In the fast-changing pace of accounting, the days in which artificial intelligence will change quality assurance are on the horizon. Artificial intelligence embedded deep into bookkeeping workflows not only makes work easier but also improves accuracy and compliance by leaps and bounds for accounting firms and their clients. Here’s how AI in quality assurance is poised to make life simpler and how Docyt AI-powered software is tailored for accounting firms to best meet their clients’ needs.

The Role Of AI In Accounting Quality Assurance

Automation of routine work

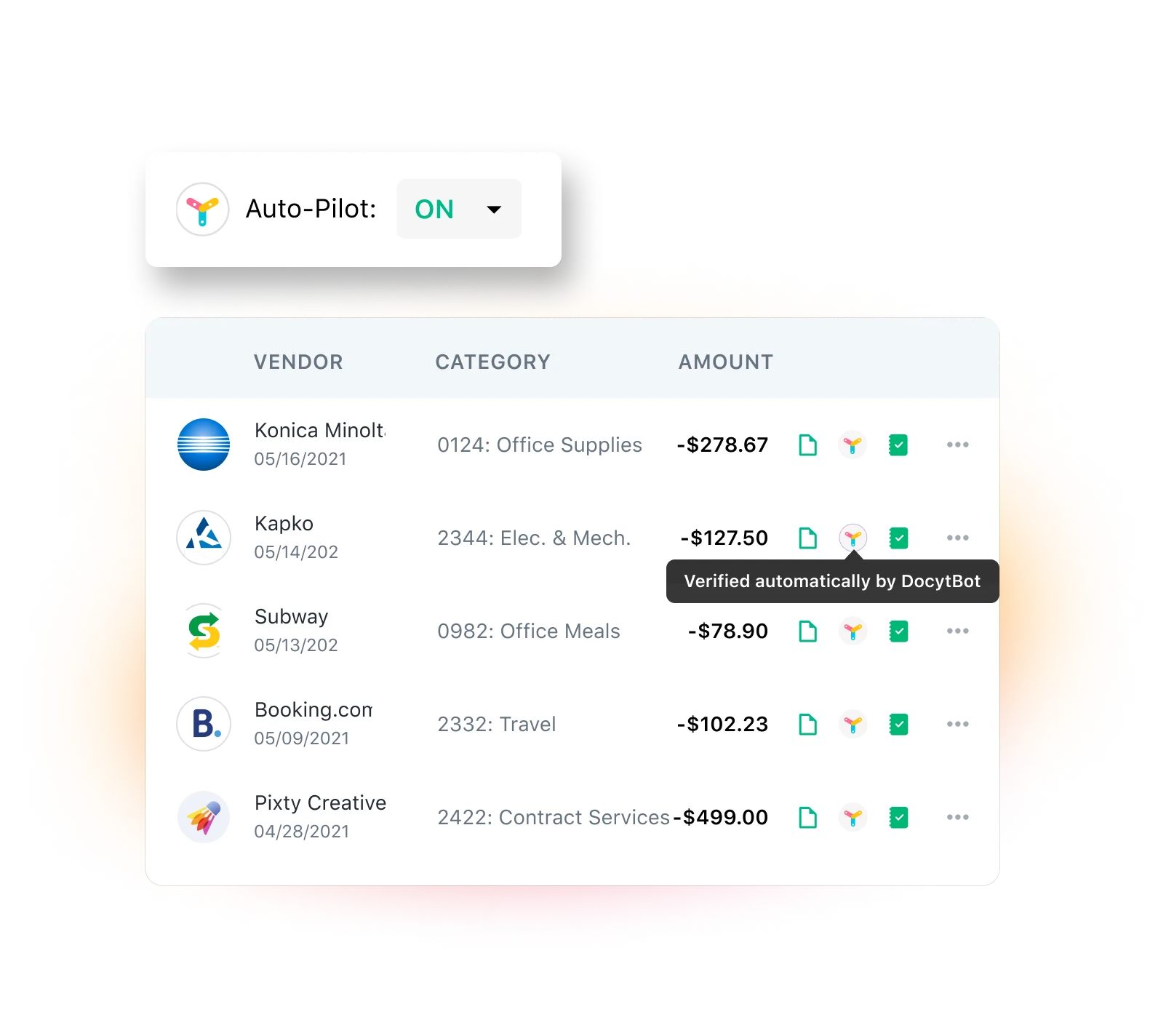

AI excels at repetitive and time-consuming tasks, such as data entry and bank reconciliations. This ultimately means that AI leaves more time for accountants to do more strategic and analytical work for their clients.

Enhancement of data accuracy

AI reduces the likelihood of errors in financial data by undertaking the analysis and validation activity itself. For instance, AI tools can quickly reconcile large volumes of data, leading to a quicker response time in detecting and addressing discrepancies and anomalies. Likewise, this ensures higher quality and more reliable financial reports (Accounting Firm Manager) (Nanonets).

Enhancement of fraud detection

AI algorithms aid in the analysis of transaction patterns, detecting unusual activity that may appear as fraud. The most significant service that AI offers in fraud detection is flagging errors identified for correction. Automatically raising error alerts reduces the time and effort spent by auditors and accountants combing over data to find them. Docyt uses AI to monitor user transactions continually to identify areas of risk in real-time. This is an essential feature when managing large volumes of clients.

