Many businesses require employees to incur various expenses such as hotel costs, airfare, and dining. However, managing these costs can be a time consuming task due to expense reports, reimbursement forms, and other administrative paperwork. Using corporate cards can help companies streamline and manage their employee expenses.

Corporate credit cards can be useful for helping employees make purchases without using personal accounts. Whether they have to fly across the country to meet a client or simply want to take a potential new customer to lunch – corporate credit cards can be a great financial tool for employees.

Corporate credit cards empower employees to act on behalf of the company. Companies can utilize these cards to simplify and manage employee expenses. With the proper process and guardrails in place, business owners don’t need to micromanage every last expense.

Top Three Expense Management Difficulties

Employees have to make company purchasing decisions to keep operations running. Let’s say you’re the owner of a hotel chain and your general manager just found out their restaurant ran out of steaks for the night. A corporate credit card can enable your general manager to run to the butchery and restock supplies before it affects the bottom line. The result – business continues to run smoothly without interruption. However, without a centralized corporate credit card system in place, it can be challenging to oversee every employee purchase.

Some of the common expense management problems business owners and managers face include:

- Manual tracking of card use: Without automated systems in place, it can be difficult and tedious to check each employee’s card usage and identify spending issues. If a company has multiple employees using credit cards, it can quickly get overwhelming.

- Receipt management: Collection of physical and electronic receipts can be troublesome. Furthermore, reviewing each employee’s credit card statement and reconciling physical receipts to each transaction is a time consuming process.

- Security risks: Employees may be trusted, but safeguards must be in place to limit the risk of fraud and misuse.

While tracking, paperwork, and security give some employers pause before issuing corporate credit cards, there are solutions that make this process easier. Using software can automate and streamline the process.

