Artificial intelligence (AI) accounting software can save you money by automating bookkeeping practices, intelligent reporting, documentation, and categorization of data. While AI-powered software offers a host of money-saving benefits, some of the most predominant involve invoice management, tax preparation, and audit proofing.

Invoice Management

It’s no surprise that invoice management is a tedious task, especially when it comes to reconciling expenses. Having good invoice processing and timely vendor payments impacts your business just as much as making sales. The odds are high that your business spends significant time managing invoices if you have not already automated your expense management process. In most companies, invoices are received, separated, and – if paper-based – scanned individually into a computer file. Then the accounting professional manually extracts the relevant invoice information before processing it. These are traditional, time-consuming, and therefore costly activities for any company, large or small.

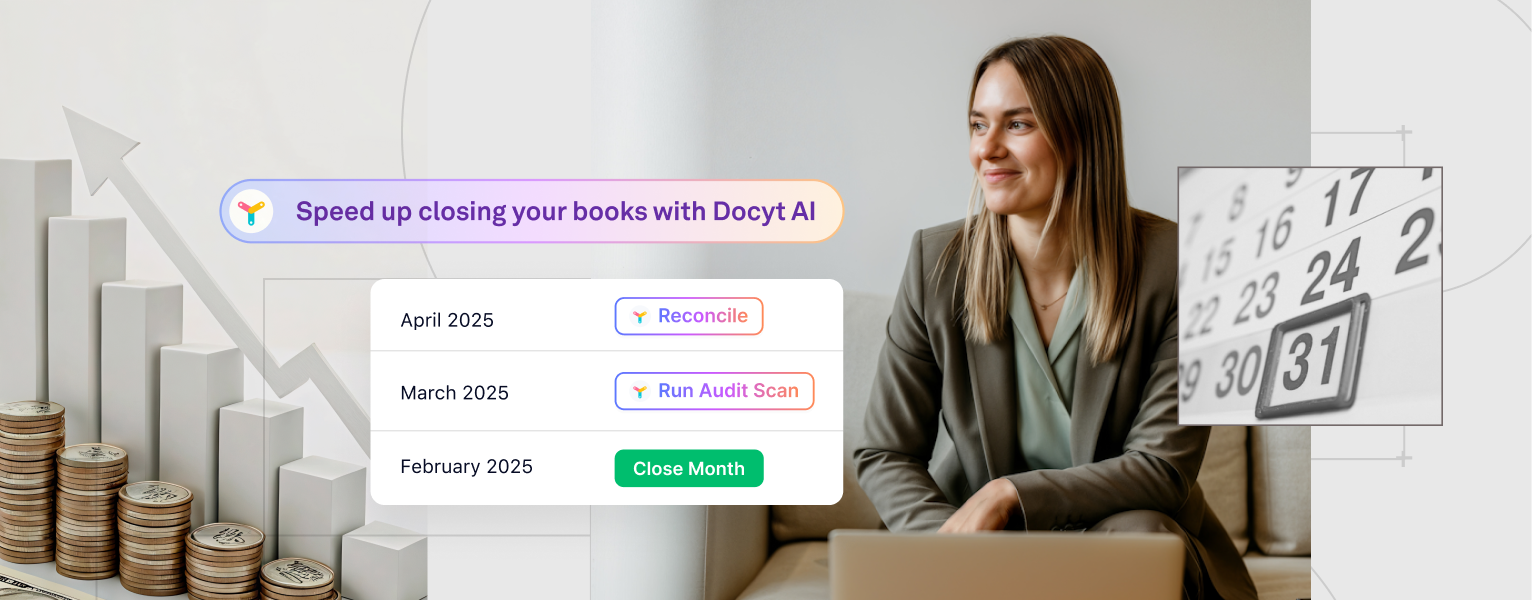

With the use of AI-powered accounting software like Docyt, most, if not all of the invoice-related processes are automated and invoices are continuously analyzed identifying specific information about the invoice, i.e. vendor cost, due date, early payment terms, etc. Docyt, extracts, analyzes, and processes your vendor invoices into the system. You get quick visibility into your expenses so you can see which vendors are being paid more or less or haven’t been paid yet. With seeing all of your expenses during any period, you can use this data to negotiate discounts across vendors for timely payments, etc. With having this kind of invoice management capabilities and insights, you’ll spend less time processing and more time putting into understanding the insights on where you can spend or save.

