You know that feeling when you’re 99% sure you locked the front door, but there’s still that tiny voice asking “but what if I didn’t?” That’s basically how AI thinks about every accounting decision it makes—and thankfully, it’s honest about it.

The “How Sure Are You?” Question

Every time your AI suggests something like “Hey, that $47 Starbucks charge should probably go under Office Expenses,” it’s also quietly whispering a number: “I’m about 85% confident in this one.”

Think of it like asking a colleague for their opinion. Alice might say “I’m pretty sure this goes to Travel,” while Jason might say “I’m absolutely certain this is Meals & Entertainment.” The confidence score is just the AI’s way of telling you whether it’s feeling like Alice or Jason about each transaction.

Here’s how most accounting firms handle different confidence levels:

> 95%: “Yeah, go ahead and post that—the AI’s practically certain.

70-94%: “Hmm, let me take a quick look before we commit.”

<70%: “Okay, I definitely need to think about this one.”

The Magic Behind the Numbers

Ever wonder how the AI decides how confident to be? It’s actually pretty clever:

First, the AI looks at all the clues—the vendor name, the amount, maybe even the email that came with the receipt. Then it thinks back to all the similar transactions it’s seen before. If it’s categorized 500 Uber charges as “Travel” and only gotten it wrong twice, it’s going to be pretty confident about that next Uber charge.

But here’s the cool part: the system keeps learning. Every time you correct it (like when you move that client lunch from “Meals” to “Business Development”), it remembers. Next time, it might be a little more cautious about similar transactions..

Where This Actually Helps Your Day

Let’s get real about where confidence scores make your life easier:

Monday morning transaction review: Instead of checking every single transaction, you can breeze through the high-confidence ones and focus your brain power on the questionable stuff.

Bank reconciliation: When the AI says it’s 97% sure that deposit matches Invoice #4847, you can probably trust it. When it’s only 65% sure, you’ll want to double-check.

Spotting weird stuff: If the AI flags unusual spending but admits it’s only 60% confident, you know to dig deeper rather than immediately calling your client in a panic.

Building Trust (Without Going Crazy)

The beauty of confidence scores is that they let you automate without losing sleep. You’re not blindly trusting a robot—you’re working with a really diligent assistant who’s honest about what they know and what they’re guessing at.

Your auditors love this too. Instead of asking “How do you know your AI didn’t mess up?” you can show them exactly where you set your confidence thresholds and prove that nothing slipped through without proper review.

Finding Your Sweet Spot

Not every firm needs the same confidence threshold. If you’re a solo practitioner handling 50 transactions a month, you might be comfortable reviewing anything under 85%. But if you’re processing thousands of transactions, you might need to push that threshold up to 95% just to stay sane.

The key is starting conservative and gradually getting more comfortable as you see how the AI performs with your specific clients and transaction types.

Making It Work in Real Life

Here’s what actually matters when you’re rolling this out:

Make sure you can see the scores—if they’re buried in some sub-menu, nobody’s going to use them.

Keep track of your overrides—when you change the AI’s suggestion, make sure the system remembers why.

Start small—pick one client or one type of transaction to test with before you automate everything.

Check in regularly—every few months, spot-check some of those “auto-posted” transactions to make sure the AI is still as accurate as it claims to be.

