If you’re like many US accounting firms, you’ve likely considered – or already adopted – offshore outsourcing to handle the mounting workload of transaction categorization and reconciliation. And for good reason: it’s helped bridge the talent gap when local CPAs are in short supply.

But outsourcing comes with its trade-offs: time zone delays, inconsistent output, and the overhead of managing external teams.

That’s why more firms are moving beyond traditional outsourcing to adopt AI-powered automation as the next step in scaling their operations.

Below, we answer the most common questions about Docyt Accountant Copilot vs. outsourcing, so you can decide what’s right for your practice.

Q1: We already outsource our bookkeeping. Why would we switch to Docyt Accountant Copilot?

Outsourcing certainly helps reduce costs, but it still relies on human labor, which means:

- Time zone delays

- Quality variance between teams

- Review bottlenecks

Docyt Accountant Copilot automates these workflows in real time, delivering consistent,

audit-ready results with 99%+ accuracy – and no onboarding, no hand-holding, and no

burnout.

Q2: Can Docyt Accountant Copilot do what a trained accountant does?

Yes – and faster.

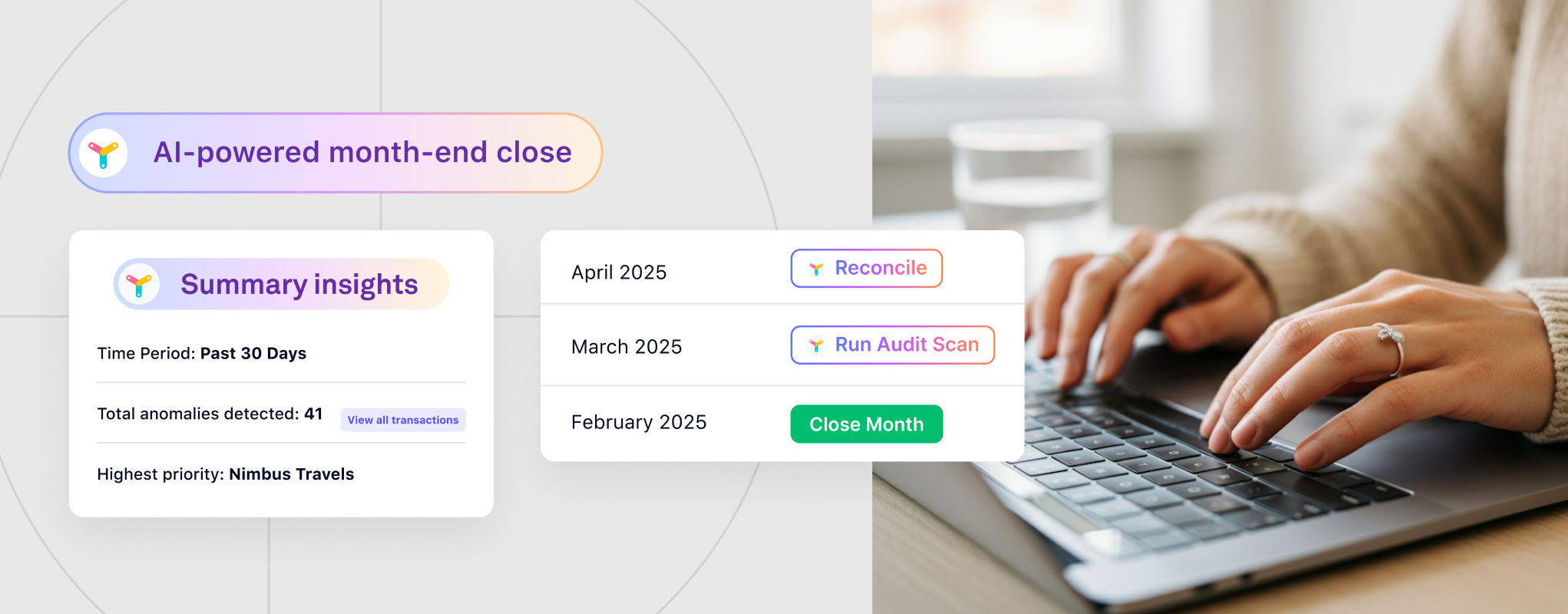

Our AI is trained on over 30,000 months of actual accounting data from across 20+ industries. It understands general ledger logic, flags anomalies, and produces month-end closes that meet the highest standards for accuracy and compliance.

