Chargebacks are one of those persistent problems the hotel industry can’t shake off. From guest disputes, OTA errors, fraudulent transactions, mismatched folios, to delayed payments, they can arrive from any direction. The causes may vary, but the outcome is always the same: money leaves the business.

However, revenue loss isn’t the only burden associated with chargebacks.

Fighting bogus chargebacks with the proper evidence within the deadlines can be a full-time job for the hotel staff.

- From managing disputes to processing them, chargebacks cost tons of valuable time, making it a full-time job for the hotel staff.

- The high chargeback volumes raise transaction fees, leading to increased costs, and then there is damage to guest experience and hotel reputation.

In many ways, chargebacks are a silent siege that wears down revenue, operations, and reputation under the cover of routine operations, all in plain sight.

Current measures help- But they don’t solve the problem:

- Transparent billing may not prevent disputes when a guest claims charges were added by mistake.

- Clear policies and pre-arrival reminders still fall short when OTAs process refunds on their own timelines and push the burden back on the hotel, often before it can present its side.

- Fraud checks can block stolen cards, but they can’t stop a business traveller from disputing a charge weeks later under the pretext of “unauthorized use.”

In a hectic industry like hospitality, even well-trained staff can slip under pressure. A slight mismatch, such as a name, signature, or booking reference, can leave the hotel vulnerable to chargebacks.

Too often, the hotel, despite possessing the proof, fails to produce it promptly because the records are buried in email chains, spread across the PMS, POS, and OTA portals, or stored in paper files. And by the time the staff put together everything, the deadline to respond had already passed, and the case was lost.

This failure to contain the growing chargebacks is clearly reflected in the numbers, too:

- According to the Chargeback Outlook Report by MasterCard, the 238 million chargebacks recorded in 2023 are expected to rise to 337 million, which is a stupendous 42% increase.

- The travel and lodging industry, specifically, has seen an alarming spike, with chargeback rates climbing by 816%.

These numbers confirm that despite all the measures in place, both the volume and cost of chargebacks continue to grow.

A stack of isolated tools and processes is ineffective in managing chargeback issues. Solving the menace of chargebacks requires a comprehensive, streamlined system that can resolve chargebacks swiftly, accurately, and most importantly, on time, like Docyt does.

A Complete Solution for Chargebacks – A Unified & Automated Document Workflow

Hotels already have policies, billing processes, fraud checks, and payment verification in place. The problem has never been the absence of defences or measures in place; it’s that they exist in isolation. And Docyt connects them all.

Integration at the source: All disparate data from PMS, POS, OTA feeds, payment processors, and bank records are pulled into a single system in real-time. So, when a guest books through an OTA, pays by card, dines at the hotel restaurant, and checks out with a folio, all this information is captured in one unified record.