Tax Time

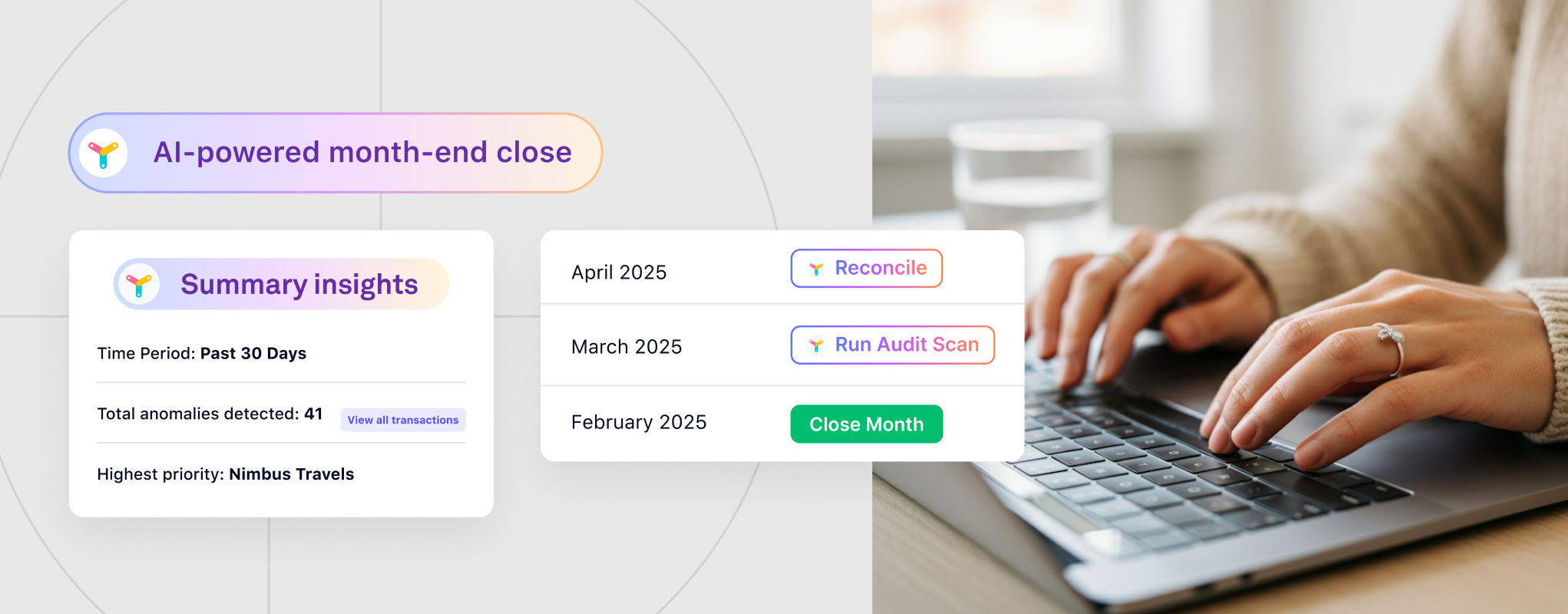

Tax time can be stressful, with complex compliance issues that need to be managed meticulously throughout the year. Automating accounting tasks can reduce stress both before and after filing. Automated bank reconciliation ensures your bookkeeping is done in real-time. It costs more when your tax accountant has to perform catch-up bookkeeping to get your books closed for the tax year. Docyt can automate 1099 reporting for vendors and contractors. If this process is mismanaged, the business then falls out of compliance with tax laws, which can lead to a host of legal issues and fines not to mention the cost of professional tax services to remedy the problem.

Audits

A business audit can be costly especially when preparing for a major transaction like an acquisition or sale. When preparing for a transaction like a sale of your business, a CPA accounting firm will conduct a financial audit of your business. An audit of this kind requires a company to have accurate, detailed, and thorough financial documentation for two or more years including the full and extensive review of and comparison with the corresponding tax filings for those years. As we already discussed, tax time alone can be expensive and time-consuming. But audits are even more tedious as the auditor combs through multiple years of accounting transactions reviewing every line item in your financial records.

With Docyt AI software, this is all possible to do now at a fraction of the cost! Why wait until the end of every month or when it comes to major events where your books need to be updated as it comes down to the wire when accounting automation technology can proactively do this in real-time?

Save your business time and money, talk to a Docyt expert today!