Automate Expense Management

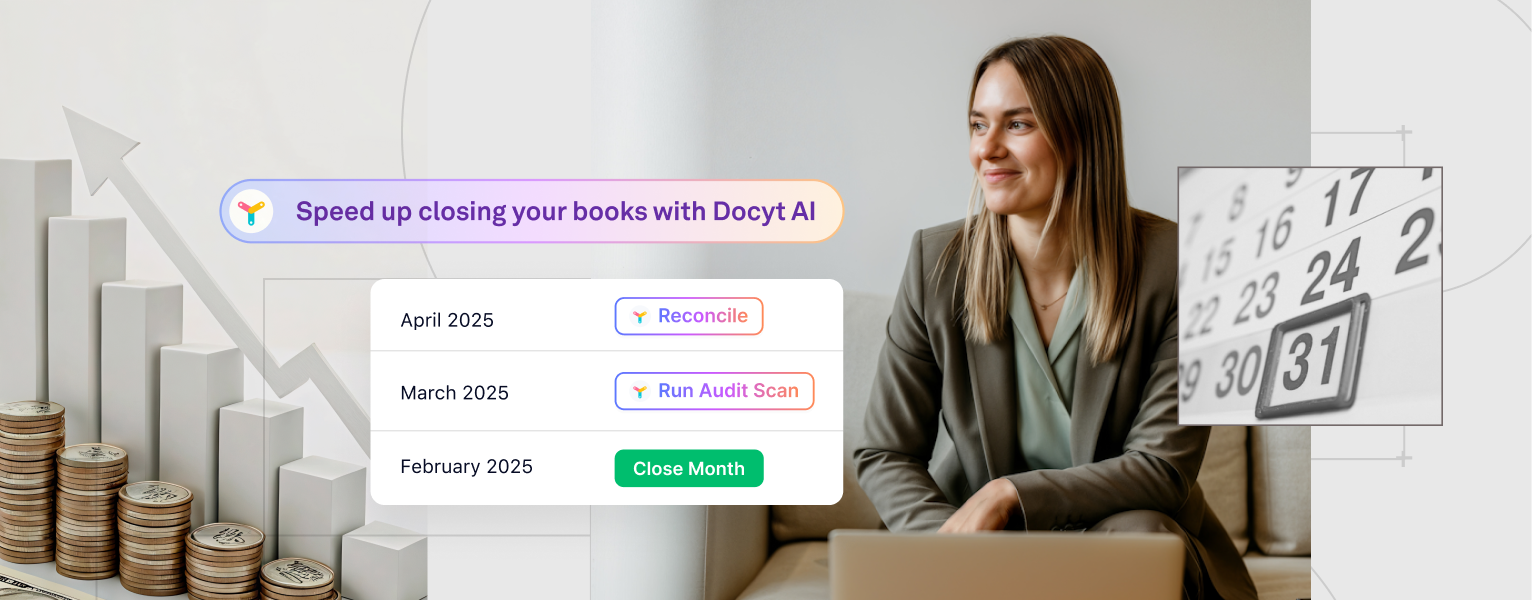

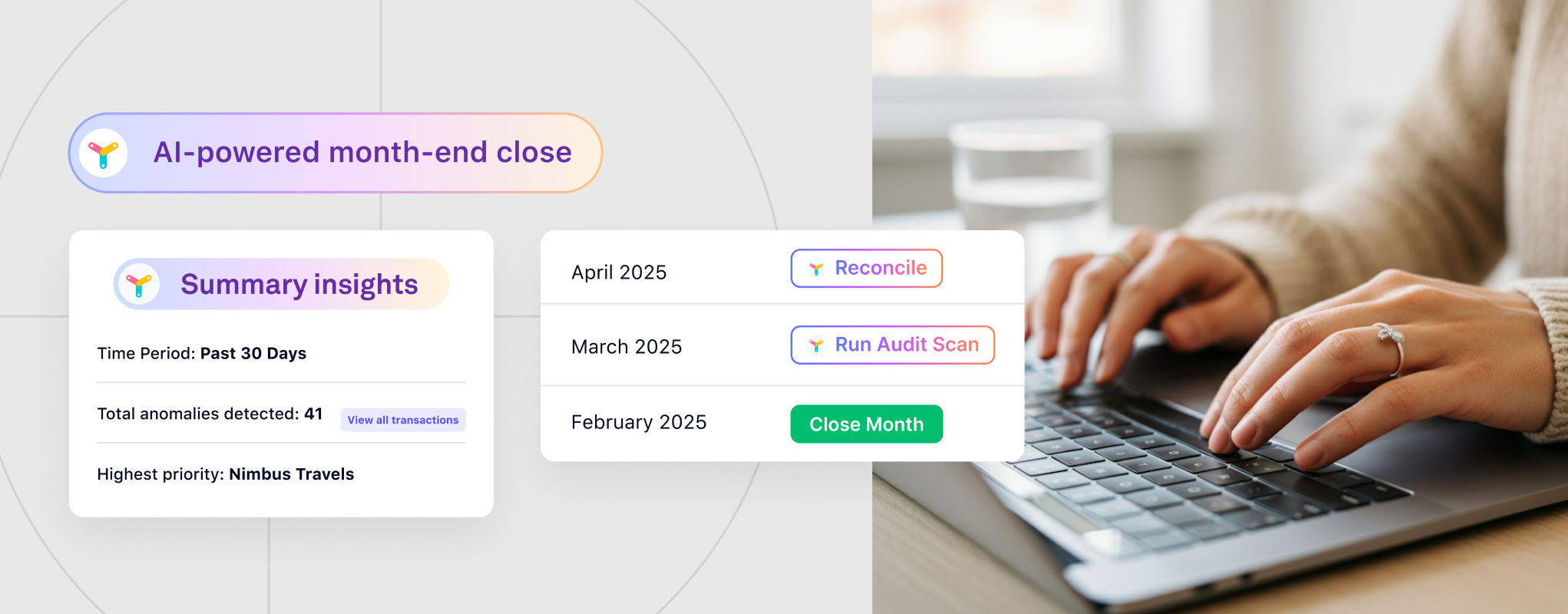

Docyt helps you view comprehensive reports of all employee expenses at a detailed level using the filter and search function. Furthermore, Docyt’s expense management report system allows you to review individual and departmental spending – giving you complete visibility and control over all employee expenses. Docyt’s automation software also has built-in security to ensure all data is safe and encrypted.

Docyt’s accounting automation software promotes employee accountability using defined corporate card spending limits. It also allows companies to track employee spending by categories such as travel, entertainment, and office supplies. Simplify your expense tracking process and make informed real-time decisions using Docyt’s corporate credit card management system.

Get Started with Docyt

Docyt enables business owners and managers to have full oversight over corporate credit card spending. With Docyt, you’ll never have to manually match paper receipts to credit card transactions again. We provide the tools for employees to easily upload receipts and see their spending, and for employers to manage and oversee the entire program. Read more about Docyt’s corporate credit card expense solution.

If you’d like to see a live demo, schedule a free consultation today.