The date of April 15th means one thing to most people – tax season is here. Although this time of year can be challenging, tax accountants can help businesses and individuals correctly file their returns. One area many small business owners struggle with is classifying expenses. Improper coding of income and expenses can result in incorrect reporting on profit and loss statements. Individual tax filings vary in complexity depending upon the client, however small businesses face an entirely different set of challenges.

Small businesses don’t always have a skilled team of accountants and back office staff to adequately prepare for tax season. Business owners may utilize haphazard accounting methods with unorganized and mismanaged documentation. Income and expense categorization may not be performed daily, weekly, or even monthly. Expenses may be miscategorized resulting in numerous mistakes that need to be corrected before the yearly books can be closed.

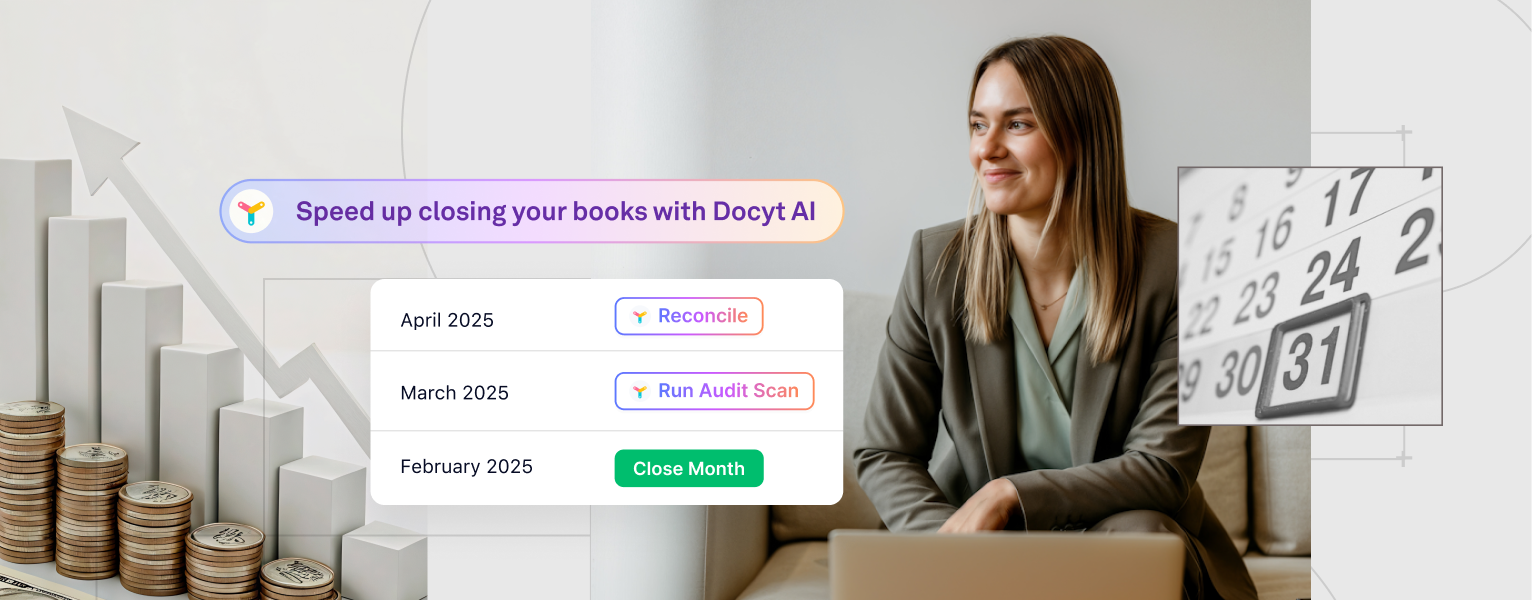

Tax accountants can spend up to 11 days closing quarterly books and over 25 days performing an annual close. If income and expenses are miscategorized by businesses, tax accountants may need to take even more time to close the books.

What if there were a simpler way to categorize transactions?

The Importance of Categorizing Transactions Correctly

Correctly categorizing transactions is critical for businesses when it comes to filing a tax return. Certain costs are expensed immediately while others are depreciated or amortized over an extended duration of time. Each expense and transaction needs to be properly classified in order to prepare accurate tax filings.

Let’s say you’re a restaurant owner who purchased a delivery vehicle for company use. If the tax code says a vehicle must be depreciated over 5 years, a business can’t deduct the entire expense in the year of purchase. Changes in expense categorization can greatly impact a business’ expenses and taxable income. While there are gray areas in the world of tax accounting, business owners must ensure taxes are prepared accurately to limit the risk of audit and litigation.

Many small business owners have to wear many hats, which means they often end up doing their own accounting. These owners typically aren’t CPAs or financial professionals, making it more likely for expense miscategorizations to occur. Furthermore, small businesses may lack the resources necessary to maintain accurate and up-to-date bookkeeping throughout the year. Tax accountants can spend countless hours reviewing boxes of paper receipts – attempting to categorize expenses and aligning them within specified IRS categories. Accounting automation software tools, such as Docyt, can simplify the process for tax accountants and business owners.

