Discover our latest feature releases for achieving more precise revenue tracking and a faster month-end close.

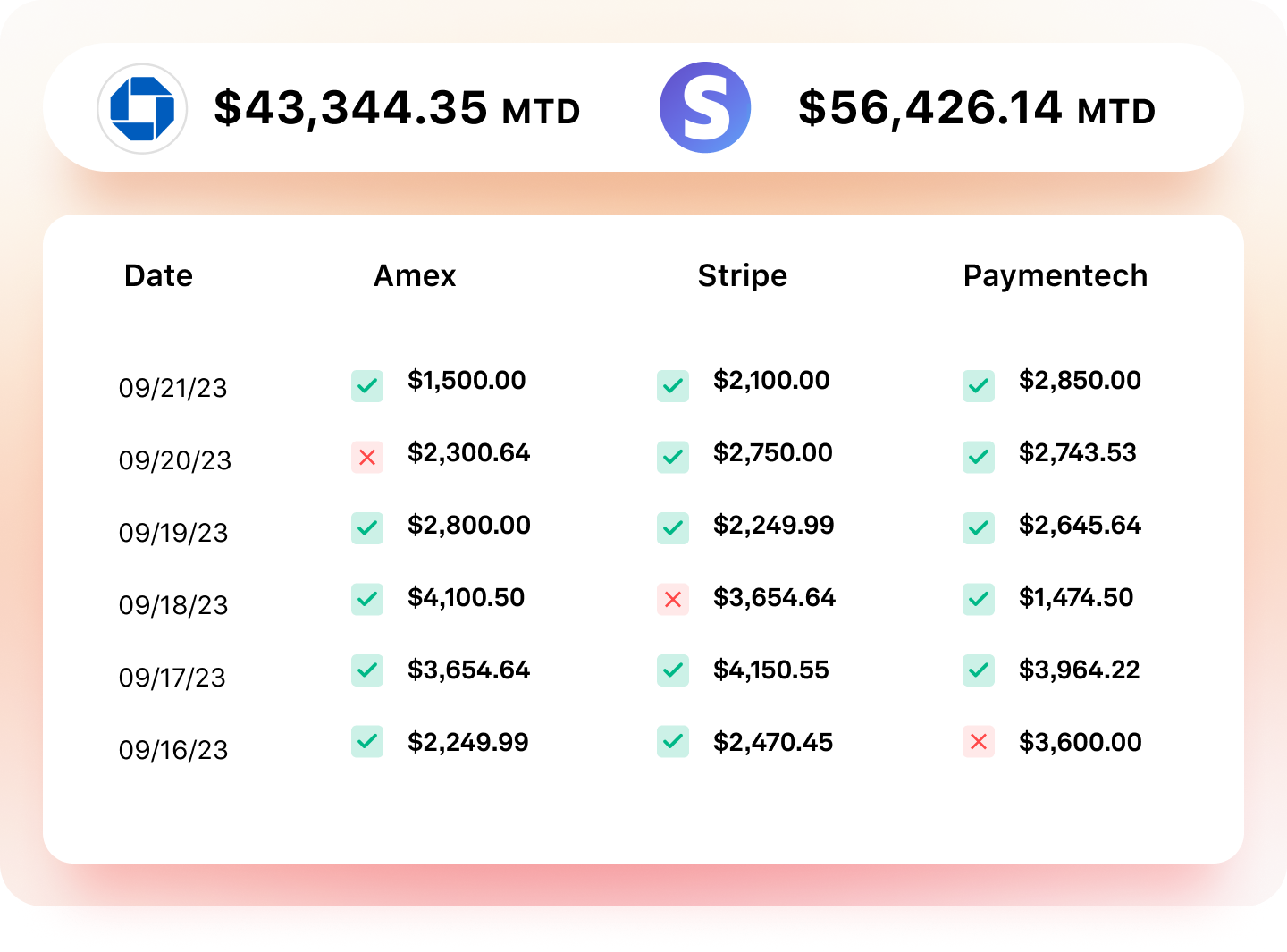

Stay on Top of Your Clients’ Daily Earnings

Exciting news! We’ve just released a game-changing new feature called Deposit Tracking! It’s like your personal revenue management assistant for keeping tabs on your clients’ daily merchant deposits.

So, what’s the buzz about Deposit Tracking? Well, imagine having a handy tool that makes sure all your clients’ hard-earned cash is where it’s supposed to be. No more guessing games or missing revenue mysteries. This feature checks daily earnings against bank deposits, catching any slip-ups or hiccups from the merchant processors.

But wait, there’s more! Deposit Tracking gives you a neat list view of all payment partners – think Cash, American Express, Chase, and Square. Plus, you get the nitty-gritty details on transactions for smoother balance management and quick fixes for client disputes.

Turn the Month-End Close into a Mere Sanity Check

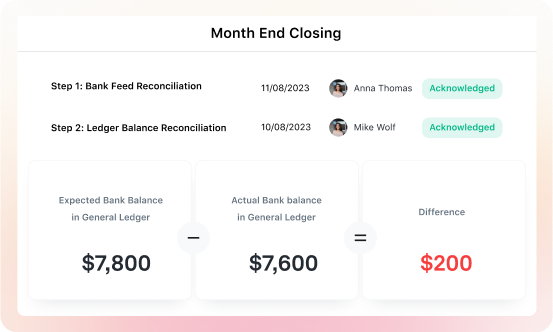

Docyt accelerates your month-end close by automating bank reconciliation, transaction categorization, and document matching. Check out our newest feature, Month-End Close, that puts the finishing touch on the entire process. It’s like the missing puzzle piece you’ve been searching for.

Imagine an end-of-month checklist that lays out all your critical tasks, ensuring everything is squared away before officially closing the books. With Month-End Close, you can enjoy this convenience by having a checklist view to quickly review and sign off on. The result? A whopping 25% reduction in closing time. Keep tabs on task progress like who is doing what, review detailed logs, and notes, and more. It’s a great collaboration tool for accounting teams, boosting task accountability.

Looking for more product training and resources? Visit our Knowledge Center.