The technological shift towards automation is changing the way companies do business. Accounting in particular is no exception. The problem is traditional accounting often involves mundane and repetitive tasks that require heavy oversight, manual work, and continuous review. This antiquated style of accounting tends to be ineffective due to mismanaged data-keeping practices and delayed record management. However, newfound technology is changing the way organizations view and manage their accounting duties.

Transitioning to real-time accounting can give companies the ability to eliminate tedious tasks while allowing for complete expense, income, and profitability oversight. Furthermore, leveraging the power of accounting automation can provide your business with ongoing real-time financial insights. The availability of this data allows business owners to become more effective stewards of their companies by helping them make informed decisions quickly and effectively.

The current state of accounting

Traditional accounting involves recording, managing and summarizing financial information. Additionally, accounting often involves monotonous and time consuming duties that can delay the receipt of financial statements. For example, books are typically not closed until 15 days after month-end.

As a result, business owners and leaders have out-of-date income and expense data, which is only marginally helpful for planning and strategic goal setting. Without the ability to see real-time, accurate financial data, companies will struggle to effectively make educated decisions. Instead, they end up relying upon their prior experience and hunches.

Accountants typically have to perform a number of manual tasks. Bank statements have to be gathered before expense and deposit information can be extracted. Data also has to be collected from point-of-sales systems that contain revenue figures. Furthermore, all receipts and invoices must be reconciled to transactions. Completing each of these tasks can be burdensome for business owners and accountants.

If this sounds like a familiar source of frustration for your company, you aren’t alone. The good news is new technologies are helping companies strea

The new world of accounting

The business environment is volatile and competitive in today’s world. Additionally, operating a business has become increasingly more complex and demanding. The companies that survive and thrive are able to quickly respond and adapt to constant change. Advancements in technology can help organizations better manage this change and allocate their available resources.

