Ask any seasoned franchise hotelier what still drives profitability in 2025, and the answer hasn’t changed: Occupancy and RevPAR. But knowing these metrics or tracking trends doesn’t guarantee results.

But data is abundant now – isn’t it?

Yes, today’s franchise hoteliers sit on a goldmine of information. From STR reports and OTA rate shops to CRS performance dashboards and accounting tools, there’s no shortage of data signals. One can view the compset’s pricing, understand the booking windows, and track trends as they occur in real-time.

And yet, most franchise hotel operators still fall short of consistently optimizing their Occupancy Rate and RevPAR – their ultimate goal.

Why aren’t data, tactics, and trends enough?

Because even data-rich reports can mislead you if they’re delayed or disconnected.

You notice high OTA cancellations, so you shift focus to brand.com. Only later do you realize the drops came from long-lead bookings. In truth, your last-minute OTA conversions were solid, and now you’ve shut them out.

Correct data, wrong context. And real demand is lost.

Or take a tactic like bundling breakfast to boost direct bookings. It sounds like a smart move until you remember that most of your weekday guests are corporate travellers, checking out before 7 a.m.

Now the bundle adds cost to the offering but not value. This is a good tactic that is trying to solve the wrong problem. Small franchise hoteliers are more prone to misguided tactics, sue to their limited set of tools and teams.

Trends can mislead, too. Say the brand-provided competitive set tools or general market reports identify a spike in weekend demand and raise your rates. But the lift was driven by a local event that didn’t include your hotel.

Or the trend might be true for the brand across a region, but not for their specific franchise hotel’s sub-market

You increase prices, and your usual bookings vanish. The trend was real, but it is not the one that benefits you.

So here’s the real issue: Data, tactics, and trends only work when they work together. Used in isolation, they don’t just fall short and even actively hurt performance.

The Missing Piece for Franchise Hoteliers – Strategy & Framework for Optimizing Occupancy & RevPAR

What’s actually needed for any franchise hotelier is a strategy that aligns trends, tactics, & data toward achieving one specific goal: RevPAR and Occupancy optimization.

So here’s how successful franchise hoteliers navigate the market:

1. Catch the trend early:

New patterns always show up quietly – fewer lead days, a shift to OTAs, and a spike in weekend searches. Noticing these trends early is your starting point.

2. Size up your position:

Not all trends work for everyone. Once you spot one, ask: how does my hotel stack up here? Look at your rates, your channels, and your pace. This is where strategy starts.

3. Build your plan to ride the trends:

Take what the trend is offering. Match it with what your hotel does best. Then turn that into an action plan with clear steps.

That’s it folks, that’s all you need to consistently optimize Occupancy and RevPAR in any hyper-competitive space. The strategy is simple, but execution, as always, is where most fall short.

If you’re a franchise hotelier who already knows the prevailing trends in 2025, accurately understands your relative market position, and has a clean playbook of tactics that sync with your goals – then we have nothing more to offer you.

But if not, this ultimate guide is built for you.

Today we provide you a cohesive framework for the strategy with a clear, sequenced approach that shows what to look at, in what order, and how each lever supports the others.

Not just a list of metrics, tactics, or plays, but a strategic framework built with the right foundation, in the right order. One that helps you see clearly, act deliberately, and use each insight the way it was meant to work in 2025.

This guide walks you through:

- A quick refresher on the four essential hotel performance metrics (so everyone is on same page)

- Why Occupancy and RevPAR together are your true north

- What trends are shaping performance in 2025

- How to benchmark your current position with clarity

- Simple, data-backed action plan you can take weekly to optimize OR + RevPAR

- How Docyt can implement everything above to perfection

So, let’s go.

A Quick Refresher: The Four Hospitality Metrics That Matter Most

Before we dive into strategy and step-by-step actions, let’s ensure we’re all working from the same playbook. Because in hospitality, performance isn’t about gut feel — it’s about how clearly you understand what the numbers are telling you.

