Traditional accounting keeps operators working with delayed information, so the numbers arrive after the work is already done. Those delays create two gaps: room for losses to slip through, and reports that never reflect the situation in time to do anything about it.

Unrecorded minibar consumption, early check-ins or late check-outs that never reach the folio, duplicate vendor payments, refunds that are processed twice, and chargebacks spotted late may seem small on their own, but together they become costly.

By month-end, all of it settles into a final figure. The loss is absorbed into the P&L or the balance sheet, and the cause disappears into last month’s close rather than being corrected when it first appeared. You identify and fix them, but the revenue gaps remain.

Fix one issue, and another appears:

Traditional accounting spreads information across files, inboxes, and timelines, so the origin of a loss sits far from where it lands. The unrecorded expenses, duplicate payments, and missing adjustments are only symptoms of deeper process gaps that sprout quietly after every busy shift.

Operators face this cycle every month and often wonder how much remains unseen simply because the system never delivers information when it is needed.

This leads to the only question that matters for anyone running a property: Where is the money actually going, and why does it take so long to surface? And how do I fix it? If you are a hotel operator asking these questions, then this blog is for you.

This guide highlights the five common areas that become the biggest sources of unnoticed losses for most hotels and shows how tools like Docyt close those gaps through real-time accounting.

Read on to know where hotels lose money, why it happens so easily, and how Docyt’s real-time engine eliminates the leakage before it ever becomes a line item:

1. Revenue breaks that form when PMS timing and bank timing refuse to cooperate

Every operator has seen this one. The PMS posts a charge late at night while the merchant processor pushes the deposit into the next day. Accounting treats two unrelated events as one and forces them together.

Suddenly, ADR looks unstable, pacing loses its anchor, and a normal day begins to resemble a weak one. You adjust rates because the numbers suggest softness, yet nothing was soft at all. The timing was the issue.

Docyt’s real-time accounting prevents this by aligning PMS, bank, and folio activity into a single revenue sequence.

- Deposits match their folios without waiting for reconciliation.

- OTA pay-outs land inside the pattern that actually belongs to them.

- Wrong-day postings reveal themselves immediately instead of hiding until the audit.

- Once the revenue line stays coherent, the hotel avoids those false alarms that push operators toward needless corrections.

2. Vendor and AP losses that grow when properties operate on separate islands

Most AP loss hides inside ordinary moments that happen like clockwork. A vendor charges more for one property than for the others.

A credit note ends up in the wrong inbox and never returns, or a duplicate invoice enters during a shift change and moves through approval unnoticed because every property believes it is handling something routine. By the time the month-end arrives, the issue’s origin feels impossible to trace.

