In most franchise hotels, accounting doesn’t get the spotlight. It’s expected to run in the background while operators focus on guests, teams, and property upkeep. That’s fair.

However, when the back office fails, the ripple effect impacts everything from cash planning and rate strategy to cost control. And one obviously can’t run a tight operation on loose numbers.

Most mistakes aren’t dramatic. They creep in quietly: a late entry, a mismatch between systems, an overlooked credit note and more. One month rolls into the next, and suddenly the P&L feels a little off and the trouble begins – but no one can say precisely why.

In today’s blog let us shed some of the most common yet simple accounting mistakes that stealthily hurt franchise hotels. And also know how automation helps accounting teams to set them right.

1. Some revenue never makes it to the books

Someone checks out. The PMS logs it. But a batch is missed during posting, or a rate is incorrectly categorized. Days later, you notice the deposit doesn’t match revenue. It’s not fraud, to be precise just a human miss. But now someone has to go back and hunt.

With an automated system syncing your PMS and accounting tools, revenue entries don’t rely on memory. They land where they should, matched to actual bank activity. The daily clean-up disappears and the numbers stay in line right from the start.

2. The same vendor is coded five different ways

Different properties interpret expense categories in their way. Linen under housekeeping at one hotel. General operations at another. That makes comparing performance a mess. One would think they are seeing interesting trends unfold, but that can be just an inconsistency due to incorrect interpretation.

AI accounting tools help smooth this out. They recognize repeat vendors and apply consistent logic every time, across properties. So the comparison becomes real and accurate, the risk of inconsistency is altogether eliminated.

3. Important invoices get lost in translation

When a vendor updates their price, a credit memo pops up or a bill lands in the wrong inbox, there’s a real chance it slips through, especially in a manual workflow. And then you end up overpaying or chasing after something that was never processed.

When invoices flow through a system that logs, matches, and flags gaps automatically, things don’t slip through the cracks. The team isn’t stuck searching. Everything’s where it should be, and visible when needed.

4. Payroll comes in after the month is over

Labor is one of the most oversized line items. But the real numbers often arrive too late. So you close the month with estimates and then reopen the books to fix it. By the time you know what happened, you’ve already made decisions based on guesses.

Linking your payroll system directly to the books closes this gap. The numbers flow in, current and complete. You don’t have to correct yourself later. You just see the truth sooner.

5. The P&L shows totals, not causes

Let’s say your margins are off or labor looks high. The report gives you the result, not the reason. Without day-to-day data feeding into the financials, you’re stuck explaining things retroactively.

That changes when operations, payroll, revenue, and banking all flow through the same system. Instead of one report at the end of the month, you see how today’s activity connects to tomorrow’s outcomes.

Taken together, these problems create a chain reaction. Incomplete numbers lead to confusing reports. Confusing reports lead to delayed action. And delayed action turns into missed targets. It’s not just about errors, it’s about how minor issues block better decisions.

Automation helps break that cycle. But not all automation is built to handle scale.

Most traditional tools depend on hard-coded rules and manual oversight. That works until your properties grow or your data gets messy. The most effective way to maintain consistent accounting across properties, systems, and formats is to utilize an AI-powered accounting automation platform that can adapt efficiently.