Whether you’re running one property or ten, these four metrics are the common language of hotel performance. They give everyone — owners, GMs, asset managers — a shared, consistent way to assess where things stand. Without them, strategy becomes guesswork.

So, let’s get started with a quick refresher.

1. Occupancy Rate (OR) = Rooms Sold / Rooms Available

The occupancy rate is a fundamental metric that tells you how much of your available inventory is being utilized.

A low OR could indicate poor visibility or an incorrect rate. A High OR, though good, may also mean they might be under-pricing and are losing money on the table due to low pricing.

Therefore, to fully understand the OR, hotel operators also need to know the Average Daily Rate.

2. Average Daily Rate (ADR) = Room Revenue / Rooms Sold

While OR focuses on volume, ADR brings value into the mix by providing you with what you’re earning per room sold. However, it makes sense only when combined with OR. For example:

- Low ADR + High OR = You’re selling cheap and staying full; likely under-pricing.

- Low ADR + Low OR = You’re cheap and still not selling; something’s broken.

- High ADR + Low OR = You’re priced high, but bookings are low; likely overpriced.

- High ADR + High OR = Best-case scenario; strong pricing and strong demand.

In short, to see the whole picture, you need both OR and ADR working together. That’s where RevPAR comes in as a single metric.

3. Revenue per Available Room (RevPAR) = ADR × Occupancy Rate

RevPAR balances volume and value perfectly. In a single revenue metric, it tells you how efficiently you’re turning available rooms into revenue.

Although a key metric, RevPAR remains incomplete on its own. It can rise even when occupancy drops because of high prices. Without OR, one can’t tell if that revenue is driven by strong demand or inflated pricing. Which is why OR + RevPAR together tend to offer a sharper & complete picture w.r.t hotel revenue performance:

- Occupancy tracks demand and fill rate.

- RevPAR shows how well your pricing and demand are working together.

4. Gross Operating Profit per Available Room (GOPPAR) = GOP / Rooms Available

GOPPAR shows how much of that top-line revenue is turning into bottom-line profit. While the RevPAR task for revues GOPPAR also accounts for costs like staffing, utilities, operations, and more. That said, you can’t fix GOPPAR directly.

It’s the outcome of what you do with Occupancy and RevPAR. If you’re selling smart and pricing correctly, GOPPAR should ideally follow.

In short, Occupancy and RevPAR are where daily decisions happen. They are the levers that one can pull in real-time by riding on the right data, tactics, and trends. And that is why we start here.

Now that we’ve got the basics down and understand why Occupancy and RevPAR are the levers that matter most, the next question is: how do you improve them in a way that works in 2025?

3-Step Essential Guide to Optimizing Occupancy and RevPAR You Need in 2025

As discussed at the beginning of this article, hot trends, simple tactics, and raw data won’t work in isolation.

Running a hotel in 2025 is akin to navigating shifting waters. Conditions change fast, and the difference between drifting and moving forward lies in how well you read those changes and respond in time, not react.

That’s why you need a framework that holds up week after week. One that connects what’s happening outside your hotel with where you stand inside it, and then helps you act in the real world with clarity and confidence.

Here’s how our 3-step framework helps you do that:

Step 1: Helps you read the environment, so you don’t waste effort fighting headwinds or chasing patterns that don’t apply.

Step 2: Grounds your strategy in reality, showing you exactly where you stand relative to your market.

Step 3: Provides an action plan tailored to your context. It aligns your position with demand trends, so every move works with the winds.

Let’s break down each step and see how you can apply them in your hotel every week in 2025.

Step 1: Understand the Winds – What’s Shaping Occupancy and RevPAR in 2025

To grow revenue, you first need to understand what forces are shaping the environment you’re operating in. Occupancy and RevPAR don’t shift in isolation; they respond to larger travel patterns, booking behaviours, and changes in guest expectations.

Think of this step as reading the wind before adjusting your sails. You can’t change the direction of the market, but you can read it better than others and adapt your strategy to ride it effectively. Step 1 lays the foundation for Step 2, where you’ll pinpoint your current position in the market and start identifying the right moves.

