For multi-property business owners and franchisees, maintaining accurate financial visibility across locations is crucial for sustainable growth and profitability. Daily revenue reconciliation and recognition processes offer significant advantages over traditional month-end approaches. Here’s how implementing a daily revenue management system can transform your multi-location operation:

1. Early Detection of Discrepancies

Identify issues immediately: When reconciling daily rather than monthly, discrepancies between point-of-sale (POS) systems, payment processors, and bank deposits are caught within 24 hours rather than weeks later.

Real-world impact: A restaurant franchise owner noticed a $250 daily discrepancy at one location through daily reconciliation, quickly identifying an employee theft situation that would have cost over $7,500 if discovered during month-end reconciliation.

2. Improved Cash Flow Management

Location-specific insights: Daily revenue reconciliation provides clear visibility into each property’s cash position, allowing for more strategic fund allocation across locations.

Optimization opportunities: With daily data, you can identify which properties consistently require cash infusions and which generate excess funds, enabling better internal lending between locations.

3. More Accurate Performance Evaluation

Meaningful comparisons: Daily reconciliation enables true apples-to-apples comparisons between properties, as you’ll be working with verified rather than estimated figures.

Beyond surface metrics: Precisely reconciled daily revenue allows franchise owners to analyze performance metrics like revenue per square foot, average transaction value, and staff productivity with confidence.

4. Streamlined Multi-Location Management

Standardized processes: Implementing daily reconciliation enforces consistent financial practices across all properties.

Centralized oversight: A unified daily reconciliation system provides headquarters with a real-time dashboard of all location performances without burdening individual property managers.

5. Enhanced Fraud Prevention

Pattern recognition: Daily review makes unusual transaction patterns immediately visible across your property portfolio.

Cross-location analysis: Identify potential fraud by comparing transaction types and payment methods across similar properties.

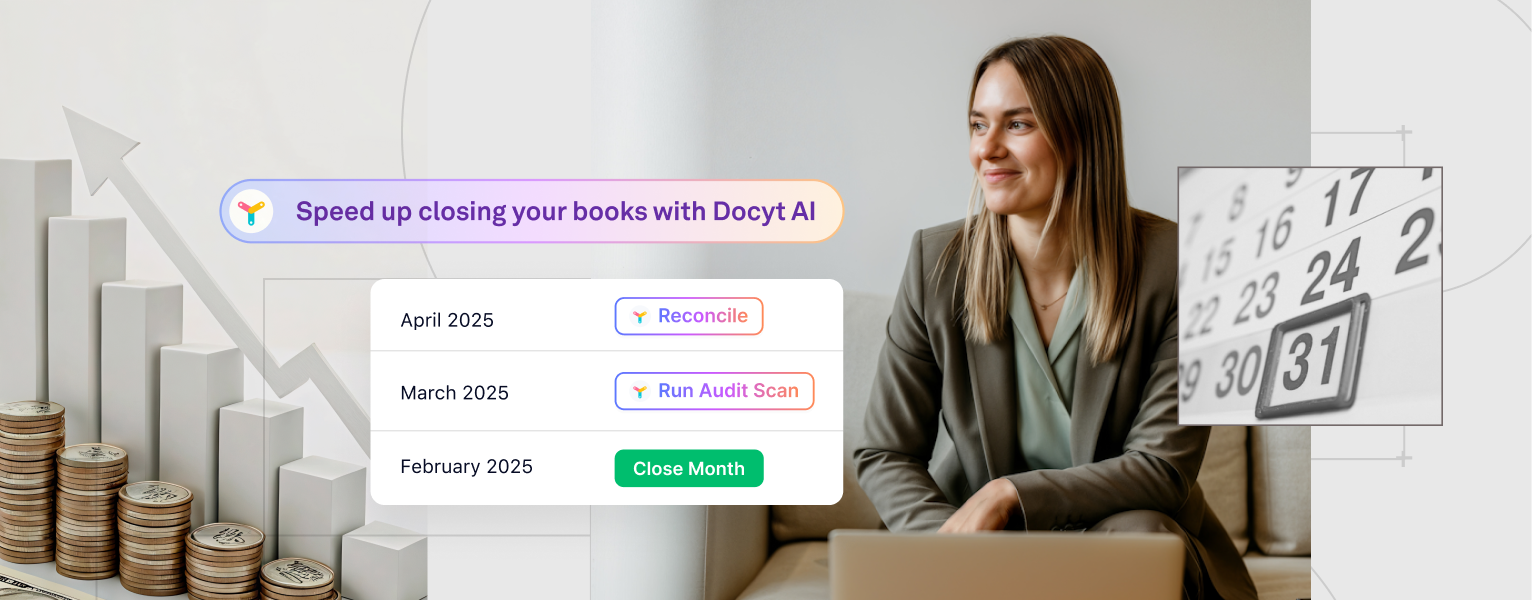

6. Faster Month-End Closing

Reduced workload: When revenue is reconciled daily, month-end closing becomes a verification process rather than a massive reconciliation project.

Resource reallocation: Finance teams can focus on analysis and strategy rather than spending days untangling a month’s worth of transactions.