Audit Streamlining

The use of AI in auditing leads to a significantly more robust and effective auditing process. AI can handle large datasets while scrutinizing contracts, invoicing, and financial statements more quickly and accurately than humanly possible. That makes the process faster and quicker without the risk of omissions (Deloitte United States) (KPMG).

The Advantages of AI in Quality Assurance

Time efficiency

By automating routine tasks with Al, the time spent completing accounting procedures is drastically reduced. This enhancement gives accountants more time to plan transactions and strategies that help the business.

Cost reduction

AI’s automation of bookkeeping tasks significantly reduces the intensive effort traditionally required for these jobs, leading to substantial cost savings. Additionally, the automation shortens auditing time and minimizes errors, further decreasing operational costs.

Effective Decision-making

AI delivers real-time insights and analytics that can empower accountants with the information required to make informed decisions. This is of great importance when it comes to the accurate maintenance of financial records and compliance with regulatory standards (Accounting Firm Manager) (KPMG).

Scalability

AI systems are easily scalable, meaning they can adjust to handle increasing or decreasing volumes of data as the business grows. This ensures that accounting processes remain effective and accurate, regardless of the business size.

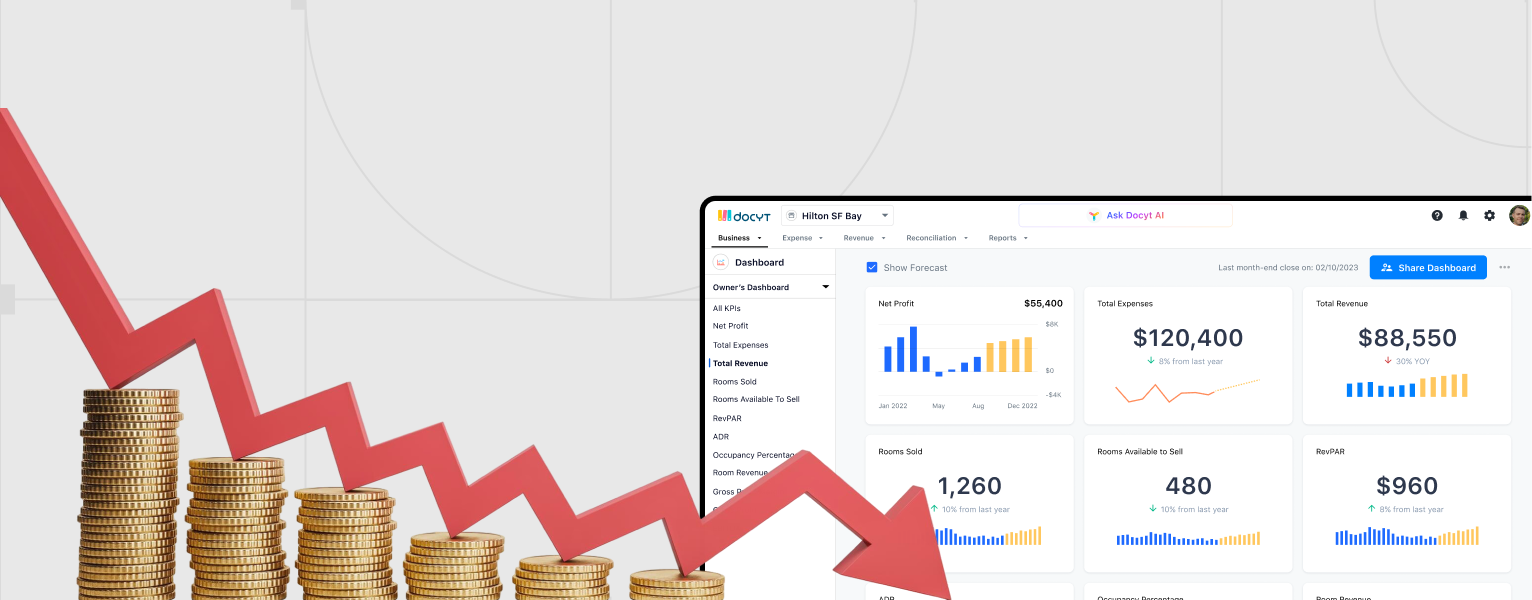

How Docyt Uses AI for Quality Assurance

- Docyt’s AI-powered bookkeeping software solution can be tailored to accounting firms to ensure that they are covering the needs of their clients. With a single tech stack essential for accounting firms’ productivity, Docyt AI standardizes your bookkeeping and accounting processes, increases efficiencies, improves profitability, and delivers real-time accounting for your clients.

- Docyt’s AI-powered automation handles tasks essential for client advisory services that are traditionally prone to human error—like invoice processing, ledger reconciliation, corporate card expense management, and reimbursement.

These features ensure consistency in data output and enable accounting firms to easily maintain compliant and reliable data for clients. Ultimately, Docyt AI is the best solution for accounting firms to ensure quality assurance for their clients.

AI will enhance quality assurance in accounting by executing routine jobs, ensuring that data is more accurate, fraud detection occurs, and a more efficient auditing process is achieved. Docyt AI highlights important ways in which a business can harness the technology to increase productivity within accounting practices, guaranteeing higher efficiency and cementing the field’s importance in quality assurance for client advisory services.

Bottom line

The advancement of AI is indispensable in enhancing accounting quality assurance.