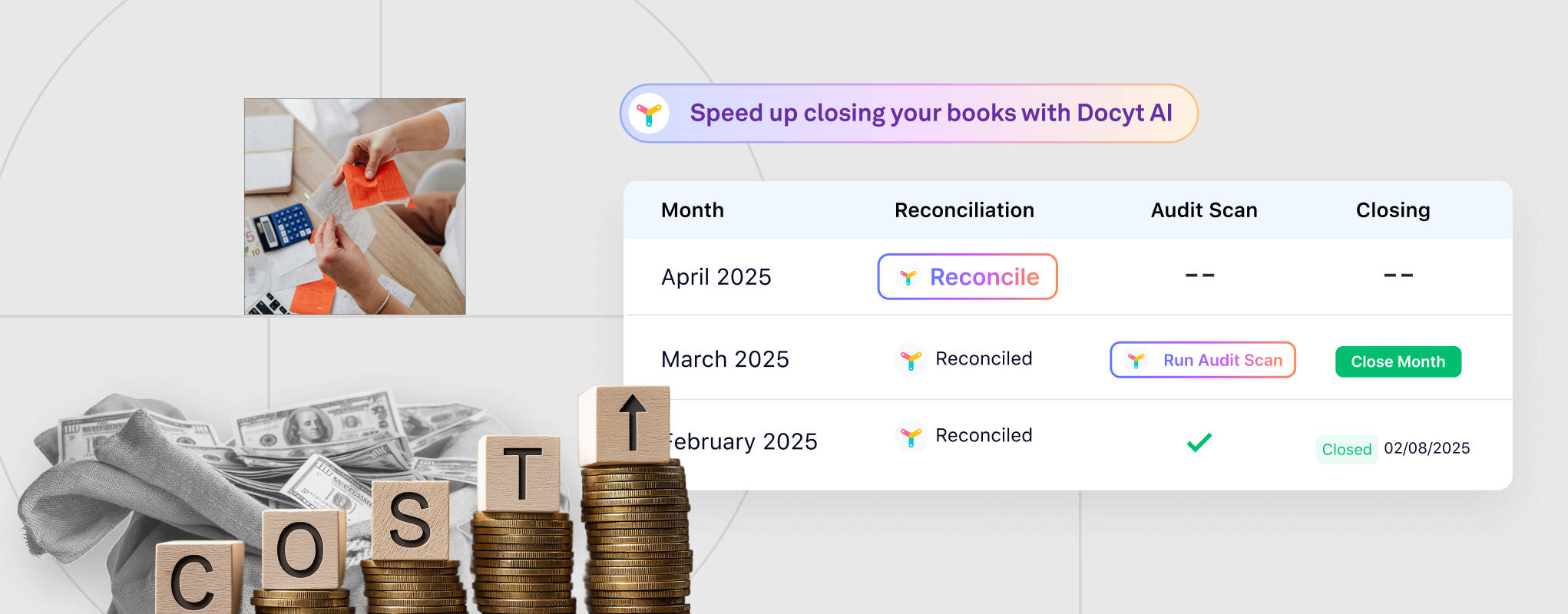

Docyt AI brings PMS data, bank feeds, invoices, merchant settlements, and ledger entries into a single structure where information maintains consistent meaning from the moment it enters the system. Instead of relying on your team to resolve disagreements, Docyt handles the interpretation before those mismatches slow the work.

Its value shows in how it manages movement across the accounting chain:

- Automated reconciliation pairs deposits with folio detail, even when timing varies across properties.

- AI-powered matching ties invoices and receipts together without forcing month-end clean-up.

- Real-time ledger updates provide clarity that operators can trust without having to repeatedly check.

This structure proves especially helpful when the portfolio expands. New hotels, new banks, and shifts in PMS behavior settles into the system without adding pressure to the accounting team.

Features that once seemed out of reach become part of routine operations because Docyt automates mechanical tasks that would otherwise consume hours.

Docyt also strengthens the long-term foundation by preparing the accounting workflow for growth rather than reacting to it afterward.

If mismatched systems continue draining time from your team, this may be the right moment to consider a different approach.

Docyt helps operators resolve system disagreements so they can focus on decisions that move their hotels forward. Schedule a Docyt demo to see how that alignment works in real life.