Now that that whirlwind is over, it is time to take a deep breath and look ahead. The post-tax season always represents an excellent opportunity to step back and reconsider the organization’s strategy, preparing it for a more efficient and productive year ahead. This transition can be made significantly smoother using AI-driven tax tools.

Here’s how.

Reflecting on the Previous Tax Season

The first step toward future readiness is observing the recent past closely. Take an inventory – what did you think were the most pressing challenges your firm faced this past tax season? Was it a bottleneck in data processing, or did some unexpected problem arise with a client? It will be important to have this understanding as it will facilitate future improvements.

Spot the Bottlenecks

Identify the tasks that consumed most of your time and resources. Was it data entry, reconciliation, or managing client communication? Understanding these areas can help you figure out how AI can be most beneficial.

Look at Client Feedback

Ask clients for feedback about their experience–were they content with your responsiveness and accuracy of services? Their answers may help you improve client relations and service delivery.

Enhance Efficiency with AI for Tax Professionals

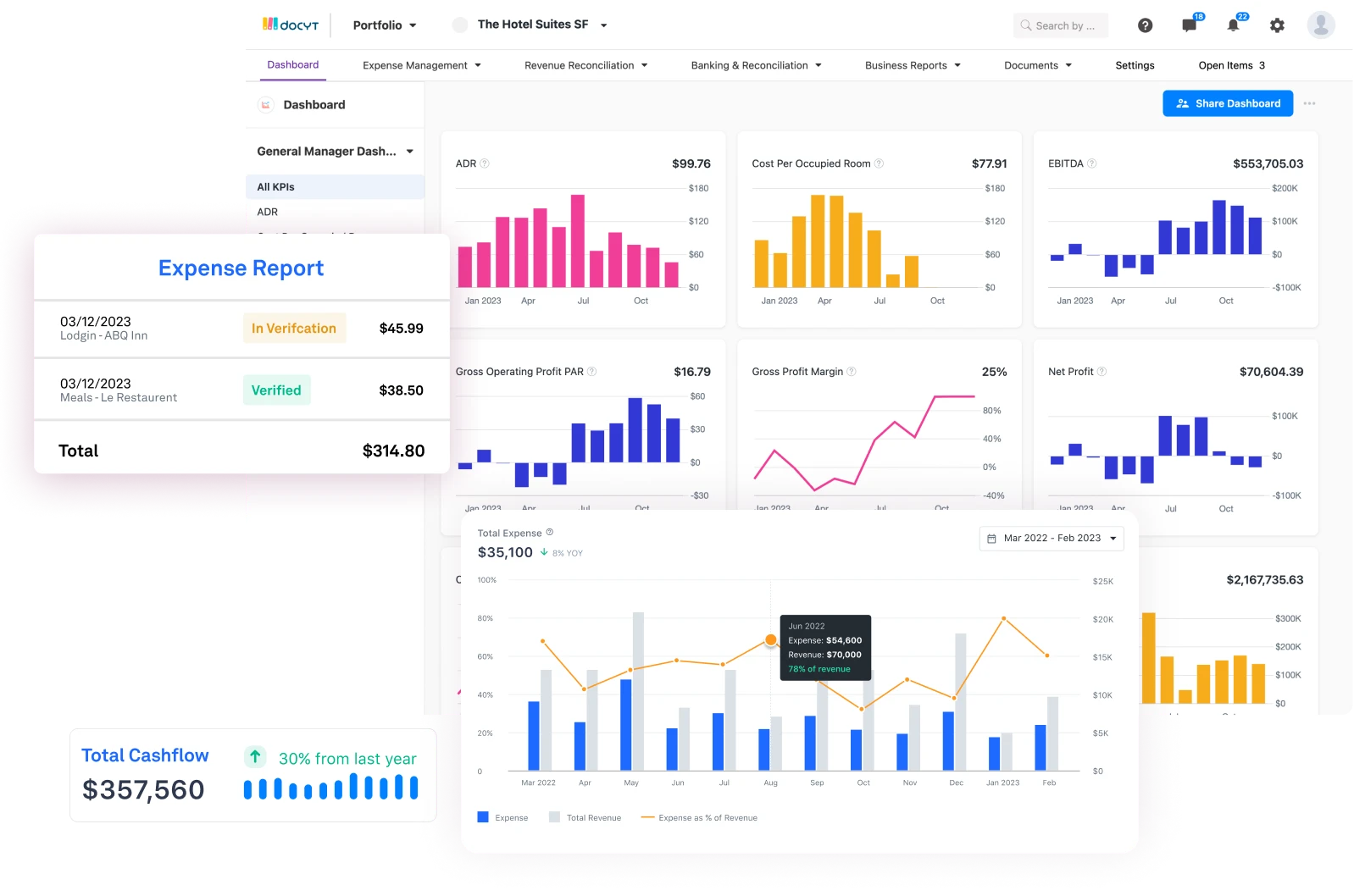

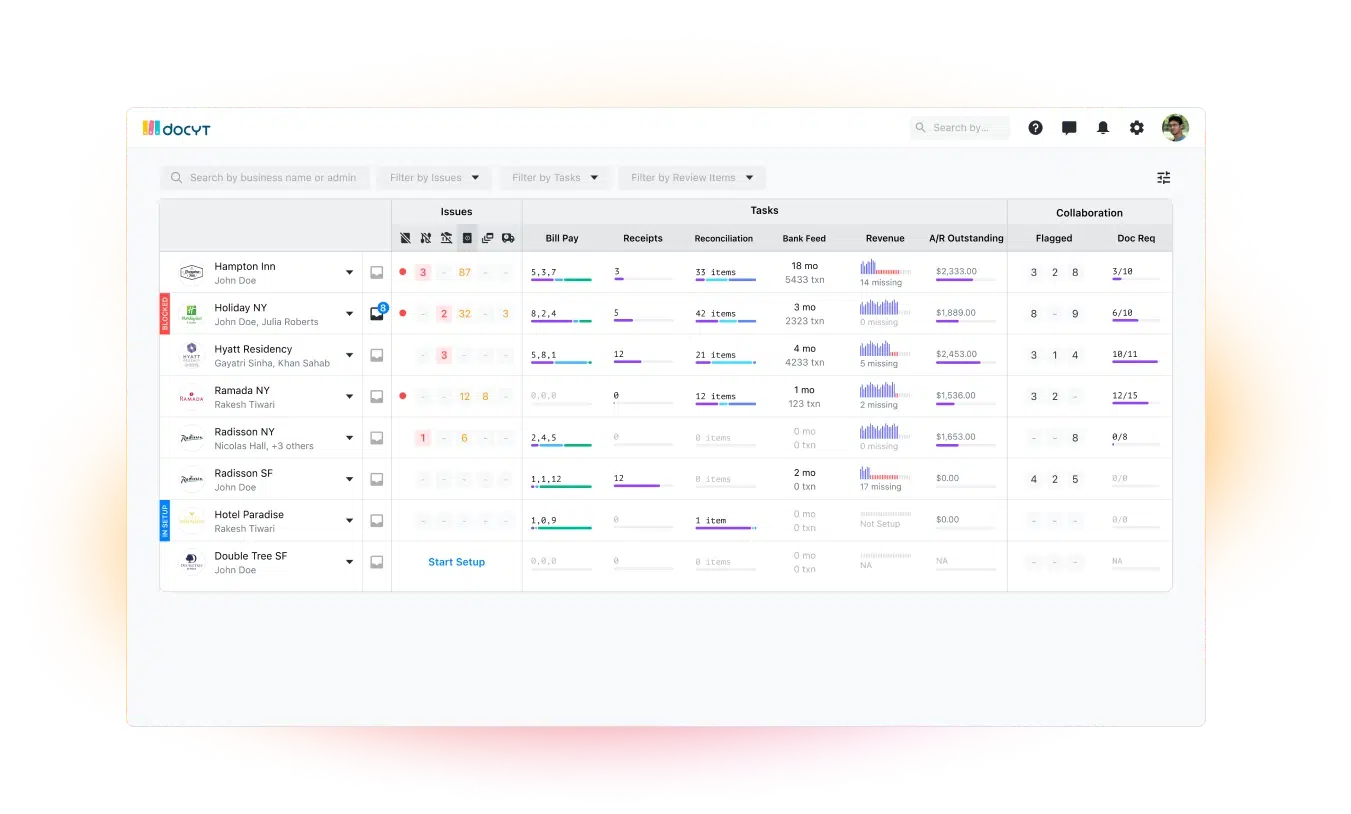

AI is changing the game for accountants with AI-powered bookkeeping platforms tailored to accounting firms like Docyt. These platforms standardize your accounting processes, increase efficiencies, and improve profitability. And for your clients, deliver real-time accounting.