Q3: But aren’t overseas accountants now getting certified in US GAAP and CPA?

They are – and that’s a great step forward for global outsourcing. However, even skilled offshore teams face:

- Fatigue

- Limited bandwidth

- Ramp-up time to learn your processes

Docyt Accountant Copilot complements or replaces this work by delivering instant, repeatable

results with no risk of turnover or human error.

Q4: What’s faster – offshore teams or Docyt Accountant Copilot?

Docyt Accountant Copilot, every time.

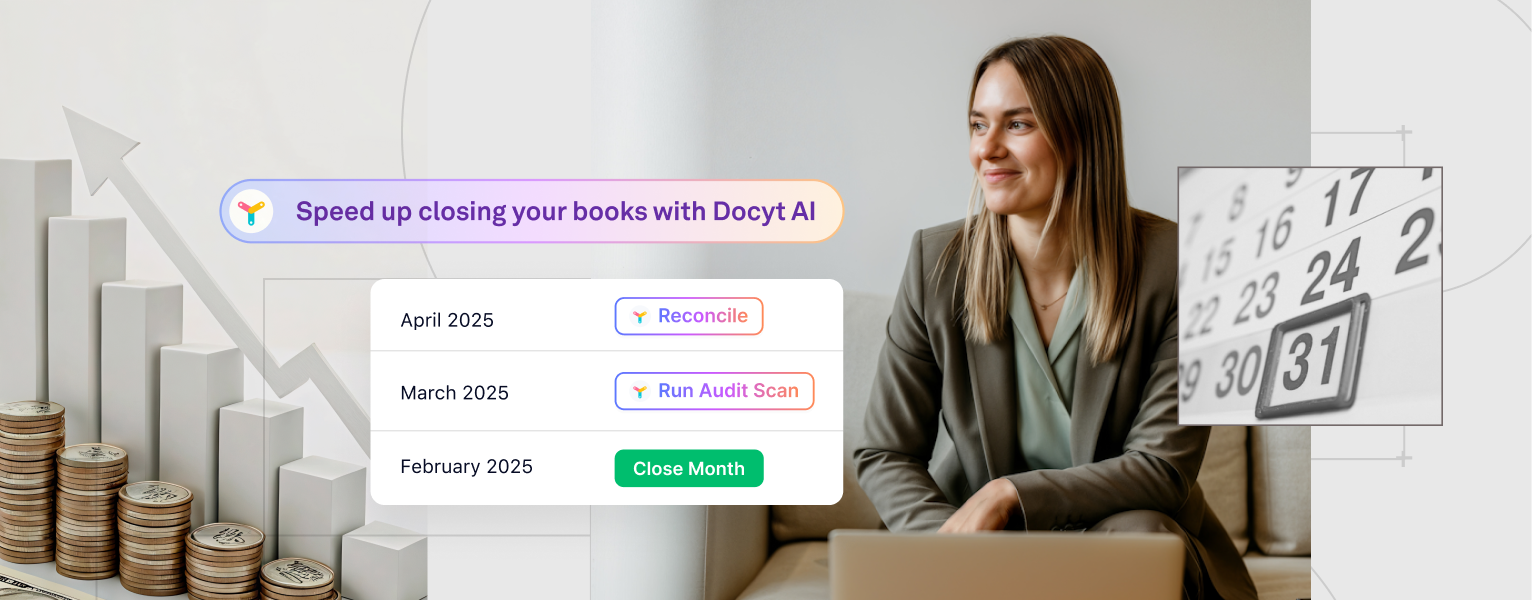

Where offshore teams typically take 4–6 hours per client to review and categorize transactions, Docyt can reduce this to under 20 minutes, thanks to:

- Real-time bank feeds

- Confidence scoring

- Automated reconciliation

Q5: What if we still want to keep our offshore team? Can we use both?

Absolutely.

Some firms use Docyt Accountant Copilot to automate the repetitive grunt work, freeing their

offshore or in-house teams to focus on:

- Advisory services

- Tax strategy

- Client relationship management

It’s not either/or – it’s smarter together.

