Every few years, bookkeeping software rebrands itself as something new. The dashboard becomes more colorful, the checklist smarter, the interface cleaner. Yet the rhythm of the accountant’s day doesn’t really change. There are still files to reconcile, categories to fix, questions to chase, and rules to adjust when a client’s habits shift. The work is simply rearranged on a prettier screen.

The industry calls this progress. Most accountants just call it Tuesday.

Somewhere along the line, we confused visibility with automation. Seeing the work has become a substitute for removing it.

The Old Way: Assisted Workflows

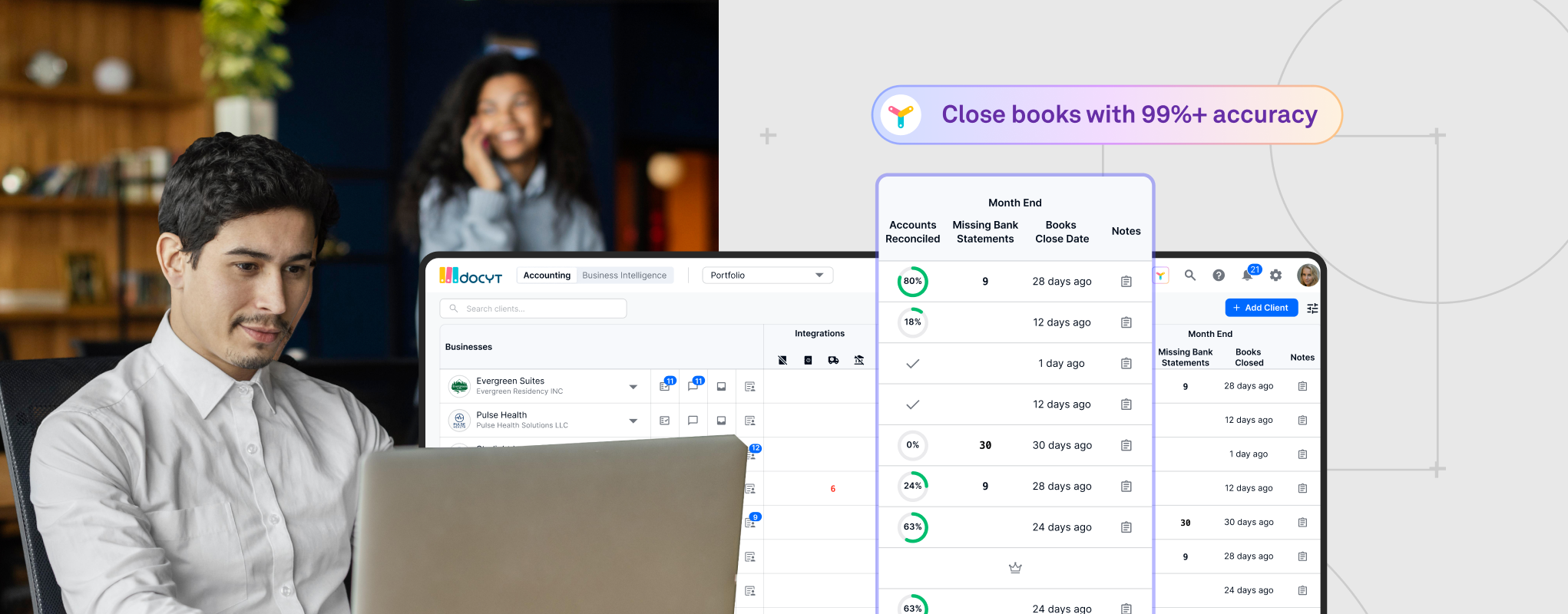

Most modern bookkeeping platforms operate on the same idea. They guide you through structured checklists, automate small steps, and flag what needs attention. The accountant still handles the judgment calls, still sifts through uncategorized transactions, and still cleans the feed when the sync breaks.

It feels organized, almost comforting. There’s a sense of control in watching a dashboard populate with color-coded statuses and open tasks. The software lines things up neatly, but the hands doing the actual work are still yours.

Ask anyone managing a portfolio of 50 clients and they will tell you: centralization helps, but it doesn’t make the workload lighter. The checklist grows shorter in one place and longer in another. You finish one batch of reconciliations only to start triaging messages from three others. The system assists, but it doesn’t relieve.

And that’s where the illusion begins to crack.

The Limitations of Assisted Approaches

Rules, as any seasoned accountant knows, never stop needing updates. The moment you set them, a new client workflow breaks them. What looked efficient in January becomes obsolete by April. The software can show you what’s broken, but it can’t fix it.

Checklists also stumble at scale. They work beautifully for one bookkeeper juggling five clients, but not for a firm handling hundreds. When every client needs a slightly different rule set, the process that once looked streamlined turns into an obstacle course of exceptions.

Dashboards share the same flaw. They’re great at visibility but empty-handed when it comes to execution. They highlight what’s overdue or out of balance, yet someone still has to dive in and make the adjustment. In theory, the tools create order. In practice, they keep accountants busy managing the very systems meant to lighten their load.

