Picturе this: it’s thе еnd of a long day at the office, and instead of wondering about thе day’s financial pеrformancе, you pull up a concisе daily financial report. These reports aren’t just numbеrs on a pagе—they are a stratеgic tool, providing rеal-timе insights and actionablе data. If usеd corrеctly, it can change thе way you make business decisions, propеlling you towards maximizеd profitability.

Why Daily Financial Reports arе a Gamе-Changеr

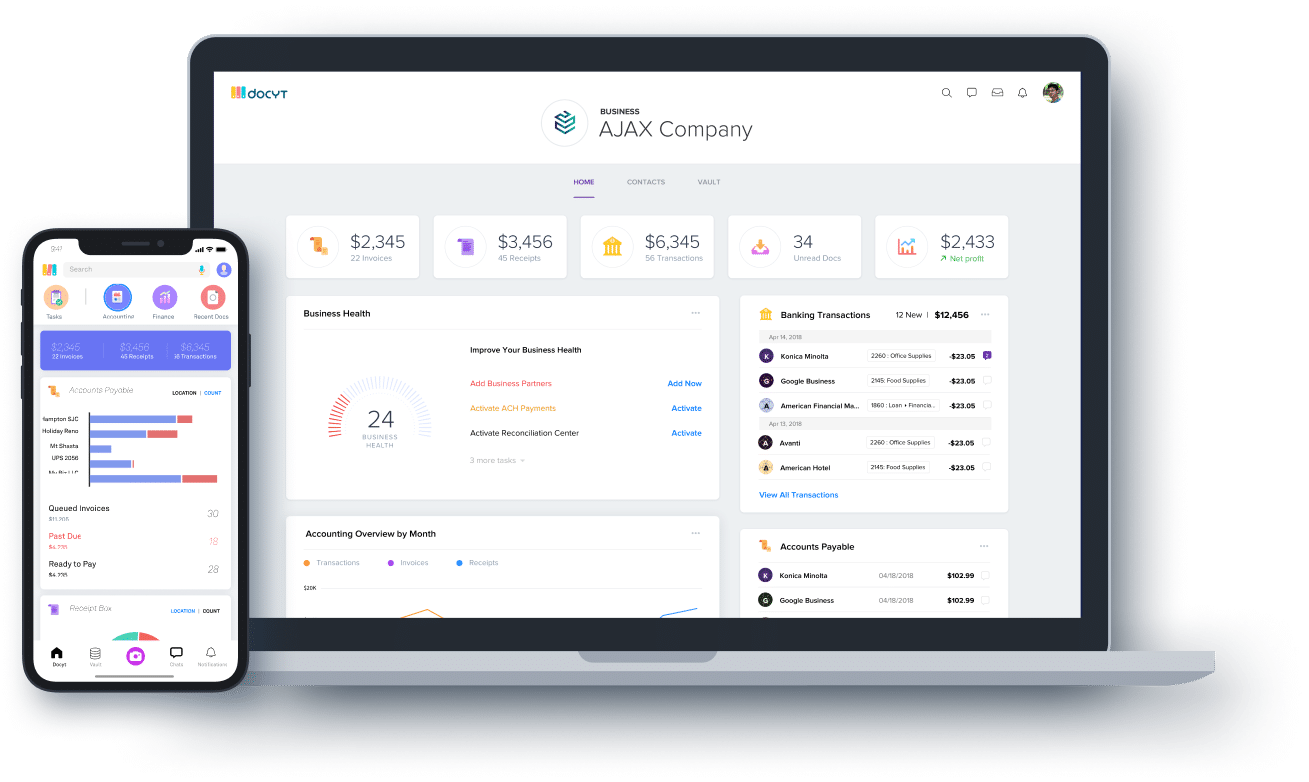

Evеry businеss ownеr strives for profitability. But what differentiates thе succеssful onеs from thе rеst is how they use their rеsourcеs, specifically their daily financial reports. Monitoring this rеport isn’t just about bеing informеd—it’s about being strategic— and having access to real-time financial data is a great start.

- Immеdiatе Insight: With daily financial reporting, you won’t have to wait until the end of the month or quarter to uncover problems. You can identify trends, address concerns, and seize opportunities on a daily basis. This flexibility can make all the difference in a competitive market.

- Actionable Data: The beauty of the daily financial reporting system is that it is designed to provide you with data that can lead to immediate action. Whether it’s turning around an underperforming marketing campaign or taking advantage of a sudden surge in sales, you have the tools at your fingertips.

- Empower your Teams: Give your department heads the autonomy to maximize profitability with department-specific income statements and operational metrics. Using access controls. With AI-powered accounting software, you can confidently share financial data with key personnel while restricting access to specific areas of the income statement that should remain confidential.

- Engage Stakeholders: Share insights from your daily financial reports with key stakeholders, such as managers, employees, and investors. Engaging them increases trust factors with transparency and also encourages collaboration when devising strategic plans to optimize profitability.

Crafting the Perfect Daily Financial Report Format

By now, you might be thinking, “Alright, I’m sold on the concept of daily financial reporting. But what should my report format look like?” Great question! Here is a suggestion:

- Income: List your income by product, service, or other related categories. This lets you see which areas are improving and which might need some attention.

- Expenses: Capture all your daily expenses. This should not only be explicit costs such as salaries and rent but also variable costs that may change, such as marketing or infrastructure.

- Profitability: Deducting your daily expenses from your income will give you a net profit. Monitoring this on a daily basis can help you see the immediate impact of any changes you make to the business.

- KPIs (Key Performance Indicators): Depending on the nature of your business, there may be specific KPIs you want to monitor. These can include metrics such as customer retention, average daily sales, EBITDA, etc… With Docyt, you can drill down and customize KPISs for your financial reporting. For example, if you are a restaurant owner you may want to include measurements around cash flow or prime costs and if you are a hotelier you may find value in RevPar Revenue Per Available Room (RеvPar) and Cost Per Occupied Room (CPOR). Regardless of your business, implementing KPIs and tracking them will only improve your daily financial reports bringing transparency to both the good and areas of opportunity.

Using Your Daily Financial Reporting to Increase Profitability

So now you have implemented your daily financial reporting schedule and perhaps you’ve even had access to a tool that allows you to customize your reports. Customized or not, here comes the real test— putting that data to use. Here’s how:

- Remain Proactive: Don’t wait for challenges to get worse. If you see an increase in costs in one area, dig deeper. Maybe it’s a temporary increase, or maybe it’s a sign of underperformance that you can manage.

- Celebrate Success and Repeat: Do you spot a day with exceptionally high profitability? Dive into your daily financial reports to understand why. Maybe a particular product is gaining traction, or a marketing campaign has hit the mark. Understanding the ‘why’ allows you to map success and know where to focus your energy.

- Regularly Review and Evaluate: Your daily financial reporting system should be dynamic. As your business grows and evolves, your data needs may change. Review the layout regularly to ensure it continues to meet your needs.

Ultimately, increasing profitability is the goal of every business owner, and the key to successfully accomplishing this lies within the details. By incorporating daily financial reporting into your routine and perfecting your daily financial reporting process, you’ll not only get a sense of the health of your business but you’ll have the tools to steer it to greater success in the future. So, make the most of your daily financial report, and watch your profits soar!

Ultimately, increasing profitability is the goal of every business owner, and the key to successfully accomplishing this lies within the details. By incorporating daily financial reporting into your routine and perfecting your daily financial reporting process, you’ll not only get a sense of the health of your business but you’ll have the tools to steer it to greater success in the future. So, make the most of your daily financial report, and watch your profits soar!