Most people in the United States will agree that 2020 went from bad to worse. While every year brings its own challenges for business owners, last year was complete bedlam. From mandated temporary closures to political and social unrest, businesses were at the mercy of forces beyond their control. In legal language, it’s called force majeure or an act of God.

In the middle of this storm, all businesses needed help – especially small and medium businesses.

During this national crisis, the U.S. government did get something right. The Treasury acted quickly. By March 27th, the CARES Act was unveiled. This $2.2 trillion dollar stimulus package included $500 billion dollars earmarked for the Paycheck Protection Program (PPP). The government’s intention was to provide local businesses with a lifeline in the form of low-interest, forgivable loans so they could pay their employees and cover their rent or mortgage. What a relief!

Here’s the tricky part – how to get through the loan process successfully.

First, a business owner had to find a bank that was actually participating in the PPP program. Then, they needed to have up-to-date books and GAAP-level financial statements to present to the lender. Once their paperwork was in order and submitted, only then could their business be considered for a loan. To make it even more hair raising, they had to act quickly. The program was announced on March 27, launched on April 3, and by April 16, the first round of funding, $349 billion dollars, was gone.

Unfortunately, but not surprisingly, tens of thousands of businesses who were eligible for PPP loans didn’t receive any money. While large companies received the lion’s share of the PPP loans. What happened?

Large companies were prepared and participated. They employ finance and accounting professionals who actively maintain their books, understand accounting standards, and can quickly generate financial statements that meet bank and government reporting requirements.

Whereas many small businesses were ill equipped and couldn’t meet the tight deadlines. Their books and financial statements were not current. Second, they didn’t understand the loan terms or how to complete the application. So they self-selected out and didn’t even apply for a program created specifically for them.

Docyt’s customers had a different outcome. Every business who wanted a PPP loan filed immediately and was approved.

That’s the crux of Docyt’s value proposition – giving businesses control of their financial data so they can act quickly. That’s a tall order. How is Docyt able to do that?

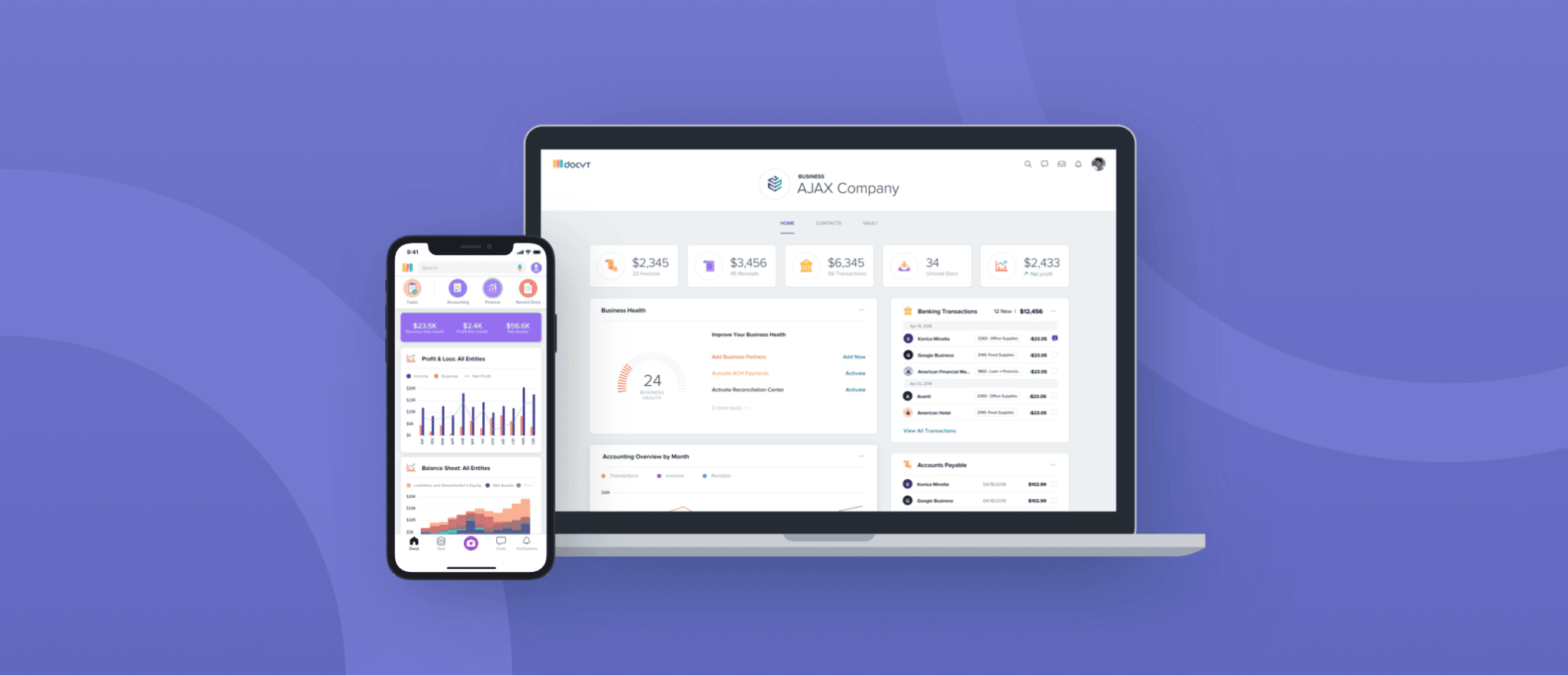

Docyt is a single system, which uses machine learning, to automate all financial workflows – both income and expense side – and provides real-time ledger reconciliation and financial statements. Since Docyt’s automation is end-to-end and the ledger is continuously reconciled, for the first time, real-time financials are possible.

In other words, with Docyt, business owners have a profit and loss statement (P&L) and a balance sheet that are continuously updated and current for each business. That means they always know where each business stands and can act quickly when there are critical events affecting, or even threatening, their operations.

Docyt software has depth and breadth, and to our knowledge, is the only software in the market with these capabilities. Because it’s new and complex, I will be writing articles over the next few months to explain each feature and capability within Docyt.

I hope you find these articles helpful. And, the best way to understand our product is to see it. Feel free to reach out and schedule a demo.