Are you a corporate finance leader looking to transform your internal finance process? If you are in need of an innovative solution to keep up with the changing tides and competition, your search is over. Comprehensive end-to-end accounting automation software infused with generative artificial intelligence will put you right on top of the AI tech wave.

Generative AI is still in its early stages. Be one of the pioneers in driving transformative change in your company by keeping pace with this powerful technology impacting all industries, including corporate finance.

In this article, we will head down an exploratory path to first bring some clarity around the power of generative AI. Second, address the ways it is reshaping finance teams by reviewing 5 practical Generative AI use cases that will demonstrate its potential in your business.

What Is Generative AI?

The answer is often more complicated than necessary, so let’s uncomplicate it: Generative AI (Gen AI) is a form of AI technology that uses deep learning methods to create new and distinctive content that is on par with human capability. It is a technology that is referred to as the next generation of AI with more diverse and powerful capabilities.

How does this apply to corporate finance? By increasing efficiencies and effective decision-making ten-fold. This tool emerged on the scene with incredible force and is proving to be an invaluable asset and true accounting ally to finance professionals.

Let’s make it simple and go straight to generative AI Use cases that will avoid some of the technical mambo jumbo and provide insight into how AI-powered software will up your accounting game.

Automated Financial Reporting

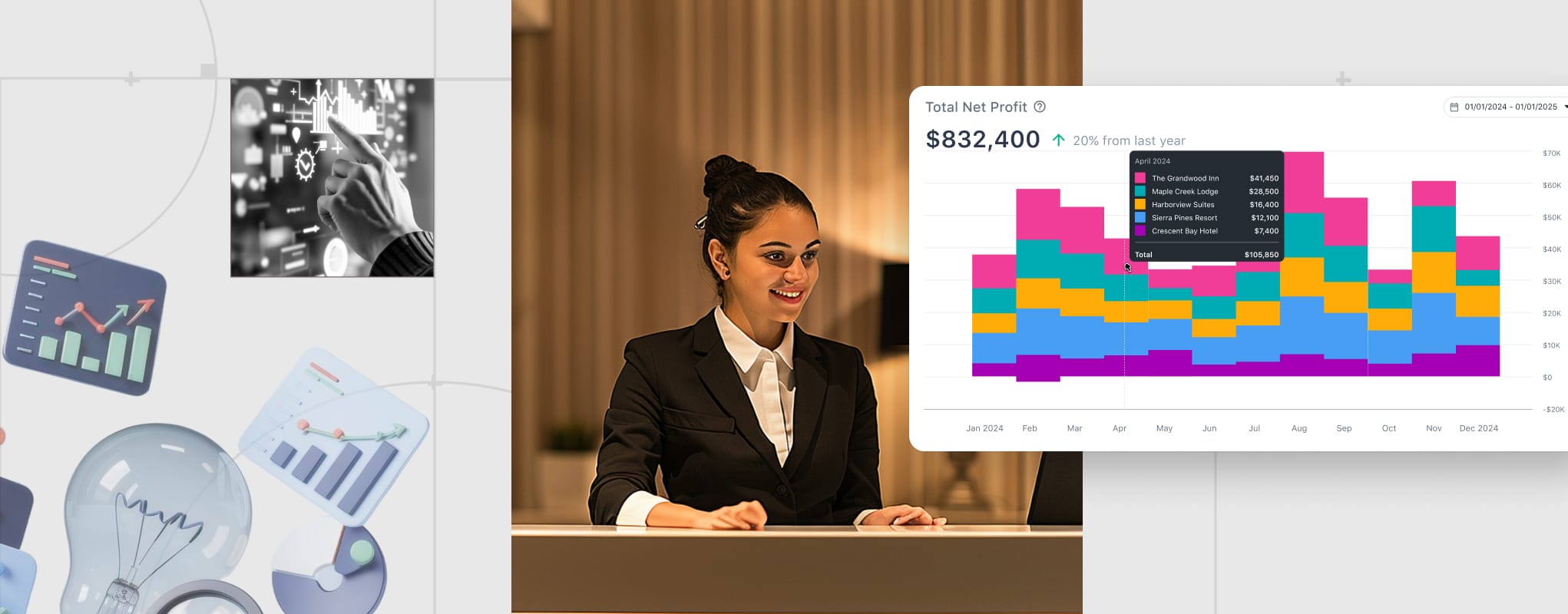

Generative AI tools generate reports faster, saving time and effort in data collection. Automating the financial reporting process ensures that reports are continuously up-to-date with real-time insights. The AI algorithms can analyze complex financial data and produce detailed reports, ensuring accuracy and efficiency. This provides finance leaders with real-time data to make informed decisions and frees up time to focus on projects and growth or corporate strategies, rather than constantly updating data and running reports to answer the 99 questions you receive daily.

