Large corporations are highly distributed. Profit incentives, shareholding structures, and financial success metrics are jointly owned by key executives of each department. Over centuries, corporations have evolved departmental budgeting and P&L management into a science. This process makes sure that there is no single point of financial failure and all departments have responsibility towards the organization’s financial success.

Small and medium-sized businesses can learn a thing or two from this process and even adopt departmental accounting standards that increase their profit. Departmental accounting and budgeting can systematically enforce financial discipline, control costs, increase spend in relevant areas, with an overall goal of achieving shareholder and owner’s profits.

Current State of Small Business and Franchise Budgeting

Budgets are just as important for small businesses as for large corporations. Small business owners typically have fewer financial resources, meaning a carefully planned and managed budget should be a top priority. However, according to a 2021 study, only 54% of small businesses have an official budget.

Without a specific budget in place, business owners have no measuring stick to evaluate goals and financial performance. Savvy small business owners should develop budgets as a big picture overview of all income and expenses. Metrics should then be established to review ongoing financials on a monthly, quarterly, and annual basis.

Success for hotel franchise owners, in particular, requires careful management of costs on a department-wide level. Each department should be included in the budget-making process including managers of spas, restaurants, sales, marketing, and human resource teams.

Hotel owners must establish a complete financial picture that incorporates costs and expenditures. Each of these figures must be compared to current and past revenues and expenses to determine if the franchise is in a healthy financial position. Further breakdown of these financial figures helps determine which departments are contributing to or hurting overall profitability. Budgeting and financial planning processes are a necessary, but sometimes complex aspect of small business ownership. Accounting automation software, such as Docyt, can simplify budgeting for your organization.

Use Automation Software to Enhance Your Budgeting

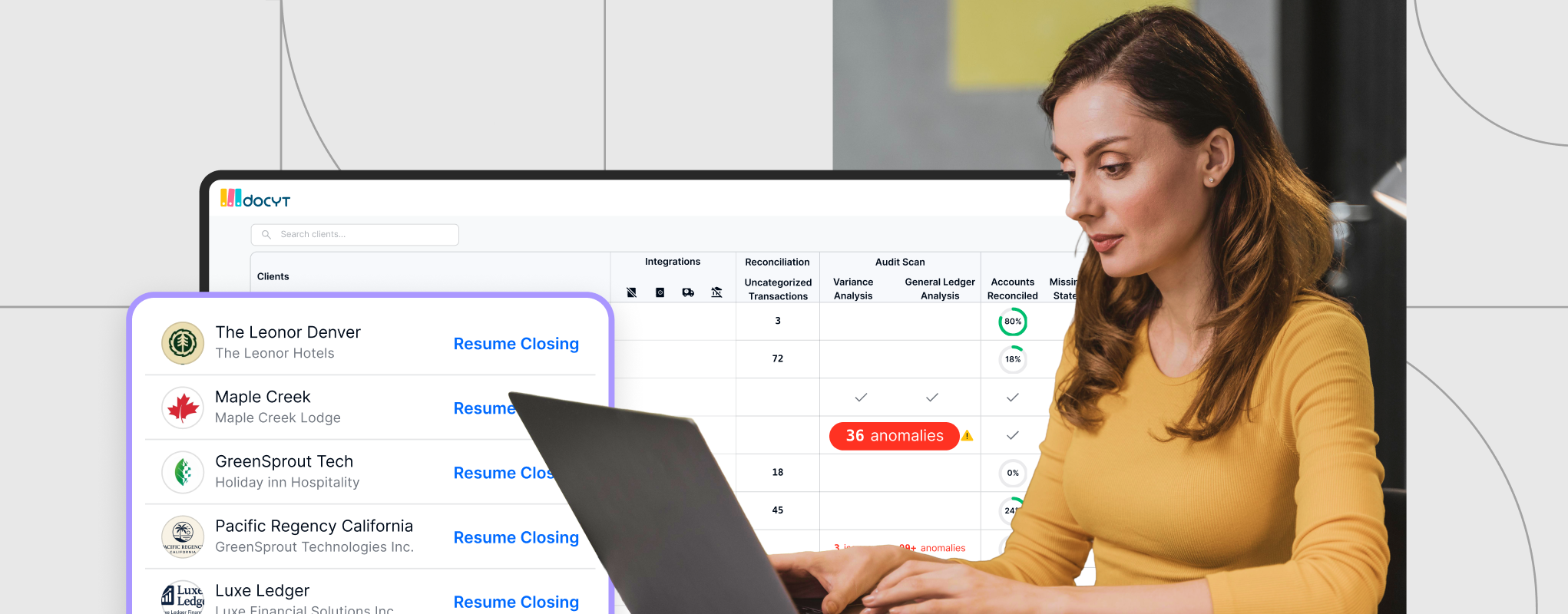

Docyt’s accounting automation software can help manage your company’s budget by department and category. Docyt captures financial data on an ongoing basis, meaning business owners can compare actual current operating costs against current year budgets.

Using your company’s chart of accounts – you can review specific costs and determine financial performance on a departmental level. Maybe you’re spending too much on equipment, but not enough on labor – Docyt aggregates and breaks down financials to help you make budgetary adjustments and improve profitability.

You can compare year-over-year numbers to determine if each department is performing better or worse than last year. Prior year numbers can also be used as the basis for creating the following year’s budget – it can even account for inflation. With real-time access to current business performance, Docyt helps you understand each and every financial detail of your company.

Use Docyt to Help Monitor Your Budget

Creating and managing a budget is a critical element of business success. Docyt’s accounting automation software can provide you with a platform to run your back office including budget reporting tools. You’ll get valuable insights and be able to review revenue and expenses and adjust departmental expenditures to maximize overall profitability.

If you’d like to learn more about Docyt’s budget tools, schedule a free consultation today.