Here are a few ways leveraging AI for taxes can help you get more done:

Automate Routine Tasks

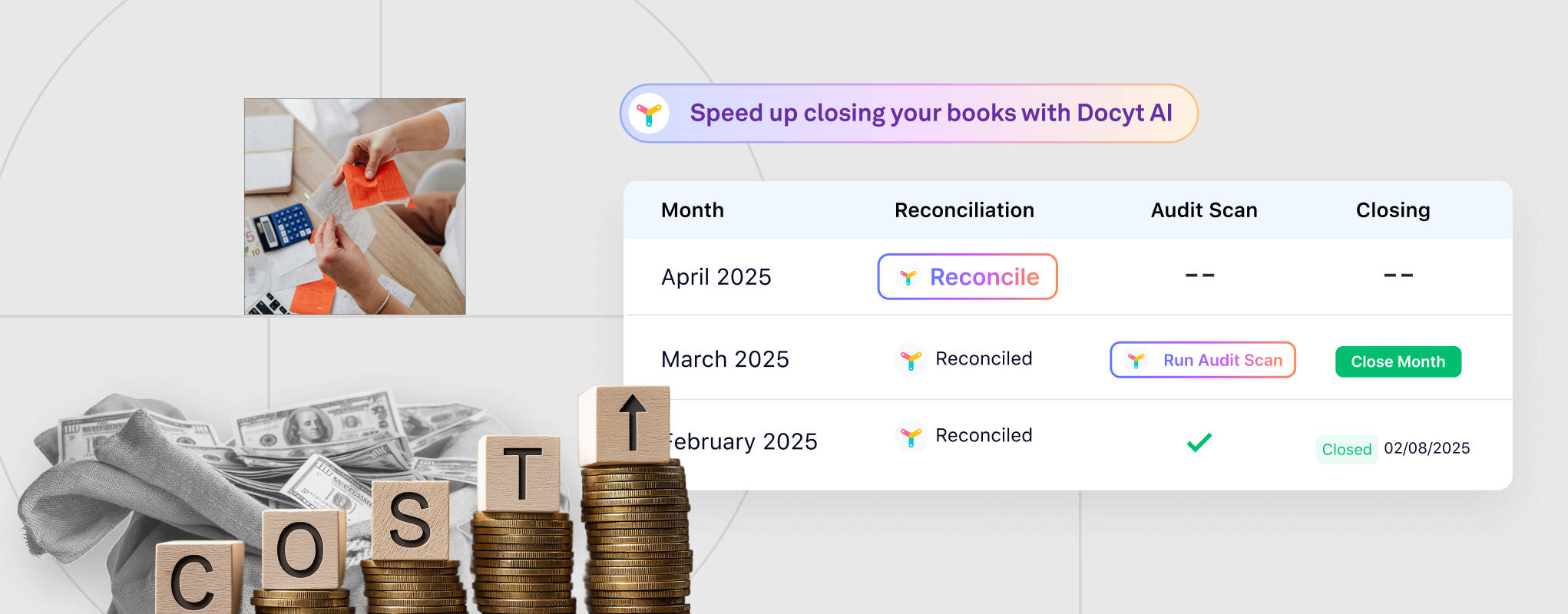

AI-powered bookkeeping automation tools will automate your entire bookkeeping workflow, including tasks like data entry, invoice processing, bill pay, continuous bank, and revenue reconciliations, as well as corporate card expense management and reimbursement. With AI-driven automation, you can count on an efficient workflow and accurate, real-time financials with a dramatic reduction in errors that would otherwise result in stressful and often expensive tax-time compliance issues.

