Benjamin Franklin once uttered the famous words, “Nothing is certain except death and taxes.” Over 200 years later, this sentiment still rings true. Tax accountants are the interpreters of the tax code, ensuring tax returns are filed correctly while adhering to local, state, and federal laws and regulations. January to April is the busiest time of the year for tax accountants as they work early morning and late nights preparing tax returns. Although individual tax filings can often vary in complexity, filing taxes for small businesses is an inherently unique challenge.

Small businesses may lack the resources necessary to employ a team of qualified accountants and bookkeeping professionals. As a result, business owners end up managing the documentation and paperwork. At year end, their tax accountant often has to pivot to the role of financial detective – searching for needles in a bookkeeping haystack. In order to do the taxes, they have to hunt for paper receipts, bank statements, and missing invoices.

Additionally, handling the nuances of journal entries can be troublesome for small businesses. They’re often so busy focusing on other aspects of the business – they end up forgetting to record income and expenses in their ledgers. While some small businesses utilize accounting software, others resort to using a single massive log, manually performing entries one by one. As you can imagine, this can result in errors and miscalculations when tax season arrives.

What if there was an easier way to manage journal entries and matching transactions to supporting documents?

Why Journal Entries Are Important

If you’ve never taken an introductory course in accounting, here’s a quick lesson. Journal entries are used to record the financial activity of a business. They’re the first step in the accounting process. The old school style of accounting uses double-entry bookkeeping, which means every recorded transaction affects two accounts – a debit and a credit.

Let’s say you’re a restaurant owner who just purchased a new oven for $5,000 dollars cash. To record this transaction, you would create a debit for inventory in the amount of $5,000 and a subsequent credit to cash for $5,000. Each and every transaction a business conducts must be recorded in a similar manner. Modern accounting software simplifies this process, however, businesses should have documentation to support each journal entry. Receipts, invoices, and other proofs of payment validate the costs, dates, and merchants associated with the transaction.

Recording journal entries and maintaining documentation to support each transaction can be a challenge for small businesses. Small businesses may lack the resources for creating journal entries and managing documents throughout the year. At tax time, their accountant may struggle to find supporting documents for every journal entry. Luckily, accounting automation software such as Docyt can make the process easier for tax accountants and business owners.

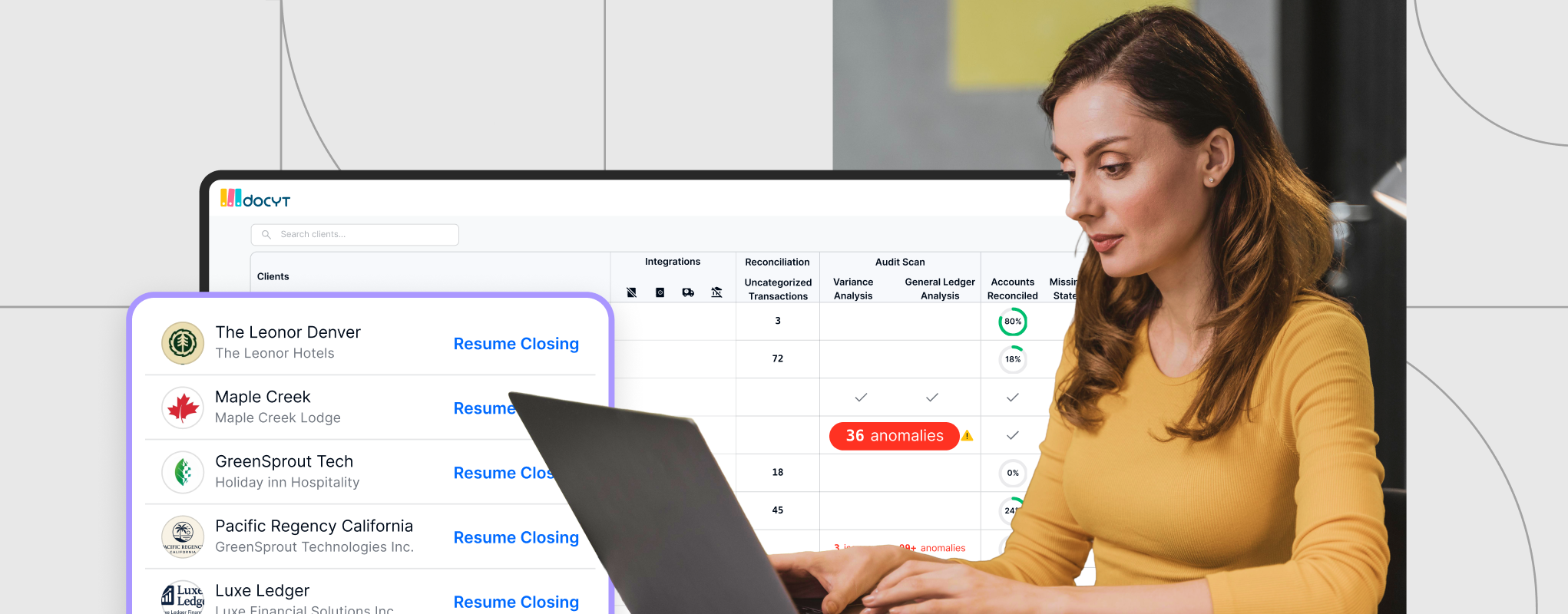

Docyt Automates Journal Entries and Document Matching

Our first article focused on automating document collection, our second focused on automating categorization. Finally, in the last part of our series, we’ll learn how Docyt can automate journal entries and document matching.

Docyt is an AI-powered accounting automation software that sits on top of accounting software ledgers, like Quickbooks®. Here’s how it works. Docyt is continuously pulling in data from your financial institutions and digesting the paper receipts and invoices you forward to it. It organizes all this data in Docyt for your review. Every time a transaction is categorized, whether by you or Docyt’s AI, Docyt syncs it to QuickBooks and creates the journal entry. When supporting documents are matched to the bank transaction, Docyt syncs the document to the transaction in QuickBooks. All journal entries and attached documents are automated by Docyt.

With Docyt, you no longer have to touch Quickbooks. Docyt continuously updates QuickBooks for you.

Docyt Simplifies Tax Season

Tax time can be stressful for small business owners, but Docyt’s accounting automation software can make the process easier. If your business is struggling to close its yearly books, Docyt can help.

With Docyt accounting automation, you’ll be able to complete your catch-up bookkeeping in 1-2 days rather than 1-2 weeks. Schedule a free consultation today.