Docyt Categorizes Your Expenses

Docyt’s accounting automation software can help small businesses manage their accounting needs. Our last article focused on automating document collection, now we’ll learn how Docyt can automate categorization.

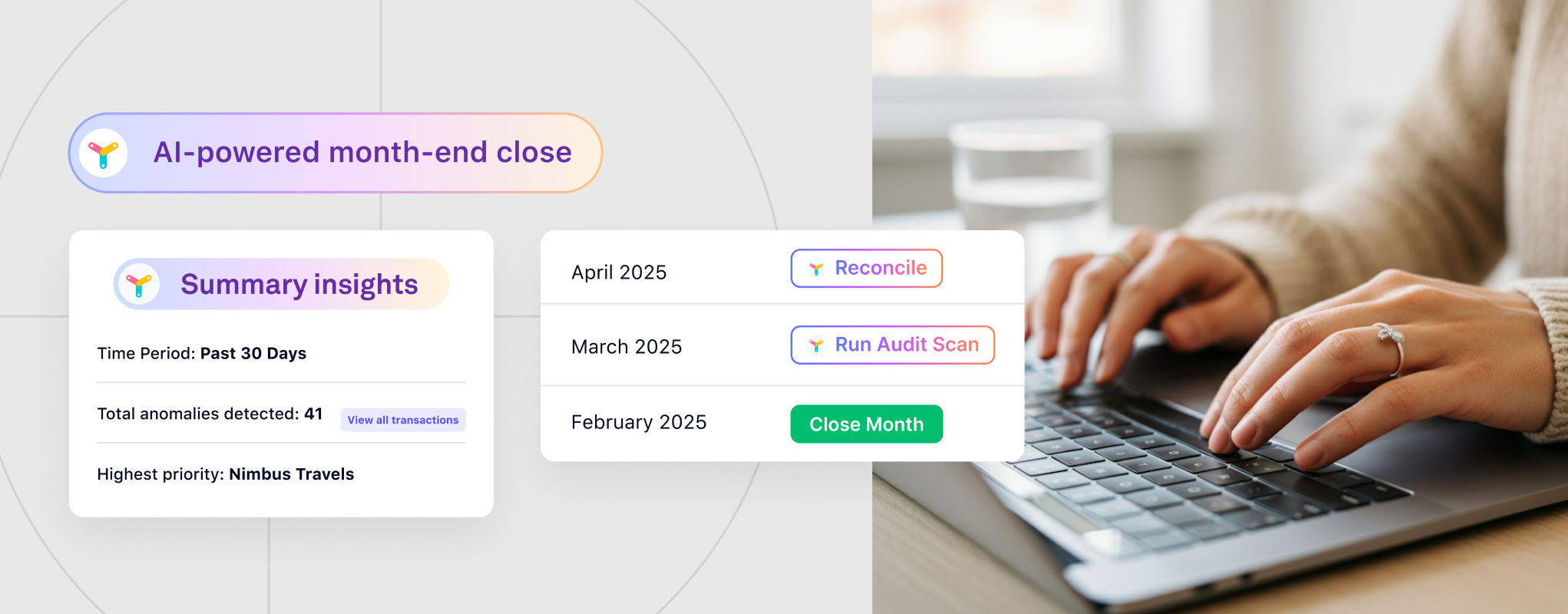

Here’s how it works. First, connect your bank and credit card accounts to Docyt. This enables Docyt to start pulling in your income and expense data. Then, within Docyt’s reconciliation center, you can review each transaction and categorize it. After you categorize a transaction, Docyt learns from you and in the future will automatically categorize this type of transaction.

Let’s say you’re a restaurant owner that purchases 5,000 napkins on a weekly basis. Since you’ve been using Docyt, you’ve taught it to classify the napkins expense as “supplies”. Docyt now recognizes future napkins purchases and immediately categorizes them as supplies. Docyt also continuously syncs these transactions to QuickBooks® so your books are always up to date.

Docyt’s AI-powered categorization saves small businesses and their accountants days or weeks of time at the end of year. For example, for businesses that are behind in their bookkeeping, Docyt’s AI can quickly learn categorization for each vendor and then categorize transactions in bulk. That’s a huge time saver.

The more you use Docyt, the smarter it gets.

Taxes are Easier with Docyt

Many small businesses don’t have the adequate resources or staff to sufficiently handle their accounting. Docyt’s accounting automation software can make tax season easier by automating transaction categorization.

This article is the second in a three-part series describing how accounting automation can simplify tax time. In the next post, learn how you can automate matching bank and credit card transactions with their respective supporting documents.

If you’ve been searching for a way to make life easier during tax time, schedule a free consultation today.