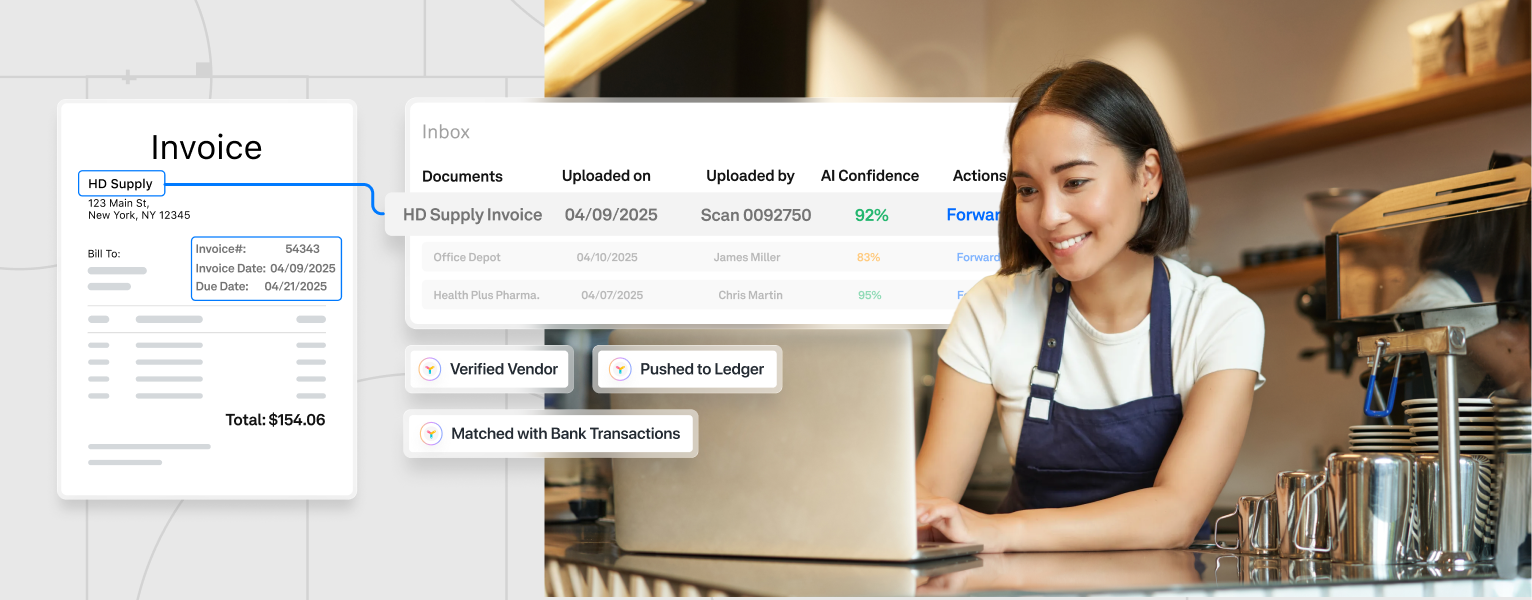

Docyt resolves this by placing all invoices into a single AP pathway.

With Docyt, operators immediately see the rate variation that should not exist. They see duplicates the moment they appear, not after payment. And notice the credits before they vanish into email threads. This never-before-seen visibility gives the operator the ability to catch the penny that wandered off rather than search across an entire month’s activity.

Suggested Reading: How Accounts Payable Automation Improves Cash Flow & Operational Efficiency

3. Labor that moves away from occupancy because no one sees the separation early enough

Labor is where hotels lose money fastest. It is also where course corrections arrive the slowest. Hours move from shift to shift with subtle changes.

A busy day convinces the team to prepare for a future day that never comes. Occupancy softens, yet the roster stays inflated. These patterns feel harmless when viewed locally, but create payroll trends that cut margin before anyone notices.

Docyt addresses this by bringing labor and occupancy into a single picture.

- With Docyt, heavy shifts appear in real time & idle periods reveal themselves early enough to adjust without harming service.

- Understaffed stretches warn the operator before the guest experience suffers. When the mismatch becomes visible early, labor transforms from a trailing indicator into an active lever that operators can use daily.

4. Micro-losses that gather quietly because no one reviews them until they form a pattern:

Some losses form through small habits. Housekeeping supplies are consumed at a rate that does not match the number of rooms sold. Or amenities that disappear faster than expected.

These losses feel too minor to investigate, yet they compound over the month and accumulate into meaningful financial weight.

Docyt detects these signals because it reads the hotel’s financial heartbeat in real time. For example:

- When refunds are collected around a specific shift, the operator sees it.

- When supply use rises without a rise in occupancy, the discrepancy becomes unmistakable.

- When linen behavior changes, the system surfaces it early enough to fix quietly rather than through a disruptive audit.

And once these small signals are visible, the correction remains small rather than evolving into a larger operational issue. Operators who catch micro-losses early avoid the expensive outcomes that form when small issues mature unchecked.

5. Decisions made with partial information because fragmented systems never tell one story

Fragmentation punishes hotels quietly. PMS, bank, AP, payroll, and accounting each describe the hotel using different logic. None of them intends harm. They simply view the same events through separate windows. When operators try to combine them manually, the story bends depending on which system spoke first that day.

Docyt replaces that fractured picture with one dependable source of truth. Operators see revenue near the moment it forms, not after deposits appear. They see AP activity in a single sequence rather than across scattered inboxes. They see labor beside occupancy in real time. They see micro-losses early enough to correct. Most importantly, they see the hotel as one coherent business rather than five competing systems.

When decisions are drawn from a unified picture, revenue strategy gains confidence and cost control gains precision.

Docyt AI – Where real-time truth becomes operational strength

Hotels rarely lose money due to a lack of effort. They lose it because they operate inside blind spots created by delayed or scattered accounting. The numbers appear, but they appear too late to guide the day that needed help.

Docyt’s Real-time accounting ends that cycle by giving operators the clarity they always needed at the moment when clarity matters most. It delivers this real-time truth across the entire hotel: revenue, AP, labor, and the micro-behaviors that ultimately shape profitability.

When equipped with Docyt, operators who once made decisions from partial information now move with assurance because the numbers hold steady and the story stays intact.

If you are looking to understand how real-time accounting can convert visibility into true operational control, explore what Docyt’s AI-driven platform can deliver for your portfolio. Schedule a free Docyt demo today.