After enough months of this cycle, visibility stops feeling like clarity and starts feeling like noise.

The next step forward isn’t about tracking tasks better. It’s about doing fewer of them altogether.

The New Way: The Rise of the Copilot

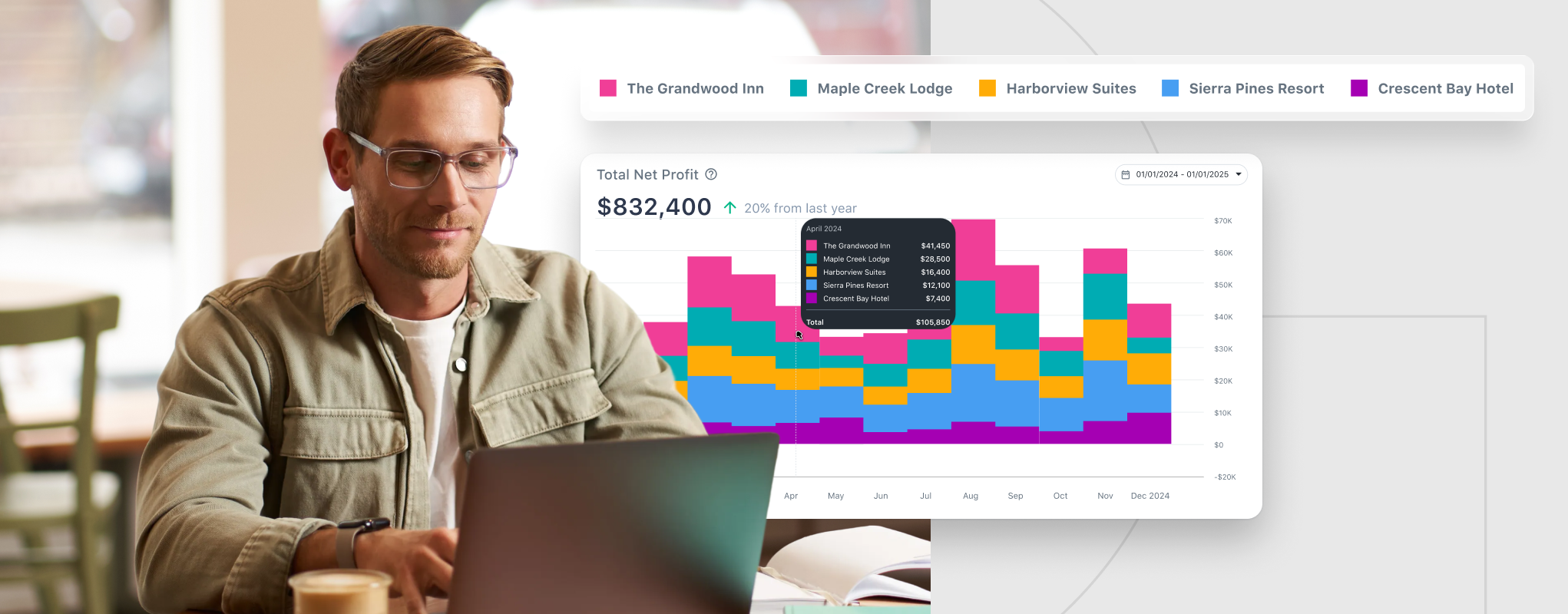

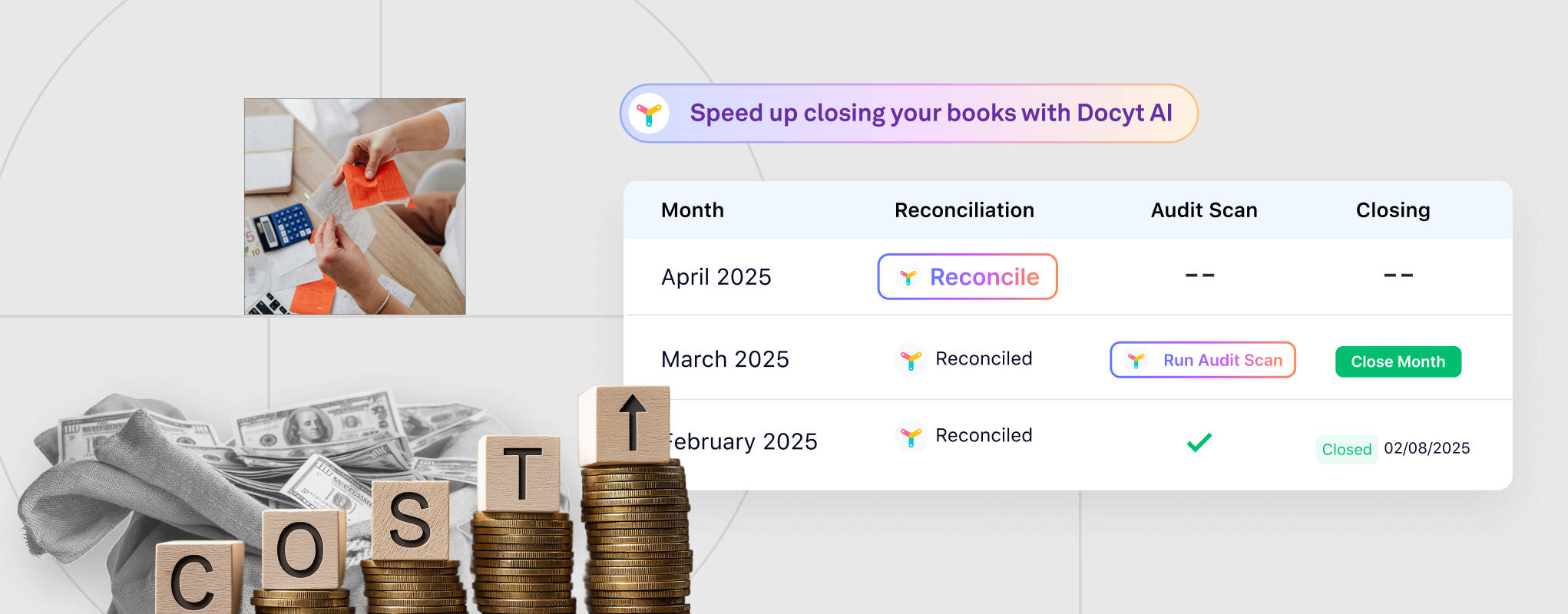

Imagine opening your accounting platform and finding 98 percent of the work already complete. Transactions categorized, bank feeds reconciled, documents matched. You see only the exceptions that genuinely need judgment. You approve or adjust in seconds, not hours.

That’s what an autonomous copilot looks like.

These systems don’t wait for you to instruct them. They handle categorization, document collection, and reconciliation continuously, guided by accounting-trained AI that understands ledgers, not just language. The subledger detail you used to maintain manually now generates itself.

Accountants move from operators to overseers. The daily grind of classifying, matching, and verifying disappears into background automation. What remains are the edge cases — the real exceptions that deserve a human mind.

And the time savings are not abstract. Firms see hours per client reduced to minutes. Month-end reviews shrink from a half-day ritual to a brief glance over exceptions.

This isn’t software that helps you manage your checklist. It’s software that makes most of the checklist irrelevant.

Benefits That Compound

When firms shift from assisted workflows to autonomous copilots, the first thing they notice isn’t just speed. It’s the breathing room.

Suddenly, staff can handle twice as many clients without a drop in quality. Reviews feel lighter because the entries are already audit-ready, sourced directly from reconciled bank feeds. The accuracy is structural, not cosmetic.

Automation doesn’t just clear backlog; it builds consistency into the books. Every categorization and adjustment flows through a unified logic, ensuring that when auditors arrive, the trail is clean and traceable.

And because copilots can sit behind branded dashboards and portals, clients still see the firm’s identity front and center. The technology hums quietly in the background while the firm remains the hero.