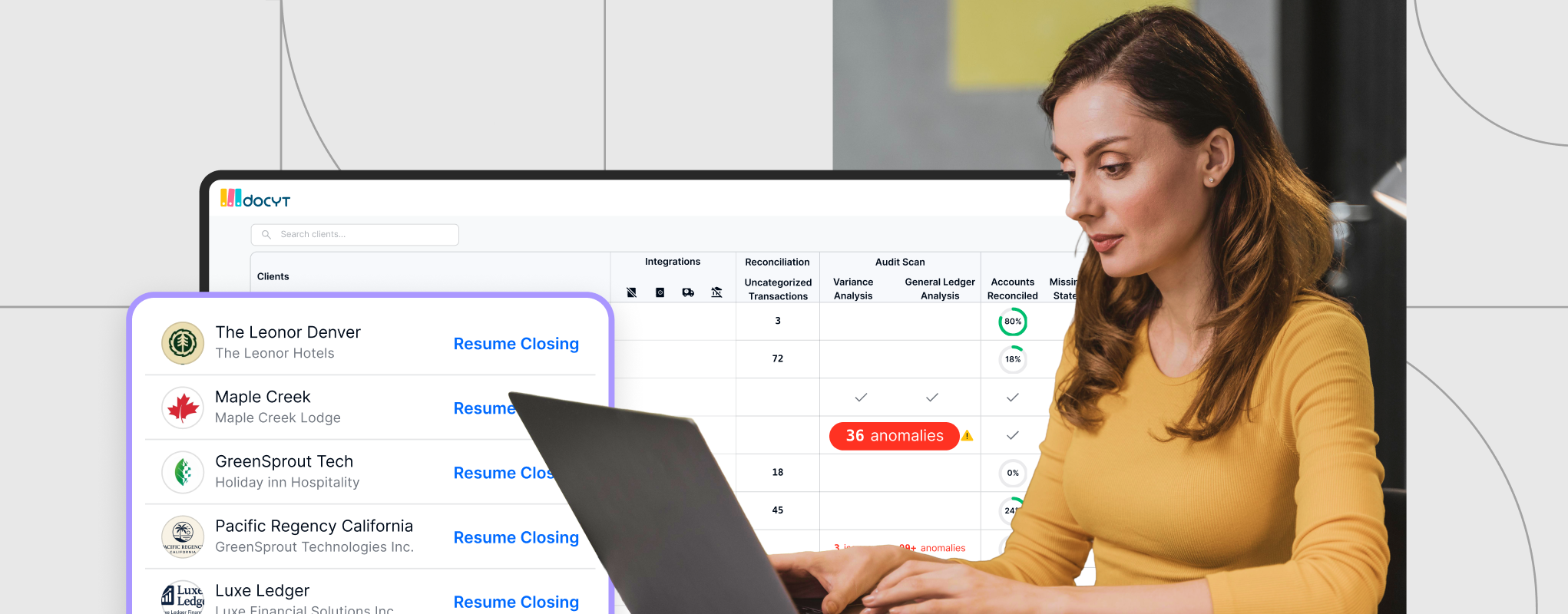

Q6: What kind of scale can Docyt Accountant Copilot handle?

Docyt is purpose-built for firms that want to grow without limits. Whether you manage 50 clients or 500, Accountant Copilot adapts instantly — no extra hiring or training required.

Firms using Docyt have scaled while maintaining a lean team.

Q7: We’ve heard AI can be inaccurate. What makes Docyt Accountant Copilot different?

Unlike generic AI tools, Docyt Accountant Copilot is powered by Docyt High Intelligence

Accounting Intelligence (HpAI), which is purpose-built for accounting workflows.

We train exclusively on real financial data, not internet text, and every transaction is processed

with:

- Real-time feeds

- Confidence scoring

- Built-in audit trails

- Anomaly detection

This ensures outputs are always auditable and compliant.

Q8: What happens if the AI gets something wrong?

You stay in control.

Low-confidence entries are flagged for review, and every action is fully traceable. Over time, Docyt’s AI learns from corrections to become even more accurate for each client’s unique chart of accounts.

Q9: What ROI can we expect from switching to Docyt Accountant Copilot?

Firms report:

- 90%+ reduction in review time per client

- Significant increase in client capacity

- Near-zero errors and cleaner audits

- Higher margins per client engagement due to less manual effort

Q10: How quickly can we get started?

Fast.

Most firms go live in 3 weeks or less, including:

- GL and bank feed connections

- AI training on historical transactions

- First month-end close with dedicated onboarding support

Ready to See Accountant Copilot in Action?

Book a demo today and discover why more accounting firms are choosing AI-powered

automation over traditional outsourcing.