So here are three trends worth tracking closely in 2025:

1. Bleisure is the new baseline:

What was once an exception has become the rule. Business travellers are extending their trips into the weekend, and families are avoiding peak days to snag better rates.

If you’re still basing rate plans or restrictions on old weekday vs. weekend assumptions, you’ll miss new demand that’s hiding in plain sight.

2. Group business is returning:

Yes, events and meetings are back. But they book closer to arrival and move quickly. If your strategy still leans on long lead windows, you’re out of sync (you might already be watching the signs). Today’s group business rewards flexibility and fast decision-making, especially when it comes to pricing.

3. Compression still exists, but it’s sneakier

High-demand spikes haven’t vanished, but they now appear differently. Instead of significant events planned months ahead, demand can surge from smaller, local moments, and, as always, with little warning. The winners in this space are the hotels that catch these signals early and react swiftly, before the market shifts.

Step 2: Know Where You Are – Benchmark Before You Set the Course

Once you’ve got a sense of what’s moving the market, the next step is to check your performance in relation to it. This is about identifying whether you’re keeping pace, falling behind, or pulling ahead, and where that’s happening.

Without this benchmarking, it’s easy to misread the signs. You might react to a market-wide dip as if it’s your problem. Alternatively, you might celebrate an occupancy bump that puts you behind your comparable set.

This step is where the broader context from Step 1 meets your actual data. Step 3 will build on this with targeted action. Here are three ways you can help evaluate your relative position with respect to the competition:

Check your STR reports regularly and read them for context, not just numbers:

Your RevPAR index tells you how you’re doing relative to competitors. It doesn’t matter if you had 75% occupancy if your compset was at 85%. These gaps indicate whether your strategy requires a reset or just refinement.

Use CRS and OTA data to track behavioural shifts:

Examine where your bookings are coming from, how far in advance they are being made, and what types of guests are converting. For example, if last-minute bookings are increasing but your rate strategy is too rigid, you’re quietly losing revenue.

Watch pickup, not just pace:

Reports that tell you what happened last month help with analysis. But they don’t help you act in time. What matters is how your bookings are moving right now; that’s what allows you to react meaningfully, not just observe in hindsight.

Step 3: Adjust Your Sails – Small Moves That Shift Occupancy and RevPAR

Now that you understand the trends and your current position, it’s time to act. But action doesn’t have to mean significant changes. The best operators in 2025 are not necessarily doing more; they’re doing the right things, faster and more consistently.

The levers you pull here should be based directly on what you discovered in Step 1 and Step 2. The goal isn’t to throw everything at the wall, but to make minor, calculated adjustments that bring results over time.

Here are three simple yet powerful ways that can make a real difference in improving your OR+RevPAR:

1. Protect your best dates by controlling access:

Every hotel experiences strong nights – typically on weekends, holidays, or event-driven peaks. Don’t water them down by opening every discount channel. Use rate fences or restrictions that reward certain behaviors, such as early booking or multi-night stays. It helps hold your ADR without losing bookings.

2. Use minimum stay rules to stretch demand across soft nights

If your Saturdays are always full but Fridays are lagging, consider introducing a two-night minimum on weekends. This doesn’t just raise occupancy, it also lifts your overall average rate by balancing strong and weak nights together.

3. Add value where you can, instead of cutting rates

Guests perceive value in more than just price. Include perks such as breakfast, Wi-Fi, or minor room upgrades where applicable. These inclusions create a sense of generosity without compromising your rate integrity, and they often encourage the guest to book with you over someone else.

Where Docyt Fits In: Bring Your Strategy to Life

If you’re a franchise hotelier trying to improve Occupancy and RevPAR using the 3-step guide, the next challenge is execution. Smarter operators and even small franchise hoteliers are already ahead because they’ve paired strategy with systems like Docyt.