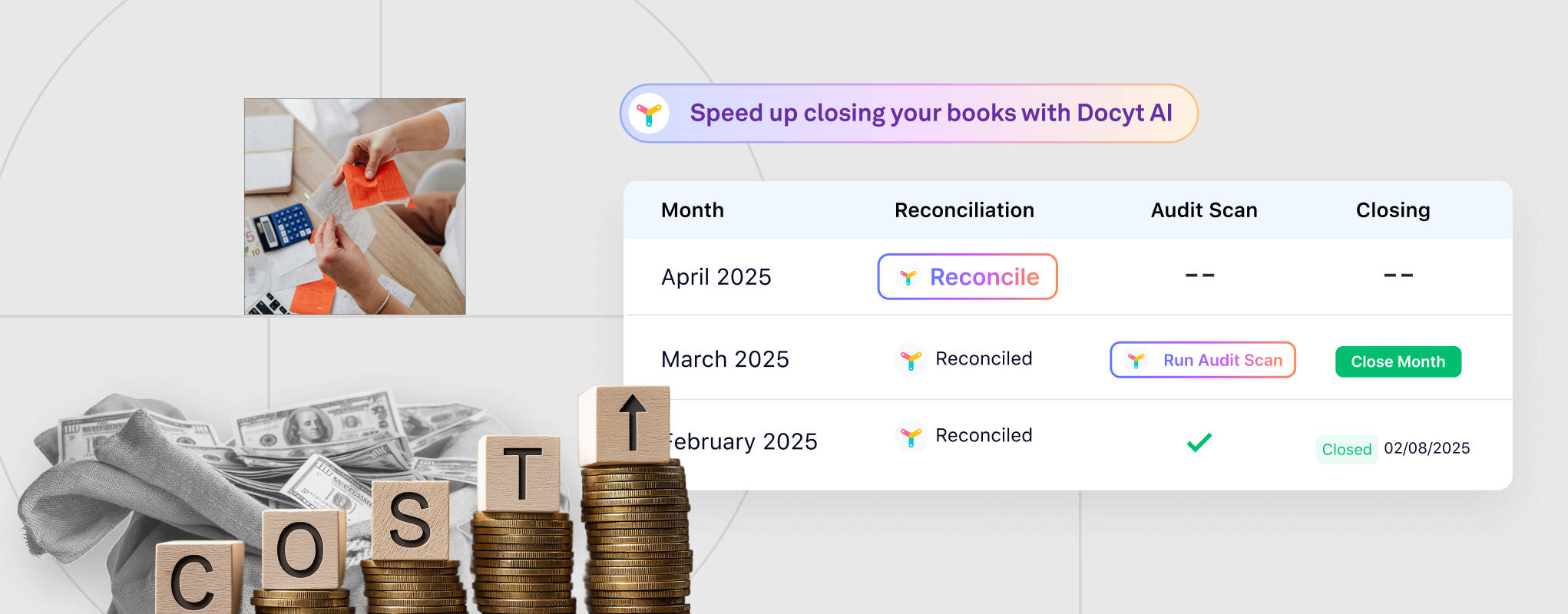

Automatic Reconciliation: Every transaction is continuously matched against deposits, folios, and receipts, with discrepancies flagged promptly. Any OTA settlement errors, missing deposits, or mismatched folio entries are identified right away to help staff resolve them before they escalate into chargebacks.

Evidence linked to transactions: Policies, billing records, fraud checks, and payment authorizations are directly attached to each booking for a complete audit trail.

So, every time an “unauthorized” transaction surfaces, Docyt instantly produces a signed folio, card authorization, and ID record linked to that exact booking – all in one file for evidence.

Dispute-ready documentation: All records are organized and instantly retrievable with Docyt. Hotel staff can pull a complete case file in minutes using folio, receipt, OTA confirmation, and payment slips for swift and accurate resolutions.

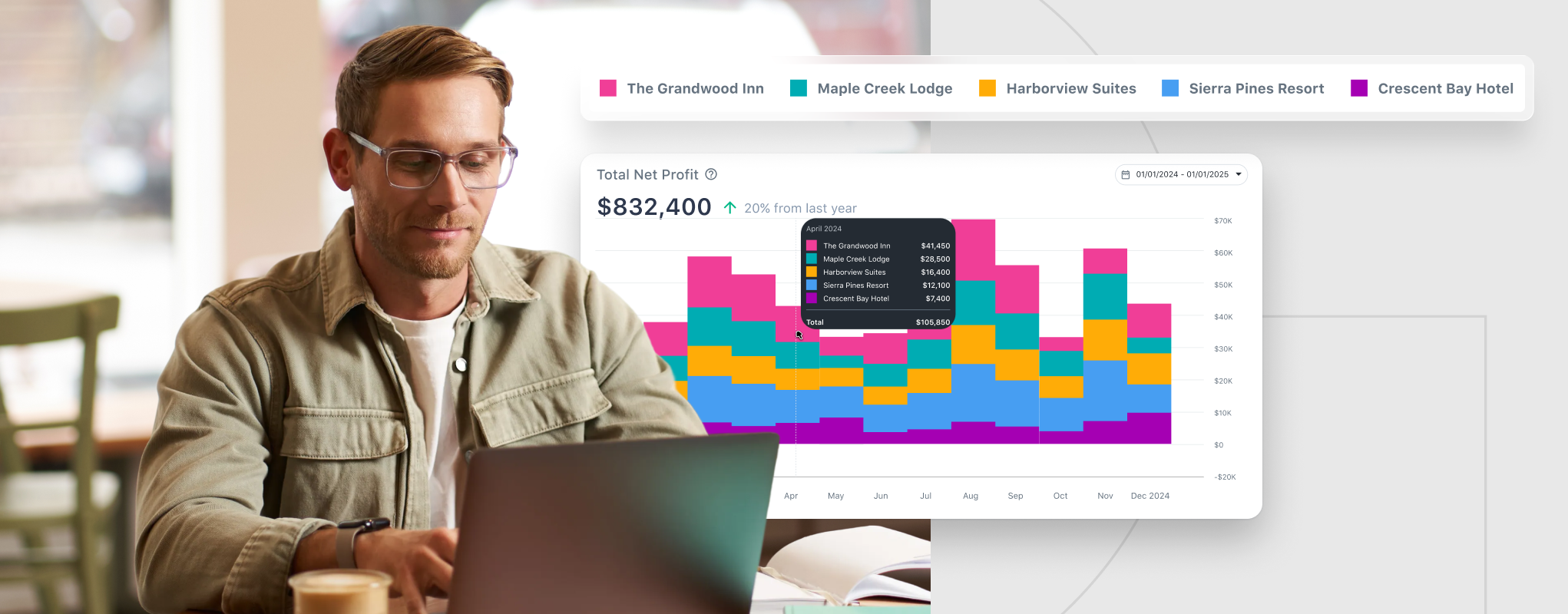

Consistency across properties: For multi-entity operations, Docyt ensures the same process and reliability portfolio-wide regardless of size. 1, 10, or 100 Docyt defends the disputed charge with the same accuracy and timeliness as at any location to prevent losses.

What makes Docyt a complete solution is its ability to close every gap that chargebacks exploit and create an automated document workflow that builds a comprehensive and well-documented evidence to prove the legitimacy of the charge.

It delivers a unified and automated document workflow without the need for major overhauls or expensive integrations. Docyt works with and on the systems you already use, turning disconnected processes into a seamless, dispute-ready document workflow that handles chargebacks with ease.

References:

https://www.paymentscardsandmobile.com/wp-content/uploads/2023/10/2023-Chargeback-Outlook-Report.pdf