How Docyt Makes This Actually Work

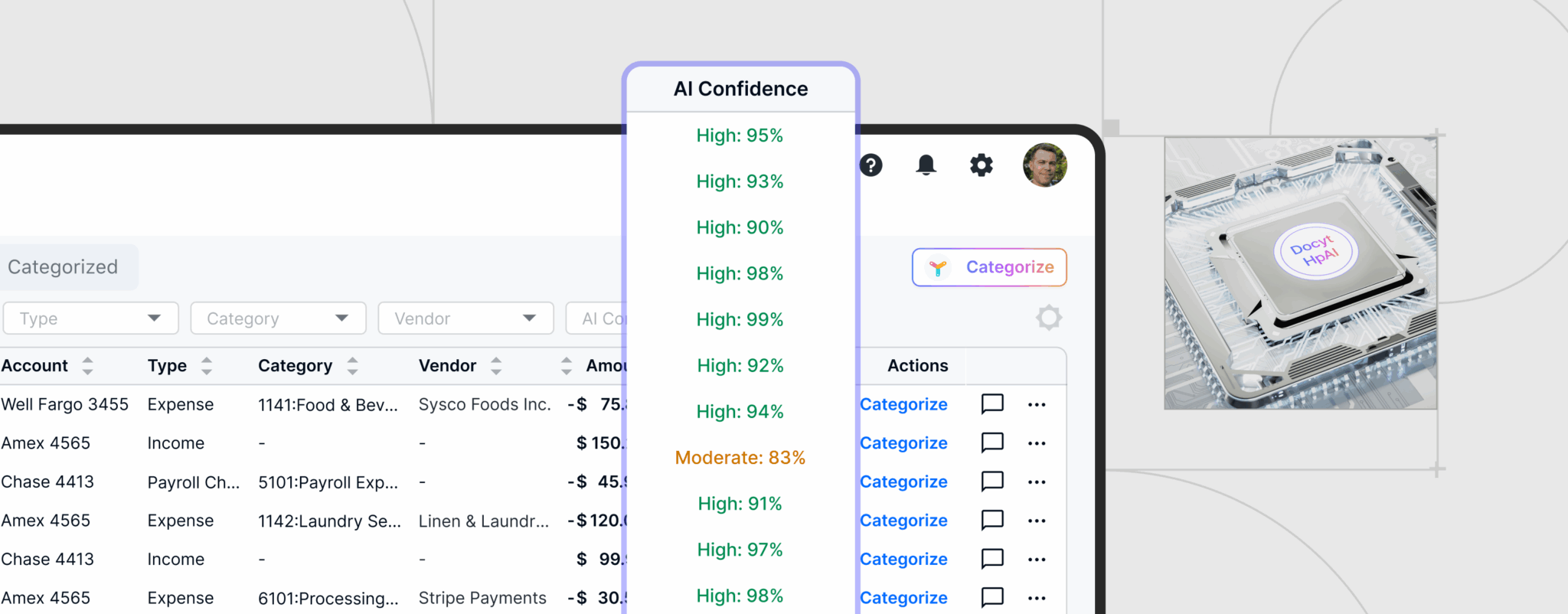

Here’s where Docyt’s approach gets interesting. Their HpAI engine doesn’t just slap a confidence score on transactions and call it a day. Every categorization, every reconciliation match, every anomaly alert comes with that honest “here’s how sure I am” number – the Docyt AI confidence scores.

By default, anything under 90% confidence gets routed to your “Accountant Review” queue. But here’s the thing—you’re not stuck with that threshold. Running a high-volume practice where 90% isn’t confident enough? Bump it up to 95%. Solo practitioner who’s comfortable with 85%? Go for it.

The really smart part is what happens overnight. Every time you correct something in that review queue, Docyt’s AI learns from it. So that confidence score isn’t just a one-time guess—it’s getting more accurate for your specific clients and your coding style every single day.

The Bottom Line

AI confidence scores are basically your AI being transparent about its own limitations. It’s saying “I’m really sure about this one” or “I’m taking my best guess here, but you should probably double-check.”

This honesty is what makes AI actually useful in accounting—instead of worrying about what the black box is doing, you get to decide exactly how much you want to trust it. You keep your professional judgment in the driver’s seat while still getting the time savings you’re after.

And the best part? As the AI gets better at your specific work, those confidence scores get more accurate too. What starts as “I think this is probably right” becomes “I’m very confident this is correct” as the system learns your clients, your coding preferences, and your business patterns.

Ready to see this in action? Docyt Accountant Copilot lets you start small—try it with one client or one type of transaction and watch that low-confidence queue shrink as the AI learns your preferences. You’ll get the efficiency gains you want while staying firmly in control of every decision that matters.