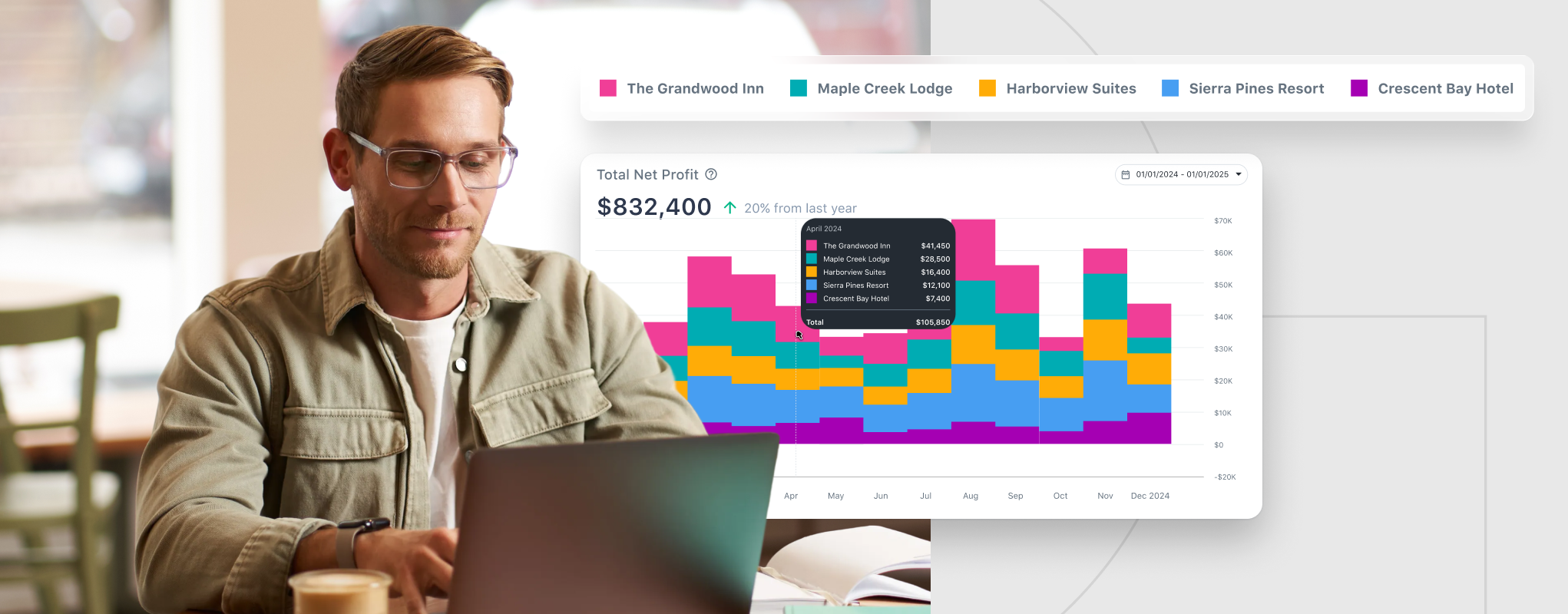

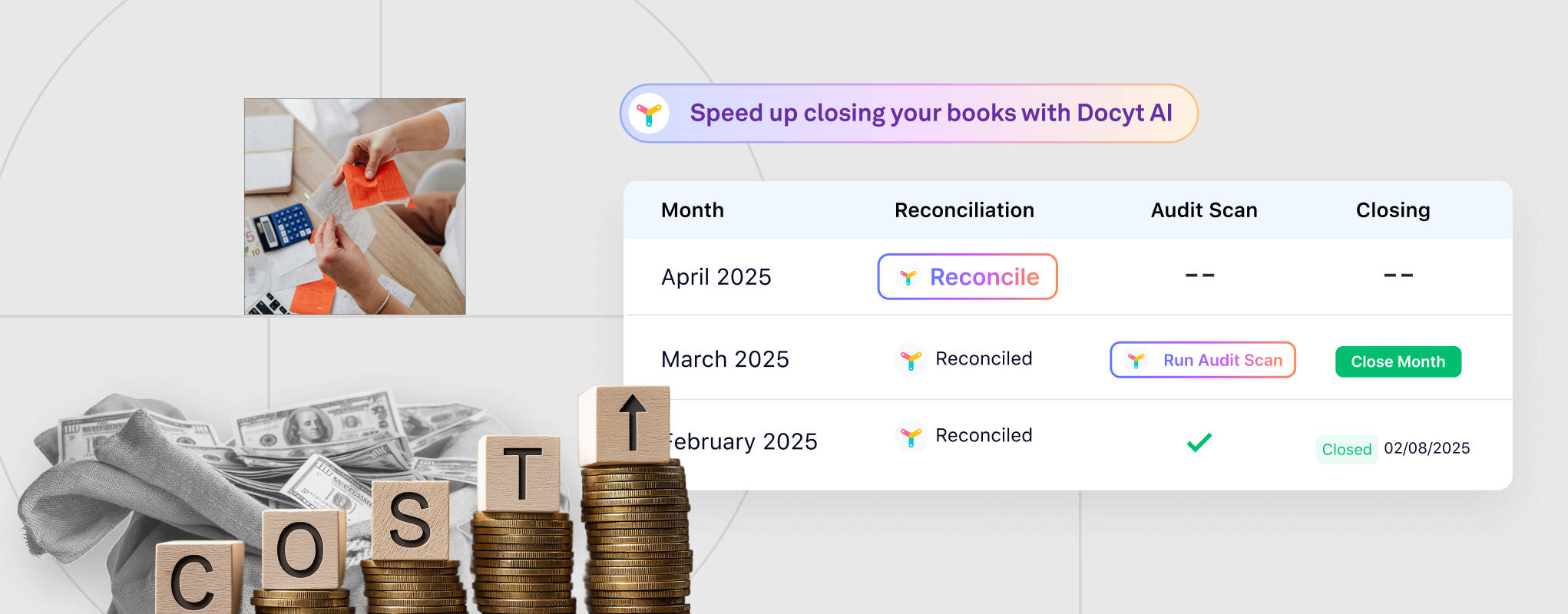

Docyt is an end-to-end AI accounting platform that connects with your existing systems, such as PMS, POS, banking, and more, to provide you with real-time visibility, reporting, and the tools you need to take action every day, across every property. Here’s how:

Track the trends early:

Docyt pulls live data from your PMS, POS, and merchant deposits. That means you can see pickup patterns, channel mix shifts, and group demand changes as they’re happening. With Docyt you are not waiting on reports; you’re already acting. For more information, check out more about Docyt’s Live Dashboards.

Know where you stand without delays:

Live P&Ls, labour tracking, and GOPPAR by property are always up-to-date. You don’t need to dig through spreadsheets or wait for someone to close the books. If something’s off, you’ll see it. If costs are creeping or revenue is slipping, you’ll know why with few clicks.

Make decisions and see the results sooner:

Docyt builds performance signals into your daily flow. You get GM scorecards, demand-aligned forecasting, and alerts when numbers shift. You can rebalance staff, tweak pricing, or cut vendor costs and see if it’s working right away.

Market and Segmentation Analytics: The Docyt’s in-built Segmentation & Market Analysis breaks down guest data into clear, actionable segments like business vs. leisure, weekday vs. weekend, or direct vs. OTA bookings.

This allows hoteliers to see which segments drive the most revenue, when they travel, and how they book, without the need for dedicated analytics tools. With clear and instant insight, you can fine-tune pricing, run targeted promotions, and shift inventory toward the most profitable segments.

This nifty feature is especially valuable for small franchise hoteliers who lack the right resources, tools, or data. Remember those costly missteps at the start of the article – wrong guest, wrong rate, wrong timing? This is exactly what Segmentation & Market Analysis helps you avoid.

Optimizing Occupancy and RevPAR in 2025 – Let Docyt AI Help You

In 2025, knowing what to do isn’t enough. You need to do it consistently, across every door. Docyt connects market signals with on-the-ground execution, helping you repeat what works with fewer blind spots and better margins.

Smarter franchise hoteliers aren’t working harder. They’re working sharper and faster with Docyt. See how Docyt can help you, too.