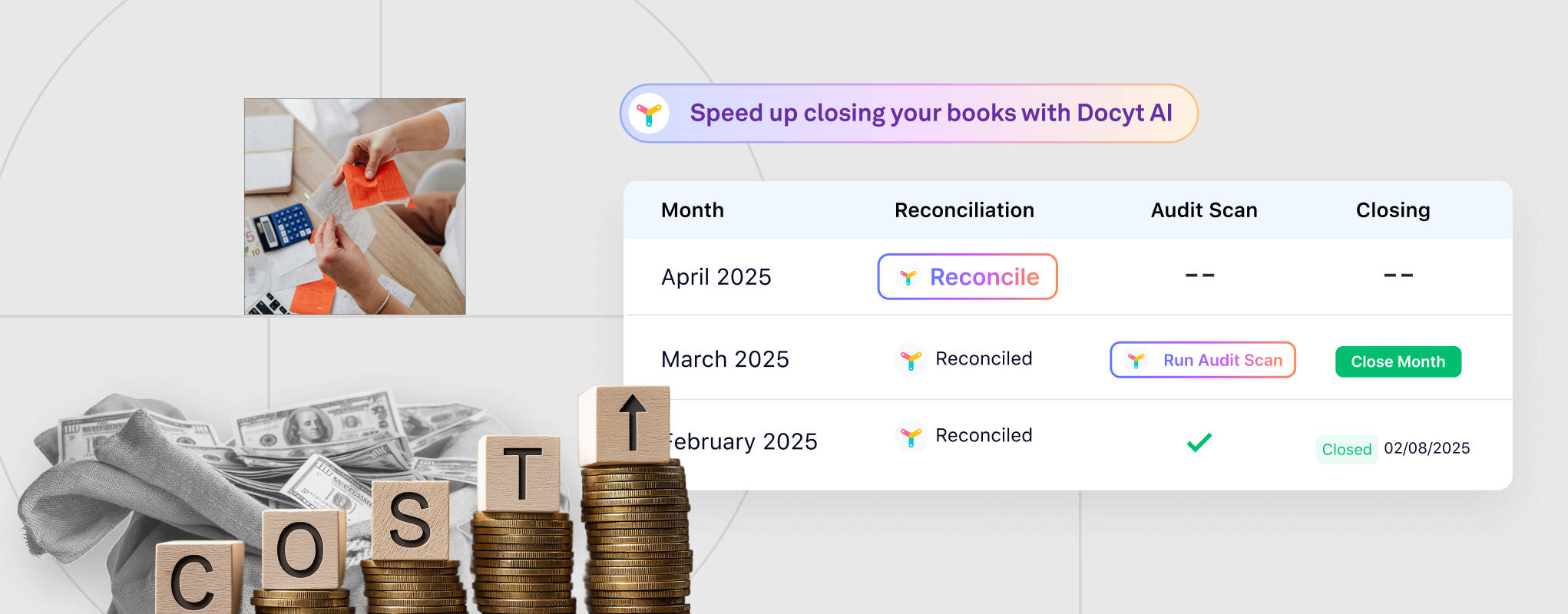

Go Beyond Automation with Docyt AI:

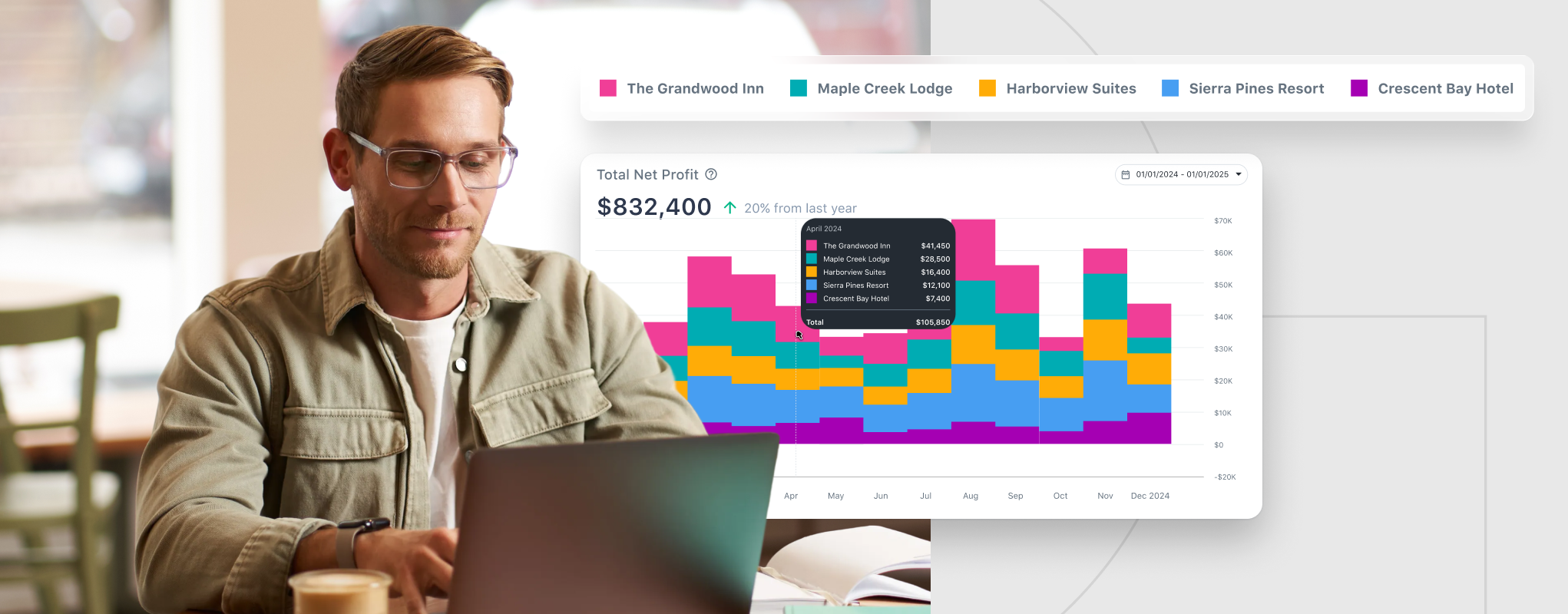

Docyt is designed to connect the full flow of franchise hotel accounting. It pulls data from your PMS, POS, payroll, and bank accounts, and then processes it automatically, eliminating the need for manual input or chasing down mismatches. From revenue recognition to daily reconciliation, it operates according to the logic you define and improves with use.

So, when payroll is processed, the changes are reflected immediately. When a credit memo is received, it is matched. When a vendor’s invoice shifts, the coding stays consistent. No bottlenecks. No backlogs. No last-minute scramble.

And when something does shift, say labor goes up, GOPPAR dips, or expenses spike, you’ll know exactly where it started. That’s the kind of visibility most systems promise but often fail to deliver. Docyt integrates it into the workflow.