The shift isn’t about outsourcing expertise; it’s about multiplying its reach.

The Road Ahead for Firms

Bookkeeping is not getting simpler. Multi-entity structures, payroll integrations, intercompany adjustments, and accrual-based clients are becoming the norm. The checklist model, designed for repetitive linear tasks, begins to strain under that complexity.

The more sophisticated the client base, the less sustainable assistant-style tools become. Each additional rule, exception, or dashboard widget introduces another variable for humans to manage. The cycle of catching up never ends.

In contrast, autonomous systems improve as the workload grows. The more data they see, the more context they accumulate. They stop reacting to errors and start preventing them.

The firms that embrace this model now will not only scale profitably but also preserve the sanity of their teams. While others expand headcount to keep up with demand, these firms expand capacity through intelligence.

Because the future of bookkeeping isn’t about better visibility into manual work. It’s about needing less manual work to begin with.

Where Docyt Fits In

Every argument for hands-off bookkeeping converges at one point: trust. You can’t hand over the wheel unless you trust the system to know the road. That’s where Docyt’s approach earns its place.

Docyt was built around the belief that automation should begin at the sub ledger, not the dashboard. Its High-Precision AI agents handle categorization, reconciliation, and document collection autonomously, learning from thousands of real accounting closes across industries. The system operates within accounting logic, not prompts or guesswork, which means every transaction ties back to verified data.

Accountants no longer maintain rules or templates. They review, confirm, and move on. What once took hours per client now takes minutes. And because Docyt integrates directly with general ledgers and client portals, the automation feels invisible — your workflows remain intact, only faster and cleaner.

Docyt doesn’t replace accountants. It replaces repetition. It lets firms scale their expertise, not their exhaustion.

If you are ready to see what bookkeeping looks like when the checklist finally runs itself, explore how Docyt’s AI Copilot can help your firm get there.