Generative AI example:

An international company uses generative AI tools to automate its monthly financial reporting. The AI-powered software pulls customized reports (even tailored to the industry) from all locations or departments, compiling them in a single dashboard. In this scenario, the reporting time is cut from weeks to hours regardless of the complexity. Not only does this save valuable time and resources, but also delivers improved data accuracy upon which effective strategies can be built.

Enhanced Internal Communication

Many internal communication processes are streamlined and optimized by the use of generative AI. This is managed through generative AI capabilities that analyze, understand, and produce high-quality text summaries and offer powerful capabilities for transforming conversations into actionable requests and quickly answering queries.

For example, managing employee expenses can be a labor-intensive process for corporate finance departments. It involves back-and-forth communication with employees to collect, verify, and accurately reimburse expenses. This is an inherently time-consuming process. Docyt uses generative AI to streamline the verification and clarification process. Instead of manually following up for additional information or supporting documentation, the Docyt AI acts as an intelligent intermediary. It answers interactive questions by referring to previous interactions and uses its search capabilities to pull suggestions or information from the web. This not only reduces the possibility of human error but also greatly speeds up the process, ensuring that all financial records are kept accurate and up-to-date without excessive back-and-forth communication.

Achieving Financial Accuracy at Speed with Automated Categorization

Maintaining financial accuracy is of utmost importance in today’s fast-paced business environment, but ensuring such accuracy can often slow things down. Docyt challenges this status quo with an innovative feature that offers its 360-degree automated transaction classification. This state-of-the-art technology not only accelerates the reconciliation process but also dramatically improves its accuracy.

Gone are the days of labor-intensive bookkeeping. With Docyt’s automated system, cumbersome data entry, endless cross-referencing, and back-and-forth communication are replaced by a simple and efficient workflow. Transactions are categorized with precision at warp speeds and in real time. This automated classification cuts bookkeeping time in half, allowing finance departments to focus on strategic tasks rather than the nitty-gritty tasks of manual bookkeeping and transaction categorization.

Having real-time capabilities means that financial records are always current, reducing end-of-month financials to almost purely automatic. Instant classification eliminates errors and inconsistencies caused by manual data entry and ensures that each financial statement reflects the true and current financial state of the business.

Essentially, Docyt’s technology does more than just keep up with transaction volumes; It provides businesses with a platform to scale with confidence, knowing that their financial equity isn’t just maintained—it’s enhanced. With Docyt, businesses can achieve financial equity faster, motivating them toward more informed decision-making and strategic budgeting.

GenAI Example:

Consider a burgeoning e-commerce company handling hundreds of transactions daily across various sales platforms. Your accounting software, boosted with generative AI, categorizes every transaction in real-time, reconciles them daily, and ultimately allows you to close books at month-end in record time and with minimal effort. This efficiency frees up the finance team to focus on more value-add activities and strategically advance the business.

Upcoming Generative AI feature: Internal Advisory Services

Docyt’s AI-driven platform will soon offer internal advisory services. This new feature will provide proactive and meaningful guidance to finance professionals across a wide range of business areas.

For example, corporate financial leaders can effectively craft cross-functional companywide initiatives and easily communicate those objectives to vertical leaders. Vertical leaders are then empowered to set meaningful and measurable inner-department goals. And so begins a series of actions that result in a high-performance culture.

How does generative AI do it?

Generative AI provides internal finance leaders with the tools to identify revenue growth opportunities and market trends. By optimizing pricing strategies and revenue models using AI algorithms, generative AI analyzes real-time financial insight and historical data to predict financial scenarios and assist with building growth strategies.

By providing proactive guidance, gеnеrativе AI plays a major role in the evolution of meaningful internal advisory.

Check back for more to come about Docyt’s internal advisory services…

Conclusion

The corporate finance world has been given a complete GenAI makeover, and financial professionals are reaping the rewards. This new wave of technology is bringing forth a new era filled with futuristic end-to-end solutions to better manage the business. The uses are vast and varied, from financial reporting to expense management. By harnessing the potential of generative AI, corporate finance departments can operate more efficiently, make better-informed decisions, and ultimately contribute to the success of their organizations.

Remember, generative AI is not a trend but a game-changer for finance departments. Embrace the power of AI tools to unlock new possibilities!

If you’d like to learn more about how you can leverage AI-powered accounting technology for your organization, contact us today.