Hotel portfolios often hold more idle cash than they can see at first glance. A property typically leaves $25K – $50K untouched in accounts that bring almost no return. In a group of ten hotels, that’s a quarter of a million dollars sitting idle!

Even worse, larger portfolios see the number steeply climb over time – all while remaining invisible in performance dashboards.

Firms such as Trovata have already pointed to visibility gaps as one of the most significant risks to capital efficiency. But hospitality has yet to catch up.

The Hidden Costs of Manual Transfers in the Hospitality Industry:

While other industries are quickly moving towards treasury automation, the hospitality industry often relies on traditional spreadsheets and email chains to transfer funds between properties.

These outdated methods result in delays in fund movement and create a range of problems across finance and operations.

Each transfer may look routine, but it quietly introduces costs, risks, and confusion that shape both financial reporting and day-to-day decisions. Here’s how:

Cash Loss: Idle balances that accumulate in low-interest accounts fail to contribute to the portfolio in any way. Money left idle is money lost.

Time drain: Accountants invest hours fixing mismatched due-to and due-from entries.

Distorted signals: General Managers are left to act on dashboards that misrepresent real cash positions.

Payment risk: Payroll or vendor obligations can (and will) fall behind when transfers stall.

For example, a city hotel may sit on a $60K surplus while its resort property awaits $30K to cover payroll. The resort naturally struggles with reduced staff morale and a weakened guest experience, while the city hotel does not contribute to the portfolio’s performance.

As an operator, one ends up carrying both costs at once: reputational damage on one side and wasted capital on the other. But that is not the

Balance Sheet Disorder Waiting to Happen

Every transfer becomes an accounting record, and each record must be precise. If even one side is missing or coded incorrectly, the imbalance carries forward into the books. Small slips compound quickly when spread across multiple properties, and the results are visible during a close inspection.

- Consolidations are often the primary victim when intercompany transactions don’t get eliminated accurately.

- Audit cycles are extended if reviewers question the overstatement of revenues or missing entries.

- Reports lack their purpose and relevance if reporting cannot be trusted in detail.

An adjustment that initially seems like a minor fix for one property can eventually reveal itself as a structural weakness in the entire portfolio.

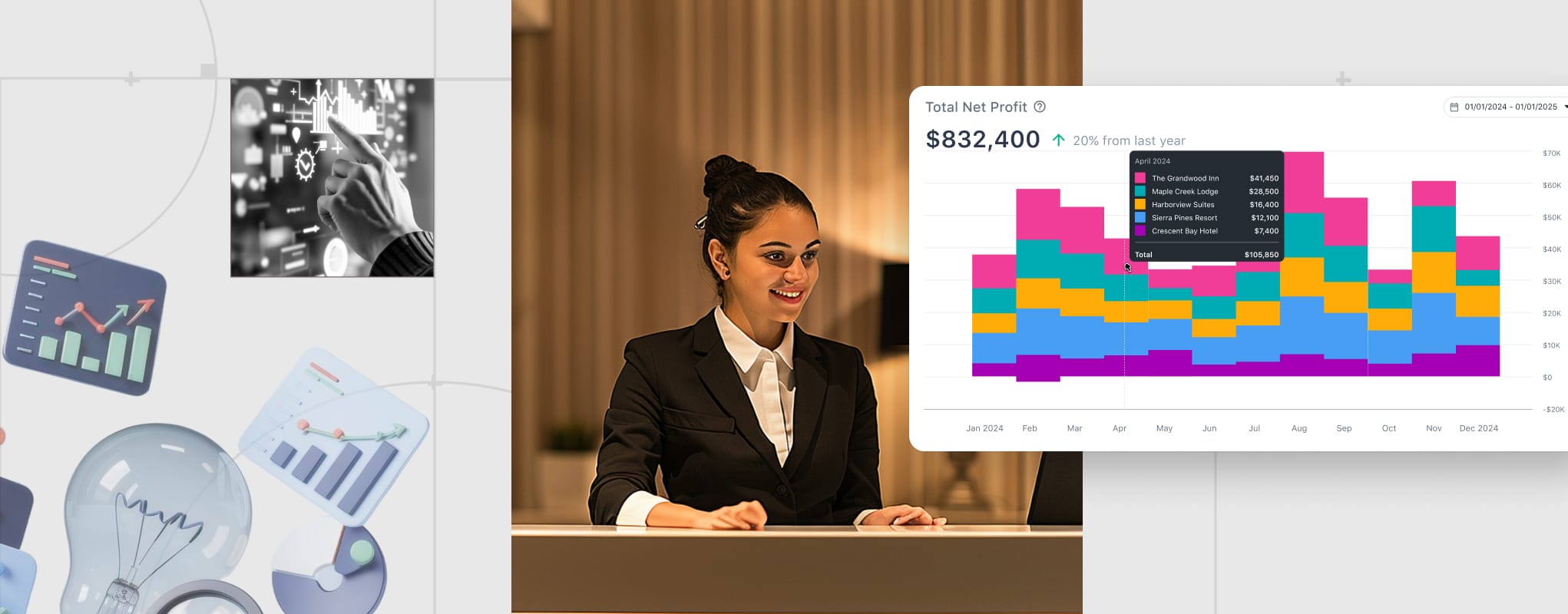

Profit AI: A Smarter Treasury Workflow Automation

Solving these issues requires more than stricter processes. It calls for a system that automates transfers and entries so the errors never occur in the first place. Profit AI, built on Docyt’s automation, manages cash across properties, records movements instantly, and keeps ledgers aligned.

Cash & Treasury Management

- Arranges scheduled sweeps that move idle balances into optimized accounts.

- Delivers real-time visibility across all properties and accounts without waiting for reconciliation.

Intercompany Accounting:

- Automatically books every due-to and due-from entry with accuracy.

- Splits shared expenses, such as insurance or marketing, fairly across hotels.

Profit Maximization:

- Reduces idle balances so more capital contributes to returns.

- Keeps records consistent, allowing finance teams to shorten the close cycle.

What It Looks Like in Practice

Once transfers, entries, and reconciliations are automated, the difference within a hotel portfolio is immediate.

Sweeps flow as scheduled, entries are posted in the correct ledgers, and balance sheets remain aligned. As a result, finance teams notice fewer disruptions and can start trusting their dashboards again, while executives receive consolidated results that can be reviewed without hesitation.

In short, what used to consume entire days of staff time becomes a routine process that requires little attention, freeing your people to focus on analysis instead of repair.

The impact of these shifts is easy to envision, but it becomes even clearer when you see it in action. Here are two short demos that show how it works:

Cash Transfer Demo:

Automated sweeps flow directly into optimized accounts.

(Video)

Intercompany Demo:

Journal entries are posted instantly and stay in balance.

(Video)

Clean Balance Sheets, Stronger Margins – Begins with Docyt’s Profit AI

When the treasury runs efficiently, the results are hard to miss. Balance sheets stay reliable, audits move faster, and lenders gain confidence in your numbers. Cash that once sat idle begins to work again, lifting portfolio margins instead of draining value. Finance teams, freed from reconciliation tasks, can finally focus on planning and strategy.

Manual treasury work might look small in pieces, but together those pieces cost real money and create unnecessary stress. Profit AI turns that burden into accuracy and clarity, making treasury a driver of growth instead of a drag on it.

Want to stop losing money to manual treasury ops?

Book a demo today to see how Profit AI simplifies fund transfers, reconciliations, and reporting.