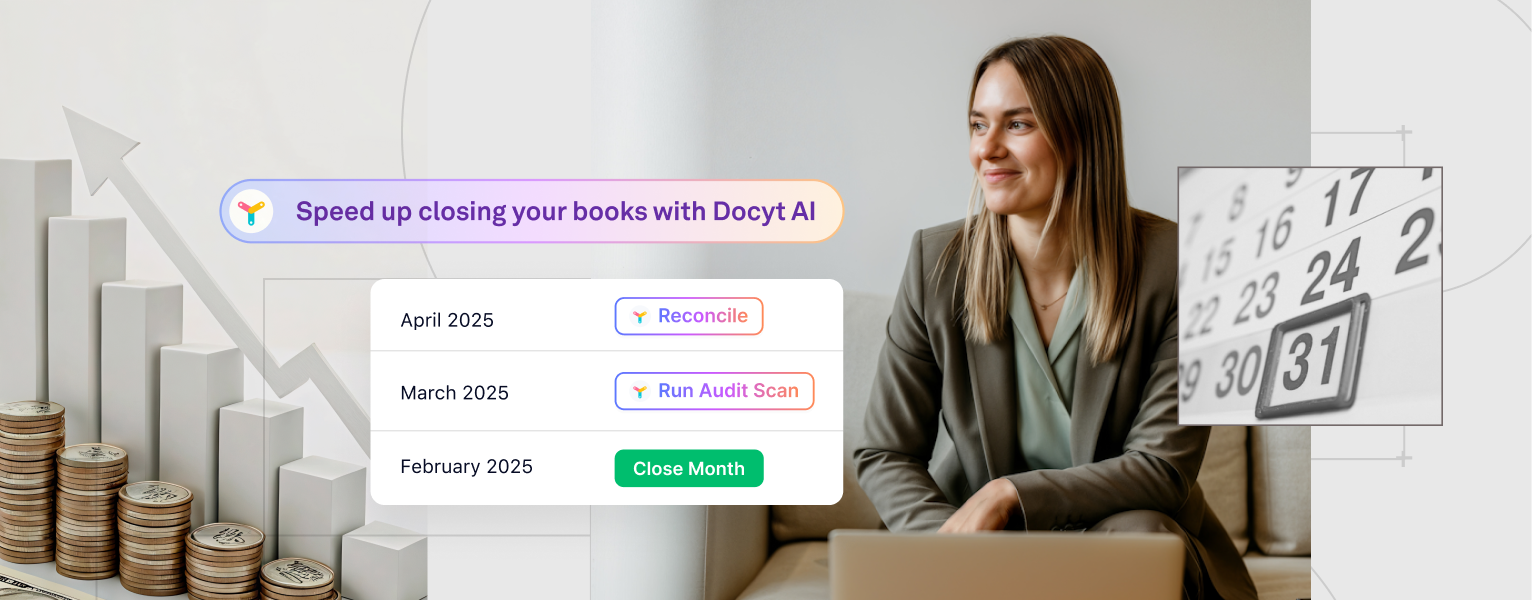

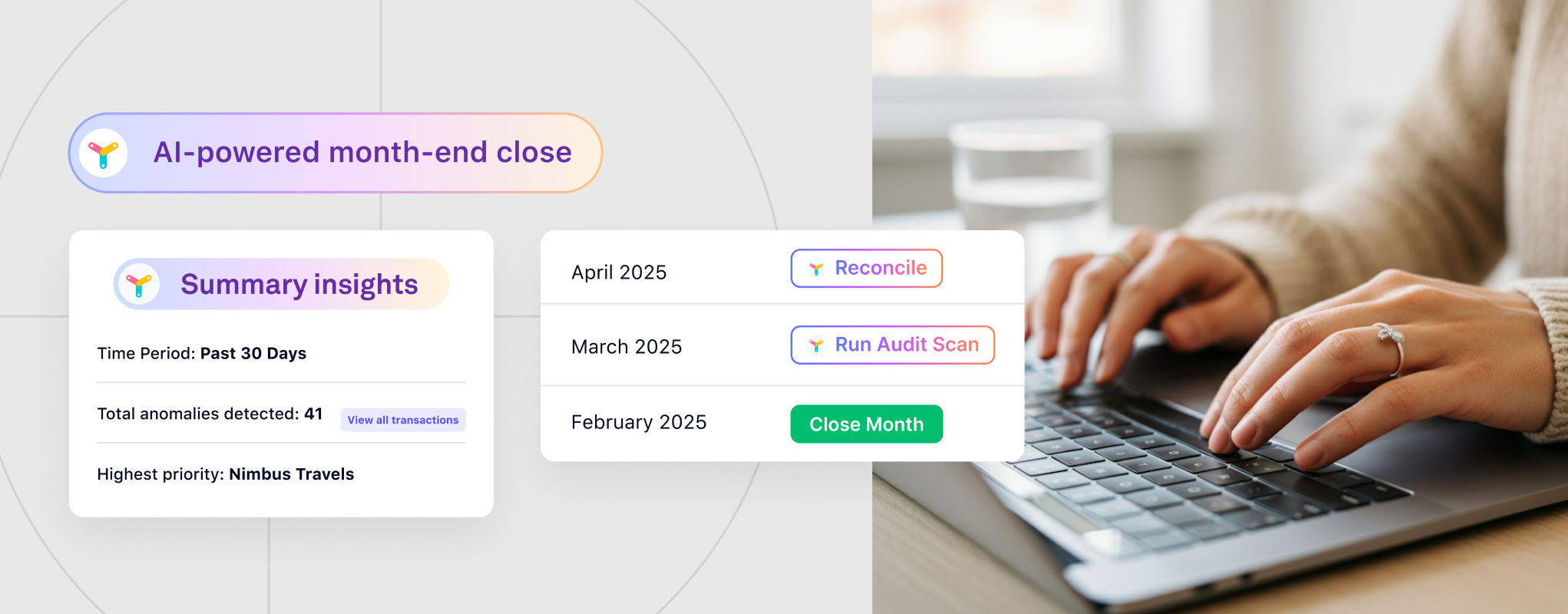

Accounting functions tend to be problematic for two reasons: time intensive bookkeeping activities and inefficient workflows. Automation can help solve many of the issues commonly associated with traditional accounting. If you’re a business owner with several locations, managing each and every expense can be a challenge. Docyt’s AI functionality allows you to validate and extract invoice data, automate the bill payment process, and continually update your accounting software. With Docyt you can use automated, cloud-based technology to conveniently pay bills using ACH or Docyt check.

No more micromanaging expense reports as employees can use the Docyt mobile app to simply snap photos of their receipts. Then, you can easily reimburse them using the accounts payable module. Docyt’s artificial intelligence technology digests data each step of the way and automatically creates journal entries in the accounting ledger while matching receipts to transactions. Business owners can easily control expenses, reduce transaction costs, and expedite month-end book closing processes with the help of Docyt.

New technologies such as Docyt can help streamline accounting processes by collecting data and organizing it into actionable workflows that result in real-time business insights.

How business owners can utilize automation to provide real-time financial insights

Advancements in accounting automation are giving accountants and business owners instantaneous visibility into their expenses, revenue and profitability. Docyt can help you shift the focus to running your business instead of spending countless hours on repetitive, manual bookkeeping. Our automation technology can help business owners run their back office more efficiently and free up their employees’ time.

If you’re looking to automate your business processes including bookkeeping, expense management, and revenue accounting – you’ll need an application that can handle every step of the process.

To learn how Docyt can automate your accounting and streamline your back office, set up a free consultation with us today.