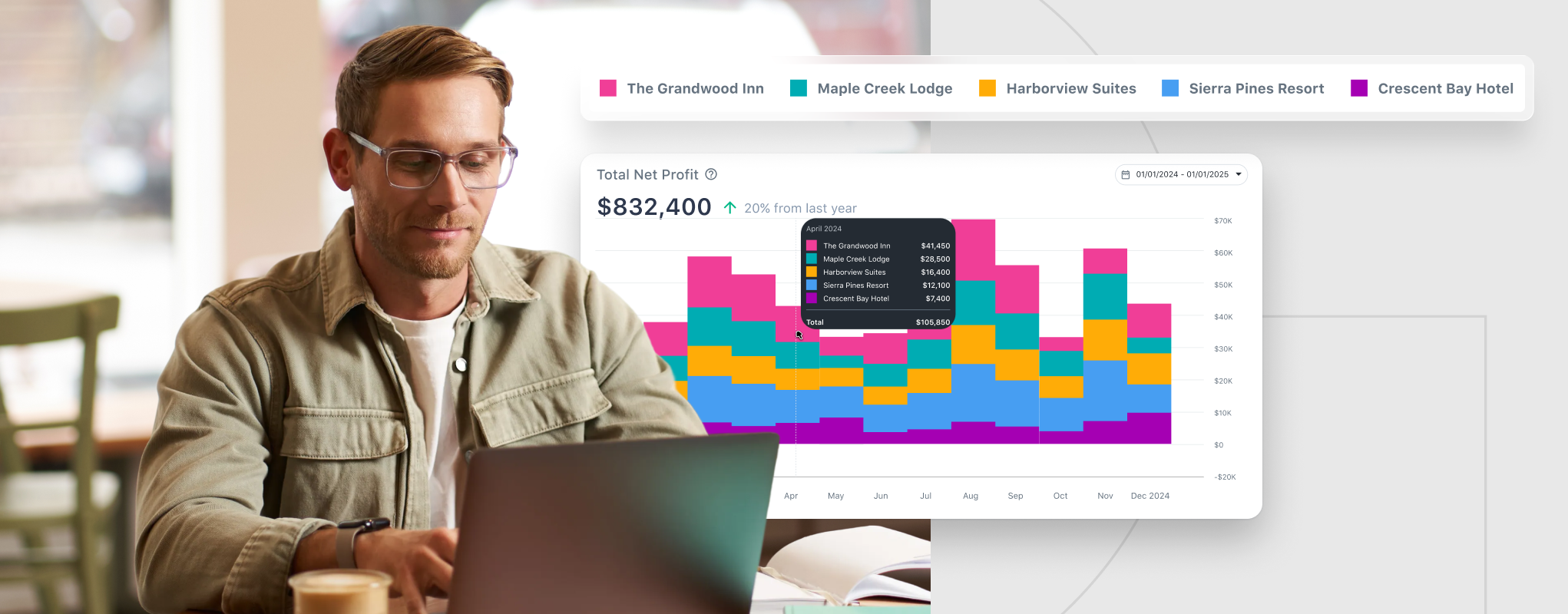

Real-time Financial Insights

Generate daily financial data and insights tailored to each client on a single dashboard. An all-in-one dashboard offers at-a-glance access to the latest financial and non-financial metrics, enabling sound decision-making and proactive client advisory services.

Data Security and Compliance

Security and compliance of data is an area that cannot be compromised in this digital age. AI-driven accounting platforms meet stringent data protection requirements with built-in security features like encrypted data storage, secure document management, 2-factor authentication, and facial or fingerprint recognition sign-in. These security standards ensure the confidentiality and protection of client’s data are in place with every exchange, easing the anxieties of compliance missteps within your workflow.

Top-notch Client Management

With AI-powered accounting automation tools, client management for accounting firms is easy. AI-enhanced automation tools enable accounting software to provide features like secure inbox and data vault, employee roles and permissions with workflow assignment, chatbots for accessible communication regarding transactions and shared documents, and real-time dashboards providing clients with detailed income reports, balance sheets, and management reports. AI features like these ease the time spent going back and forth with clients and make tax time a smoother experience for all parties involved.

Does it get any easier than that? It sure does…

Better client relations

Strong relationship building and its continued maintenance is the soul of a successful accounting practice. AI can help tremendously in enhancing client satisfaction through better communication and service delivery.

Proactive client advisory

Use AI-driven data insights to advise your clients proactively. You will realize significant value for your client relationships when you get ahead of issues with proactive advice.

Efficient communication

Automate routine client communication, including reminders, updates, and follow-ups, to ensure timely and consistent interaction with your clients and improve their experience.

Planning for Continuous Improvement

The post-tax season is a perfect time to plan for continuous improvement. You need to set clear goals and strategies that leverage AI features to improve your firm’s operation.

Continuous learning: Update your team with the latest AI technologies and best practices in accounting. This ensures that your firm is always at the forefront of the industry.

Adapt and Evolve: The accounting landscape is ever-changing. Show readiness to adapt to new technologies and methodologies to be the best-in-class accounting firm.

In fact, the post-tax season reset is an excellent time for critical reflection, reevaluation, and gearing up for the next more productive and successful year. Adopting AI tax tools for professionals guarantees that any accounting firm or CPA will increase productivity, efficiency, accuracy, and customer satisfaction, taking them to new heights and ensuring a smoother sail in the tax season ahead.