7. Better Vendor and Partner Relationship Management

Accurate commission calculations: For franchise owners, daily revenue recognition ensures timely and accurate royalty calculations.

Vendor payment optimization: With daily reconciled figures, you can optimize payment timing to suppliers across multiple locations.

8. Data-Driven Decision Making

Immediate feedback: Test pricing changes, promotions, or new offerings at specific locations and get verified financial feedback within days, not months.

Expansion planning: Use precisely reconciled historical data from existing properties to create more accurate projections for new locations.

9. Improved Audit Preparedness

Documented history: Daily reconciliation creates a detailed audit trail that simplifies tax preparation and financial audits.

Reduced audit costs: Well-maintained daily reconciliation records across all properties can significantly reduce the time and expense of annual audits.

10. Greater Adaptability to Market Changes

Rapid response: When economic conditions shift, daily revenue recognition provides the data needed to make quick, informed adjustments across your property portfolio.

Location-specific adaptations: Identify which properties are most affected by market changes and implement targeted strategies rather than one-size-fits-all approaches.

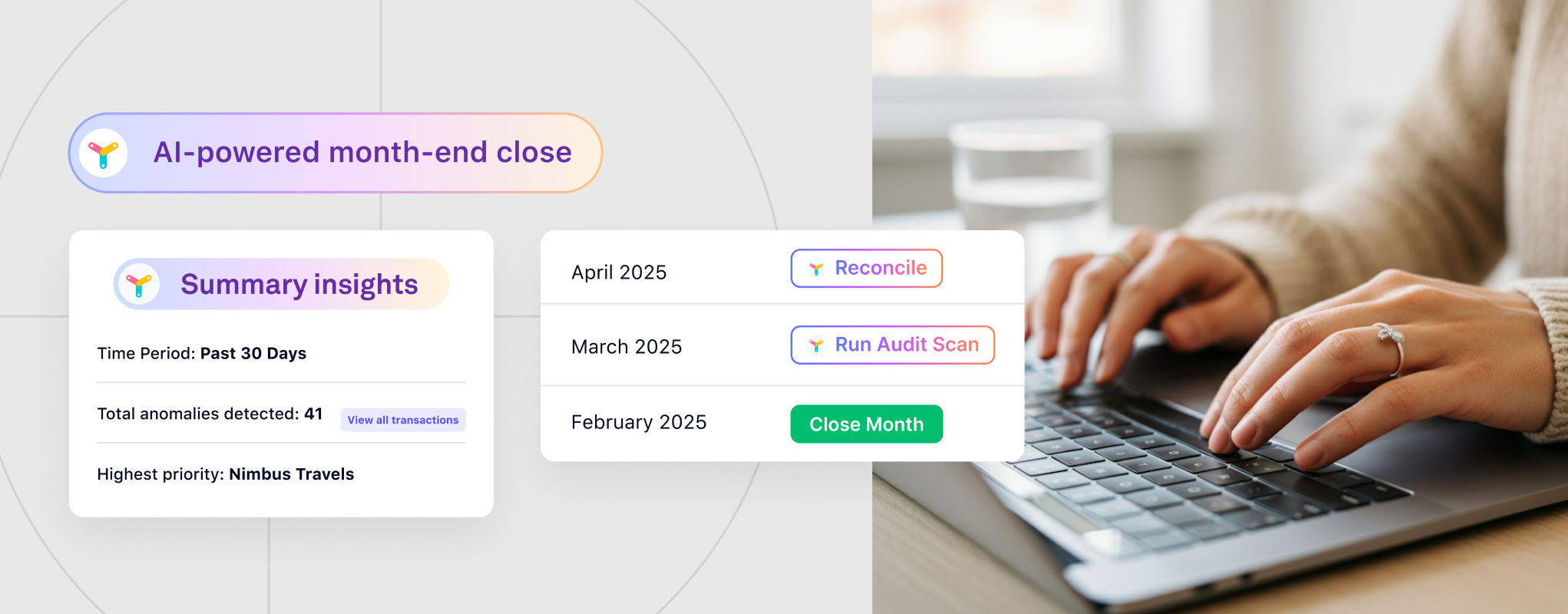

How Docyt Enables Effective Daily Revenue Management for Multi-Property Businesses

Docyt’s platform transforms daily revenue reconciliation and recognition from a burdensome task to a streamlined process by:

- Automatically importing transaction data from all revenue sources across properties

- Applying intelligent matching algorithms to reconcile transactions

- Flagging discrepancies for immediate attention while handling routine reconciliations

- Providing customizable dashboards for both property-level and portfolio-wide analysis

- Enabling standardized processes across all locations regardless of local management

- Integrating with existing POS and property management systems

- Generating location-specific reports while maintaining consolidated visibility

Conclusion

For multi-property businesses and franchise owners, daily revenue reconciliation and recognition isn’t just a best practice—it’s a competitive advantage. By implementing these processes, you’ll gain unprecedented visibility into your operations, make more informed decisions, and identify both problems and opportunities faster than competitors still relying on traditional month-end reconciliation.

The initial investment in establishing daily revenue management processes pays dividends through improved financial accuracy, reduced fraud risk, streamlined operations, and ultimately, increased profitability across your entire property portfolio.